Lari Bat/iStock via Getty Images

Netlist, Inc. (OTCQB:NLST) is a maker of high-performance memory modules. The company is growing revenue substantially, preparing to launch new memory technology, and making progress in three major lawsuits against tech giants.

While some have doubted Netlist’s ability to pursue these suits, court documents suggest the endgame is rapidly approaching. In the meantime, investors have an opportunity to purchase the stock at depressed levels before what promises to be a busy fall season.

Legal Dominoes

Although far from a company focused on patent trolling, it makes the most sense to address the three large legal cases currently facing Netlist. These are against Samsung (OTCPK:SSNLF, OTCPK:SSNNF), Google (GOOG, GOOGL), and Micron (MU), all for infringement of various parents.

As of now, none of these companies have a license to use Netlist’s products or IP. Last fall, Netlist won a critical ruling against Samsung that released them from the contract because of Samsung’s breach. Seeking Alpha author Gold Panda minimized this case by focusing on the minor aspect of it, namely the actual breach damages.

In that breach of contract case, Netlist asked to receive approximately $2.5 million in damages, totally unrelated to a license for their product or any patent infringement. A jury decided not to award them those damages, which are ultimately insignificant.

The bigger prize was confirmation that the contract is no longer in effect, meaning Samsung has no license to utilize Netlist’s products or patents. Yet Samsung is using their products, and they also distribute those products to Google.

Samsung Running Out of Options

Note that Samsung is currently on the hook in Texas for infringement of seven different patents. For one of those patents, Samsung requested the Patent Trial and Appeal Board to complete an inter parties review (IPR). That request relates to Netlist’s seminal 912 patent that was already reviewed and upheld by the PTAB in 2020 as part of the lawsuit against Google.

The law allows each individual party to request an IPR, although it is for the exact same patent and virtually identical applications as the Google case. Netlist contends that the 912 patent teachings can be found throughout the memory industry, including in the latest DDR5 standard.

So why did Samsung focus on the 912 patent in hopes of getting an IPR? Quite simply, the patent has been proven seminal. What that means is the technology is groundbreaking and that the industry needed it to advance forward. In short, Netlist owns a patent that proved a lynchpin in the success of Google and Samsung over the last decade.

And thus, Netlist sits in the catbird’s seat waiting for the tech behemoths to agree on a settlement and licensing deal, or to face a jury and allow them to determine how much money should be awarded.

If you think I’m exaggerating these claims, you should by all means explore the patent and its ubiquity in Google’s servers. When a judge asked for an independent examination of Google servers, it was found that every one of them contained a Netlist part.

Keeping the Pressure on Google

Further, Netlist won an important hearing this summer, where Google asked for intervening rights to minimize its liability. Judge Richard Seeborg, in California’s Northern District, informed Google they would be liable for infringement damages going back more than 15 years.

Recently, after Samsung requested their IPR, Judge Seeborg granted Google a 90-day stay in the Netlist case that will likely hinge on whether the Patent Board grants an IPR to Samsung. If that happens, expect the share price could take a blow as investors grow impatient with the legal process.

Barring that delay, Netlist looks set to move ahead with discovery and to pursue a significant award or settlement with Google.

What to Look for This Fall

Lastly, there is another case in Texas against Micron, where Netlist has accused them of infringing multiple patents in its IP catalog. The jurisdiction is favorable for Netlist and could yield a positive settlement once Claim Construction is completed.

While the waiting feels interminable, there are signs of moving toward a resolution. One major hurdle stands in the way, which is the pending IPR request by Samsung on the 912 patent. If that review is granted, it will extend the timeline by another year (the length of time the board has to make a ruling on the review). Such a decision seems unlikely in the face of previous decisions, but it’s a risk investors should be mindful of.

A decision is due October 21, and less than a week after that, there is a scheduled case management conference in California to move the Google case forward. Based on historical releases, investors should also get to see Q3 numbers by the first week of November, meaning it’s going to be quite a busy couple of months coming up for the company and its shareholders.

Beyond the Lawsuits

It is also important for investors to understand that Netlist is not a business based on patent trolling and does not depend on these lawsuits for its future success. They are in their own right a high-quality memory module manufacturer.

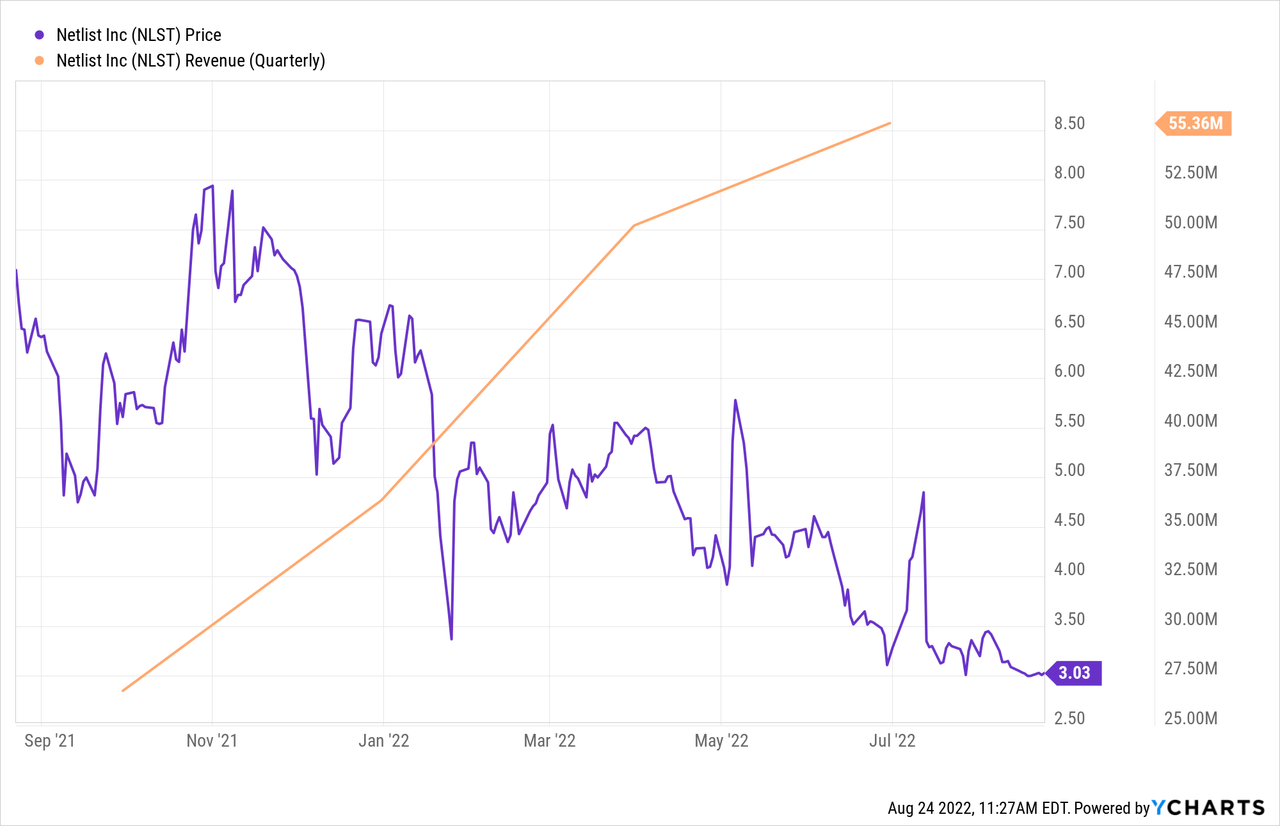

Year-over-year revenues have grown by more than 100%, and the company is on track for over $200 million in sales this year, including $55.4 million posted in the recent second quarter.

And the future looks even brighter. Next year, Netlist will be launching its next generation of memory components focused around DDR5 and CXL memory products. In combination with their five-year partnership with SK Hynix, revenue should continue to grow steadily.

Moving Toward Profitability

For now, earnings are roughly flat, in large part due to a significant uptick in hiring and the ongoing legal costs. The hiring has been done in anticipation of rapid growth in business over the next year, and the legal costs, despite what the naysayers might believe, will not go on forever.

At the annual Roth Conference back in March, CEO C.K. Hong commented that he believes the lawsuits will be wrapped up in the next 12 to 18 months. Since that was nearly six months ago, the timeline has now been shortened to roughly a year or less.

Furthermore, genuine progress has been made in all three of the lawsuits, including a jury trial date of May 1st, 2023 in the Samsung case in Texas, a district notorious for moving expeditiously.

Stock Price Struggles

Year-to-date, NLST stock has declined by more than 50%, from over $6 to $3.

Although the share price has been in a difficult downward trend since peaking at $10 last summer, the fundamental value of the company already well exceeds the current price, and the potential for future growth is enormous.

Stripping away the lawsuits for a minute, and imagining that they have absolutely no value, the company trades at just over three times this year’s sales, and probably only two or two-and-a-half times next year’s sales. For an emerging growth technology company, that is too low.

The one-year chart shows the disconnect between climbing revenue and falling stock price.

Even in a bearish market, one that has turned away from tech companies over the past year, I believe a five-times sales valuation would be perfectly reasonable here. That would put the share price closer to $5 based on this year’s sales figure, and again does not factor in much future growth or any potential deals or payments coming from the ongoing lawsuits.

The Road to Double Digits

Netlist briefly touched $10 per share last year, but it has come nowhere near that level since then. And the path to get back there will likely be bumpy and challenging. However, I see a very reasonable way for that to happen in the next 12 months. First, it will take continued sales and organic business growth, with a quarterly run rate in the 75 million range by this time next year.

In addition, investors will be looking for progress on the lawsuits. The best news would be any kind of settlement deal that includes both an upfront payment and an ongoing license. But if necessary, the company appears well-prepared to go all the way through a jury trial and await a decision about how much they will be awarded then.

Estimating the exact value of any kind of award is extremely difficult, and juries are notoriously unpredictable. That said, last year’s deal with SK Hynix, which provided 42 million in upfront cash and a 5-year licensing deal, will have a total value somewhere in the neighborhood of $500 million.

That deal was small potatoes in comparison to what the company will be expecting from these other lawsuits. One of the reasons they accepted such a small upfront payment at the time was that their cash balance was low and they were concerned about having to dilute shares. With the current revenue and cash balance, those concerns are greatly diminished so that the company can be in a more advantageous position for future negotiations.

Again referring to Hong’s comments made at the Roth conference in March, the CEO indicated that the value of each of the three lawsuits was worth “upwards of nine figures.” Parsing those words, one implication is that upwards suggests “more than,” meaning that each suit could be worth $1 billion or more.

Conclusion

Without getting too carried away, it’s still fair to say that the three remaining suits are more valuable than the SK Hynix deal and could bring several hundred million in cash on top of many times that in ongoing licensing deals.

I, for one, look forward to this upcoming time as an opportunity for Netlist to resolve these ongoing lawsuits once and for all and to move forward as a solid and growing tech company with an incredibly bright future.

Be the first to comment