Justin Sullivan

Investment thesis

About two months ago I wrote my initial thesis on Broadcom (NASDAQ:AVGO) and the share price has increased by 23% since then. Yesterday, on Oct. 8, Broadcom released its 4Q22 results and they delivered another strong quarter. Financial results were very impressive across the board and showed real resiliency in the business. The tough economic circumstances are causing a lot of difficulty for the semiconductor sector in general with several companies such as Nvidia (NVDA) and AMD (AMD) reporting significantly lower growth rates. In addition to this, Broadcom also guided for another strong 1Q23 with revenue and EPS expectations above the analyst consensus. Growth is expected to slow down slightly but remains comfortably in the double-digit range.

Despite strong financial performance so far this year and the recent increase in share price, Broadcom is still down by 20% so far this year. Within this article, I want to see whether these latest financial results change anything for my long-term thesis and see if the stock is still a buy at current levels.

In my previous coverage, I wrote that I thought the company was a no-brainer at prices of around $430 a share. I expected Broadcom to deliver another strong quarter of growth and so it did. I also added the following:

The company continues to show very strong growth and sees no slowdown as of yet. If the company manages to deliver on next quarter’s results, a bounce back to above 600 per share is highly likely. The exceptional dividend, low valuation, and high growth make the stock a beautiful buy at current prices. The stock has been pulled down with the rest of the semiconductor sector, completely unjustified, and so this is a rare occasion for any investor to buy a beautiful company at a discount. Broadcom is a very strong buy for me.

With the shares now trading close to $550, the stock is not far from that $600 price target. Broadcom did confirm my thesis of strong resiliency and continuing growth. With the semiconductor company still down 20% so far this year, despite strong results, is it still cheap?

Let’s see how Broadcom did over the latest quarter.

Financial results

Broadcom beat analysts’ expectations for both revenue and EPS by small margins as it was another strong growth quarter despite economic worries. Revenue came in at $8.93 billion which equaled 21% YoY growth. There are not many large-cap semiconductor companies managing to still report growth rates this strong and consistently. Net income was $3.36 billion with an EBITDA of $5.72 billion. Non-GAAP EPS was $10.45 and cash from operations was a strong $4.58 billion, resulting in $4.46 billion in free cash flow. This means the free cash flow margin is a stunning 50% of revenue which is quite impressive considering inflationary pressure. The free cash flow margin was only down by 1% compared to the previous quarter. Broadcom remains to be a cash flow machine under any circumstances it seems. Broadcom continues to see strong demand from all sectors. This is what CEO Hock Tan added:

Broadcom’s fiscal year 2022 revenue grew 21% year-over-year to a record $33.2 billion, as a result of strong demand from hyperscale, service providers, and enterprise. This growth was driven by our strong partnerships with customers and accelerated adoption of our next generation technologies. As we look into fiscal 2023, our increased R&D investments during the preceding years position us to extend our leadership in next generation products within the end markets we address.

Hock Tan continues to be very optimistic about the growth prospects for Broadcom, and from a business performance standpoint, he has no reason not to be. He believes Broadcom can extend its leading position in several categories which will keep driving growth for fiscal 2023. When reading Hock Tan’s comments about the outlook and seeing the business performance, I really cannot explain why people are willing to pay way higher multiples for many other, less stable, semiconductor companies. Broadcom seems to be a perfect combination of growth and value.

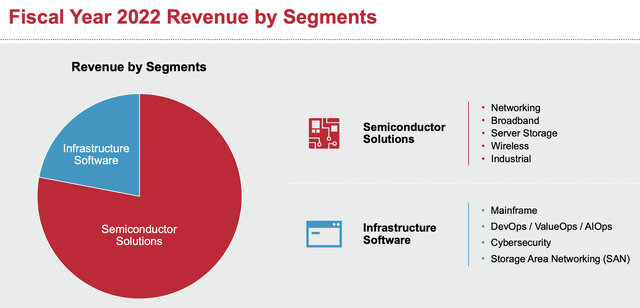

Broadcom’s business consists of a semiconductor segment and an enterprise software segment. The semiconductor segment has been the main revenue driver for Broadcom for years and this continued over the latest quarter. Semiconductor solutions grew by 32% while the infrastructure software business grew by 5%. 78% of revenue for Broadcom now comes from the semiconductor solutions segment. Broadcom is trying to diversify its business away from the traditionally cyclical semiconductor industry by acquiring many businesses within the infrastructure software industry. The latest acquisition, although still awaiting regulator’s approval, is VMWare (VMW).

All in all, it was another excellent quarter for Broadcom with growth remaining very solid despite a lot of industry weakness. With investors lately paying a lot of attention to outlooks to see just how strong a company is, they were looking for a strong outlook from Broadcom as well. Management’s outlook did not disappoint as it came in above analyst expectations. Broadcom guides for $8.9 billion in revenue for 1Q23, flat QoQ. Yet, this does represent a YoY growth rate of 16%. Despite a small slowdown, which is likely inevitable, Broadcom keeps guiding for solid double-digit growth and that is simply hard to find anywhere among the large-cap semiconductor companies.

I expect Broadcom to beat these expectations and report another record quarter for revenue. The performance of Broadcom continues to be impressive, the outlook is resilient, and the price remains inexpensive.

Business update

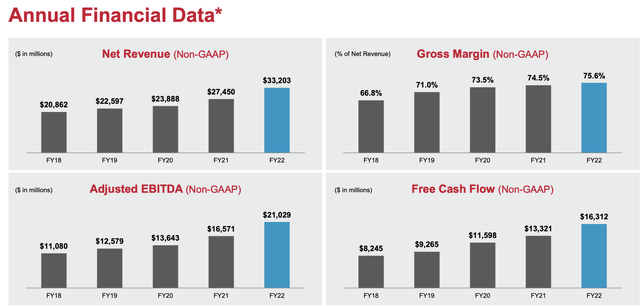

A few important facts to take away from the investor update is that Broadcom ended its FY22 with a record revenue of $33.2 billion. The company spends a solid $4.9 billion on R&D over the year and now holds over 17,000 patents. Broadcom continues to expand its business offering and is a category leader in both the semiconductor industry and enterprise software industry.

As for the business, not a lot has changed as the company keeps focusing on developing solutions for high-growth industries and opportunities such as High-performance Connectivity, Cloud, Mobile, and industrial (with exposure to renewable energy and Automotive). I believe Broadcom has exposure to a lot of promising industries that will drive growth over the next decade. Broadcom remains to be an industry leader in connectivity for mobile, broadband, and cloud. As a lot of solutions offered by Broadcom are essential and less cyclical compared to companies like Nvidia or AMD, with exposure to PC and gaming, Broadcom has so far been less exposed to the economic slowdown. Broadcom is simply less exposed to cyclical industries and consumer spending. Exposure to high-growth industries such as cloud, automotive, and cybersecurity will keep growth resilient as these industries are not expected to slow down by as much.

All of the factors mentioned above also drive growth in general and allowed Broadcom to earn $16.3 billion in free cash flow for FY22, which is approximately 50% of revenue.

Broadcom FY22 results (Broadcom)

For a more in-depth view of Broadcom’s products and history, I recommend reading my previous article on Broadcom.

Broadcom is a technology leader and continues to expand its huge portfolio of solutions. This brings me to one final point to discuss and that is the acquisition of VMWare. Not a lot has been released about the progress of an eventual review from the FTC. On Dec. 6, Seeking Alpha did report that the focus from the FTC would be on conglomerate effects as there do not seem to be horizontal overlaps or vertical concerns. Broadcom is reportedly speaking with antitrust authorities in both Europe and the UK to force a deal.

On Nov. 21, Seeking Alpha reported that the $61 billion deal was under scrutiny in the UK as the antitrust regulator stated that the deal could severely lessen competition.

I do not see any significant threats to the potential acquisition and expect the antitrust regulators to allow the deal to be completed. This would significantly increase the enterprise software exposure for Broadcom and diversify the business. Of course, this does bring some risk as VMWare needs to be integrated into Broadcom without many issues. Luckily, Hock Tan has done it many times before and very successfully as well.

As for industry outlook, the semiconductor industry is expected to grow at a 12.2% CAGR until 2028. Broadcom is exposed to a lot of high-growth semiconductor markets and therefore has solid growth potential from market growth. The enterprise software market is expected to grow at a 9.5% CAGR until 2030 and should drive growth for Broadcom as well with the business getting more exposure to this industry.

Balance sheet and dividend

The company’s cash and cash equivalents at the end of FY22 were $9,97 billion, compared to $9 billion at the end of the prior quarter. With a total debt position of close to $40 billion, the company has a significant net debt position still, but this is not something to worry about as we have seen Broadcom is very much able to generate significant amounts of free cash flow which it could use to pay down its debt if necessary. For now, the debt is not a problem.

Broadcom pays a very strong dividend yield and even increased the dividend with the latest earnings release. Broadcom increased the dividend by 12.2% to $4.60/share. That brings the forward yield to a very solid 3.46%. Broadcom has been increasing its dividend at a five-year CAGR of 32% and therefore receives an A+ for dividend growth from Seeking Alpha. The payout ratio still stands at a safe 43.65% and allows Broadcom to keep increasing the dividend over the next few years.

In addition to the strong dividend, Broadcom also continues to buy back its shares. During the latest quarter, Broadcom returned $1.5 billion of cash to its shareholders through share buybacks and returned $1.7 billion through dividends. This brings the total return to $3.2 billion for the quarter, which is well covered by the free cash flow of $4.5 billion. There’s still $13 billion remaining in the current share repurchase program and Broadcom will keep buying back its shares over the next couple of quarters.

Risks

The main risks for Broadcom appear to be a slowdown in the business as a result of a severe recession and the risks as a result of the VMware acquisition. I do not expect Broadcom to be able to keep growing by double digits if the economy would enter a severe recession by the end of 2023. This could significantly lower the growth rate for the business and make it hard to keep cash flows as strong. A potential slowdown would mean a drop in share price, but I think there is a significant margin of safety at the current price as a lot seems to have already been priced in.

As for the VMWare acquisition, there’s still the risk of an antitrust suit from regulators, but this chance seems to shrink. There seem to be more risks if the deal would be completed. Broadcom will need to integrate the business, and this might bring some problems. Hock Tan has done it many times before and it will be nothing new, but it still offers some challenges and could bring on some unexpected problems which could hit margins. It’s important to be aware of, but at the same time not something to worry about too much for now.

Conclusion

In my previous article, I rated Broadcom a strong buy at a share price of $432. The share price has increased significantly, and the stock now trades in the $550 range. The forward P/E has also increased from a very low 11.7 to over 14 today. Is the stock still cheap? My answer, considering the latest results and outlook, is yes. Considering the potential growth remaining for Broadcom over the next decade, the resiliency, and the sales mix, I believe Broadcom should be valued significantly higher than at 14x earnings. I also expect analyst expectations to increase over the next several weeks as the strong results and outlook are being priced in.

Broadcom continued to outperform expectations and report incredible growth, despite a difficult economy. I’m very impressed by the business and continue to see Broadcom as a high-conviction pick for long-term growth and strong shareholder returns. My long-term thesis has not changed, but I have become more convinced.

I expect Broadcom to report high-single to mid-double digits for FY23 depending on the severity of a potential recession. Growth will most likely slow down compared to previous years but still remain strong.

I believe the fair value for Broadcom to be closer to $650-$700 per share and think the company is a solid buy on current prices and remains to be inexpensive. I do think the share price is less attractive than it was two months ago and therefore lower my rating to a buy rating from strong buy.

I rate Broadcom a buy at current prices on long-term growth potential, solid dividend growth, and business resiliency.

Be the first to comment