Artur

Duolingo (NASDAQ:DUOL) is an online education platform that is best known for their gamified mobile language learning app through which people can learn up to 43 languages, including Spanish (30.8m learners), Japanese (12.9m learners), Hindi (7.5m learners), Hebrew (971k learners), Swahili (438k learners), and Esperanto (298k learners). They have a devoted base of 49.5m monthly active users (MAUs) and 13.2m daily active users (DAUs).

The business was founded in 2011 by Luis von Ahn, a Computer Science Professor at Carnegie Mellon University, and one of his PhD students, Severin Hacker. Both Co-Founders remain actively involved in the business, either as CEO (von Ahn) or CTO (Hacker).

Duolingo offers a ‘freemium’ model where customers can use the app free of charge but with ads (ad-supported plan) or pay around $7 USD per month to gain access to the app without ads and with other features, such as the ability to use the app in offline mode, practice common mistakes, and complete a mastery quiz (Super Duolingo). In that sense, the model is similar to other direct-to-consumer (D2C) software apps like Spotify (NYSE:SPOT) and Bumble (NASDAQ:BMBL).

![Duolingo Pricing Options [USD]](https://static.seekingalpha.com/uploads/2022/9/23/49966653-16639899957740505.png)

Duolingo Pricing Options [USD] (Duolingo Website)

Duolingo had a strong base of early private investors, including Tim Ferriss, Ashton Kutcher, Kleiner Perkins, CapitalG (NASDAQ:GOOGL), and General Atlantic, which enabled Duolingo to focus solely on growing their MAUs until 2016 when they first began to monetise their platform via ads.

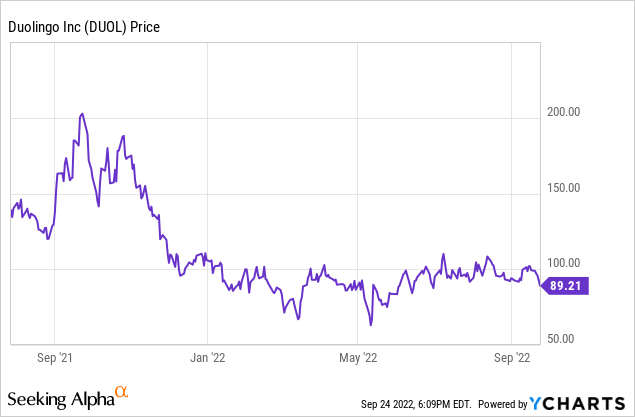

Duolingo went public via an IPO in July 2021, a few months before the beginning of the brutal tech sell-off, which has seen a large swath of unprofitable tech companies lose >50% of their market value in the past 12 months. Caught up in this broader market sell-off, Duolingo’s share price has fallen 36% from their IPO price and 56% from their peak in September 2021, despite consistently beating their revenue and adjusted EBITDA guidance each quarter. Duolingo’s share price has been surprisingly resilient so far throughout 2022, only down 15% vs. a fall of 31% for the Nasdaq Composite index.

I believe Duolingo’s current share price represents an attractive entry point for investors looking to gain exposure to a founder-led, high-growth tech company with a dominant position in a large (and growing) market, a fortress balance sheet, and consistent positive free cash flow. Here’s why I recently bought shares in Duolingo.

1) An excellent and highly differentiated product

Some readers of this article may already be familiar with Duolingo’s popular language learning app, but others may have not. Two months ago, for ‘primary research purposes’, I decided to download Duolingo and begin the daunting process of learning Italian, the native language of my fiance. Learning Italian was something I had been considering for the past 18 months, but had frequently been dissuaded by the cost, time, and anxiety associated with attending formal language learning classes. But 10 minutes a day through Duolingo? That was something I could commit too.

61 days into the process (yes, I’m fanatical about not losing my daily streak!) and I’m hooked. Duolingo’s app is incredibly sleek and modern, and genuinely makes the process of learning a language fun. They’ve cracked the code for how to ‘gamify’ the language learning process through daily streaks, prizes, competitive leaderboards, and a highly visible “progress tree”.

Duolingo User Interface (Duolingo Q4 2021 Shareholder Letter)

Question formats are constantly varied between simple reading comprehension, recall of individual words or phrases, listening exercises, and speaking exercises. Mistakes are frequently repeated and the structure of the course is such that you always feel like you’re slightly outside of your depth and learning new material, but it’s never so daunting that you begin avoiding certain lessons.

Duolingo has a maniacal focus on A/B testing to determine which app layout and sequences generate the highest user engagement and retention, and their significant investments in research and development (R&D) are clear to any consistent user of the app.

We use A/B testing to optimize nearly everything related to our products, from new gamification features, to our learning content, to our Super purchase page design, and even to the notifications that learners receive as reminders to do their lessons. These tests help us grow users, teach better, and grow subscribers, all of which are key elements of our growth strategy. We run about 500 A/B tests every quarter.

– CEO Luis von Ahn, Duolingo Q2 2022 Shareholder Letter

Overall, Duolingo’s app represents a unique and cost-effective way to learn a language relative to other methods. For some context, my fiance pays $40/hour for weekly lessons with her private Italian tutor (which is well below market rates), totalling $2,080/year. In contrast, my annual Super Duolingo subscription costs around $110/year, 5% of the cost of weekly private tutoring. And 93% of Duolingo’s MAUs are free users!

I’m not here to argue whether Duolingo is more/less effective for learning a language than private tutoring, but it’s worth highlighting the cost-effectiveness of the platform, particularly for those in developing economies.

2) A product-led growth company

Software companies generally grow via one of two ways: (1) product-led growth where the focus is on developing the best possible product and user acquisition comes primarily through word-of-mouth from positive customer experiences or (2) sales-led growth where the focus is on spending significant amounts on sales and marketing (S&M) to raise awareness of a product and acquire new customers.

Both approaches can be successful and, in reality, most software businesses grow via a combination of product-led and sales-led growth. It’s hard to sell a crappy product even with the best sales team in the world (and vice versa). However, my slight preference is for product-led growth, as it makes companies less dependent on digital marketing costs (which can fluctuate wildly) and unit economics tend to be better in the long-term due to lower customer acquisition costs.

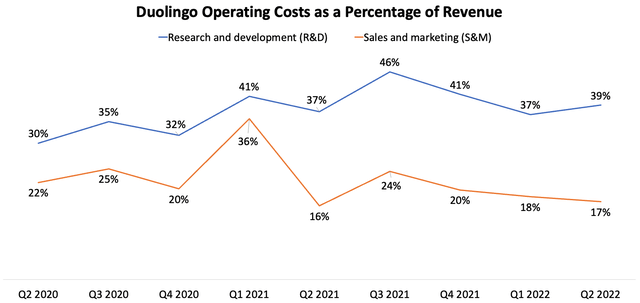

One simple method to assess whether a business has a product-led or sales-led culture is to compare the percentage of revenue being spent on R&D (product-led) and S&M (sales-led).

Duolingo Operating Costs (Author, Company Filings)

As can be seen above, Duolingo’s R&D spend has consistently exceeded 30% of revenue since Q2 2020. In contrast, S&M spend has generally hovered around the 20% mark, ranging from 16-36% of revenue. Thus, Duolingo appears to be more of a product-led than sales-led growth company.

Another reason why I prefer companies with product-led growth is that R&D spend is a lever which can be pulled back when times get tough to optimise for profitability. Duolingo is already the dominant market leader with the best brand recognition amongst mobile language learning apps, but chooses to invest heavily in R&D to further cement their leadership position and develop new products.

However, if we remain in a prolonged macroeconomic downturn, Duolingo could easily dial back their R&D spend to 15-25% of revenue and substantially improve operating margins, without significantly affecting their current user experience (but likely delaying the roll-out of new features/products).

3) Consistent user growth

Duolingo has a demonstrated track record of steady and predictable increases in both MAUs and DAUs. Since Q4 2019, Duolingo has grown their MAUs at a 27% CAGR from 27.3m to 49.5m. DAUs have increased at a much faster 45% CAGR from 5.2m to 13.2m over this same period.

In their latest quarter (Q2 2022), Duolingo reported 44% YoY growth in DAUs (consistent with their 2.5-year trailing CAGR of 45%) and 31% YoY growth in MAUs (slightly above their 2.5-year trailing CAGR of 27%). Thus, unlike many other tech companies, growth has not decelerated for Duolingo coming out of the COVID-19 period.

Growing MAUs and DAUs is the top of the funnel for Duolingo; the more users that interact with their app on a monthly or daily basis, the more opportunities they have to convert free users into premium subscribers and to have a larger audience for targeted ads.

We can also track the ratio between DAUs and MAUs to get a sense of customer engagement. As can be seen below, the ratio of DAUs to MAUs has trended up slightly over the past few quarters, suggesting increasing engagement and utilisation of Duolingo’s core language learning app.

| Quarter | DAUs | MAUs | Ratio of DAUs to MAUs |

| Q2 2021 | 9.1m | 37.9m | 24% |

| Q3 2021 | 9.8m | 41.7m | 24% |

| Q4 2021 | 10.1m | 42.4m | 24% |

| Q1 2022 | 12.5m | 49.2m | 25% |

| Q2 2022 | 13.2m | 49.5m | 27% |

4) A long runway for growth in paid subscribers

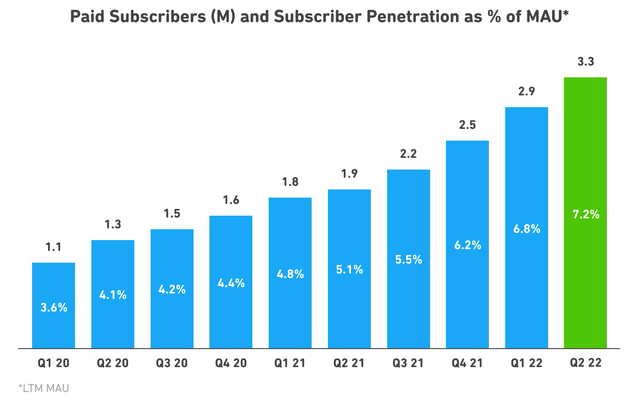

One of the core aspects of my thesis for Duolingo lies in their ability to continue to convert MAUs into paid subscribers and thus increase paid subscriber penetration over the coming 5-10 years.

As is shown in the below figure, Duolingo has doubled their paid subscriber penetration from 3.6% in Q1 2020 to 7.2% in Q2 2022, increasing consistently each quarter like clockwork. In Q2 2022, Duolingo’s paid subscriber count grew an impressive 71% YoY to 3.3m.

Paid subscriptions generate the bulk of Duolingo’s revenue (74% in Q2 2022), so consistent strong growth in the number of paid subscribers bodes well for their overall revenue growth.

Paid Subscriber Penetration (Duolingo Q2 2022 Shareholder Letter)

While Duolingo’s paid subscriber penetration has doubled over the past nine quarters to 7.2%, inverting this metric reveals just how much growth is left for Duolingo. Indeed, 92.8% of Duolingo’s current MAUs are using the free or ad-supported version of the app.

In absolute terms, this is a very low paid subscriber penetration rate and is the result of Duolingo only beginning to offer paid subscriptions in 2017, six years after the initial launch of their mobile app. It’s tough to find comparable figures for other public D2C software companies with a freemium model, but for some context, Spotify boasts a 43% paid subscriber penetration rate with 188m paid subscribers and 433m MAUs.

In their Q2 2022 earnings call, Duolingo’s CEO Luis von Ahn predicted that Duolingo’s paid subscriber penetration could reach the “mid-teens” over time:

I’d say our penetration of the fraction of paying subscribers to MAUs has definitely outperformed what I thought would happen. When we IPO-ed, we had been seeing kind of a 1 percentage point growth per year. So each year, it would go from like 3% to 4%, from 4% to 5%. The last couple — since IPO, it seems we’re up to about 2 percentage points per year.

So it is more than I expected. And I think that we’re very happy with that. And your question is how high can I get? We still don’t know. I don’t see a reason why this can’t get to the mid-teens.

Thus, there is substantial scope for Duolingo to increase paid subscriber penetration over the coming years. As a base case, I’m expecting Duolingo to reach a 15% paid subscriber penetration rate by the end of 2030.

5) Strong top-line growth rates

Duolingo is a classic growth company with strong and consistent revenue growth. Since Q2 2020, Duolingo’s revenue has increased between 6-15% QoQ (with no sequential QoQ declines) and >40% YoY each quarter where YoY comparisons are publicly available.

| Quarter | Revenue | QoQ Growth | YoY Growth |

| Q2 2020 | $40.0m | n/a | n/a |

| Q3 2020 | $45.3m | 13% | n/a |

| Q4 2020 | $48.3m | 7% | n/a |

| Q1 2021 | $55.4m | 15% | n/a |

| Q2 2021 | $58.8m | 6% | 47% |

| Q3 2021 | $63.6m | 8% | 40% |

| Q4 2021 | $73.0m | 15% | 51% |

| Q1 2022 | $81.2m | 11% | 47% |

| Q2 2022 | $88.4m | 9% | 50% |

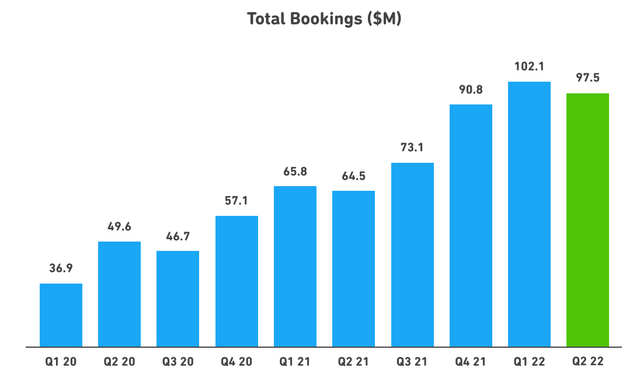

Duolingo’s other main top-line metric (total bookings) has followed a similar trend, albeit with more lumpiness from quarter-to-quarter. The main difference between total bookings and revenue is that annual subscriptions for Super Duolingo are recognised upfront as total bookings, while revenue is only recognised monthly over the course of the annual subscription.

Duolingo Total Bookings (Duolingo Q2 2022 Shareholder Letter)

However, it’s important that strong top-line growth isn’t the result of unsustainably high S&M spend, so I find it helpful when evaluating the unit economics of a business to compare their revenue growth rates vs. growth in S&M spend.

As can be seen below, Duolingo’s YoY revenue growth has outpaced their growth in S&M spend for four of the past five quarters, suggestive of strong unit economics. As such, Duolingo appears to be continuing to generate revenue from existing customers (due to low churn) and is not overly dependent on high digital marketing spend to acquire new customers and fuel revenue growth. This is what I like to see.

| Quarter | YoY revenue growth | YoY growth in S&M spend |

| Q2 2021 | 47% | 12% |

| Q3 2021 | 40% | 37% |

| Q4 2021 | 51% | 50% |

| Q1 2022 | 47% | (24%) |

| Q2 2022 | 50% | 59% |

6) A credible management team that ‘underpromises and overdelivers’

One of the first things I assess in companies which are new to the public markets is the ability of the senior management team to accurately forecast their business and exceed their guidance communicated to the market.

A few quarters of missing guidance, especially within the first 12 months of being a public company, often puts a business into the doghouse with analysts and can signal a management team that is: 1) overly ambitious or carrying excess hubris, or 2) does not have a clear line of sight over their business operations. Either reason is not a positive for investors.

However, Duolingo’s management have established an early ‘beat-and-raise’ culture and exceeded all revenue and adjusted EBITDA guidance since their IPO in July 2021, despite a substantial slowdown in the broader macroeconomic environment.

| Quarter | Revenue Guidance (Midpoint) | Revenue (Actual) | Beat vs. Guidance (%) | Adjusted EBITDA Guidance (Midpoint) | Adjusted EBITDA (Actual) | Beat vs. Guidance (%) |

| Q3 2021 | $60.0m | $63.6m | 6% | $(10.0m) | $(6.0m) | 40% |

| Q4 2021 | $68.0m | $73.0m | 7% | $(5.0m) | $(0.3m) | 94% |

| Q1 2022 | $77.0m | $81.2m | 5% | $(4.0m) | $3.9m | n/a |

| Q2 2022 | $85.5m | $88.4m | 5% | $(2.5m) | $4.2m | n/a |

This is a very positive sign for investors. A management team with a strong track-record of beating guidance is also one that often surprises to the upside, either by: 1) launching new products and creating new revenue streams, 2) accelerating their path to profitability, or 3) implementing investor-friendly measures, such as share buybacks (less relevant at this stage of Duolingo’s journey).

7) Duolingo is only in the early innings of ad monetization

As mentioned earlier in this article, 74% of Duolingo’s revenue in Q2 2022 came from paid subscriptions to Super Duolingo. In contrast, only 13% of revenue was generated from showing ads to free users on ad-supported plans, which is interesting given that Duolingo began to show ads on their app several years before launching a paid subscription offering.

Ad revenue only accounts for a small portion of Duolingo’s current revenue because management have deliberately limited the frequency of ads to preserve the free user experience and ensure user engagement remains high. While this philosophy has been critical to their strong user acquisition, the pressures of being a public company should inevitably lead Duolingo to increasingly monetise their free user base via ads over the next few years.

If we crunch some basic numbers, it’s clear that Duolingo still has significant runway to increase the average annual revenue per user (ARPU) of their ad-supported users without damaging the user experience. As of Q2 2022, Duolingo has 49.5m MAUs, of which 46.2m are free users (the remaining 3.3m are paid subscribers). In Q2, Duolingo generated $11.2m in ad revenue from these 46.2m ad-supported MAUs, equating to 24c per ad-supported user per quarter, or almost $1 on an annualised basis.

An annual ARPU of $1 seems incredibly low given the amount of value an ad-supported user is able to extract from Duolingo’s platform, albeit without all the bells and whistles of a Super Duolingo subscription. I personally know at least half a dozen friends who were able to become fluent enough to hold a basic conversation within 18-24 months of being a free user of Duolingo.

Over time, I expect Duolingo to dramatically increase the frequency of targeted ads on their platform, which will help to: 1) boost annual ARPU for ad-supported users and 2) potentially increase paid subscriber penetration as free users convert to paid subscriptions to avoid ads. However, ad revenue is lower margin revenue than subscription revenue, so if growth in ad revenue begins to outpace growth in subscription revenue, it might be a slight drag on overall gross margins.

8) Don’t sleep on the Duolingo English Test

Duolingo’s third largest revenue source (behind paid subscriptions and ad revenue) is their Duolingo English Test (DET), which is an online test that assesses one’s proficiency in English. The DET is primarily used by international students looking to gain admission into an English-speaking university and costs a very reasonable one-time fee of $49 USD. As of Q2 2022, more than 3,700 higher education programs accept the DET, including more than 80% of US universities:

And by now, depending on how you measure, but about 80% of U.S. universities are accepting our test … But also we’re increasing our efforts in other big markets of English proficiency exams, that’s Canada, the U.K., and Australia.

– CEO Luis von Ahn, Duolingo Q2 2022 Earnings Call

Revenue for the DET has increased substantially from $1m in 2019 to $15m in 2020 and to a $32m annualised revenue run rate through the first two quarters of 2022. Revenue for the DET was up 60% and 66% YoY, respectively, in Q1 and Q2 2022.

While the DET has achieved significant penetration in their core US market, there is still substantial room for growth in other developed English-speaking markets (e.g., Canada, Australia) and possibly even non-English speaking countries (e.g., Japan, Germany). Indeed, the DET is currently the sleeping giant within Duolingo’s business, with its revenue growth consistently outpacing growth in their larger business segments.

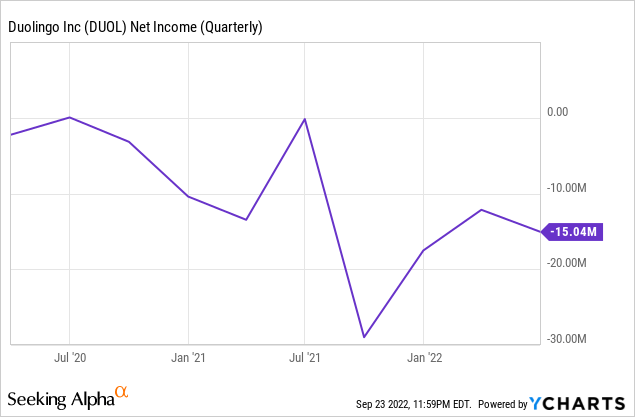

9) Duolingo has multiple levers to become GAAP profitable

Like many of the tech businesses that went public in 2020/2021, Duolingo is not profitable on a GAAP net income basis.

In the last 12 months (LTM), Duolingo generated $2.5m of adjusted EBITDA (1% margin) but reported $73.7m of net losses (-24% margin). Most of this delta between adjusted EBITDA and net income came from the $68.0m of stock-based compensation (SBC) issued to staff over the past four quarters.

However, I believe Duolingo has multiple levers to become GAAP profitable over the next 6-12 months:

- Duolingo has strong gross margins, which have expanded from 70.5% in Q2 2020 to 73.0% in Q2 2022, due to their recurring subscription business model. This creates the conditions for significant operating margins at scale.

- Since Q2 2020, 30-46% of Duolingo’s revenue has been invested back into R&D to enhance their user experience and accelerate new product development. If needed, R&D spend could be decreased to 15-25% of revenue without substantially harming the user experience in the short-to-medium term.

- Duolingo appears to have strong unit economics and revenue growth has consistently outpaced growth in S&M, so Duolingo could pull back on S&M spend without seeing a proportionate reduction in revenue growth. Indeed, S&M spend has decreased from 24% to 17% over the past four quarters as revenue and user growth has accelerated.

- SBC as a percentage of revenue should decrease over the coming quarters as a large portion of recent SBC was related to founder equity awards from the IPO.

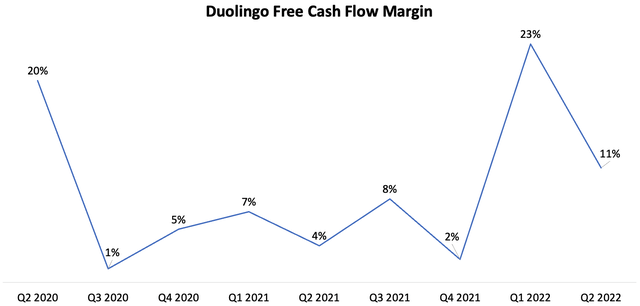

10) A strong cash position with consistent positive free cash flow

As of Q2 2022, Duolingo had $591.2m in cash and cash equivalents on their balance sheet and $25.5m in long-term liabilities, resulting in a strong net cash position of $565.7m. This net cash position represents around 16% of Duolingo’s current market cap of $3.54b.

While Duolingo is flush with cash following their IPO in mid-2021, the company is also consistently generating positive free cash flow. Free cash flow margins have bounced around a bit over the past few years, but have generally hovered around the mid-to-high single digit percentage mark, which is surprisingly strong for a company investing so heavily in R&D and at the early stages of monetising both their ad-supported and premium user base.

Duolingo Free Cash Flow Margin (Author, Company Filings)

In the current market where investors are severely punishing companies with high cash burn, Duolingo’s strong cash position and consistent positive free cash flow is a breath of fresh air and perhaps accounts for why shares are only down 15% YTD vs. 31% for the Nasdaq Composite index.

11) A seemingly strong corporate culture

When evaluating companies, I like to take a cursory glance at the company’s Glassdoor reviews to get a sense of the corporate culture. Based on these public reviews, Duolingo appears strong with CEO Luis von Ahn receiving a 4.5/5 rating (56 reviews) and 92% approval rating. 82% of Duolingo employees would recommend working at Duolingo to a friend. Reviews seem largely positive and a testament to the mission-driven nature of Duolingo’s work to empower all individuals to be able to learn a language.

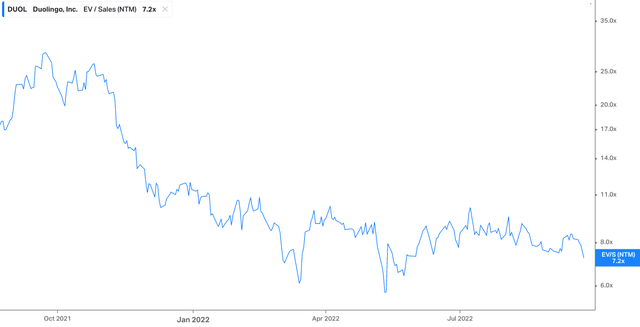

12) A reasonable valuation

For most of Duolingo’s life as a public company, I have been dissuaded by their rich valuation. However, the recent market volatility has provided an opportunity to initiate a starter position in Duolingo at what I think is a much more reasonable valuation.

As of the 25th September 2022, Duolingo trades on the current valuation metrics:

- 9.7x LTM revenue.

- 7.2x NTM revenue based on analyst estimates.

- 83.5x LTM free cash flow.

Duolingo Forward EV/Sales Multiple (Koyfin)

As Duolingo is not profitable on a GAAP basis, we cannot use a P/E ratio and Duolingo’s EV/adjusted EBITDA ratio of >1,000 is not meaningful for investors (except maybe the mega-bears). Thus, while Duolingo is trading near their cheapest valuation on an EV/sales basis since entering the public markets, it is not cheap on an absolute basis.

Below I’ve done some back of the envelope maths to attempt to model Duolingo’s revenue in five years time to work out whether the current valuation seems reasonable given Duolingo’s growth prospects.

Paid subscriber revenue

Let’s conservatively assume that Duolingo grows their MAUs at a 15% CAGR over the next five years (note: their trailing 2.5-year CAGR is 27%) and achieves a 12% paid subscriber penetration by the end of this period (circa 100bp increase in paid subscriber penetration each year). Under these assumptions, Duolingo would exit Q2 2027 with around 100m MAUs and 12m paid subscribers.

If we assume that Duolingo’s quarterly ARPU for each paid subscriber of $19.8 remains constant (calculated by dividing $65.2m in Q2 subscription revenue by 3.3m paid subscribers), this would equate to around $238m of subscription revenue in Q2 2027 or around $950m of ARR. On a current enterprise value of just under $3b, this would value Duolingo shares at around 3x subscription revenue in 2027.

Ad revenue

If we assume that Duolingo’s ad business grows at a 20% CAGR over the next five years (keep in mind that the annual ARPU is a measly $1 for ad-supported users), Duolingo would generate around $28m of ad revenue in Q2 2027 or $112m annualised.

DET revenue

I have the least confident to forecast Duolingo’s DET business given it faces the most competitive threats from incumbents and has already achieved significant penetration within the US market. If we assume a substantial deceleration in growth to a 5-year CAGR of 20% (note: DET grew at 60% and 66% YoY, respectively, in Q1 and Q2 2022), the DET business segment would generate around $20m of revenue in Q2 2027 or $80m annualised.

Sum of the parts

Adding together the revenue for each of these business segments implies that Duolingo would be generating around $1.15b in annualised revenue in Q2 2027. If we assume gross margins stay largely unchanged from their current 73% mark, Duolingo would also be generating around $840m in annualised gross profit.

By Q2 2027, I think it’s reasonable to expect at least 25% adjusted EBITDA margins and 10% net income margins as the business reaches scale, SBC returns to more normalised levels, and the benefits of Duolingo’s previous investments in R&D began to crystallise, reducing the need for further spend. Under these margin assumptions, Duolingo would be generating around $290m in adjusted EBITDA and $115m in net income. This values Duolingo at current levels at around 10x 2027 adjusted EBITDA or 26x 2027 earnings.

While not downright cheap, it’s worth keeping in mind that I have: 1) been very conservative in the above calculations when forecasting Duolingo’s future growth rates and 2) not ascribed any business value to Duolingo’s other/new business segments, such as in-app token purchases or their online maths courses, which have consistently been growing at 100%+ over the past few quarters.

Conclusion

Duolingo has many of the qualities I look for in an investment: 1) led by a mission-driven founder, 2) capital-light and scalable business model, 3) best-in-class and highly differentiated product, 4) strong top-line growth rates with a significant runway for future growth, 5) capable management team with an ‘underpromise and overdeliver’ culture, 6) strong balance sheet and consistent positive free cash flow, 7) clear path to profitability, and 8) a reasonable valuation.

All things considered, this seems like a good time to pick up shares in Duolingo and I initiated a starter position last week. I’ll be looking to continue to average down over the coming months if the market remains weak and Duolingo continues to chalk up impressive numbers.

Be the first to comment