Andy Feng

NIO’s (NYSE:NIO) end to Q2 was marred by a short report from Grizzly Research, accusing Nio of fraudulent schemes to boost revenues via a battery-focused subsidiary – while Nio is working to defend itself from the report and launching a response, it’s falling further behind rival XPeng (XPEV). Nio’s early-year slump in deliveries has placed it further behind XPeng, whose stellar performance has vaulted it ahead in a short amount of time. Nio’s lack of progress in deliveries in over three quarters is not a positive signal as XPeng, BYD (OTCPK:BYDDY), Tesla (TSLA) and others continue to see strong growth metrics.

June Deliveries Reach A Record

Nio’s June numbers reached a record, with the manufacturer delivering 12,961 vehicles during the month to close Q2 on a strong month.

Nio June deliveries (Nio (Twitter))

Nio marked its second straight monthly increase in deliveries for the first time this year, as it struggled to find growth throughout the first half of the year, falling prey to component and chip shortages, retooling facilities, and production halts.

The 12,961 unit figure represented 60.3% growth y/y and 84.5% growth m/m from a relatively weaker May. Per vehicle, Nio delivered “1,684 ES8s, 5,100 ES6s and 1,828 EC6s, and 4,349 ET7s.” Taking a look at the per vehicle breakdown and trends in each vehicle line shows a different picture than the headline delivery figure does.

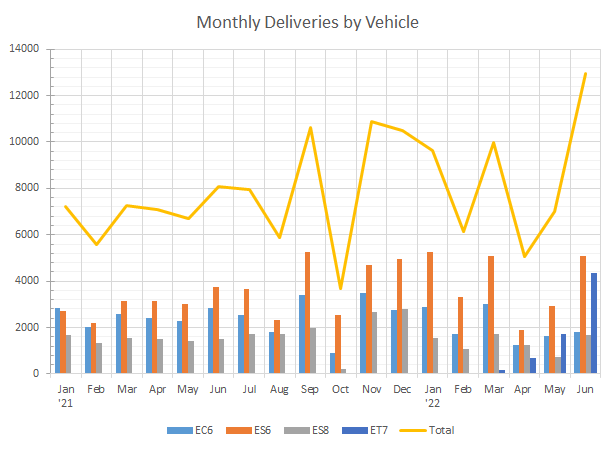

Monthly Deliveries by Vehicle (Nio)

Nio’s June was dominated primarily by a resurgence in ES6 sales, cresting above 5,000 units for the month for the first time since March to reach 5,100 units. ET7 continued its blazing growth to reach nearly 4,400 units delivered during the month, playing a major role in pushing Nio to its new monthly delivery record. ES8 recovered on the month as well, more than doubling to 1,684 units, while the EC6 performed relatively flat.

June’s performance sets up an interesting preview into Q3’s opener – ET7 sales have taken off rapidly, and while Nio has had the capacity to support 15,000 to 20,000 vehicles during Q2, it failed to eclipse the lower bound of that range, suggesting production capacity may continue to come up short as NeoPark commences operations ahead of the ES7 launch in August/September. With NeoPark, Nio should have the capacity to support up to 20,000 to 25,000 units/month by Q4 this year, but again, the company has a high bar to meet to reach those volumes. For example, Deutsche Bank “forecasts 2022 deliveries of 160K,” suggesting that in their view, Nio is likely to average 18,000 units of production for the remainder of the year.

Q2 Deliveries Show No Growth

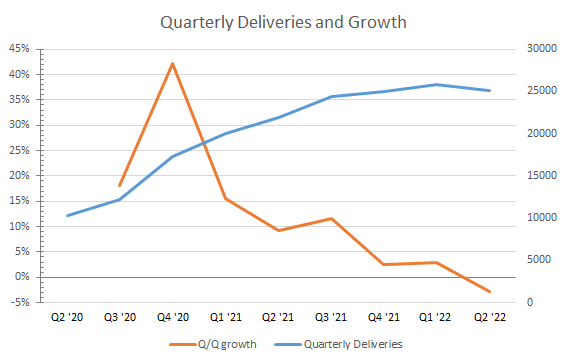

Nio’s Q2 deliveries increased 14.4% y/y to 25,059 vehicles, just slightly above its previously stated Q2 guidance of 23,000 to 25,000 units.

Since Q3 2021, Nio has shown relatively no growth in deliveries, with the manufacturer unable to solidify a quarter above 26,000 units. The tide may be about to turn with the launch of the ET7 scaling rapidly with NeoPark and the ES7 ending the year on an expected high note. Nio has high expectations ahead of itself for the remainder of the year, with Q3 the proving ground for Nio to show to the market that it can resurrect growth and re-accelerate deliveries after this prolonged slump.

Nio Quarterly Deliveries (Nio data)

Nio’s q/q growth rate for deliveries slipped into contraction, even with June’s record month, as April and May faced difficulties from supply chain issues. Nio has struggled to show growth in monthly deliveries since Q4 ’21, a string of poor results that Nio has to break in order not to fall further behind peers, and to regain its once darling status with the market.

There are multiple factors that are [likely] influencing Nio’s string of weakness:

- broader industry weakness: Q2 was plagued with broader auto industry weakness in China, as lockdowns heavily impacted demand. The industry suffered a 47.1% decline m/m (-47.6% y/y) in April and a 38.3% decline in NEV sales. May rebounded 57.6% m/m from April, but was still 12.6% lower y/y. June sales continued a rebound, although the industry still shrunk 6.6% in 1H compared to last year. CAAM has cut its forecast for the industry, seeing just 3% growth for the year, compared to a prior forecast of 5.4% as commercial vehicle demand has evaporated quickly.

- lagging EV sector growth rates: for 1H in China, NEV sales expanded 115% y/y, with June surging 129% y/y; Nio’s growth rates severely lagged both June’s and 1H’s metrics, with Nio seeing just 60.3% y/y growth for June and 21.1% y/y growth for 1H as deliveries failed to meaningfully grow. For comparison, XPeng saw deliveries grow 133% y/y for June and 124% y/y for 1H, heavily outstripping Nio’s growth

- heightened competition: competition in China is only getting stronger, with XPeng taking a swift lead above Nio, delivering 35.7% more vehicles than Nio during 1H (over 18,000 units more). Tesla “achieved its highest monthly sales of China-made vehicles” since the Shanghai plant opened, selling nearly 79,000 vehicles (+145% y/y), while BYD sold 133,762 NEV passenger vehicles (of which 69,544 were BEV), up over 160% y/y. Growth rates of this degree show that Nio is quickly falling behind against strengthening competition

- supply chain constraints: while this is more of an industry-related factor, supply chain constraints are not expected to ease relatively quickly, with Mercedes (OTCPK:DDAIF) the latest to see chip shortages persisting through at least the end of 2022, while GM (GM), Intel (INTC), NXP (NXPI), and others all forecasting chip shortages to last into 2023, adding further pressure on the industry and further pressure on solid execution for Nio. Although the company expects supply chain constraints to ease, the fragility of the supply chain has been visible already this year, and any minor impacts to critical component supply could easily derail targets.

- lack of concentration: Nio’s current strategy raises concerns that the manufacturer is doing too much, too soon. Nio is working to expand to multiple countries in Europe, while expanding their model lineup, charging and battery swapping network, while still accumulating losses. Nio is “confident of ramping up of [its] deliveries at a much faster pace in the second half of this year,” but it raises questions of if Nio can successfully execute all of these facets while pushing to scale new models.

Outlook – Is There A Chance For Growth?

Nio is expecting production capacity to improve, as well as deliveries to scale higher in the back half of the year, due to new model launches and NeoPark’s launch. CEO William Li noted that “order growth is quite significant” and Nio should see “certain growth” in Q3, but also pointed out that problems in the “supply chain, especially in terms of the chipset and also the production capacity of our suppliers,” still persist.

Nio has a lot on its plate in the back half of the year, working to build out its charging and battery swap network, get NeoPark operating, launch new models, expand internationally, navigate supply chain issues, and continue innovating in ADAS and related tech. Nio is projecting a strong 2H, but its performance over the past four quarters has shown a trend of struggling to grow deliveries. June’s record deliveries reflect that Nio may be on the cusp of a turnaround and a resumption of q/q growth in deliveries, but the manufacturer will have to perform substantially better in each month this year in order to meet both lofty targets from the Street, and to squash concerns that deliveries will fail to grow >20% q/q again. If Nio’s order book and production hold firm, and the manufacturer can deliver an average of 15,000 vehicle per month by Q4 to reach a tally of 45,000 units, the outlook reflects more positively for shares; however, risks of remaining behind do remain from the competitive landscape as XPeng, Tesla, BYD and others grow at much quicker rates.

Be the first to comment