KanawatTH

The market-wide sell-off has allowed me to establish positions in wish list tickers and add to some of my favorite positions. In addition, the indiscriminate selling pressure has uncovered countless investment opportunities in the small and mid-cap healthcare arena. Organogenesis (NASDAQ:ORGO) is a small-cap regenerative medicines company that is trading a significant discount after dropping ~72% over the past twelve months despite being a profitable company with respectable upside potential. I believe the market has taken the selling too far and provided me with an opportunity to put ORGO in my Compounding Healthcare “Bio Boom” Portfolio.

I intend to provide a brief background on Organogenesis and will discuss why I think it deserves a spot in my Bio Boom Portfolio. In addition, I point out some downside risks for ORGO. Finally, I reveal my plans for finding an entry point for a starter position in ORGO.

Background on Organogenesis

Organogenesis is a regenerative medicine company that is committed to developing, manufacturing, and the commercialization of products for several U.S. healthcare markets including advanced wound care, surgical, and sports medicine. The company has multiple platforms that utilize regenerative technologies that have generated several marketed products. Organogenesis markets these products to hospitals, wound care centers, institutions, and physician offices.

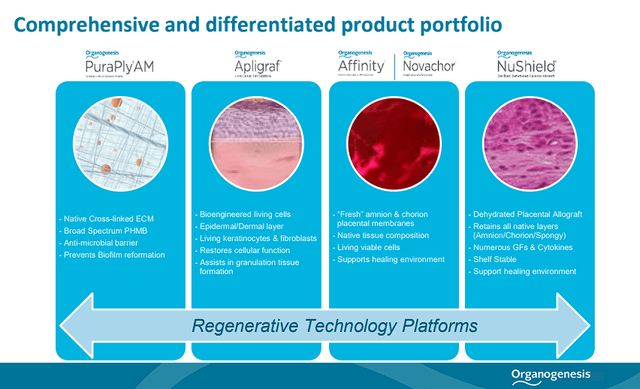

Organogenesis Platforms (Organogenesis)

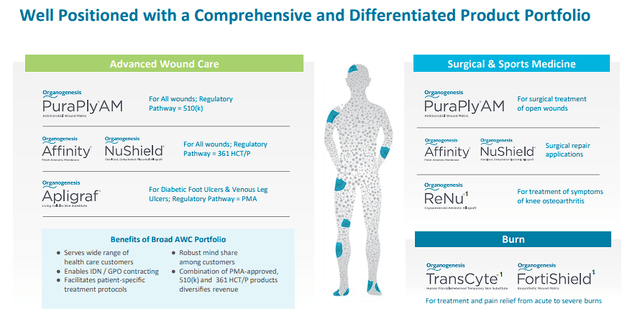

The company’s advanced wound care products consist of PuraPly, an antimicrobial barrier that enables conformability and fluid drainage used to treat wounds at high risk of infection. PuraPly is the company’s leading product is essentially a skin substitute used to treat wounds that have a biofilm, surgical wounds, ulcers wounds, and burns to name a few.

In addition, the company has Affinity, an amniotic membrane wound covering that preserves tissue. NuShield, is another wound-covering product that uses both amnion and chorion membranes. Apligraf, is a bioengineered living cell therapy that yields a gamut of cytokines and growth factors to restore cellular function. Dermagraft is the company’s bioengineered product that generates human collagen, ECM, proteins, and cytokines. Moreover, the company has Novachor, another amniotic membrane wound cover that is intended to aid in the preservation of cells, growth factors, cytokines, and ECM proteins.

Organogenesis Products (Organogenesis)

Organogenesis has surgical and sports medicine products that comprise NuCel, a dehydrated placental tissue to support native healing. ReNu, is the company’s cryopreserved suspension for soft tissues. Moreover, the company has FiberOS and OCMP, which are bone void fillers primarily for orthopedic and neurosurgical uses.

The company’s burn products include FortiShield a biosynthetic wound matrix for severe wounds. In addition, Organogenesis has TransCyte, a bioengineered tissue for the treatment of partial-thickness burns.

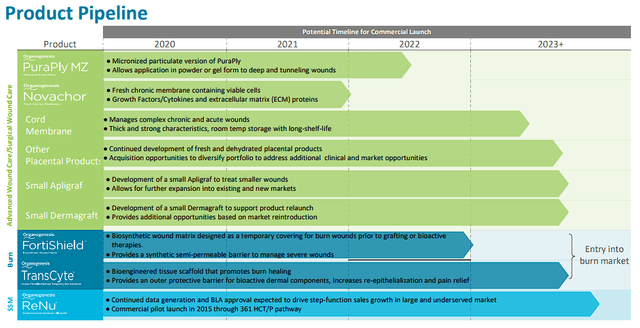

Organogenesis Pipeline (Organogenesis)

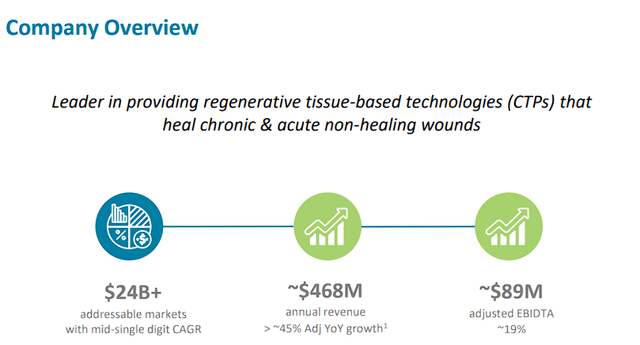

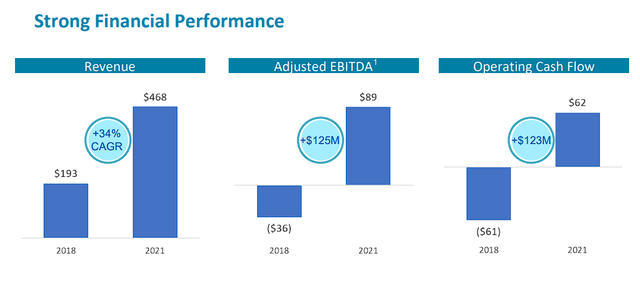

In terms of performance, Organogenesis has relied on PuraPly to accelerate growth, while enjoying a diversified revenue stream from their other marketed products. In 2021, the company pulled in ~$468M, which was ~45% adjusted year-over-year growth. In addition, the company recorded $89M in adjusted EBIDTA up ~19%.

Organogenesis Company Overview (Organogenesis)

Since 2018, Organogenesis has reported a 34% CAGR in revenue; a $125M increase in adjusted EBITDA; a $123M increase in operating cash flow.

Organogenesis Growth History (Organogenesis)

In terms of cash, Organogenesis finished Q2 with $112.9M in cash, cash equivalents, and restricted cash. The company also has $131.61M in total debt.

Growth Prospects

Organogenesis has several growth drivers that should help the company extract additional growth in the coming years. First, the company is expected to see organic market growth with the advanced wound market projected to experience a 12% CAGR through 2026 and the surgical & sports medicine market growing ~6% annually.

The company already has a big commercial infrastructure and they are working on expanding their capacity while improving manufacturing efficiency.

Organogenesis Manufacturing Updates (Organogenesis)

Organogenesis also has new products ready to hit the market in the near future including PuraPlyMZ and FortiShield. In addition, the company is eyeing a BLA for ReNu and the relaunch of Transcyte. The products should only contribute to the company’s growth in the coming years.

What is more, Organogenesis could execute some M&A or in-licensing deals in order to bolster the company’s portfolio and add supplementary growth opportunities.

Discount Valuation

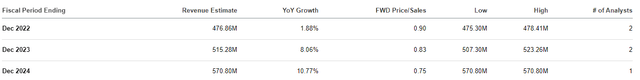

Currently, ORGO is trading at a significant discount based on multiple valuation metrics. First and foremost, ORGO is trading below 1x forward price-to-sales for its 2022 revenue estimate.

Organogenesis Revenue Estimates (Seeking Alpha)

Typically, we see tickers that are trading under a 1x forward price-to-sales when the company is several years away from hitting those revenue estimates and the company is not profitable. Whereas ORGO is expected to hit those numbers this year… and they are a profitable company.

Keep in mind, the industry’s average price-to-sales is around 5x, so, ORGO should be trading above $18 per share. Considering ORGO is currently trading in the $3 area, I believe it is reasonable to say that ORGO is trading at a discount for its 2022 projected sales and is trading at an even bigger discount for its future sales.

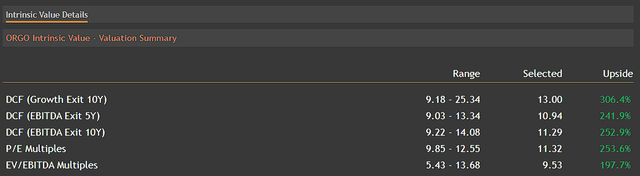

If we take a look at some of the standard valuation models, ORGO is tremendously undervalued at these trading levels. ORGO’s 10-year growth DCF is at $13, which is over 300% higher than its current share price. The P/E multiples model is at $11.29, which would be over 250%. The EV/EBITDA multiples model has ORGO’s fair price around $9.50, up nearly 200% from its current share price.

ORGO Valuation Models Summary (Value Investing)

Considering these models and ORGO’s calculated fair values, we must brand ORGO as a heavily discounted ticker at these levels.

Notable Risks

ORGO has a number of notable downside risks that could be weighing down the share price. Firstly, Organogenesis has only been a profitable company for a couple of years and has failed to accelerate growth enough to be safely in the green. Indeed, being a profitable company with a strong growth trajectory is one of the company’s strengths, however, the market is going to punish a ticker that is hovering just above breakeven with choppy earnings. Investors need to accept that the market will continue to punish the ticker if they cannot make the step in their growth path to be deep into the green.

Another major concern is the company’s competitors, who are numerous and capable. Some of ORGO’s competitors include Vericel Corp (VCEL), MiMedx Group, Inc. (MDXG), 3M (MMM), Integra LifeSciences Holdings Corporation (IART), Medtronic plc (MDT), Smith & Nephew plc (SNN), and Stryker Corporation (SYK). Considering some of the names on this list, we have to accept that Organogenesis is going to have to a lot of effort into gaining market share, while also having a hard time defending theirs.

The company’s IP is cause for concern considering that Apligraf, Dermagraft, and NuShield products, are not covered by patents and they don’t have pending patent applications. Indeed, other companies might not have the ability or know-how to take advantage of the company’s weak IP, but Organogenesis will have a little-to-no defense against encroachment if tested.

Another risk comes from an “anonymous short report” published in October of last year that accuses Organogenesis of “ripping off” the U.S. government with $250M in reimbursement charges per year and pricing Affinity “exorbitantly high” to take advantage of Medicare reimbursement. Although I can’t prove or disprove if this short report was accurate or not, I must consider it a looming risk because the market has not allowed the share price to recover since the report was published. Unless the company can publicly address the claims, we have to accept the market is not going to allow ORGO to trade at a premium valuation.

Considering the points above, I have to give ORGO a conviction rating of 2 out of 5.

Bio Boom Candidacy

The Bio Boom Portfolio is made up of healthcare tickers that are highly speculative, however, they offer substantial upside due to a potent upcoming catalyst, projected revenue growth, or a potential turnaround. Typically, these are small to mid-cap companies with volatile tickers that will offer recurrent trading opportunities to help generate substantial profit while developing a “house money” position. These tickers will be traded as long as it is in play or the company graduates to the Bioreactor Portfolio.

For ORGO, I am looking at the valuation, growth metrics, and financials, and I see a very strong company. What is more, Organogenesis is considered one of the leaders in multiple markets that are growing. Despite the company’s current value and long-term outlook, the share price has deteriorated by more than 70% over the past twelve months. This discrepancy between intrinsic value and market valuation provides an opportunity to invest in a profitable ticker that is technically oversold and fundamentally undervalued. I suspect the market will continue to focus on the ticker’s downside risks, however, it will eventually have to recognize the ticker’s prospects and price it appropriately. Considering the stock could be valued above $10 per share, I would say that ORGO is a perfect candidate for the Bio Boom Portfolio.

My Plan

Regardless of the market’s ongoing sell-off, I am looking to open a starter position in the immediate term below my Buy Threshold of $3.50 to take advantage of the current prices.

ORGO Daily Chart (TrendSpider)

Once I have established a position, I will attempt to make an upsized addition on a high conviction reversal setup below my Buy Threshold. Subsequently, I will set sell orders around my Sell Targets in order to get my position to a “House Money” status to hold for a long-term position.

I expect to maintain an ORGO position for at least five years in anticipation the company will continue to be a market leader and the share price will eventually match the company’s value.

Be the first to comment