imaginima/iStock via Getty Images

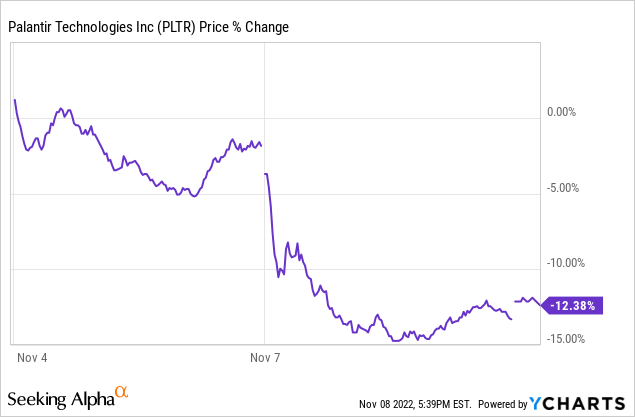

Palantir Technologies (NYSE:PLTR) reported Q3 results and forward guidance on November 7th that disappointed Mr. Market, sending the share price lower:

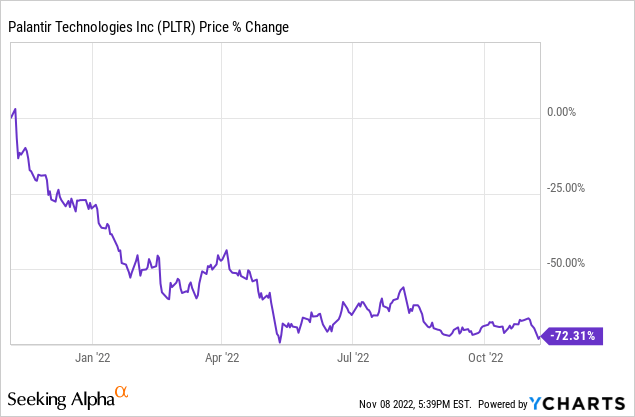

It is pretty hard to imagine that the stock could drop this much further given how badly the stock price has already been beaten down over the past year:

This means that the results were bad, right? Well, while I certainly concede that there were some less than impressive elements of the Q3 report and forward outlook, overall things are looking pretty good for the company, especially at the current valuation. As a result, I bought the dip in the shares below $7 and will share why I believe this is an excellent price to buy PLTR at.

PLTR Stock Q3: The Bad

The bad news for PLTR from its Q3 report and forward guidance was pretty straight forward:

- Its $0.01 adjusted earnings per share and revenue guidance for Q4 of $503 million – $505 million both missed Wall Street estimates of $0.02 and $506.51 million, respectively.

- The U.S. Government business saw its growth further decelerate for a second quarter in a row to a 23% revenue growth rate in Q3, down from 27% year-over-year growth in Q2.

- Adjusted gross margin also slightly declined to 80% in Q3, down from 83% in Q4 2021 and 81% over Q1 and Q2 2022.

- Adjusted operating income margin declined significantly from 30% in Q3 2021 to 17% in Q3 2022. While management claimed this was due to significant investments in the business for future growth and success, it was a pretty major decline that reflects the business is not moving towards near-term profitability.

Meanwhile, shares were likely also hit by Citi’s analysis of the earnings report, stating that it expects “further downside” next year due to “fast decelerating growth” along with potential further downside due to a reduction in government spending with the U.S. government widely expected to be divided following the midterm elections.

The continued deceleration in U.S. government growth is particularly troubling for PLTR given that it is arguably the company’s strongest business segment and is a key part of the long-term bull thesis for the stock.

PLTR Stock Q3: The Good

That said, there was plenty of positive to take away from the quarter too.

First and foremost, stock-based compensation – which has been a major sticking point with investors so far – declined substantially year-over-year. In Q3 2021, stock-based compensation plus related payroll taxes totaled $208.05 million. In Q3 2022, that number had plummeted by 31.1%, resulting in a narrowing of the GAAP loss from operations from $91.94 million to $62.19 million year-over-year. If PLTR can continue to reduce its stock-based compensation moving forward, this bodes well for it being able to become profitable and reduce shareholder dilution as well.

On top of that, while revenue growth may not have been quite as robust as it has been recently, it still increased by a robust 21.9% year-over-year, slightly beating analyst expectations. The U.S. Foundry business continued to be extremely strong, growing 53% year-over-year with its customer count growing by 124% year-over-year, indicating that strong growth could be continuing for many quarters to come as new clients typically grow their demand for PLTR products over time. PLTR also confirmed its full year revenue guidance of between $1.9B – $1.902B, so the company continues to generate solid growth momentum.

One of the biggest stories for PLTR as we have already mentioned is the fate of the U.S. government business’s growth trajectory. While it has been decelerating in recent quarters and there are concerns that government spending may decline in 2023 under a divided government, there are also potentially very strong tailwinds for that business given the growing geopolitical challenges facing the United States. Additionally, this would not be the first time that PLTR’s government business has experienced choppy growth. After all, PLTR already has some major contractual growth potential with the As CEO Alex Karp said on the earnings call:

We’re positing that the future will look more like the traditional baseline of 35% than the baseline of this year of upper 20s. What is the proof of that? Okay, I could tell you how our products are being used on the front line. You can read the news, you can probably surmise that things like

Nexus peering, foundry, GAIA are powering events that you may be reading about. And then there’s our massive TCV. It’s like, yes, TCV in the USG is just under $1 billion. This is massive. There’s a legitimate question, when do you capture that in the form of GAAP revenue? That’s a legitimate question to which we have no answer. But we will capture it because the contracts have been concluded and because we are sitting on the most important missions in the world, and those missions are going to end up being fully funded, and you see that in our contractual relationships.

Investor Takeaway

While PLTR remains ways off from profitability and its government business is currently facing decelerating growth, the investment thesis remains in good shape.

Importantly, stock-based compensation is declining at a pretty brisk pace, the government business still has TCV of nearly $1 billion, implying strong future growth there, and the U.S. Foundry business has tremendous growth momentum. When you combine each of these factors with the fact that the global macro situation plays to PLTR’s strengths, its balance sheet is in phenomenal shape, and its total addressable market remains massive and continues to grow rapidly while PLTR invests aggressively in further innovation, and the long-term growth story remains intact.

Meanwhile, PLTR’s valuation is looking increasingly attractive thanks to its plummeting share price. On an EV/EBITDA basis, PLTR now trades at a 23x multiple and trades at 46.8x normalized earnings. Through 2026, EBITDA is expected to grow at a 41.9% CAGR and normalized earnings per share is expected to grow at a 79.9% CAGR, making the current valuation multiples look quite cheap. If PLTR’s P/E ratio shrinks to a very conservative 20x by 2026 and it achieves analyst consensus estimate growth to a $0.49 earnings per share total (assuming $5.4 billion in revenue in 2026, or a 29.8% revenue CAGR over that span), the share price will be $9.80. That implies a total return CAGR of 8.2% moving forward. If the P/E ratio is a more realistic 30x in 2026, that implies a share price of $14.7 or a 19.1% CAGR moving forward. At a P/E ratio of 25x, we get a share price of 14.1%. As a result, we view PLTR as a Strong Buy and were happy to go long at a share price below $7.

Be the first to comment