andresr

A Quick Take On EBET

EBET (NASDAQ:EBET) went public as Esports Technologies in April 2021, raising approximately $14.4 in gross proceeds from an IPO that was priced at $6.00 per share.

The firm provides online gambling products via its recently acquired brands.

EBET’s high and increasing operating losses provide no path to operating breakeven and I see no upside catalyst given the firm’s current financial results unless it makes meaningful progress toward operating breakeven.

As a result, I’m on Hold for EBET in the near term.

EBET Overview

Las Vegas, Nevada-based EBET was founded to develop an online esports/sportsbook gambling service focused on the regions of the Asia Pacific and Latin America.

Management is headed by president, Chairman and CEO Aaron Speach, who has been with the firm since 2020 and was previously a founding member at ESEG Limited, which was acquired by the firm.

The company’s primary offerings include real money betting on:

-

Esports titles

-

Professional sporting events

-

iGaming casino games

The company operates via gaming license from the Curacao Gaming Authority with almost all of its wager history sourced from the Philippines.

Management seeks to expand its target sources to Japan, Thailand, Mexico, and South America.

The firm operates its platform at gogawi.com, where 70% of its customers bet on esports competitions and 30% bet on traditional sporting events.

Management has sought to create a ‘business-to-business’ experience that seeks to match larger volume betting interest ‘across businesses operating in the esports wagering space,’ since it believes the industry has produced solutions that have been more focused on the ‘recreational bettor.’

EBET’s Market & Competition

According to a 2020 market research report by QYResearch, the global market for esports and esports gambling was an estimated $142 billion in 2020 and is expected to exceed $203 billion by 2026.

This represents a forecast CAGR of 6.2% from 2021 to 2026.

The main drivers for this expected growth are an increase in demand from mobile users to bet on esports activities as well as a wider range of esports events and opportunities to wager on.

Also, in 2019, Europe accounted for the largest market share in the industry at 47.7%. China [Macau] represented the second largest market at 21.2% market share.

Major competitive or other industry participants include:

-

DraftKings (DKNG)

-

Bet365

-

Pinnacle

-

Flutter Entertainment (FanDuel) (OTCPK:PDYPY) (OTCPK:PDYPF)

-

William Hill (OTCPK:WIMHY) (OTCPK:WIMHF)

-

Roar Digital

-

Luckbox

EBET’s Recent Financial Performance

-

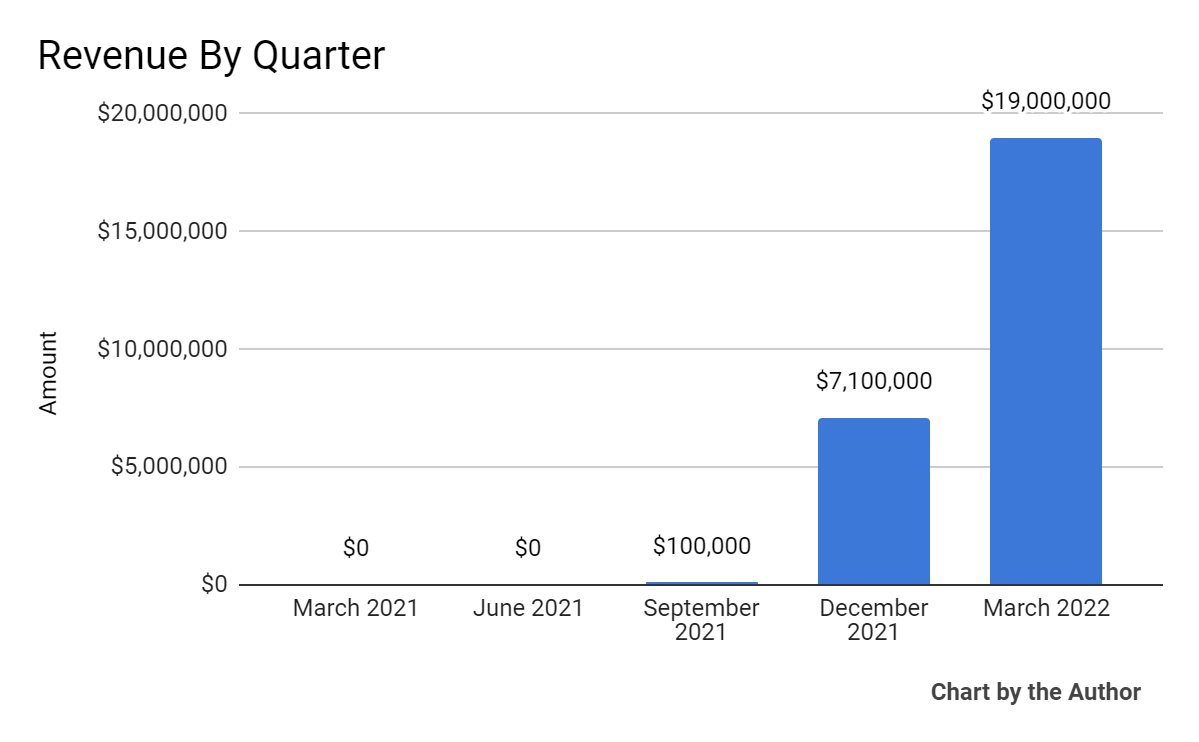

Total revenue by quarter has grown markedly in recent quarters due to the acquisition of a number of brands:

5 Quarter Total Revenue (Seeking Alpha)

-

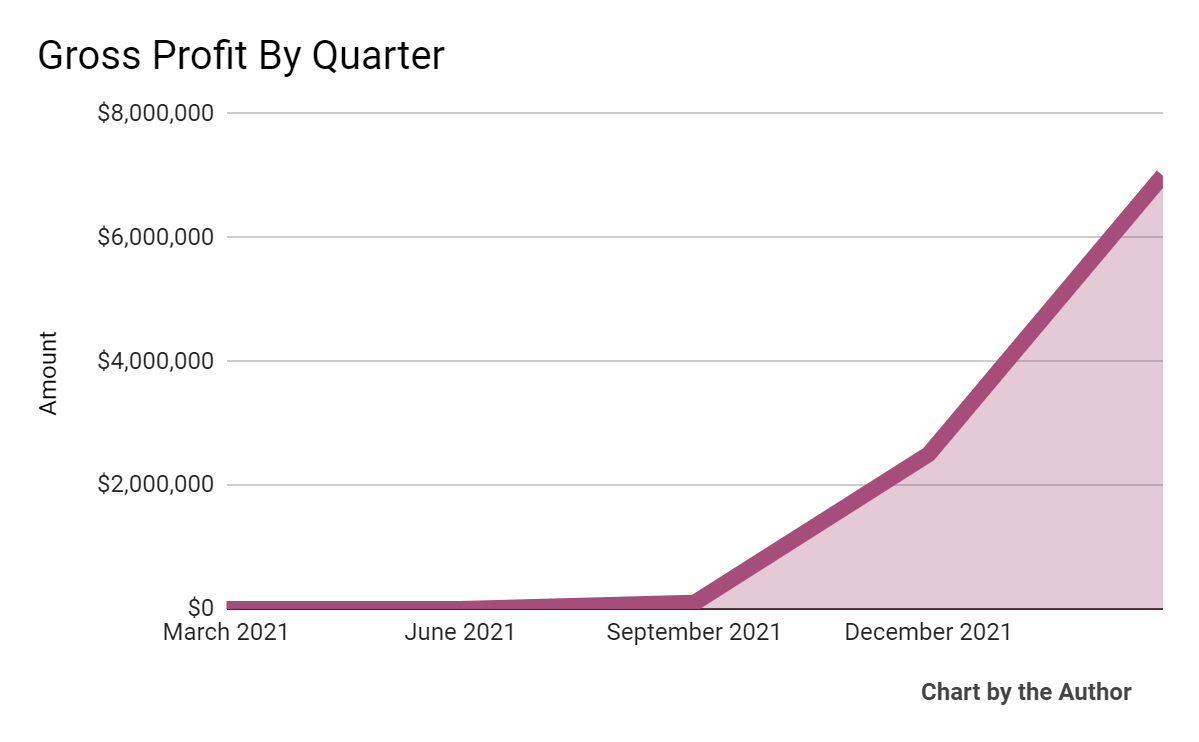

Gross profit by quarter has also grown in a similar trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

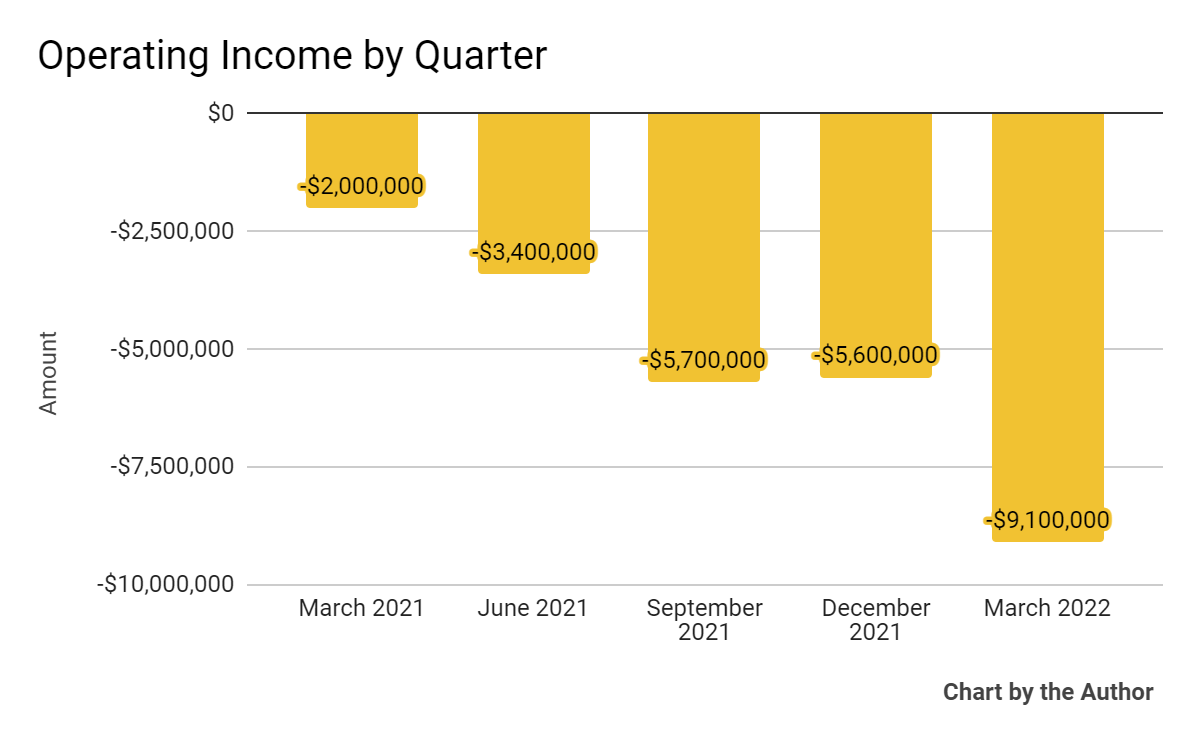

Operating income by quarter has worsened sharply into negative territory over the past 5 quarters:

5 Quarter Operating Income (Seeking Alpha)

-

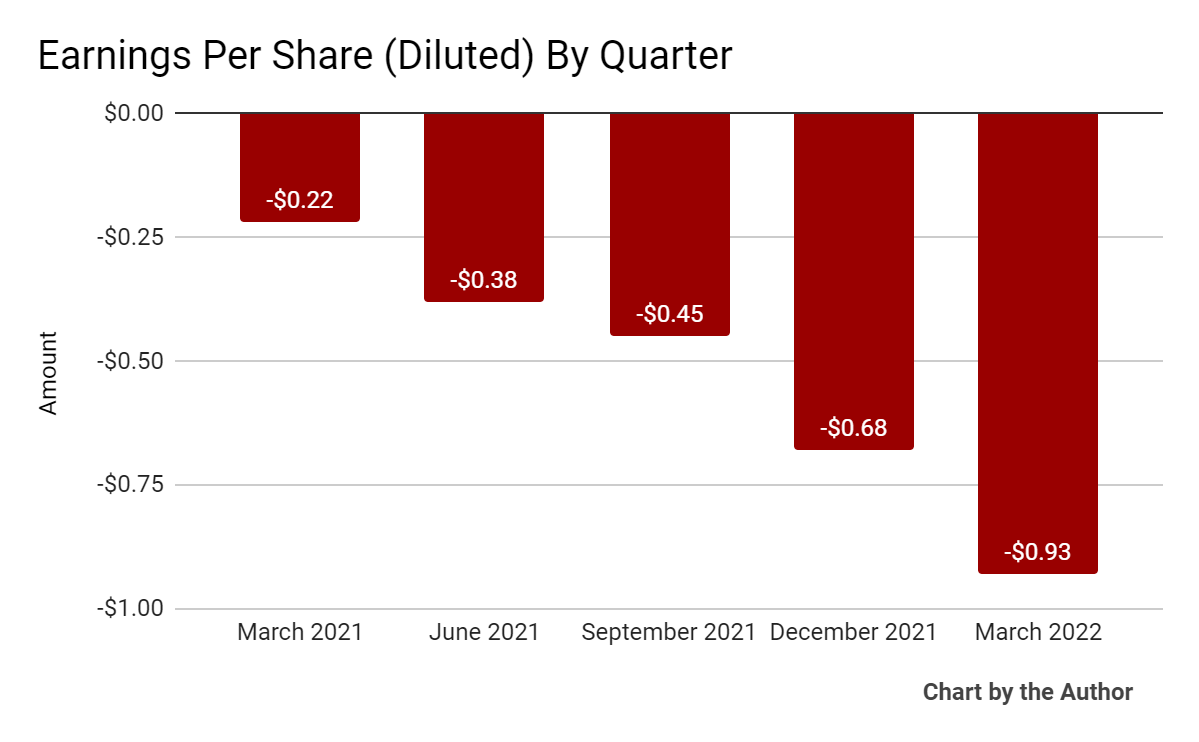

Earnings per share (Diluted) have followed a similar path as Operating Income:

5 Quarter Earnings Per Share (Seeking Alpha)

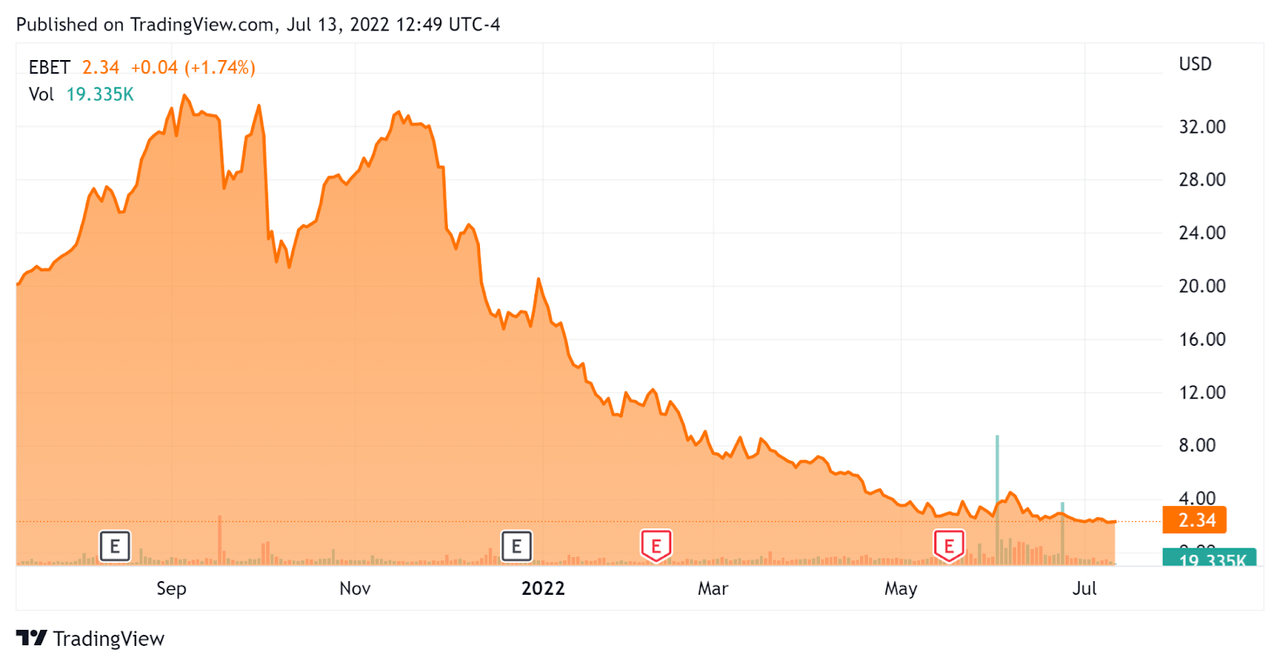

In the past 12 months, EBET’s stock price has dropped 88.4 percent vs. the U.S. S&P 500 index’ decline of around 12.7 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For EBET

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$63,700,000 |

|

Market Capitalization |

$35,980,000 |

|

Enterprise Value / Sales [TTM] |

2.43 |

|

Price / Sales [TTM] |

1.18 |

|

Revenue Growth Rate [TTM] |

16059.00% |

|

Operating Cash Flow [TTM] |

-$14,050,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.44 |

(Source – Seeking Alpha)

Commentary On EBET

In its last earnings report (Source – Seeking Alpha), covering calendar Q1 2022’s results, management highlighted the revenue growth due to recent acquisitions of ‘Karamba, Hopa, Griffon Casino, BetTarget, Dansk777, and Generation VIP’ in November 2021.

With these deals, the company intends to focus its revenue growth efforts on its sportsbook, esports, and iGaming brands.

Also, EBET plans to expand its esports odds modeling and wagering products into major European markets and beyond.

The company recently closed a private placement transaction valuing the stock at $3.58 per unit, consisting of one share of common stock and one warrant exercisable at $5.00 per share.

The private placement produced gross proceeds of approximately $3.5 million.

As to its financial results, while total revenue and gross profit have grown due to the firm’s recent acquisitions, operating losses have worsened significantly, a distinct negative in the current stock market environment due to a rising cost of capital.

For the balance sheet, the firm ended the quarter with $7.1 million in cash and equivalents.

However, its free cash use over the past 12 months was $15.1 million, and in the most recent quarter, it was a use of $5.1 million, so the company has very little cash runway based on current use of cash results.

The primary risk to the company’s outlook is its ability to obtain further financing to fund its cash use.

EBET’s high and increasing operating losses provide no path to operating breakeven and I see no upside catalyst given the firm’s current financial results unless it makes meaningful progress toward operating breakeven.

As a result, I’m on Hold for EBET in the near term.

Be the first to comment