AsiaVision

Doximity, Inc.(NYSE:DOCS) took the market by storm on the IPO day in June 2021, when the stock became uber-popular and was bid up more than 100% in one day. At the time, the market participants couldn’t stop themself from buying anything remotely growing and Doximity was actually quite unique as it was also very profitable as well. Like pretty much anything else these days, the stock was not able to hold those highs for long and is now sitting even below the IPO price, down around 75% from all-time highs. The market is being very much indiscriminate in its negativity, allowing long-term investors to potentially scoop up some bargains and I believe that Doximity might very well be one at today’s price. Let’s see why that could be the case.

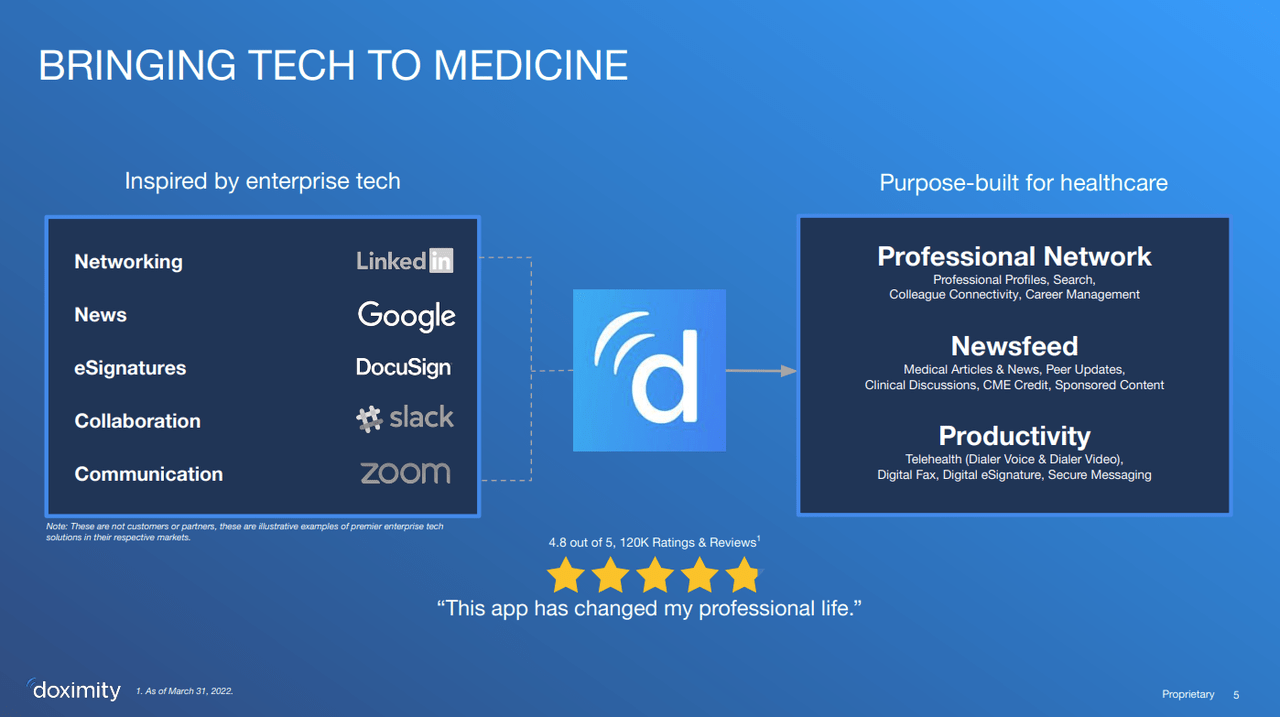

It’s LinkedIn … it’s Zoom … it’s Doximity!

Investor Presentation March 2022 – Doximity

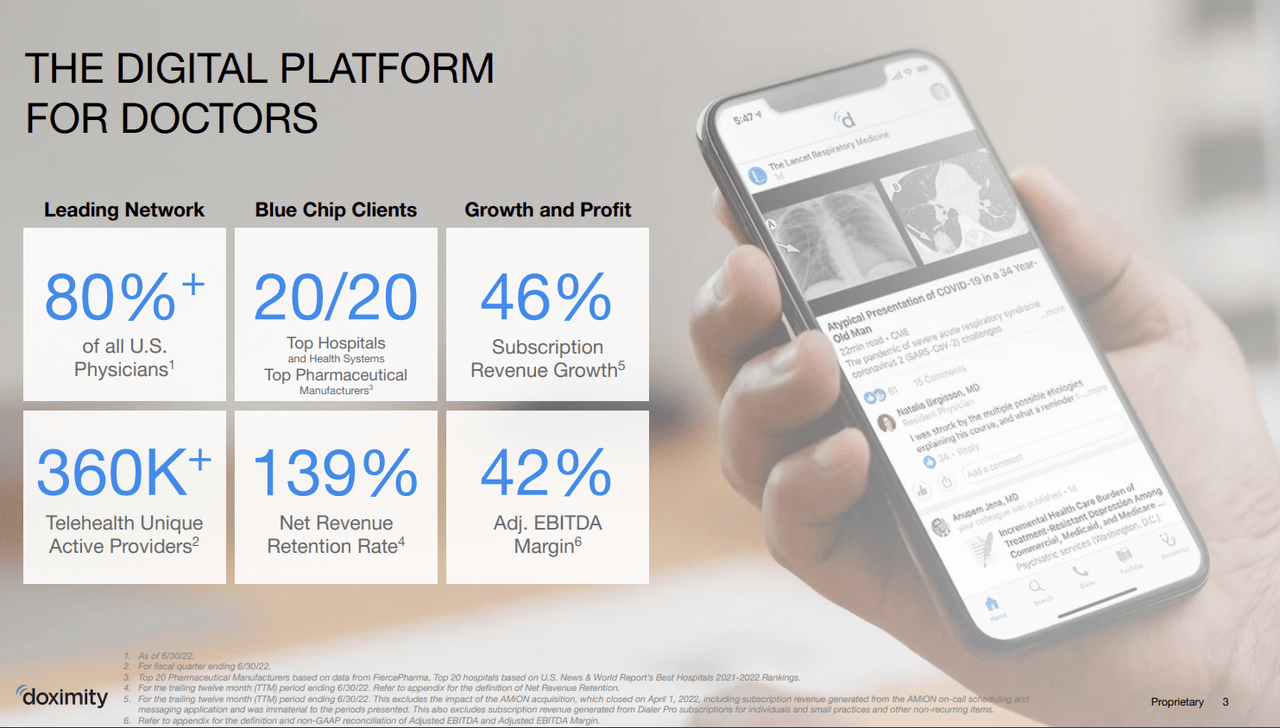

Doximity is a technology company focused on digitalizing the workflow of medical professionals, allowing them to be more productive and to offer better care. Despite being a relatively young company (founded in 2010) and a new entry into the public market, Doximity can actually boast impressive numbers related to its user base, having already attracted over 80% of total U.S. physicians onto the platform and 90% of graduating medical students.

Doctors can utilize Doximity in many use cases to improve their productivity. For examples, thanks to Doximity they can quickly access colleagues’ information for medical referrals and exchange messages with them, they can receive and send faxes through the app and sign documents directly on the phone screen. Doximity can also facilitate televisits by easily allowing even older patients that are not tech savvy to receive phone calls by physicians, who can then seamlessly transform the phone call into a video call and start the visit. The company has confirmed that 350,000 unique telehealth providers are active on platform as per the latest update in March 2022.

During the latest earnings quarter, management has given some interesting insights on how the “new normal” is very much hybrid also in the medical field as in the case of many other white-collar jobs, with Telehealth playing a very important role in it:

Our data shows that doctors, just like the rest of us, are not just reverting back to their pre-pandemic work schedules. Rather, they’ve evolved a new, more mobile hybrid schedule. Doctors are following up with patients from their offices, in their living rooms, calling them with lab results or prescription renewals and they’re billing for it. Everyone is happier for this, especially the patients who save hours of drive time and wait room time for what is essentially a 10-minute visit. We completed over 200,000 patient calls per workday last quarter. […] So among our mainstream hospital and clinic clients, the first visit may still be live, but the follow-up visits are increasingly virtual.

Doximity can also leverage its extensive data to offer its users valuable information for their career’s progression. This function can basically be seen as a LinkedIn specific for medical professionals: doctors can see statistics in relation to specializations that are currently requested, or analyze if another state would offer them better potential remuneration for example.

Doximity also focuses on the knowledge side of the job: doctors need to continuously stay up to date with the latest on the field, however the company claims that there are too many articles, researches and studies that are published every day. Doximity’s Newsfeed promises to deliver only information related to the user’s specialization and interests thanks to an algorithm, operating very much like Facebook in that regard. Newsfeed will also show some sponsored posts that generate additional advertising revenue for DOCS.

The company has clearly created a product that thrives if used by as many users as possible, and with over 80% of U.S. doctors already members Doximity can clearly rely on a very strong network effect. This creates a very powerful moat that is already at play and is visible through DOCS’s very high Net Revenue Retention Rate: in the most recent quarter (Q1 2023 ended in June 2022) the company posted 139% NRRR, down from a sky-high 167% a year before but at current level is still very much positive. This metric indicates that existing customers during the quarter spent a lot more compared to the same quarter a year before and speaks volume to the success of the company’s “land-and-expand” strategy: once Doximity is inside the door, it manages to convince its users to adopt more and more services.

Investor Presentation March 2022 – Doximity

Earnings Q1 2023: Very good overall but guidance was cut

During the latest quarter Revenue rose 25% YoY to $90.6 million, actually a bit higher than management’s prior guidance of $88.6-$89.6 million announced in May 2022. Despite being a growth story DOCS is profitable and also posted positive Net Income of 22.4 million, albeit down 15% YoY (24.7% Profit Margin). Impressive Free Cash Flow margin of almost 50% as the company managed to achieve $43 million of positive FCF in the quarter.

The problems started with the guidance. For the next Q3 2023 management has guided for revenue between $99.5 million and $100.5 million (up 26% YoY at the midpoint). For the full year management has lowered the previous revenue outlook by about 6% to a range between $424 million to $432 million, which would represent YoY growth of about 25%.

The reason for the guidance revision was attributed by management to an unforeseen slowdown in upsell for specific modules that are not selling as well as in the past, probably because more and more customers are starting to operate more frugally. Management has detailed how digital projects are one of the easiest expenses that can be cut when clients start tightening the belt, however in the long run there is still conviction that these tools will provide such a high return on investment (ROI) that higher growth should come back.

From the latest Earnings Call:

Our formulary upsell module, for example, parses reams of insurer data for each doctor to show them which drugs offer the best co-pays for their particular patients. Doctors appreciate the clarity and personalization of our format. […] Our conference upsell module shows each doctor who signed up to go to a medical conference, a list of who they know who’s also going. Doctors like our One Click interface to meet up with old friends or coworkers. […] Well, despite being steady sellers in the past, these modules haven’t done as well this year. We’ve realized that as a midyear add-on, they’re more discretionary and vulnerable to budget shifts.

Risks and Valuation

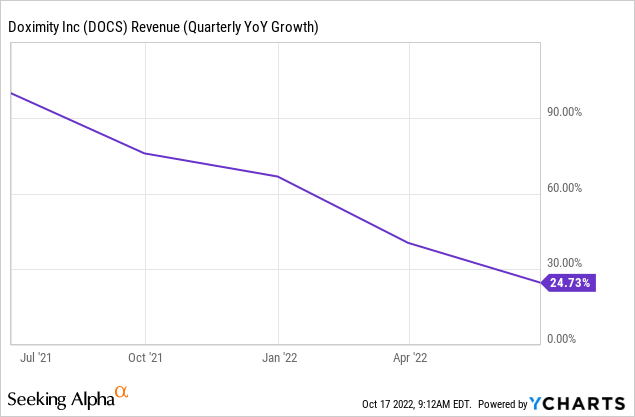

The market at the moment is solely focused on the company’s growth. Is Doximity’s growth coming to an end? Management thinks that they are only at the beginning of a decade-long transition to a new, digital-focused normal.

YCharts – Seeking Alpha

In my opinion although the revenue growth is undeniably slowing, the hyper-growth observed during COVID when lockdowns were widespread and digital was the only channel available was destined to end; If Doximity new normal means long-term growth between 25-30%, I believe the current price point still represents an attractive entry point. The latest full year entry in terms of FCF is for 2022, which stood at around $121 million. For context, the company has grown FCF during the past 4 years (2019-2022) at a CAGR of 72%. By projecting 25% long-term growth (10 years) at a discount rate of 10% and terminal value of P/FCF of 20 (half of current value), Doximity’s intrinsic value today would be around $9.5 billion, pretty much double the current valuation. On top of this, the company is already starting to deploy some capital to buy back shares, albeit at the moment at a very slow rate ($8.9 million spent in the latest quarter); however, given how profitable Doximity is this number might get much more meaningful very fast especially if the stock keeps going down.

Of course, slower growth or even more pessimistic sentiment by the market (which equates to lower valuation) could mean that the intrinsic value would be impacted but it seems to me that the market might be overshooting on the downside here.

The next quarters will be very important to observe. If DOCS’ offerings will turn out to be much more discretionary than structural as the management thinks, revenue growth might slow more and the Net Retention Rate will drop. The market won’t like it either and the stock can definitely go lower from the current valuation. However, one could also argue that a current Forward P/E of 45 does not seem too crazy for a nicely profitable growth stock. If the company grows anywhere near 25% that multiple will come down very quickly. At current prices I believe a small entry point makes sense and I will follow closely the next quarters to see how the growth story will develop.

Be the first to comment