eclipse_images/E+ via Getty Images

Investment Thesis: While Duluth Holdings (NASDAQ:DLTH) seems to be in a stable financial position to weather the current macroeconomic conditions, the stock could still see short-term downside.

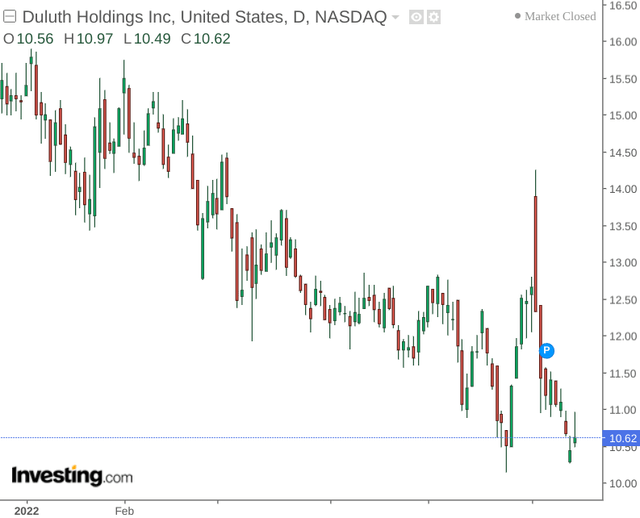

Back in April, I made the argument that despite the recent decline in Duluth Holdings, the reversal seemed to be overdone and we could see a rebound in upside.

However, the decline has continued:

With the S&P 500 having recently reached a dip of over 20% from its high – this officially confirms a bear market. As such, a significant driver of the continued decline in Duluth Holdings is likely to have been market-driven.

Acknowledging that some further downside could be possible as a result, the purpose of this article is to analyze the company’s financial position in more detail to determine whether Duluth Holdings can withstand the impact of higher manufacturing costs as well as a temporary dip in demand due to inflation.

Performance

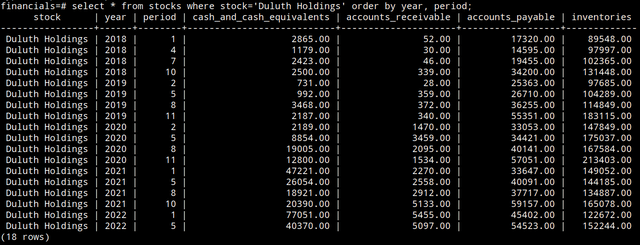

Taking quarterly data from 2018 to the present, I decided to collate quarterly data for cash and cash equivalents, accounts receivable, accounts payable and inventories, using SQL to aggregate and analyze relevant ratios using these metrics.

Here is the collated data (2022 quarterly data included to date):

Figures sourced from historical quarterly reports from Duluth Holdings (2018 – present). SQL table created by author.

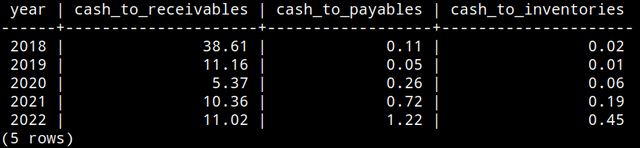

Using the quarterly data, I decided to calculate the ratio of cash relative to accounts receivable, accounts payable, and inventories. In addition, the calculated ratios were averaged by year to get a broader picture of performance.

Ratio calculations made by author using SQL.

Since 2018, both cash and accounts receivable have grown strongly by virtue of the company’s overall growth. As such, we have seen a drop in cash to receivables ratio. However, the ratio for both cash to payables and cash to inventories has risen since 2018 – which means that Duluth Holdings holds more cash relative to the amount it owes in payables, as well as holding more cash relative to the amount of inventory it holds.

The company’s long-term growth in cash reserves is encouraging, as it puts Duluth Holdings in a better position to withstand both higher costs as a result of inflationary pressures, as well as a potential drop in sales revenue.

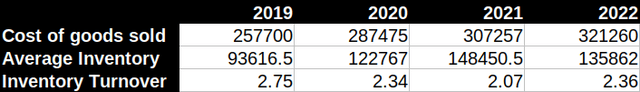

Of course, cash levels that are too high can also be a concern, as it might indicate that the company is not sufficiently reinvesting this cash to drive further sales growth. However, In the case of Duluth Holdings, we can see that inventory turnover (as measured by cost of goods sold over the average inventory of the current and previous year) dipped slightly from 2019 levels but overall saw growth from that of last year.

Figures sourced from previous annual reports for Duluth Holdings. Inventory turnover ratio calculated by author.

From this point of view, while turnover was on a downward trend since 2019, the fact that we have seen a recovery in this metric so far this year has been encouraging. With that being said, investors are likely to pay attention to this metric going forward and a decline in inventory turnover as a result of lower sales could be seen as a bad sign.

Looking Forward

Going forward, it is probable that rising inflation and associated cost pressures might place some pressure on Duluth Holdings going forward. However, the long-term growth in cash reserves is encouraging and I envisage that this should allow the company to be able to withstand anticipated macroeconomic pressures.

As previously pointed out in my last article, 53% of the company’s purchases comes from their largest supplier in Hong Kong as of 2021. As such, the fact that Hong Kong has seen a significant exodus of labour as a result this year as a result of high incidences of COVID-19 and associated restrictive policies might mean that supply chain capacity has been significantly affected. This could also have been compounded by the effects of COVID-19 lockdowns in Mainland China and the extent of this is likely to become clear in upcoming quarters.

From this point of view, the dependence of Duluth Holdings on Hong Kong as a supply base may mean that even if consumer demand remains strong as a result of inflation, the company might be unable to fulfill such demand.

Conclusion

To conclude, my overall take on Duluth Holdings is that the company is in a strong financial position to withstand broader macroeconomic pressures. However, the post-pandemic sales rebound could show signs of abating as inflation takes hold, and supply chain concerns may further dampen the growth outlook for the near term.

Be the first to comment