Justin Sullivan

This article was published for members of Leads From Gurus on July 06.

I have never driven a Ford (NYSE:F). In this part of the world where I live (Dubai, to be more precise), sedans dominate the passenger vehicles market in complete contrast to the United States where trucks enjoy the lion’s share. In recent years, however, sales of SUVs have skyrocketed in the Middle East, but Toyota Motor Corporation (TM) and Nissan Motor Co., Ltd. (OTCPK:NSANY) have taken an early lead in this market. Ford Motor Company has built a name around its flagship trucks including the F-series, but due to demographic reasons, Ford is not among the most popular vehicle brands where I live. This could not stop me from investing in Ford stock last year when the stock was trading hands at around $12. In follow-up articles I published after initiating coverage of Ford over a year ago, I have highlighted many reasons to invest in the company including its ambitious plans to penetrate the EV market, the attractive dividend, and the long runway for growth as a new-generation automobile manufacturer. In this article, I will discuss several important developments that could potentially impact my investment thesis for the company.

How Good Are Ford’s June Sales Numbers?

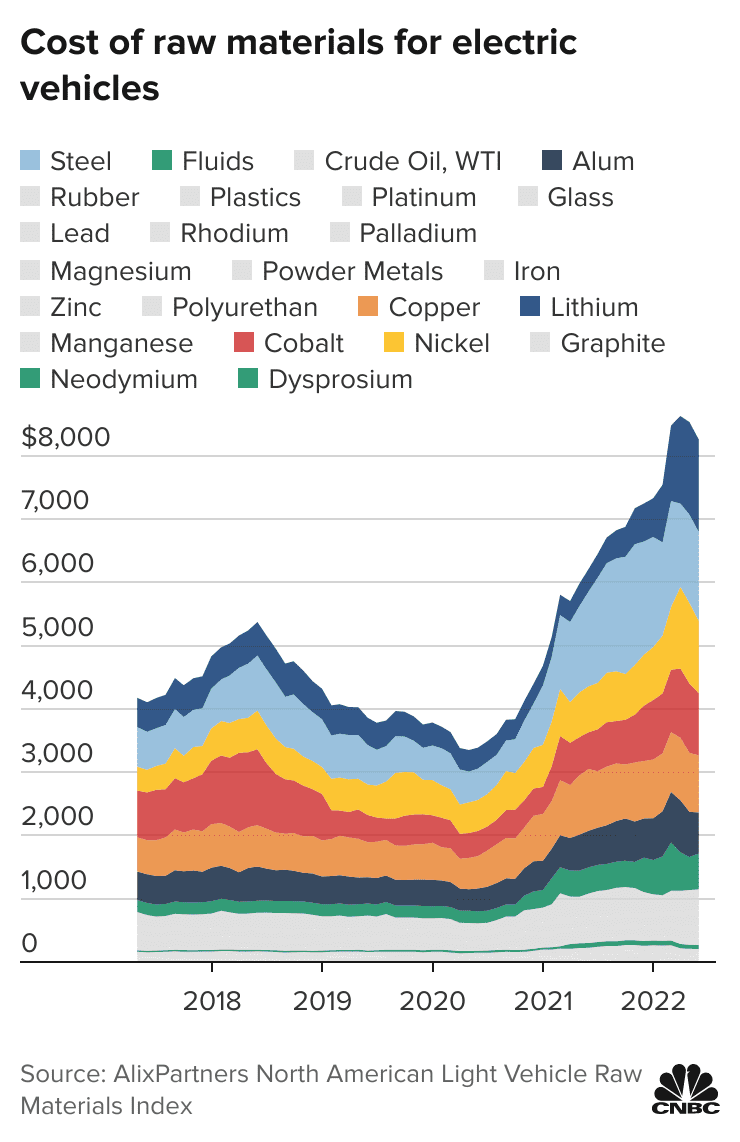

On July 5, Ford reported a 31.5% YoY increase in total U.S. sales to 152,262 vehicles. The company, as illustrated below, registered growth in each of its main vehicle categories.

Exhibit 1: June 2022 sales

EV sales jumped a stellar 77% from a year ago, which should be welcome news for investors as it highlights the progress the company has made in penetrating the EV market in the U.S., which is expected to grow exponentially in the next 5 years as the industry makes the transition into embracing sustainable business practices. In June, industry sales dipped by around 11% so it would be fair to say that Ford has bucked the industry trend. The decline in total vehicle sales in the U.S. auto industry paved the way for Ford to account for a higher share of total sales as well. Ford enjoys higher margins on trucks and SUVs, so the fact that over 95% of June sales came from these categories is another positive for investors. To add some more color, Toyota Motor Corporation reported an 18% decline in June sales in the U.S. while General Motors (GM) reported a 15% decline in Q2 sales.

These numbers certainly look good, but as investors, we need to remain objective when analyzing the numbers of a company that we have already invested in. To put it more simply, we should not let confirmation bias get to us. If we look at the big picture, it’s easy to understand that Ford had an easy comparable to beat this June because of its struggles in June 2021. Ford, in case you did not notice, was the hardest-hit automaker in the U.S. from the global chip shortage last year. The company’s sales were negatively impacted in June 2021 so Ford was anyways well-positioned to deliver impressive numbers this June.

Exhibit 2: Number of vehicles taken out of production due to the chip shortage as of May 2021

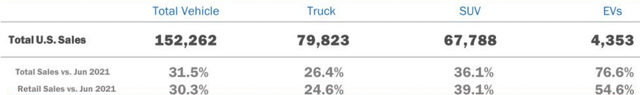

The low base for comparison was one of the major reasons why analysts were expecting Ford’s Q2 sales to rise over 3% but Ford reported a 1.9% rise in sales. Ford’s apparent failure to meet Wall Street expectations was not welcomed by Mr. Market.

In conclusion, there were a lot of positives in Ford’s June sales report but the numbers may not be as impressive as they sound.

Fighting Inflation is Easier Said Than Done

Ford is successfully executing its turnaround strategy – at least from what we saw in recent quarters. Although I could have booked a gain of almost 100% early this year when Ford stock hit a high of above $25, I decided not to do so as I am looking for multi-bagger returns from my investment in Ford. For this to happen, however, Ford needs to double down on its EV strategy to become one of the leading EV companies in the U.S. and worldwide. Because of Americans’ love for trucks and SUVs, I believed and still believe Ford is in a great position to become a leading EV maker in America, which is the biggest target market for the company. Inflation, however, is very likely to get in the way of Ford’s ambitious EV plans in the short to medium term.

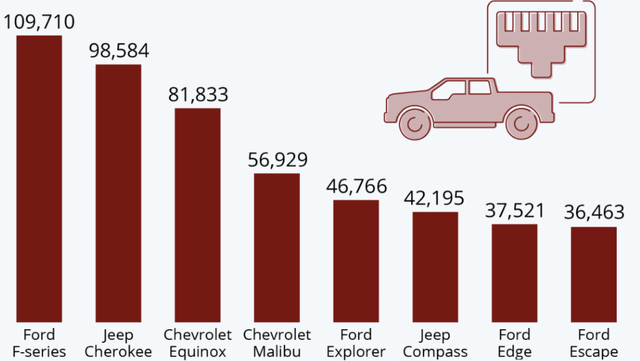

According to AlixPartners, the cost of raw materials used in electric vehicles has more than doubled since the start of the pandemic, and this inevitably has resulted in automakers passing some of these costs to consumers as well.

Exhibit 3: Cost of raw materials for electric vehicles

CNBC

Tesla, Inc. (TSLA), Ford, and General Motors have already hiked their EV prices this year, with some Tesla models costing more than 10% than they did at the start of the year. According to JD Power data, the average price of an EV in the United States has increased from $44,000 in May 2021 to $54,000 in May 2022, which confirms EVs are increasingly becoming expensive to the extent that these vehicles are now becoming luxury products. Demand continues to stay strong for the time being but it would be irrational to expect this strong demand to continue through the end of this year with the Fed firmly focused on fighting inflation with rate hikes while geopolitical tensions are contributing to inflation.

The rising inflation, in my opinion, will eventually lead to a slowdown in demand for EVs and all other vehicle categories in the next few quarters, which is not good news for Ford at a time when the company is transforming itself. Even if Ford sales were to remain unchanged because of its strong combustion engine vehicle portfolio, Mr. Market is very likely to punish the company nonetheless as EV sales seem to hold the key to Ford stock’s success.

Intel Corporation (INTC) CEO Pat Gelsinger believes the global chip shortage will not materially improve until the end of 2024, so we are likely heading into a period where Ford will face challenges from both the demand and supply front (the company currently is seeing strong demand).

The Path to Recovery

I would like to think of this period as a consolidation period where Ford can focus on getting its EV strategy right to prepare for a boom in demand for EV trucks as macroeconomic conditions improve. The company should reap the rewards of its combustion engine vehicle portfolio which has already delivered impressive returns in the last few decades. In the short run, I believe Ford stock is unlikely to please shareholders due to reasons that are not in the control of the company management. Gaining traction in China will not be easy either with many local brands increasingly becoming appealing to Chinese consumers because of the localized features they offer, and for this reason, I believe Ford is unlikely to impress investors until things move forward in the United States. The company’s EV investments may not yield the expected results in the short run, and this could lead to lower stock prices in the coming months as well.

Takeaway

Ford has been a part of our portfolios at Leads From Gurus for over a year now, and I believe investors will have to stomach some short-term pains before things get better for the company in the long run. I feel comfortable adding to my long position at these stock prices but I am not comfortable going all-in given that more troubles are likely in the coming quarters. Even after incorporating all the challenges faced by today, I still believe Ford stock is the best bet to ride the expected boom in EV sales.

Be the first to comment