Spencer Platt

With the meme-stock mayhem behind us, Robinhood (NASDAQ:HOOD) has collapsed over 70% from its IPO. As Q2 2022 earnings made abundantly clear, the company is struggling on all fronts: new deposits are no longer growing, the lucrative option trading business is slowing, and worse of all it is losing monthly active users (MAUs) at a rate of nearly 2 million per quarter.

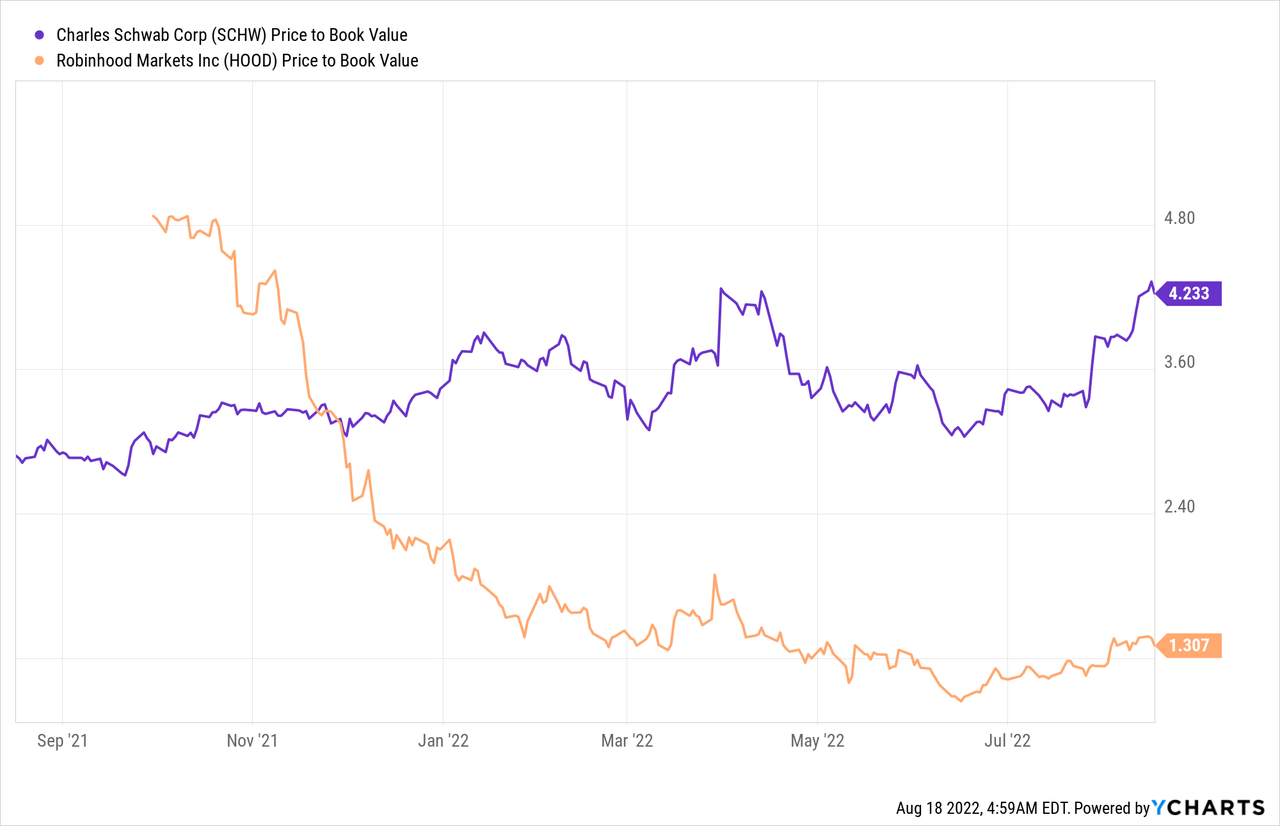

But the whims of the market have gone too far. After being quartered, Robinhood is now very cheap and trades at close to its book value (primarily comprised of no debt and ~$6 billion in cash). For reference, its brokerage peer Charles Schwab (SCHW), which also owns brokerage TD Ameritrade, trades at over 4x its book value.

Robinhood’s rock-bottom valuation provides a margin of safety that essentially de-risks the company from an investor’s perspective. Instead of expecting high-flying growth and pristine execution, my thesis is first and foremost a return to profitability. Secondary to that is a clear path towards a more diversified business model that does not dependent on wild market fluctuations, but instead leverages its valuable users in a sustainable manner.

Profitability is Within Reach

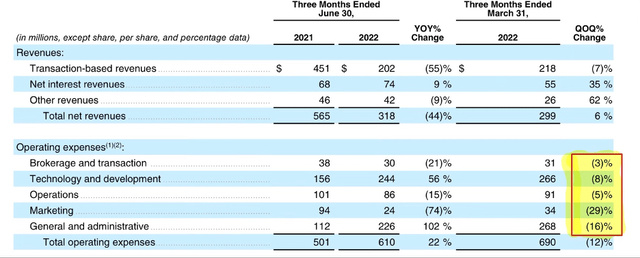

The most immediate challenge is for Robinhood to return to profitability, and Robinhood is well on the path towards this goal. In Q2, it reported a net loss of $295 million driven by lower revenues (down 44% YOY), but also significant cost increases. Notably, Technology and G&A spend reported increases of 56% and 102% YOY respectively.

Despite the YOY cost increase, all cost segments declined significantly on a QoQ basis. This decrease likely reflected the initial results of its April layoffs that cut 9% of its workforce, along with reigned in spending.

Since the April layoffs, the company announced a second, more expansive headcount reduction of 23% in August. Though severe in nature, I believe these mark Robinhood’s shift from “grow at all costs” towards becoming a disciplined company focused on responsible growth. Notably, despite staff reductions, Robinhood still plans to roll-out a suite of new consumer banking products this year. Beyond layoffs, CEO Vlad Tenev has taken steps to drive efficiency, including shifting to a General Manager organizational structure that will instill greater cost discipline.

I expect these cost reductions that happened between Q1 and Q2 to accelerate in the last two quarters of 2022. As an exercise, I assumed that only Technology/Development and G&A spend categories (the two largest) would decrease for the next two quarters at 15% and 25%, a slightly accelerated rate from the QoQ change in Q2.

|

Expense Type |

Q2 2022 (millions) |

Q3 2022 (Estimated) |

Q4 2022 (Estimated) |

|

Technology and Development |

244 |

207.4 |

176.29 |

|

General and administrative |

226 |

169.5 |

135.6 |

Source: Author’s rendition using 15% and 25% linear decreases for Technology/Development and G&A expenses

Though by no means conclusive, this exercise helps understand the possible magnitude of Robinhood’s cost-side actions. In these two areas alone, Robinhood can eliminate ~$160 million of quarterly costs by year-end, a significant portion of its $295 million Q2 loss.

In short, I believe that cost reductions can bring Robinhood to the brink of profitability and are a major catalyst for its depressed valuations.

Responsible Growth and Diversification

In addition to cost discipline, Robinhood is taking significant steps to drive topline growth. Though the struggling markets have led to dampened retail trading enthusiasm, Robinhood is benefiting from the higher interest rates environment. For every quarter-percent interest rate hike, Robinhood earns an addition $40 million in interest and rising rates have already delivered a 9% YoY increase in net interest revenues. More favorable market conditions along with better monetization will continue to be a tailwind.

Beyond interest, crypto is a major revenue driver that is magnitudes more lucrative than equities. Payment for order flow for crypto trades are at 0.35%, meaning Robinhood is paid $0.35 for every $100 in order volume. In contrast, equities bring in <$0.20 per 100 shares (old but relevant data). In fact, crypto transaction revenues of were nearly double that of equities, coming in at $58 million compared to $29 million for equities. Robinhood is keenly aware of this, and while its commission-free model means it will never catch up to Coinbase’s (COIN) scale and juicy margins, it is a strong growth area. For the ordinary retail investor, Robinhood is simply a more convenient way of investing in crypto as it allows you to trade equities and crypto within a single account (and also for no fee). As Robinhood rolls out more coins in a disciplined manner (as opposed to Coinbase’s much looser approach), this value proposition is very attractive.

Notably, Robinhood is branching out to offer more sophisticated crypto features as well. The launch of Robinhood’s own crypto wallet, branded as its “web3 wallet,” is a major step and already has over 1 million people on its waitlist ahead of its launch later this year. This new wallet will be a standalone app (reducing confusion with the core app) and matches Coinbase’s wallet functionality that has grown to become an industry leader. Given Robinhood’s compelling proposition of low fees and ability to serve equity and crypto in an all-in-one platform, this will help Robinhood catch up in an industry it has been slow to enter. Though there certainly is doubt as to the future of the crypto market (and the recent turmoil supports this), the market is wildly profitable and one Robinhood simply cannot miss.

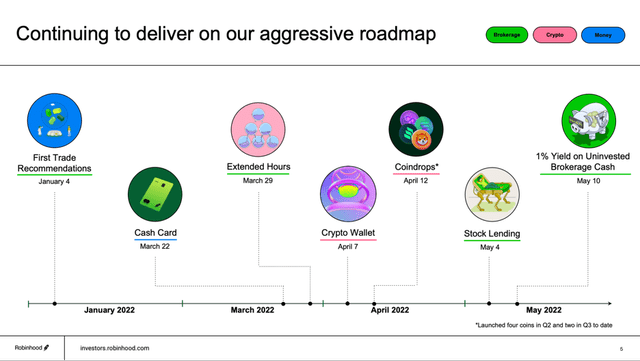

On the similar lines of offering more sophisticated features, Robinhood has been rolling out features to better serve its advanced traders. Extended trading hours launched in March 2022, Advanced charts just launched on August 17, 2022, and, as Vlad Tenev made abundantly clear, more UX enhancements for advanced investors are on the way. After all, advanced traders are the ones driving option trading and equity volumes and appealing to them will have a significant revenue impact.

Robinhood is continuing to innovate and launch new features that improve the customer experience and expands into new services. (Robinhood Q2 Earnings Presentation)

Finally, Robinhood has a clear vision of being more than just a brokerage. Its greatest strengths are its unique 14 million MAUs that are primarily young and experiencing their first major macroeconomic turmoil. Just like the glory days when Robinhood was riding high in the COVID boom, these are unusual times that will pass. Robinhood’s “Cash Card,” banking services, and soon to be launched retirement funds are planting the seeds now for it to truly become a holistic consumer finance company. I don’t believe these steps will have any short- or medium-horizon impact, but they are keys that position it for long-term success. They also continue to be ways for its customer base to grow and maintain its strong rate of >80% organic/referred new customers, which significantly lessens the need for marketing spend.

M&A Opportunities

Beyond growth and cost initiatives, Robinhood most valuable asset-its 14 million young customers-make it a compelling acquisition for companies across the finance spectrum. On the Q2 earnings call, Vlad Tenev repeatedly shot down thoughts of selling Robinhood and instead mentioned the possibility of Robinhood using its $6 billion cash pile to be a buyer (something I would vehemently oppose). Given the strong potential fits, I will briefly cover some potential options.

Consumer/Payment Companies: PayPal (PYPL), owner of Venmo, and Block (SQ), owner of Cash App, already directly overlap with Robinhood’s consumer focus and would benefit from expanding into a different part of their consumers’ financial lives. Crypto trading is natively built in to both Venmo and Cash App, though the fit naturally creates a level of cognitive dissonance that might be better left for a dedicated brokerage platform like Robinhood. To both companies, Robinhood would allow them to expand horizontally and engage their active users on a deeper level (beyond payments).

Goldman Sachs (GS): Goldman Sachs CEO David Solomon made it a top priority to boost Marcus, its consumer finance division, and has undertaken a series of initiatives that include its partnership with Apple Pay. Nevertheless, investment banking still brings in close to 70% of revenues and Marcus has struggled mightily to grow. Robinhood would instantly allow GS to break in to consumer finance at scale and reach the coveted young adult demographic. Moreover, it would better position it with its top Wall Street rival Morgan Stanley (MS), which owns E-Trade and has outperformed GS in recent years.

Summary

Robinhood is simply too undervalued. The company is trading at close to book value, and catalysts like a return to profitability will drive the stock upwards. At current valuations, the company is valued like a company rapidly faltering, yet there is still a lot of blue skies and green grass ahead. Growth among advanced investors, crypto, and increased diversification to new consumer finance areas are all potential tailwinds. Certainly, the company has struggles, but right now the valuation is simply too attractive to pass up.

Be the first to comment