eclipse_images

Investment Thesis: While Duluth Holdings could have potential for a longer-term rebound – supply chain concerns could result in low growth in the interim.

In a previous article back on June, I made the argument that while Duluth Holdings Inc. (NASDAQ:DLTH) had been maintaining a solid cash position, supply chain concerns and inflation could place pressure on the company in the short to medium-term.

The stock has continued to take a downward trajectory for the year-to-date:

The purpose of this article is to investigate whether the company could have potential for a longer-term rebound, despite the ongoing inflation risks.

Performance

When looking at the P/E ratio for Duluth Holdings, we can see that when comparing performance in January 2021 versus January 2022 – we can see that earnings per share was up significantly over this period – with the P/E ratio dropping from 22.88 to 16.23.

| January 2021 | January 2022 | |

| Price | 9.61 | 14.61 |

| Diluted earnings per share | 0.42 | 0.9 |

| P/E ratio | 22.88 | 16.23 |

Source: Figures sourced from Duluth Holdings Fourth Quarter and Fiscal 2020 and 2021 Financial Results. P/E ratio calculated by author.

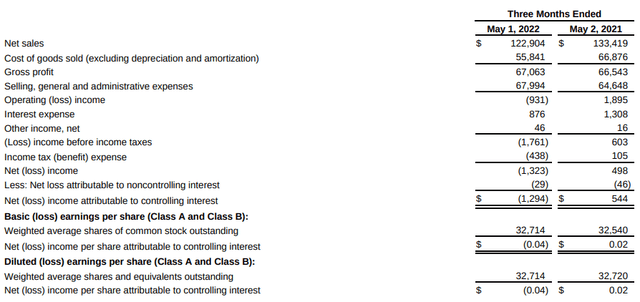

However, it is important to note that in the last quarter, gross profit may have risen slightly, but this was down to a reduction in cost of goods sold. Net sales decreased from that of last year – and we can see that higher selling, general and administrative expenses resulted in an overall drop in earnings on a three-month ended basis.

Duluth Holdings: First Quarter 2022 Financial Results

While the precise nature of the fall in net sales is unclear, inflation may have reduced spending habits on the part of customers. Moreover, the fact that cost of goods sold has also decreased suggests that the company has had difficulty in sourcing sufficient supplies and this could have been due to supply chain issues. As such – it is also possible that Duluth Holdings has simply not been able to meet demand.

It is also reported that a shortage of women’s apparel in particular led to lower sales growth overall. Moreover, while shoppers were more likely to shop online during the pandemic – a preference for shopping in stores also saw downward pressure on eCommerce sales – which could have placed pressure on overall sales growth.

Looking Forward

With Duluth Holdings set to release its next quarterly earnings report on September 1, investors will be looking carefully at whether the company can bolster net sales once again in spite of macroeconomic pressures.

Moreover, as Duluth Holdings specializes in workwear and accessories – it is probable that sales will be lower in the summer months, which could also place downward pressure on growth.

However, investors will want to see evidence that the company can maintain sufficient cash flow to deal with a further potential drop in sales. We can see that cash and cash equivalents fell significantly from January to May of this year.

Duluth Holdings: First Quarter 2022 Financial Results

Should we see this trend continue – then investors might be more reluctant to initiate a position in the stock, as there is no guarantee that supply chain issues will alleviate themselves in the near future.

While I pointed out in my last article that the company’s cash position has strengthened overall – and that a drop in cash levels is expected as the company ramps up production post-pandemic – this ultimately needs to be accompanied by sales growth to drive earnings higher.

Conclusion

To conclude, Duluth Holdings has seen a fallout from supply chain issues. In the upcoming quarter, investors will be looking for evidence of a rebound in sales growth – or reassurance that Duluth Holdings can maintain a strong cash position to ride out a period of lower sales.

While I take the view that the company has the potential for a longer-term rebound – I do not take a particularly bullish view at this point in time.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment