Oranat Taesuwan

Following our previous Dow Inc. (NYSE:DOW) publication, today we are back to comment on the American chemical giant’s Q3 results. Here at the Lab, we recently published a follow-up note called Dow is too discounted based on macro to micro implications such as supportive chemical spread, FCF yield and EBITDA margin across the cycle, and debt & pension liabilities consideration.

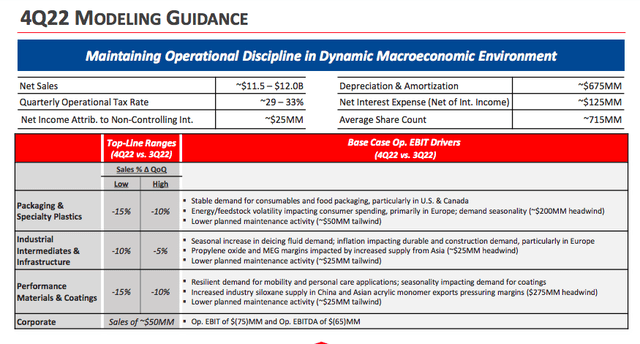

As already mentioned, during the CS presentation, Dow’s top management was forecasting the Q3 EBITDA at $1.9 billion. During Q1, the company managed to beat its own expectation; however, this time all was in line with their internal guidance. At the aggregate level, Dow’s global volumes were down, this was weighted down by Europe. On the turnover side, on a quarterly basis, the price was down by 6%. Looking at the modeling guidance provide by the company, we derive a projected Q4 EBITDA of circa $1.5 billion against a consensus expectation of $1.75 billion.

Dow Q4 Expectations (Dow Q3 Results Presentation)

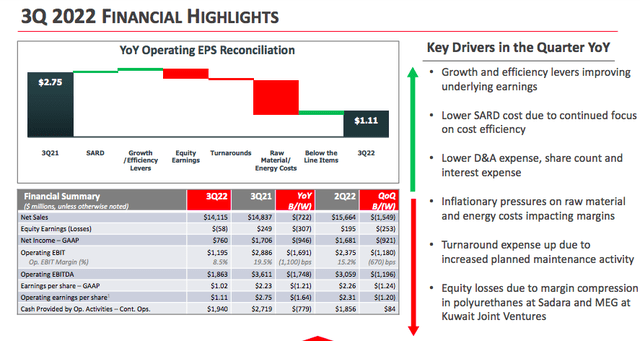

Q3 Results

Regarding the specific divisions, here below are Mare Evidence Lab’s main key takeaways:

- Industrial Intermediates and Infrastructure segment was again one of the worst performers. In this sector, the EBIT margin decreased significantly from 15.9% to 4.1% (on a quarterly basis). This was driven by lower volumes and prices, negative FX evolution, and more importantly lower contribution in earnings at the Kuwait and Sadara JVs. We should also note that EMEA’s high energy price environment was a key negative catalyst to the division’s profitability;

- Packaging and Specialty Plastics EBITDA declined 34% on a quarterly basis and more than 50% on an annual basis. Output decreased by 8% and the price was down by almost 11% (adding also the negative FX evolution). Specialty plastics sales were significantly down, and a key catalyst will be LyondellBasell’s earnings release this Friday. However, these results were partially offset by hydrocarbons and energy performance and margin in polyethylene division;

- Performance Materials and Coatings were above Wall Street estimates, and it was the only division to increase EBITDA on a yearly basis. However, on a quarterly basis, EBITDA declined by more than 34% with lower volume achieving a minus 7%. Looking at the sub-sectors highlights, we see that there were supportive numbers in downstream silicones and weaknesses in upstream silicones. JVs earnings contributions were also lower.

Dow Financial Highlights (Dow Q3 Results Presentation)

Conclusion and Valuation

To sum up, we might conclude that it was not a good quarter for the American chemical giant. The CEO’s words were encouraging and this negative sentiment was confirmed. He said that “the macro environment will remain dynamic” in the short-term horizon. “As a result, we have outlined a playbook of actions that have the potential to deliver more than $1 billion in cost savings in 2023″ adding also that “Decarbonize and Grow strategy with higher-return investments that will extend our competitive advantages and industry leadership positions”. Despite that, we believe that Dow’s worst-case scenario is already priced in by Wall Street. In the past, the company was trading at an average EBITDA multiple of 6.5x versus the current NTM EBITDA at 4.5x. Therefore, taking into consideration Dow’s Q4 expectations, we have decide to lower our forecast NTM EBITDA to $8.5 billion. Applying a 5.5x multiple, we derive a target price of $52 per share, maintaining our buy rating.

Be the first to comment