Olivier Le Moal/iStock via Getty Images

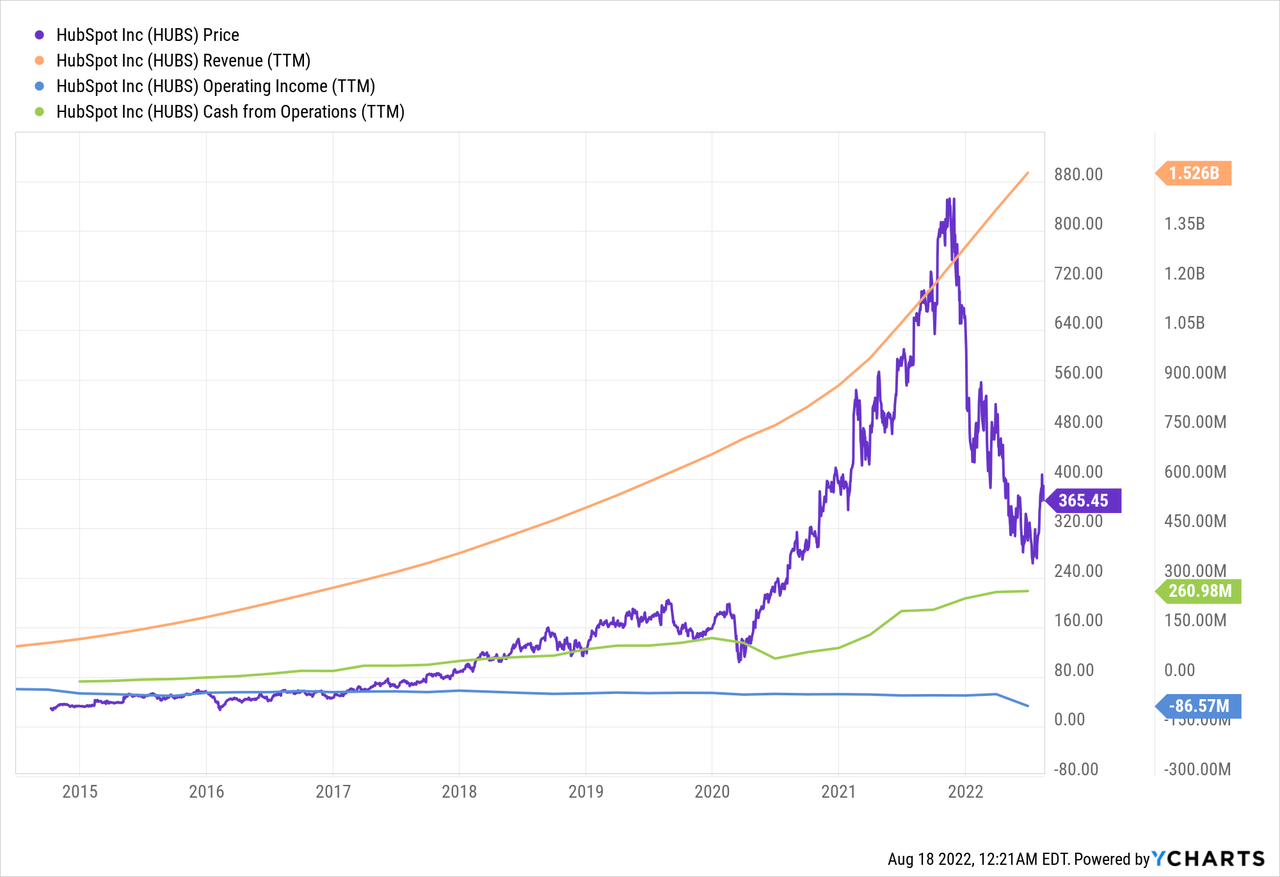

HubSpot (NYSE:HUBS) has been an incredible performer since its 2014 IPO.

The CRM platform has been a four-bagger in the past five years and has become one of the big winners in the App Economy Portfolio. It’s my sixth largest holding as of this writing.

I previously shared my bull case publicly here in 2019.

Despite a stellar execution, the stock has erased the last two years of gain. HUBS has collapsed alongside other mid-cap growth stocks in a challenging macro environment, making it a relevant investment topic today.

With more than 150,000 customers and 13 office locations worldwide, HubSpot helps SMBs (small-and-medium-sized businesses) create valuable experiences that attract and engage prospects and customers through relevant and helpful content. They call it “inbound marketing.”

Over the years, the CRM platform has expanded into additional products (more on that in a minute). Today, HubSpot wants to be the platform of choice for scaling businesses.

The company has many of the traits I look for in enterprise software:

- Founder-led.

- High insider ownership.

- Recurring revenue model.

- Excellent retention metrics.

- Strong underlying unit economics.

- Large and growing TAM opportunity.

- Balancing fast growth with profitability.

- A net cash position on the balance sheet.

- An extensive ecosystem with new products over time.

HubSpot just reported its Q2 performance last week, so it’s an excellent opportunity to look at the progress so far.

Let’s dive in.

HubSpot Logo (Company Website)

An Award-Winning Culture

Yamini Rangan stepped in as CEO in 2021. The two co-founders, Brian Halligan and Dharmesh Shah, are still involved as Executive Chairperson and CTO.

Yamini Rangan, current HubSpot CEO, alongside Brian Halligan, Executive Chairperson. (HubSpot)

How well is Yamini doing at her new job? She’s crushing it! She was named No. 1 on Comparably’s list of top-rated CEOs for women.

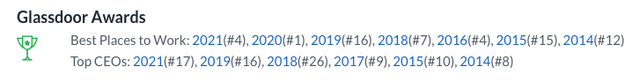

HubSpot is one of the very best employers in America. The company was #2 in the Best Places to Work 2022 rankings. I explained in this article why it could be an indicator of future alpha.

HubSpot Awards (Glassdoor) HubSpot Ratings (Glassdoor)

That makes me bullish over the very long-term, as I try to illustrate in the tweet below.

Product-led Growth

Over the years, HubSpot has embraced a product-led growth.

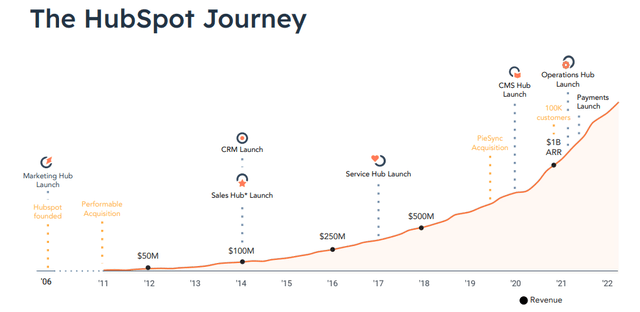

It began as an app focused on marketing. Then, it became a suite of ‘hubs’ covering marketing, sales, operations, and web content. Finally, it’s becoming a platform with e-commerce, developer tools, and an entire ecosystem of apps and partners.

The new products have led to exceptional revenue growth, as illustrated in the chart below.

HubSpot Product Launches (Company Presentation)

HubSpot focuses on mid-market customers, but it’s moving upmarket with them as they scale.

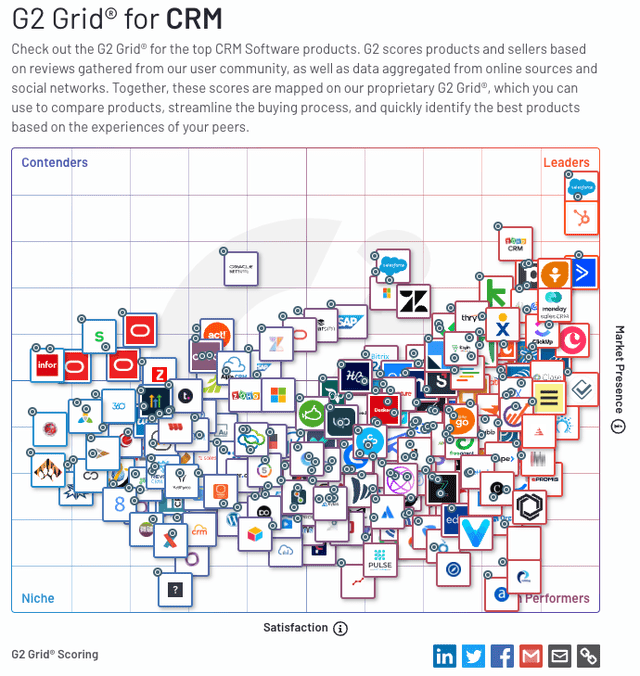

If we look at the G2 Grid for CRM software products, HubSpot is a leader detached from the pack alongside Salesforce (CRM), the CRM OG (as illustrated by its stock ticker).

And HubSpot also excels with its CRM-adjacent software products.

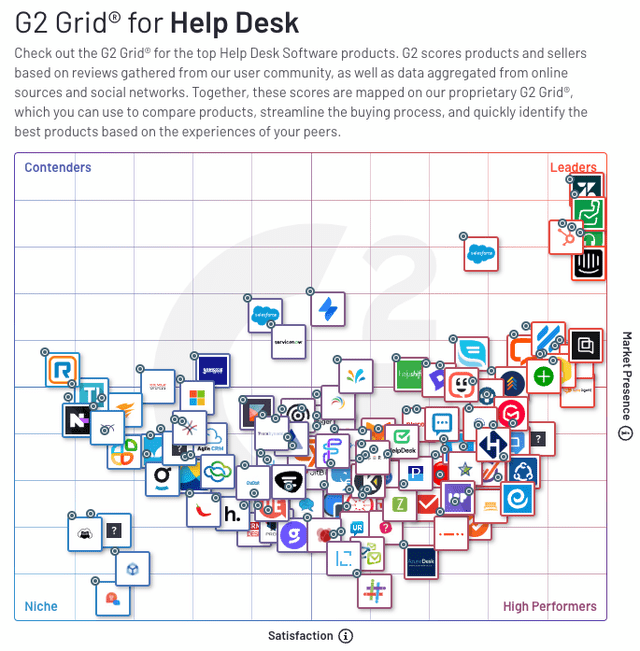

For example, the company re-launched Service Hub in 2022, and it’s one of the leading Help Desk software products alongside Zendesk (ZEN) today. Additionally, this category remains untapped for HubSpot, with many tools in the pipeline.

I love the idea that HubSpot could thrive in a few years, thanks to products yet to be released today.

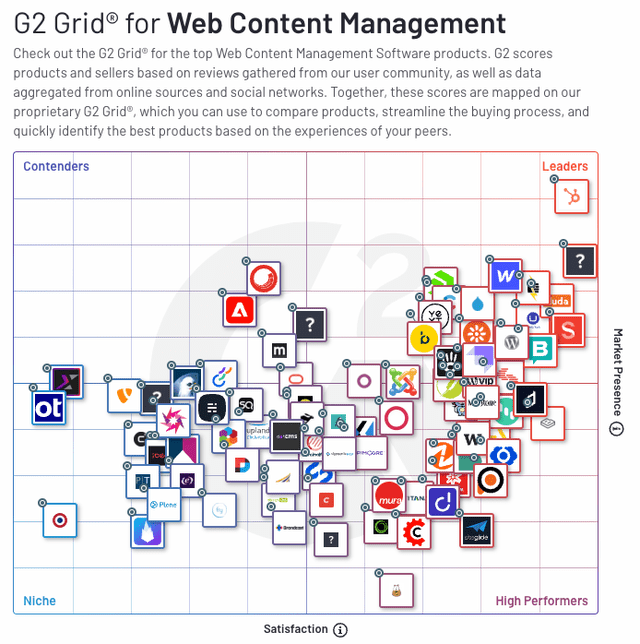

To illustrate, HubSpot CMS (web content management software) launched in April 2020. And today, it’s the leader in Web Content Management in just two years. This is what optionality looks like.

Web Content Management (G2 Grid)

They have an excellent go-to-market strategy with a free drag-and-drop web builder released a few weeks ago.

When you invest in innovative teams, your investment can flourish for reasons not included in your initial bull case. That’s what I call stacking the deck in your favor.

Martech is a highly fragmented and competitive landscape. However, the way I look at it, that’s bad news for all the single-point solutions that try to compete with HubSpot.

Underappreciated Product Milestones

I believe the CMS Hub Free announcement is still under Wall Street’s radar.

According to CEO Yamini Rangan, CMS Hub benefits from a key differentiator because a free CRM platform powers it. She explained:

That means companies can easily build a beautiful website to attract visitors and leverage CRM to nurture that business across their entire front office, all on HubSpot.

That combination is powerful and unique. As part of the launch in June, we also introduced CMS website themes in our marketplace to give Business Builders the tools and the assets to get started online. As a result, we’ve seen nearly 4000 CMS free signups in the first month since launch, and 110% increase in marketplace transactions.

Additionally, the company has shown signs of pricing power thanks to the added value provided through product iterations:

On the upper end of the market, we’re increasing marketing hub enterprise pricing in September, to match the additional value we’ve been delivering to customers over the last few years with more sophisticated functionality, like revenue attribution reporting, AI powered AB testing, and more. These changes are consistent with our pricing and packaging strategy of driving high value features down to starter, while fueling innovation at the higher tiers.

Founder-CTO Dharmesh Shah mentioned during the earnings call the long runway ahead in terms of product innovation:

One continuing trend we’ve seen is that customers still have ideas. It’s not like they’ve kind of crawled into a hole like, okay, we’re done here. They’re still asking for new features. They’re asking for new developments, so there’s years and years of innovation left across the front office, which is not a static industry, where everyone’s kind of said, okay, well, we’re done here, we’re seeing just as much kind of demand in terms of innovation from our customers and partners, as we have in the past, so that has not slowed down. And, and the list of things that we want to do over the coming years, is just as long as it’s ever been.

HubSpot’s strategy is straightforward:

- Driving high value for starters.

- Then, fueling innovation at the higher tiers.

Payments and commerce could be a significant growth opportunity in the future. Management sees the potential for integrated tools within marketing campaigns and sales conversations (paid meetings, forms and links, recurring ACH, and payment objects).

Navigating The Macro Environment

Yamini Rangan touched on longer sales cycles and more decision makers getting involved in deals recently.

She unpacked three core principles to thrive through this challenging time:

- Solving for the customer: Helping the digital transition, driving efficiencies through a single platform via consolidation.

- Sustained investments in products: Maintain product innovation to create levers for long-term growth with platform and payments.

- Execute with focus: Management is focused on what they can control (increase customer engagement and partner enablement).

While there could be a short-term slowdown, management is seeing deals close favorably.

HubSpot is a mission-critical software for SMBs to run their front office. Sales and marketing operations are not optional, even during a recession.

HubSpot has an obvious value proposition with clear TCO (Total Cost of Ownership) savings through their platform approach. They encourage customers to let go of single-point solutions and consolidate their front office under one roof, which is attractive to C-level looking for efficiencies.

Q2 FY22 Highlights

Let’s review the main highlights from the most recent quarter.

Key metrics:

- Total customers grew +25% to 151K (vs. +26% Y/Y in Q1).

- Average revenue per sub grew +10% $11,200 (vs. +12% Y/Y in Q1).

- It would have been an acceleration to +14% Y/Y FX neutral.

- More than 50% of customers use multiple HubSpot products.

- Net revenue retention was “comfortably above the 110% target.”

- Gross retention remained in the high 80s.

Financials:

- Revenue grew +36% to $422M (vs. a guidance of +32% Y/Y).

- Revenue grew +41% Y/Y FX neutral.

- Subscription revenue was 98% of the top line (+1pp Q/Q).

- International revenue was 46% of total revenue (flat Y/Y).

- Gross margin was 81% (+1pp Y/Y).

- Operating loss margin was -12% (-7pp Y/Y).

- Adjusted operating margin was 7% (-2pp Y/Y).

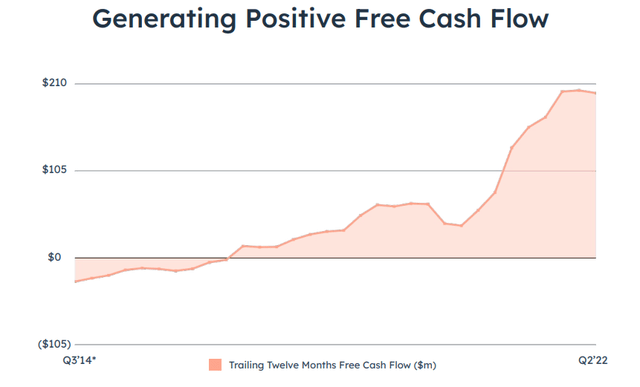

- Free cash flow was $22M (5% margin).

- Balance Sheet: Cash $1.4B. Long-term debt: $0.7B

Guidance:

- Q3 FY22 is $425M or +25% Y/Y and 7% non-GAAP operating margin.

- FY22 is $1.695B or +30% Y/Y (vs. $1.725B previously), 8% non-GAAP operating margin (-1pp vs. previous guidance), and ~$200M in free cash flow (including a $10M FX headwinds).

FX headwinds and the macro slowdown explained the FY22 revenue guidance reduction by 2% or $30M.

Notably, FX headwinds are 8pp in the third quarter and 6pp for the full year. So HubSpot’s growth profile is +36% Y/Y for FY22 FX neutral.

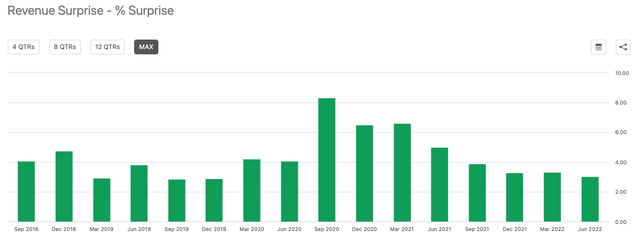

Additionally, HubSpot has a history of under-promising and over-delivering. The company has a track record of beating its guidance by 3% to 8% in the past 16 quarters, and Q2 FY22 was no exception.

HUBS Revenue Surprise (Seeking Alpha)

Of note, the company will slow hiring in the second half outside of product, engineering, and sales headcounts.

Average subscription revenue per customer accelerated for the fourth quarter in a row (FX neutral). In addition, customer growth showed barely any slowdown, with 7,000 logos added during the quarter.

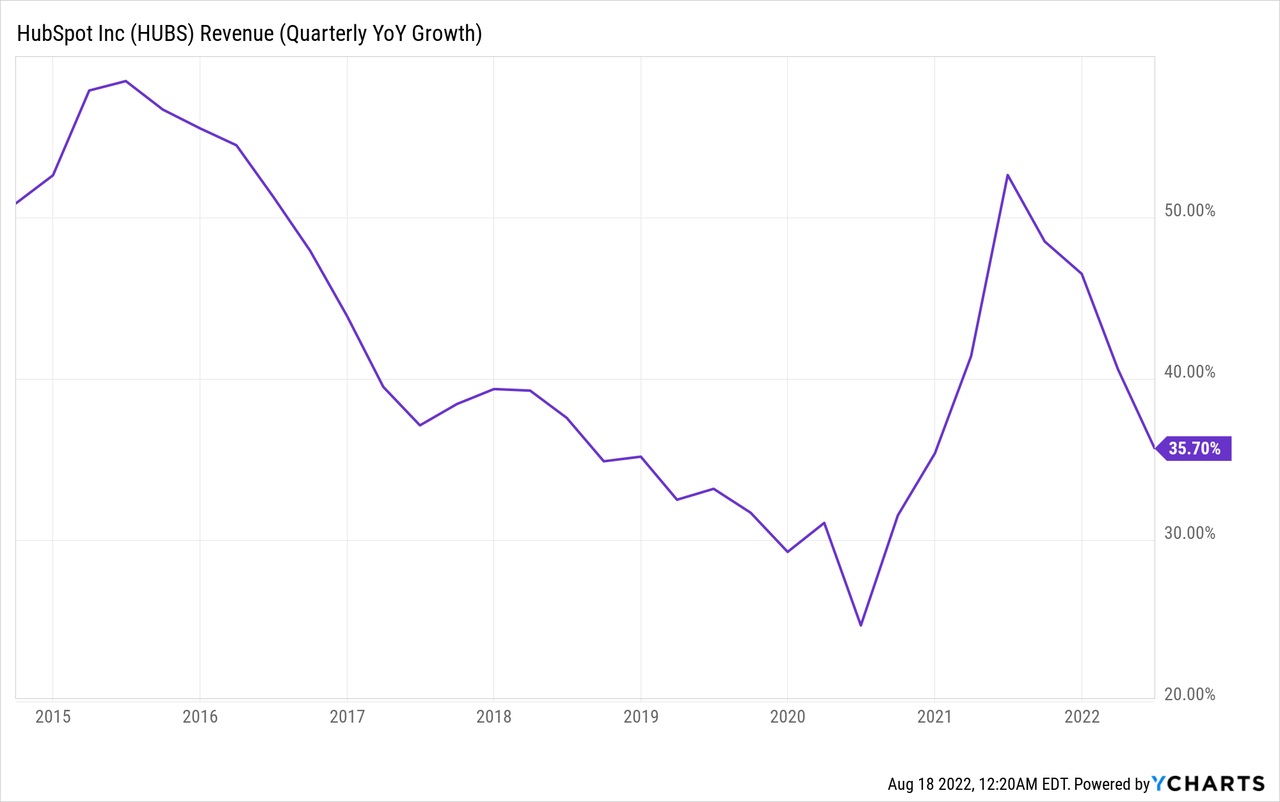

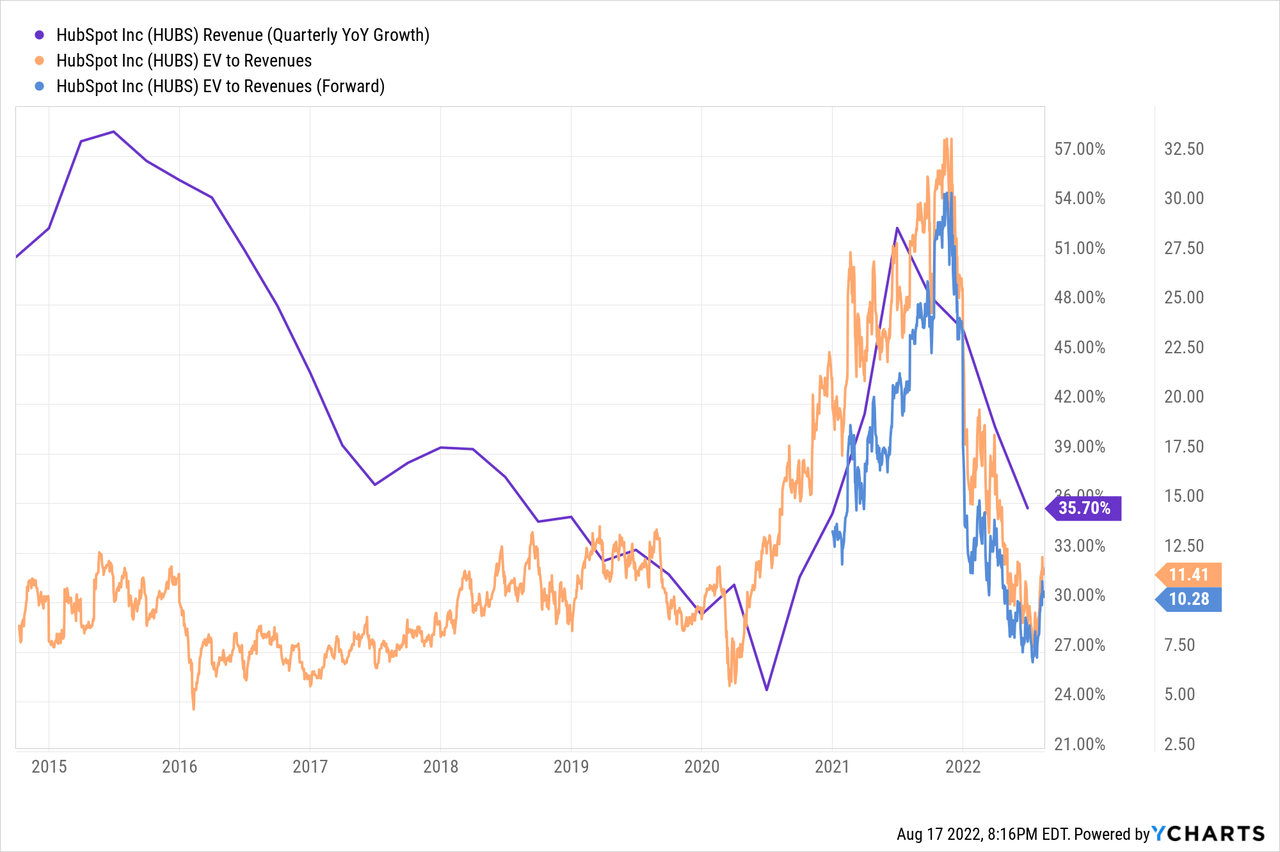

Revenue growth is normalizing to its pre-COVID trend, though it’s still ahead of the 2018 pace, despite tough comps. In the chart below, we can see the impact of COVID with a sharp drop in Q2 2020, followed by a great acceleration driven by SMBs embracing digital transformation and a rise in new businesses.

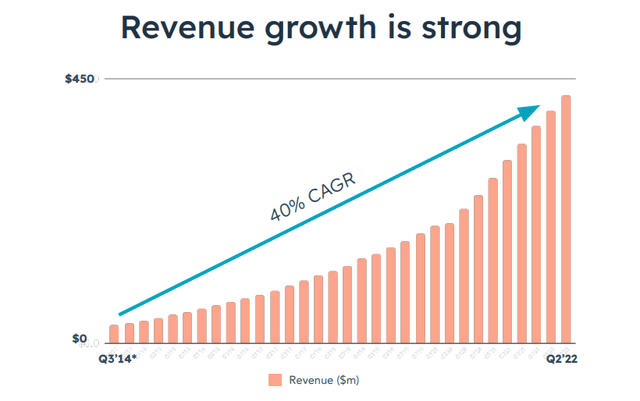

HubSpot has been an unstoppable force, growing its top line at a 40% CAGR since its 2014 IPO.

Revenue growth since IPO (Company Presentation)

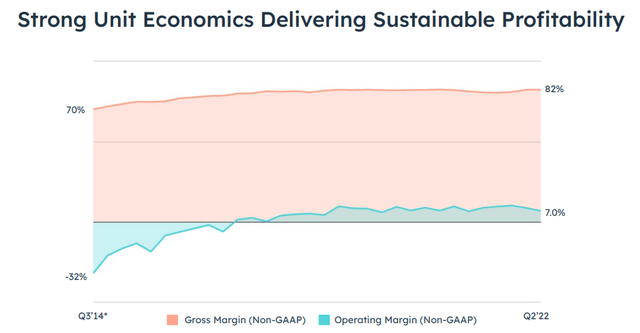

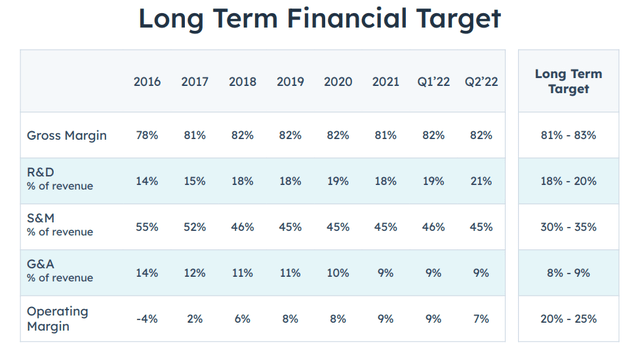

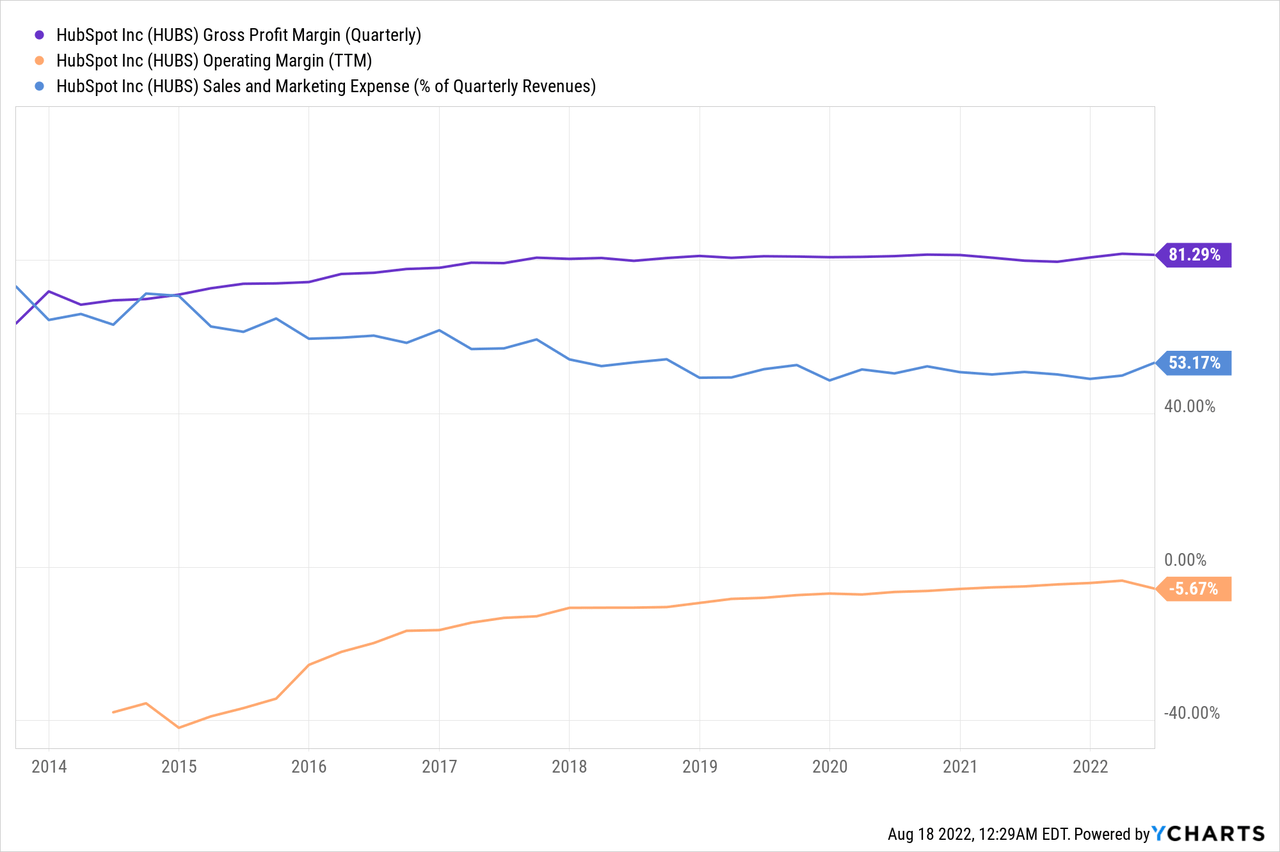

The company has been cash flow positive for years and has been capital-efficient throughout its exceptional growth phase. The margin profile of the company has steadily improved over time.

Improving margins (Company Presentation) Free Cash Flow (Company Presentation)

Stock-based compensation was $166M in FY21, which was 13% of revenue. This is on the low end of the spectrum compared to peers of a similar size. In addition, the ~1% dilution annually is not a concern for me.

Management provided a clear roadmap for future margin expansion. Over time, the adjusted operating margin is expected to reach 20% to 25%.

Long Term Financial Target (Company Presentation)

The consistency of the execution has been something to celebrate.

Overall, the company’s most recent financial results can be summarized as follows:

- Strong top-line growth (+36% FX neutral) – showing strength.

- Stable gross margin at 81% – showing long-term potential.

- Flagging sales & marketing costs – showing scalability.

- Improving operating margin – showing operating leverage.

- Positive cash from operations – showing sustainability.

Valuation: Back to Pre-COVID

HubSpot has historically been valued between 10 and 13X trailing revenue in the two years pre-COVID (close to Salesforce), and today it’s trading at ~11X.

Here is more context on HubSpot’s valuation based on Wall Street’s estimates:

- 10 times FY22 revenue estimate.

- 8 times FY23 revenue estimate.

- 7 times FY24 revenue estimate.

So as you can see, even assuming HubSpot will merely meet Wall Street’s expectations moving forward, it will “grow into” its valuation multiple quickly. Moreover, given the company’s track record, I believe it’s well-positioned to outpace Wall Street’s expectations.

If a company like Salesforce trades at 7X trailing revenue while growing in the mid-20s, it does make sense to see HUBS trade at a premium while growing in the mid-30s (FX neutral). Given the company’s track record, I believe the premium is justified, and HUBS is cheaper than companies growing at a similar pace, such as Sprout Social (SPT) or Five9 (FIVN).

I tweeted the comparison below last month, illustrating how HubSpot has a better growth profile than Salesforce at the same revenue milestone.

While HUBS is up +35% since my tweet, I believe the opportunity remains compelling for investors with a multi-year time horizon.

Bottom Line

To wrap it up:

- Opportunities:

- HubSpot has an outstanding track record of innovation with new product launches. In addition, CMS, payments, and commerce could be the next growth phase in the coming years.

- International revenue has grown from 22% in 2014 to 46% in 2022, illustrating the potential outside of North America.

- Risks:

- Martech is increasingly competitive, with many companies building platforms and consolidating multiple services under one roof. So while HubSpot is well positioned as a leader in most categories, it may have a smaller piece of the pie over time.

- SMBs can suffer in a challenging macro environment, leading to a higher churn.

- While the valuation is attractive from a historical standpoint, it could still compress dramatically in the near term, like Salesforce in late 2008.

HubSpot has the trajectory of a secular grower, creating tremendous value for its customers, employees, and shareholders.

What about you?

- Do you like HubSpot’s long-term potential from here?

- Has the valuation cooled down enough?

- What are the main risks and opportunities you see for the company?

Let me know in the comments!

Be the first to comment