JHVEPhoto

Shopify (NYSE:SHOP) released its third-quarter earnings this week and surprised the market with a revenue beat of $30.33 million. In addition, the company displayed improved income statement management by exceeding its earnings-per-share estimate by 5 cents.

Market participants reacted positively prior to and after Shopify’s earnings beat as the stock surged by more than 18% during its last five trading days. However, we decided to analyze the stock’s prospects from a more holistic vantage point and discovered a few key variables that investors should take notice of.

We previously assigned a strong buy rating to the stock; we now downgrade Shopify to a sell; here’s why.

Shopify Q3 2022 Earnings Review

Earnings & Segment Analysis

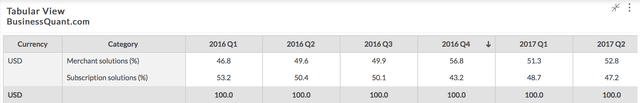

Shopify operates through two main segments, namely merchant and subscription. During its latest quarter, the company displayed growth in both segments, with merchant revenue jumping by 26% year-over-year and subscriptions by 12%.

Shopify’s continuous monthly recurring revenue growth is encouraging to see, as subscription-based businesses can be especially cyclical. The company’s 8% year-over-year increase in MRR speaks volumes, as trying economic periods would’ve likely waned on small enterprises and individual entrepreneurs that make use of platforms similar to Shopify.

A feature that we applaud is Shopify’s subscription layering. The company has various levels of offerings, with PRO and Plus subscriptions luring a slightly different customer base with altered income elasticity.

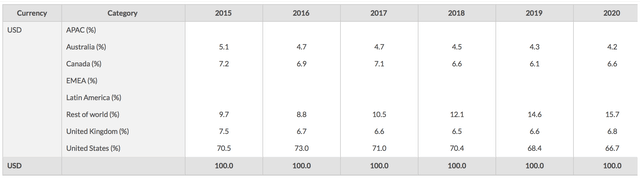

Furthermore, the company’s merchant solutions are adding significant growth with an integrated business model that includes various payment, financing, and supply-chain solutions. In addition, Shopify is geographically diversified, allowing it to formulate business relations with a wide variety of merchants and ancillaries.

Outlook

As previously mentioned, Shopify caters to various small and medium-sized enterprises that likely exhibit excess sensitivity to consumer sentiment. Therefore, the company’s fortunes could go one of two ways here.

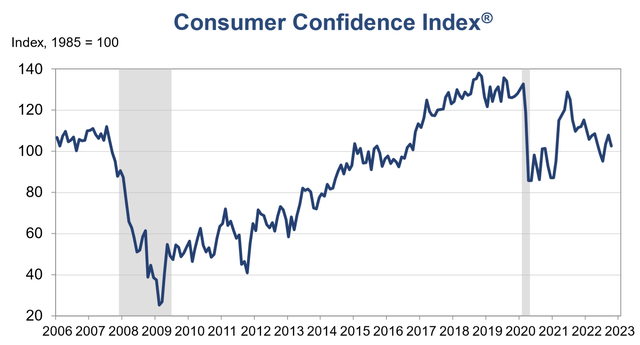

Firstly, consider the recent drop in consumer confidence (U.S. Only); Shopify’s core operations will likely feel the brunt if consumption slows. For example, a new business owner might revert to the jobs market and close down his/her website.

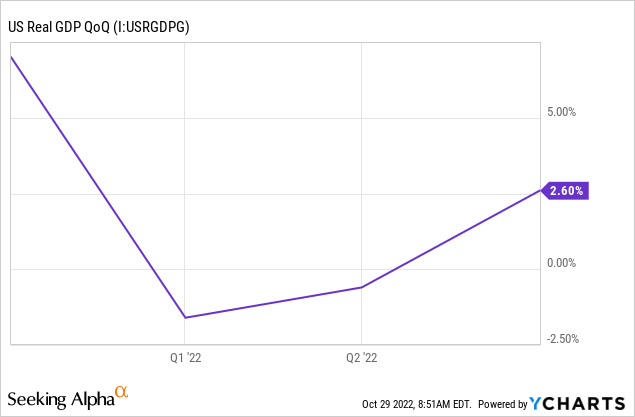

On the flip side, we’ve recently seen a reversion in U.S. (Shopify’s largest market) GDP growth with a 2.6% quarterly spike after drawing down by 0.6% in the previous. Thus, there could be a chance that the global economy’s in better shape than we thought, which could, in turn, proliferate Shopify’s core business activities.

The Conference Board

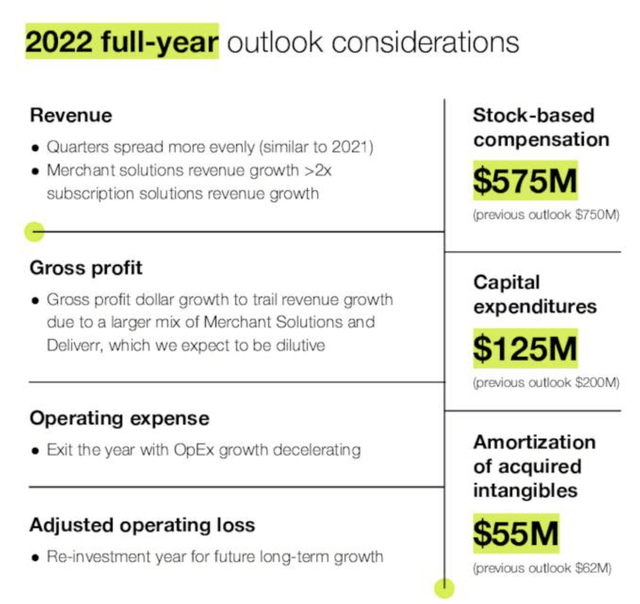

Looking ahead, Shopify expects its revenue growth to continue steeply with merchant-orientated growth. Also, the company expects its operating expenses to decelerate, which could be noted positively by shareholders as Shopify’s been unprofitable for most of the past decade, which has bothered its investors in more recent times.

Furthermore, the company aims to repay its investors with $575 million in stock-based compensation (during the full year of 2022). This could be accretive to the stock unless other variables phase out the benefits.

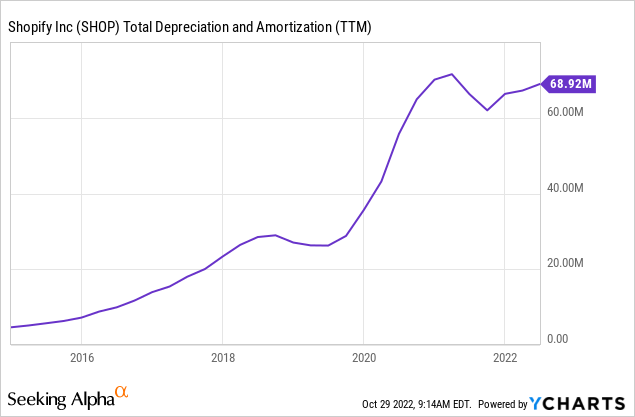

The company recently acquired Deliverr for $2.1 billion, which could compress gross margins in the short run. However, we believe the acquisition could add valuable long-run synergies as a vertically integrated acquisition.

In addition, the acquisition has added to Shopify’s amortization pile. We don’t see the company’s amortization expenses as a concern, as they’re allowed to be capitalized once the related intellectual property shows signs of yielding significant economic benefits.

Collectively, we believe Shopify’s third-quarter earnings report to be encouraging. The company still needs to work on managing its income statement more effectively. However, high embedded growth and intelligent acquisitions indicate that the company’s on the right trajectory to present future residual value to its shareholders.

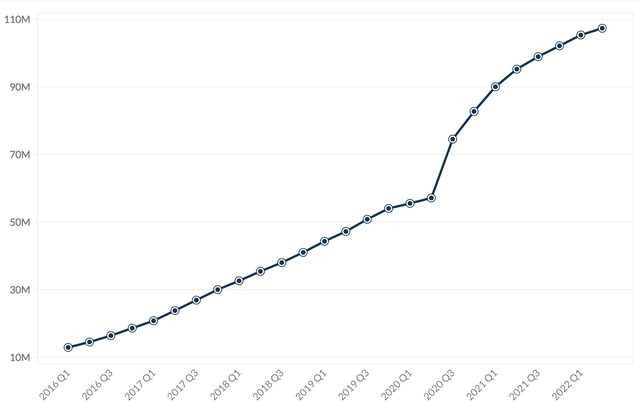

| Y/Y CAGR | 24.59% |

| 3-Y CAGR | 54.69% |

| 5-Y CAGR | 55.29% |

Source: Seeking Alpha

SHOP Stock Valuation & Return Metrics

To be honest, we think Shopify’s relative valuation metrics are quite astounding. The stock’s trading at more than eight times its sales, indicating that the market has overhyped this stock significantly. Moreover, the company’s forward EBITDA growth rate of -49.36% suggests that value might remain scarce for quite some time.

I wish I had something positive to say about the stock’s valuation, but I don’t. We believe Shopify’s unfavorable valuation metrics to be a key risk.

| Price-to-Sales | 8.23x |

| EV/Sales | 7.58x |

| EBITDA Growth (fwd) | -49.36% |

Source: Seeking Alpha

Concluding Thoughts

Is SHOP Stock Suited To The Current Market Climate?

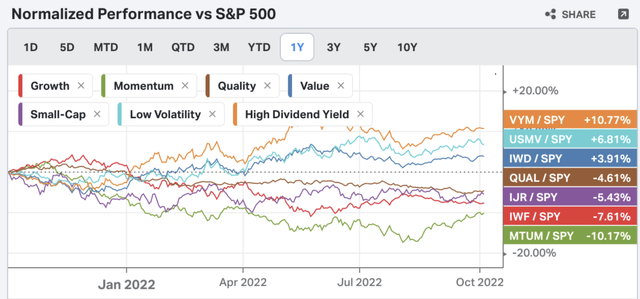

This year’s bear market has been plagued by various systemic risks, such as the war in Ukraine, inconsistent global monetary policies, energy shortages in Europe, and general supply-side inflation. As such, investors have opted to circle out of growth stocks such as Shopify and into low volatility and high dividend assets. This is a usual occurrence during uncertain economic times, and it’s likely to resume for a few more quarters until recession risk finds calm. Thus, we believe the market isn’t conducive for a growth stock such as Shopify to perform, and we think it will suffer further cyclical headwinds.

Final Word

Shopify’s recent earnings report suggests the company is on an upward trajectory. However, there are various signs that its stock is unfavorable as it doesn’t pass much value through to investors. In addition, the current market environment likely isn’t growth stock conducive, and Shopify’s relative valuation metrics need to be better aligned. Thus, we assign a sell rating to Shopify.

Be the first to comment