Just_Super

Overview

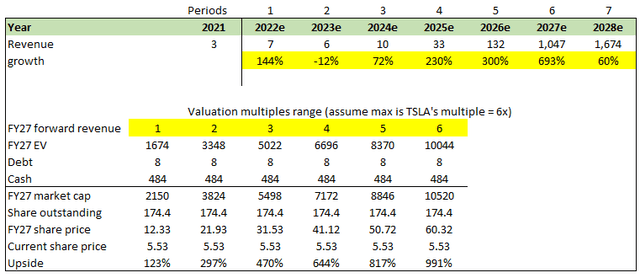

I believe Solid Power (NASDAQ:SLDP) is worth at least $12 in FY27, representing at least ~120% upside from the date of writing. In an evolving world, I believe the adoption of EVs is inevitable, and SLDP is developing a technology that will see immense demand once EV adoption picks up.

Company overview

Solid Power seeks to replace the liquid or gel polymer electrolyte used in lithium-ion battery cells with a sulfide-based solid electrolyte. As a company, it develops all-solid-state battery cells for the fast-growing battery-powered electric vehicle market. Solid Power is a revolution that works in line with another. As the global demand for electric vehicles rises, the need for all-solid-state battery cells will also skyrocket. It is only a matter of time before its full adoption.

EV adoption is eventual

Statistics compiled by the International Energy Association indicate that passenger cars are responsible for more than 45% of all transportation-related emissions. Air pollution can be greatly reduced if people start buying and driving more electric vehicles.

Many automotive companies, spurred by consumer demand and government support, have started making the transition from conventional automobiles to electric vehicles. This transition is made easier by the potential higher energy density, longer calendar life, lower costs of production involved, and increased safety. The United States is blazing the trail, leading the movement with its significant investments in the process of creating electric vehicles. In June 2021, the US Department of Energy announced additional initiatives to boost the domestic supply chain of advanced batteries. As part of these projects, federally funded grants, cooperative agreements, and the release of a national model for the development of a domestic advanced battery supply chain were used to make the United States’ manufacturing needs stronger.

In August 2021, President Biden issued an executive order mandating the sale of only zero-emission vehicles by 2030. These vehicles must be either fully electric, plug-in hybrid electric, or fuel cell electric. In addition to this, federal and state tax concessions are enjoyed by those who use electric vehicles. The contributions of the state governments are not any less important than those of the federal government. An example of proactiveness towards electrifying vehicles is seen in the proposed budget for 2021–2021, where the governor of California set aside $500 million to increase the number of electric vehicle charging stations in the state. The state of Michigan has also provided economic grants to ensure the installation of direct current fast chargers. Other countries have joined in the race, with Germany’s announcement that it will invest €5.5 billion to support the installation of electric vehicle charging stations. This is followed by providing a €6,000 subsidy to consumers off the cost of an electric vehicle.

The problem with EV adoption

The liquid electrolyte-based lithium-ion battery cell has helped the adoption of electric vehicles at the initial stages. However, considering the factors of safety, energy density, and stability, any further investment may yield diminishing returns. This means that technology has reached its limit. Without a newer, more sustainable source of energy for electric vehicles, the demand for them may rapidly drop off. Apart from this, there are downsides to the use of lithium ion battery cells that discourage the spread of electric vehicles.

- Drive range is limited because the current generation of lithium ion battery cells does not produce enough energy density to allow for longer drives before running out of power.

- According to management, the calendar life of today’s electric battery cells is shorter than that of the average automobile. This means constant replacement of battery packs, leading to a waste of money over a period of time.

- When exposed to abusive conditions, the liquid electrolyte is a fire hazard. The lithium ion battery packs have parts that are highly flammable and volatile, which is dangerous.

- Expensive materials and pack systems: The currently used battery packs are complicated in their makeup. Their highly volatile and flammable systems require cooling systems to maintain a stable system. This exacts a heavy toll on the cost of production.

SLDP proprietary product solves the problem

The all-solid-state battery cell technology provides vital advancements towards solving the problems of the lithium-ion battery cell. The improvement encompasses these four areas.

- Energy Density: Compared to the last generation of battery cells, the changes in electrode capacity make the energy density better in a bigger way.

- Using a solid electrolyte based on sulfide improves high temperature stability. These new designs for battery cells are meant to make a big difference in how long the battery cell lasts.

- Safety: The sulphide-based solid electrolyte used in the battery cell will make a big difference in safety by getting rid of the reactive and flammable liquid and gel parts.

- Cost Savings: Without needing a complex battery design, SLDP is able to use simpler manufacturing systems, encouraging cost savings. In addition, the new all-solid-state battery cell is built based on the infrastructure of the older lithium batteries, thus attaining cost equivalence.

The above advancements SLDP has made in solid-state battery cells are predicted to generate important benefits for the EV industry. The fresh battery cells will procure an upgrade in energy density compared to the best of the lithium-ion battery cells. Reduced pack mass due to the removal of cooling systems and increased energy density will give automated OEMs the flexibility to stabilize cost and range. Based on SLDP’s internal modelling and projections, the Lithium Metal EV cell design could deliver a similar vehicle range while shaving off mass by 46%, compared to the liquid electrolyte-based lithium ion-based battery cell.

Proven capability to manufacture at scale

By 2022, SLDP is expected to achieve automotive qualification, making it the only inorganic, all-solid-state battery cell company to achieve this feat. Solid Power has demonstrated its ability to manufacture EV-relevant battery cells with suitable dimensions for their application to automobiles. It is the only known battery cell company using the industry-standard, scalable manufacturing methods and equipment. Since early 2020, SLDP’s pilot production line has been running at full speed. Since then, hundreds of battery cells have been made and tested.

Key partnerships with leading automotive OEMs

As someone said, “If you want to go far, go with people who are going in your direction.” That’s what SLDP is doing. It recognizes the importance of some partnerships, especially when a big new idea is about to be made. Its partners, BMW (OTCPK:BMWYY), Ford (F), and SK Innovation, all notable automobile heavyweights, announced that the successful development of the solid-state battery cells could put these companies in a powerful position when compared to their contemporaries. This advantage will show up in terms of driving range and cost.

Patents to protect proprietary technology

Eight years of backbreaking work have gone into the proprietary all-solid-state battery cell technology, the past 3 years showing that the technology can be widely produced using the existing lithium-ion battery cells as a foundation. To protect its technology from being stolen and to keep internal trade secrets secret, SLDP has kept a vast portfolio of patents and patent applications.

Valuation

I believe SLDP is worth at least $12 in FY27 which represents at least 120% upside from the date of writing. The key assumption is that SLDP would be able to meet management’s guidance.

This value is derived from my model based on the following assumptions:

- Revenue growth will follow management’s mid-term guidance stated in the SPAC presentation.

- SLDP would at least trade at 1x revenue in FY26. Honestly, I believe it would trade somewhere in the mid-single digits – derived by applying a discount to TSLA’s (TSLA) forward revenue multiple today. The reason for using TSLA is that it is a widely known EV player that is well covered.

Considering that this is a forecast for the next five years, all of these assumptions are very contentious and unlikely right now. We must, however, estimate how much SLDP may be worth if it reaches guidance, and my model indicates a substantial upside if it does.

Key Risks

No commercial agreement yet

SLDP has not reached any commercial agreements with its partners on economic terms for the supply of solid-state battery cell technology or deals in sulfide-based solid electrolytes. This means that the projections for future revenue and other monetary terms are unpredictable.

Complicated process to manufacture the batteries

Solid Power works with top-tier battery cell suppliers and automotive OEMs that will manufacture the solid-state battery cells while signing licensing agreements. The development of a manufacturing process that works with existing lithium ion battery cells will provide substantial competitive benefits. However, constructing these lines for production of the battery cells could present unforeseen challenges.

Solid-state battery cells need to be widely adopted

The business plan is able to thrive only when there is a ready market for the battery cells. This market must be able to develop at the anticipated levels in the time frame. If this does not work out, there might be revenue problems.

Summary

SLDP is undervalued at its current share price as of the date of this writing. Based on the productive capability of SLDP to manufacture in large quantities, its key partnerships with bigger vehicle brands, and its proprietary patents, Solid Power is the business of the future. As the demand and sales of electric vehicles increase, so will that of solid-state battery cells.

Be the first to comment