Editor’s note: Seeking Alpha is proud to welcome Saguaro Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

hapabapa

While the context and terms of the Figma acquisition show some cracks in Adobe’s (NASDAQ:ADBE) long-standing creative suite monopoly, its core creative products remain unchallenged. I believe the market has grown too pessimistic, removing ADBE’s long-standing premium over the S&P IT sector and discounting it relative to what I estimate to be its fair value. I recommend ADBE as a buy to take advantage of discounted growth, profitability, and dominant market position.

Deal Overview

Going over the details briefly, Adobe entered into an agreement to purchase Figma, which offers collaborative, web-based interface and application design tools. Figma’s application integrates all tools needed throughout the process of creation and design (storage, asset creation, prototyping, handoff and version control), while Adobe’s closest competing product, XD, only handles asset creation. Figma had done a good job of creating its own customer base, one that was much different than Adobe’s. I recommend reading the replies to the announcement of the acquisition by Adobe’s CPO on Twitter. Many responses past the first recommended encapsulate Figma customer reactions.

Adobe hopes this will accelerate product availability on the web; according to Adobe’s management, Figma’s team solved engineering problems related to cloud-based online collaboration tools, and I’ll return to what this implies for internal R&D (spoiler: it’s not great). Unlike other Adobe products, two-thirds of Figma’s users are developers and not designers, which could be a step toward broadening their customer base.

As Figma is privately held, there are just a few financial performance metrics available. Their YoY growth in revenue is expected to be 100% for FY22 at $400mm with 90% gross margins (in line with Adobe’s ~88%). Their net dollar retention (the rate of ARR growth/shrinking from existing customer base) is an impressive 150%. This is an indicator that churn should not be a worry and that Figma is able to upsell existing customers effectively, a testament to the attractive value of their products.

Monopoly No More?

Pricey

The sticking point for many investors was the purchase price of $19.410B for 50x FY22 revenue multiple, the largest acquisition by Adobe by more than $15B. Of the 50 largest application software acquisitions ever, this is the 11th largest in implied target enterprise value, yet the largest implied EV/revenue multiple. The closest is 33.3x, with an 8.27x median – expensive indeed for a deal this size.

The deal was announced in approximately half-cash/issued stock, with the number of shares issued fixed based on trading prices preannouncement. Those are obviously not ideal terms given how much shares have fallen since, and in good part as a result of the news.

Approximately 6mm additional shares will be issued over four years post-closing to hopefully retain Figma’s leadership and employees, undoubtedly key players in the company’s success so far and necessary to ensure Adobe can benefit not only from the existing technology, but also from Figma’s operational success and future innovations. Management expects the deal to be accretive to Adobe’s EPS at the end of the third year following the closing of the deal, which is set to happen in 2023. This puts expected accretion in mid- to late 2026.

Repurchases and Issuances Don’t Mix

The purchase terms give insight into what I think was a rushed acquisition process, or at least one where Adobe wasn’t driving the negotiations. According to basic corporate finance theory, companies engage in a stock repurchase program when they believe shares are trading below their intrinsic value, want to consolidate ownership, return to shareholders, boost ratios, etc. The nonsensical part here is that before announcing an acquisition partly funded by the issuance of 20mm shares, and during the same quarter, Adobe repurchased 5.1mm.

According to Shleifer and Vishny’s timing hypothesis, equity is to be issued if management believes it trades above its fair value and the proceeds are to be used to acquire less overvalued targets, extending the benefits of overvaluation by giving shareholders more hard assets per share. If anything, Figma is overvalued by the terms of the deal. On the other hand, if Adobe’s management saw their equity as overvalued, why repurchase shares before signaling such an expensive/dilutive acquisition? I’m hard-pressed to believe they did not have the foresight to know the news would drag the stock price down and present a better opportunity to return to shareholders. Either the prospect of a stock acquisition emerged after the repurchases had been made (which implies a rushed process of under three months), or the repurchase was not thought out (implies capital misallocation). I prefer to believe the former; both are possible.

When Adobe CEO Shantanu Narayen was asked about this potential misallocation in an interview with CNBC, he simply repeated that they will offset the dilution in three years. He did not address the implied contradiction in their assessment of their equity value.

Considering the above, I believe the contradiction is the result of Adobe feeling competitive pressure to close the deal, giving it the short end of the stick during negotiations. Stock issuance was, at that point, the only option to avoid debt in an uncertain macroeconomic environment with a depleted cash balance, but one that would guarantee closing the deal before Figma scaled even more and became costlier or was acquired by another competitor. Perhaps Adobe wasn’t the only one discussing acquisition with Figma at the time.

Not a Bright Light on Internal R&D

During the earnings call following the deal announcement, management said the following:

Figma has been able to do on the web by solving a lot of these multiplayer, high scalability requirements to allow the tens of millions of people to use Figma design and even more important FigJam on the web, is an engineering marvel. And having access to that technology and being able to take advantage of it dramatically increase anybody who’s participating in our design products.

What I think was supposed to be praise sounds like an admission that their much larger R&D department wasn’t able to develop such a product, or that they doubted their own could effectively compete. If such an acquisition were to happen again with a seemingly consistent product- or competition-driven rationale, Abode’s creative monopoly will mostly be invalidated.

If Adobe is unable to compete in new market segments organically, competitor acquisitions become R&D expenses with a hefty premium: Figma raised only $400mm over its lifetime.

Valuation

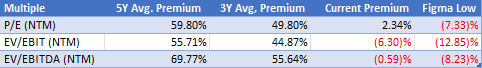

It is no secret that ADBE has traded at a premium to the broader S&P 500 IT index in past years. Take a look at how that premium has evolved until recently:

S&P Capital IQ (Aggregated and Formatted by Author)

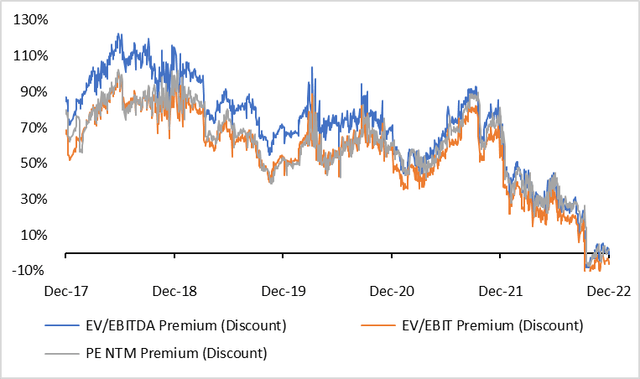

And for those who like visuals, here is ADBE’s premium evolution charted over the past five years and since the acquisition:

S&P Capital IQ (Data Aggregated and Formatted by Author)

Clearly, the market doesn’t judge ADBE as deserving of a premium anymore, but I do.

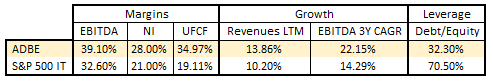

S&P Capital IQ (Data Aggregated and Formatted by Author)

ADBE has above-par growth and profitability, lower leverage, and a dominant market position. Despite the holes Figma might poke in the assessment of Adobe’s dominance in the creative industry, most of its products remain non-substitutable creative tools for both professionals and consumers. They are deserving of a premium over extremely competitive sectors where such long-term advantages are few.

Back-of-the-Napkin Multiple Analysis

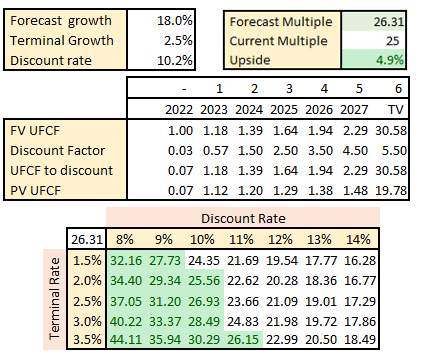

I created a simple two-stage model of UFCF growth to ballpark a fair EV/UFCF LTM multiple by taking this year’s UFCF as 1 and applying regular DCF assumptions to cash flows, WACC, terminal value, etc. Here are the results of the model:

Author Forecast, Current Data from Seeking Alpha

Note that while the forecast period growth might seem overly optimistic, it is actually below the three-year CAGR UFCF growth rate (~25%). Along with the fact that I used a conservative WACC and only forecast at this growth rate for five years, I’m confident in the output.

While the analysis above doesn’t imply significant undervaluation, Adobe traded at an ~21 EV/UFCF multiple low since the acquisition. While it has recovered, I would stay ready to act on further share price reductions and capitalize on the opportunity I’ve outlined above.

Risks and Catalysts

There are some risks to what I judge to be Adobe’s fair value. The materialization of any of the below would require reassessment of Adobe’s competitive prospects:

- Lack of R&D success, forcing further expensive competition acquisitions.

- Anti-trust opposition allowing runaway competition from Figma in an underdeveloped product segment. However, it’s worth considering that following the market’s reaction to the deal announcement this should provide a share price boost.

The catalysts below would increase earnings stability and competitive breadth:

- Significant Figma talent retention, increasing new product development success in new competitive areas.

-

Document Cloud continues to drive steady revenue from enterprise customers in a cost-cutting period for many corporate customers.

Conclusion

I do not believe the Figma acquisition will be a short-term negative catalyst, but rather that it will help Adobe grow into new market segments. However, since the acquisition might signal Adobe’s struggle to organically keep up with innovative competition, their acquisition and R&D strategy should be monitored closely going forward. Given its current market valuation, I recommend a buy as Adobe’s dominance in creative applications remains.

Be the first to comment