kaedeezign

Investment thesis: Short-term thinking seems to be skewing public policy preferences toward a confrontational approach towards China as well as Russia and other countries. It is rightly concluded that depriving a country like China of technological inputs that make the production of very complex goods possible can easily take down entire industries in countries deemed as adversarial. The takedown of China’s emerging tech giant Huawei was a clear example of what can be possible if certain Western technologies or technologies produced by advanced economy allies such as Japan & South Korea are withheld from a company, an industry, or a country.

Denying certain nations access to the Western-dominated global financial system is also seen as a potent tool. This approach was tried with Russia, in response to the war in Ukraine. There are more and more signs emerging that while the short-term effects of such sanctions against adversaries may be quite impressive, in the long run, our own industries may end up holding the short end of the stick. Companies and industries, ranging from the US tech giants or financial institutions to Europe’s petrochemical and metallurgical industries are at risk of losing ground in the global markets, with potentially severe consequences for them as well as for our overall economy.

For investors, the negative effects of geopolitical frictions are broad in scope, with risks that are already in place, such as supply chain disruptions, and commodities-based inflation being amplified. New risks, such as regional market loss, FX volatility, a lack of opportunity to participate in investment opportunities, due to sanctions, delistings, and so on, as well as other potentially negative effects, are emerging, making the current investment environment perhaps the most challenging ever for small investors. Wealth preservation is already a challenge, given high inflation rates that are approaching double digits levels, which puts pressure on investors to keep up with average yearly returns at a level that at least matches inflation. Add to it the fact that the entire investment scene has become a minefield and the task gets a lot harder. The worst part of it is that there seem to be no prospects for improvement in the foreseeable future.

Western economic war on Russia is splitting the world in two

While Russia’s military attempt at shock and awe in Ukraine may have failed, our own economic shock and awe attempts on Russia’s economy seem to be an equally spectacular failure. Soon after we supposedly turned the ruble to rubble, it recovered to a much stronger level versus the dollar & the euro relative to levels it was at just before the invasion. The magnitude of its economic contraction also seems to be less and less severe in relation to initial expectations. I should point out that in dollar terms, Russia’s economy will in fact expand this year, as long as the ruble remains at current levels. In other words, the appreciation of the ruble more than makes up for the GDP deterioration, so in USD terms Russia’s economy will be larger by the end of this year than it was at the end of 2021.

One of the main factors contributing to this is that we saw a very clear split between the Western World and a few Asian allies on one hand, and the rest of the world, most of which declined to participate in the economic war on Russia. Furthermore, many countries or regional groups of countries expressed dissatisfaction with the effect that attempts to economically isolate Russia were having on their own economies and overall wellbeing. Not to mention that many countries were alarmed by the fact that the West used its dominant technological and financial position to try to undermine Russia’s economy. It makes many governments around the world more reluctant to continue being over-reliant on our technology, or on the Western-dominated global financial system, as that is now increasingly seen as a vulnerability.

This feeling is likely to persist in much of the world, and it opens the doors for alternative supply chains and institutions to emerge, as well as potential cooperation in terms of R&D initiatives among various countries. These emerging trends risk producing new economic synergies around the world that will leave Western inputs out, out of fear that even a small contribution from Western entities will expose them to future demands in terms of where certain products can and cannot be marketed, or how certain countries can trade with each other. Such demands on third parties can have an increasingly detrimental effect on the economies that we are subjecting to such demands. It, therefore, makes perfect sense for most other nations on earth to seek out alternatives that will shield them from such policies.

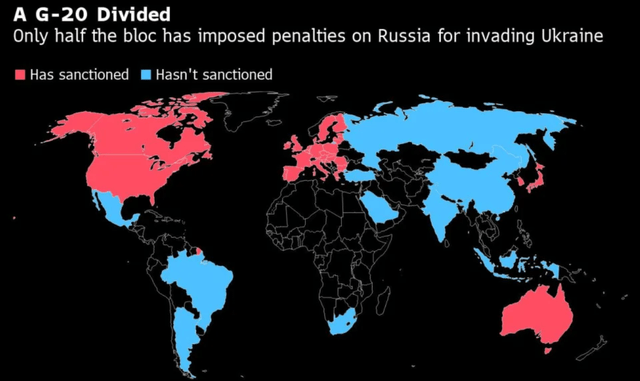

G20 split on Russia sanctions. (Bloomberg)

As we can see, the G-20 nations are deeply split on the issue. Most of the countries outside of the G-20 also shied away from our sanctions drive. Furthermore, we are hearing more and more about bilateral deals meant to help many countries avoid exposure to the sanctions, such as the recent agreements between Russia & Turkey, including agreements for gas trade in rubles as well as acceptance of the Russian MIR payment system as an alternative to Western payment systems, such as Visa (V) and Mastercard (MA). This is an example where sanctions are actually helping to stimulate the spread of potential future competition to our own companies and institutions.

China may succeed in setting up an entire high-tech supply chain system independent of our own inputs. Combined with its powerful manufacturing capacity, it can become a threat that we helped to stimulate into its existence

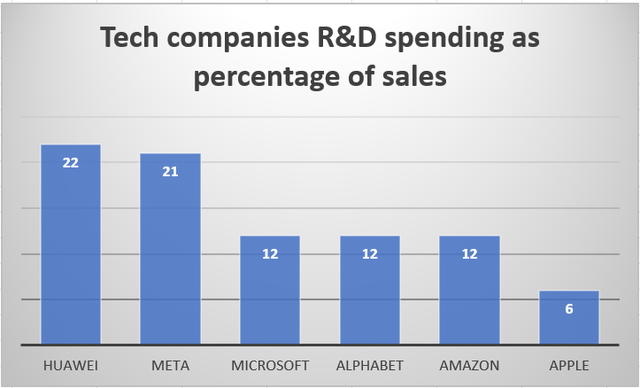

The Huawei takedown seemed like a huge victory for the Western tech industry, as well as that of close Asian allies from South Korea to Japan.

As the data seems to show, far from relegating Huawei to a non-player, it forced it to re-focus on innovation meant to eliminate its exposure to Western technology. It remains to be seen how much it will be able to do in-house, as well as rely on Chinese products that are exclusively reliant on domestic inputs. If significant breakthroughs will occur in this regard, Huawei may return as an even more formidable competitor, offering technological solutions that will be sanctions-proof from Western policies.

The SMIC breakthrough, seemingly jumping forward two generations, in terms of microchip manufacturing, without Western inputs may be a sign of things to come in regards to an emerging parallel China-dominated high-tech supply chain, which is increasingly divorced from dependence on our own supply chains. What this means is that whether we are talking about lithography machine producer ASML (ASML) which until recently was thought to be irreplaceable in the manufacture of high-quality microchips or AMD (AMD), Intel (INTC), and Taiwan Semiconductor (TSM), they are all in danger of having their inputs replaced and eliminated from a growing list of goods around the world, especially electronics brands not based and marketed in the Western World or a handful of Asian allies.

This trend does not stop with semiconductors or other communications technologies. There is a risk that eventually most countries around the world will seek to reduce their exposure to Western goods as much as possible in order to avoid primary or secondary effects of sanctions. For instance, in the airline industry, they may seek to reduce reliance on Boeing (BA), or Airbus (OTCPK:EADSY) in their fleets and adopt emerging plane manufacturers such as China’s Comac or Russia’s Irkut in order to make sure that there are always non-Western alternatives. We may not see this happen until perhaps the end of the decade, as product development in this regard tends to be slow. I do think it is likely to happen eventually and it may even happen faster than thought if China & Russia as well as others with some capabilities in the field such as Brazil will start collaborating in this regard, perhaps complementing each other’s current supply chain deficiencies, which can speed up product development and manufacturing.

EU petrochemicals and metallurgical industries face collapse in the absence of adequate, reliable, and affordable energy supplies. Other industries may be affected as well. Russia may pick up the global market share with its own expanding industries

Russia, unlike China, has been widely considered by much of the Western punditry as a declining power, which is increasingly only capable of supplying the world with raw materials and not much more. Any success outside of this narrow framing of Russia’s economy tends to be dismissed, scoffed at, and generally underestimated. For instance, Russia’s ability to keep its store shelves well-stocked after it stopped importing food products from the EU, in large part through product substitution by emerging local food producers was doubted even after clear signs emerged that it managed to thrive in the food processing industry. That one factor helped to turn Russia from a major net food importer in 2014, which is when the proxy war over Ukraine really started, to a significant net food exporter. It involved the expansion of domestic agro-business meant to support food production, as well as an expansion of food processing abilities. Farm machinery production for instance expanded significantly, increasing by about half just last year. In other words, the loss of European food imports turned out to be a blessing for Russian industry.

There have been some recent hints at a further boost to some Russian industries, now that there has been a large-scale loss of Western product imports, as well as the loss of countless foreign firms operating in Russia. The resulting decline in manufacturing activities in Russia only lasted a few months it seems, as by May the situation stabilized, even as losses to our own multinationals are just starting to be counted. For instance, Renault (OTCPK:RNLSY) suffered a major loss of about 1/6 of global sales when it decided to exit the Russian market this year.

Russia’s own personal vehicle manufacturing suffered a major hit this year as most of the foreign producers that dominated the industry until recently left the country. In May, production declined by 97%. It looks grim. However, there is every chance that Russia is prepared to replace the foreign manufacturers, with local manufacturers likely to reorganize and take over, probably with some help from China’s extensive auto supply chain. Once a domestic industry will take root and start to dominate, as is the case with the agricultural industry, our own brands will no longer be able to muscle their way back in. They may even encounter Russian brands as competitors in other markets in the future, especially in the former Soviet space and in places with a lot of growth potential such as in Africa, once they will establish themselves.

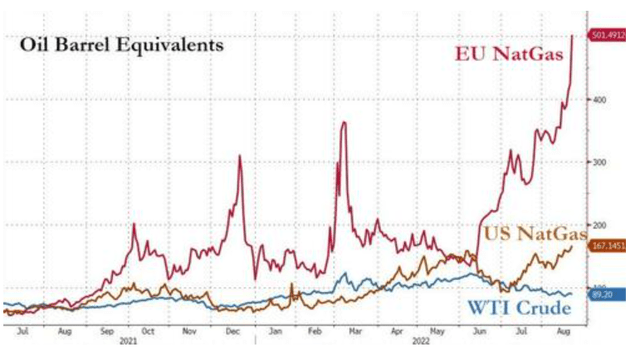

Perhaps no other Western industries face a greater threat from the current situation than the EU petrochemicals and metallurgical industries. The economic war with Russia is leading to a curtailment of Russian gas exports to the EU. As a result, energy prices are now hovering at unsustainable levels. As I pointed out in a recent article, companies like BASF (OTCQX:BASFY) are seeing a squeeze on profits in their European operations. All indications are that things are about to get worse and petrochemical and metals-processing companies across the EU will be asked to cease operations at their plants as soon as this winter. Things are not looking great beyond the coming winter either. Its petrochemical industry is likely to collapse as it will be forced to operate within unsustainable input prices, in addition to being periodically asked to shut in production. Russia on the other hand is likely to divert the gas to its own domestic petrochemicals industry, which it has been stimulating towards expansion for some years now.

There are of course those who will point out that any domestic attempts at displacing the collapsing European petrochemical industry will be unsuccessful because Russian petrochemical producers will never be able to achieve the level of technological advancements that the likes of BASF and other European companies achieved. The harsh reality is that they do not have to because it has now become a matter of who has the natural gas as well as other affordable inputs available to make anything happen.

On a different note, this should benefit America’s own petrochemicals industry, as I pointed out in a recent article entitled “BASF A Potential Loser And Dow A Likely Winner In This Geopolitical Turbulence” Assuming that America’s LNG export capacity will not expand to the point where its market will converge with the European and Asian markets, natural gas and other inputs should, in theory, remain comparatively competitive, which should give companies like Dow (DOW) a significant advantage over the likes of Europe’s BASF. It should also retain a technological advantage over emerging Russian competition, at least for the next few years, or perhaps for the rest of the decade.

Euro & USD global reserve currency status may suffer a slow and steady erosion

Another aspect of the blowback to sanctions we are seeing is the seemingly growing interest worldwide in gaining some degree of independence from the global USD and euro-dominated financial system. Russia is leading the way in this regard, which is understandable given that we froze hundreds of billions of dollars & euros worth of reserves that they earned over the years by selling the world its commodities and other products. It is now increasingly demanding ruble payments for its resources. If it accepts foreign currencies as payment, it increasingly demands the Chinese yuan or other currencies issued by states that are not fully aligned with the Western World. For instance, India now pays for Russian coal with the Chinese yuan or the UAE dirham. Turkey is set to purchase Russian gas with rubles. Russia is likely to increase its own payments for imports in rubles, once its own export payments in rubles become institutionalized, paving the way for international market demand for the currency.

The fundamental flaw in the sanctions on Russia’s central bank and its funds is that it exposes the threat to all nations to the possibility of being faced with similar sanctions. All of them will feel similarly vulnerable, therefore their reliance on the current Western-dominated global financial institutions, including the use of our main currencies in trade has been exposed as a massive liability. It is a liability that they can only reduce in magnitude by gradually adopting new financial institutions and embracing the concept of bilateral settling of payments, with the deals that Russia is currently making serving as a useful pattern to follow. New paths may also emerge, as exemplified by Iran’s recent payment for an international transaction in cryptocurrency.

With all the problems accumulated over the past decades, the EU economy could potentially suffer a massive hit if I am correct and we will see a growing rejection of its currency in international trade. The ECB will probably have to move to defend the currency, at the great cost of having to abandon support for a number of fiscally-distressed countries including Italy & Greece. Borrowing costs will probably rise significantly going forward throughout the EU, ending the era of free borrowing that helped to keep the EU economy afloat in the past decade. The US dollar could actually benefit from a battered and retreating euro currency, at least in the short term, as the euro enters a vicious cycle towards its eventual demise. Longer-term consequences for the Western World as one of its two pillars disintegrate economically, and perhaps politically as well will most likely outweigh the benefits that the US will see from a collapsing euro.

Investment implications

From every aspect one can think of, the EU is by far the most at risk of suffering an economic and socio-political meltdown. When people are asked to start living in a war economy mode, in other words, save energy resources through the self-sacrifice of one’s basic comforts, things are clearly not headed in a good direction. The fact that there is no light at the end of the tunnel for Europe’s current energy predicament, in other words, the current state of things is set to last for the foreseeable future, suggests that the EU economy is set to be battered on every front.

With the ongoing energy crisis, we are starting to see some of the first glimpses of EU industrial activities moving out of the first stage, namely temporary shutdowns, or reduced activities, and we are now moving into the second stage, namely permanent de-industrialization. The recent decision taken by Norsk Hydro (OTCQX:NHYDY) to shut down an aluminum smelter in Slovakia seems to be an early sign of things to come. All indications are that EU industries will be asked to conserve energy this winter. We have to wonder how many of them will opt to reopen by the spring, given that there are no indications that things will be better next winter. Even between winters, energy prices are so high that many industrial activities are just not viable anymore.

On a different front, with Russia increasingly no longer accepting euros as payment for its exports, it makes sense for all countries that do significant trade with Russia to cut their euro holdings. A potential plunge in EU industrial output further reduces the argument for holding euros. If euros cannot be used to buy Russian exports, or many EU manufactured goods that are no longer made available, the argument for holding euros is further diminished, meaning that fewer and fewer countries will be eager to accept large volumes of euro inflows in trade.

A desire to reduce exposure to sanctions initiatives will further reduce global demand for EU goods, especially when it comes to intermediary products that have the potential to reduce the ability of sellers of goods to market in certain countries or regions. The replacement of EU & American intermediary products on the global market will take time, especially when we are talking about high-tech inputs that the global industrial complex depends on. The net effects on the euro from growing rejection of it as a medium of exchange between third parties, as well as the prospects of EU products no longer being available for export, or no longer being desired as an export product by certain buyers, could combine to have a devastating effect on the euro currency in coming years.

In addition to external pressure on the euro, where its global role as a means of transaction is likely to come under serious threat, the internal economic situation looks increasingly dire, which adds up to an investment environment that is less than stellar for all assets denominated in euros. All companies that have heavy exposure to the EU market, whether they are domestic EU companies or foreign companies that do a lot of business in Europe should be viewed with caution going forward. Q2 GDP results for the EU may have come in better than expected, which might make for a tempting argument to bet on the EU always coming out better than feared. I do not think that this will be one of those times, as we see more and more industrial establishments in the EU either reducing output or shutting down altogether. And the longer this goes on, the higher the likelihood that there will be permanent, irreversible damage to the EU economy.

US assets are looking much better in this regard, however, we should not underestimate the risks. The US dollar may initially see growing international demand, even as the euro will start to suffer. At some point, however, efforts around the world meant to reduce reliance on the dollar as a medium of trade and as a reserve currency can potentially lead to a significant net reduction in the USD’s role in global trade. US financial institutions will also likely see a reduction in demand for their transactional and other services.

The greatest threat to US assets may arguably be China’s rise as an alternative source of technologies, which may be complemented by other emerging sources around the world. The recent news about the emergence of a BRICS membership application drive seems to suggest that a growing number of nations are looking at finding synergies with partners that are not aligned with the Western World. Thus semiconductors produced by SMIC for instance may increasingly replace products made and designed by the likes of Intel or AMD.

A Turkish company making widgets, for instance, may find that its largest potential export markets are Iran, Russia & China. Given current trends of extraterritorial sanctions, the Turkish widget-maker may find that AMD inputs are not a desirable item to have embedded in the product, given that it may provide the US government reason to ban Turkey from selling widgets with AMD chips in it to any or all of those countries, or perhaps even most countries on this planet, outside of the Western World. If the product can be developed and produced with SMIC-produced chips in it instead, it will then make sense to do so, even if AMD might be slightly more performant or better-priced. Alternatively, it might opt to use both, in two slightly different versions of the widget, destined for different markets. Bottom line is that geopolitical considerations may increasingly push Western inputs out of the process, whether we are talking about intermediary components or financial services.

Summing it all up, as ordinary investors such as myself, the choices are increasingly unpleasant in this regard. For instance, I would have considered investing in SMIC, but that option is no longer readily available. The potential for a Russia-style economic confrontation makes it further undesirable to pursue such an investment. I own some AMD, and Intel stock, which are readily available. As I pointed out, however, there is a real risk that they may see their global market reach curtailed in coming years, not so much because they may be doing anything wrong, not performing as they should, but rather because they are likely to become collateral damage in the emerging global economic conflict that arguably our own Western governments started. It is yet another potential pitfall and source of risk for investors, within what is arguably already an ugly outlook for investment return prospects for the foreseeable future.

Be the first to comment