ArtemisDiana/iStock via Getty Images

Investment Thesis

Cloudflare (NYSE:NET) is a founder-led, industry-leading, cloud-native CDN (content distribution network) and cybersecurity company, with a mission “to help build a better internet”. The company offers an efficient, scalable, global network that customers can simply ‘plug into’ in order to improve both their security and performance.

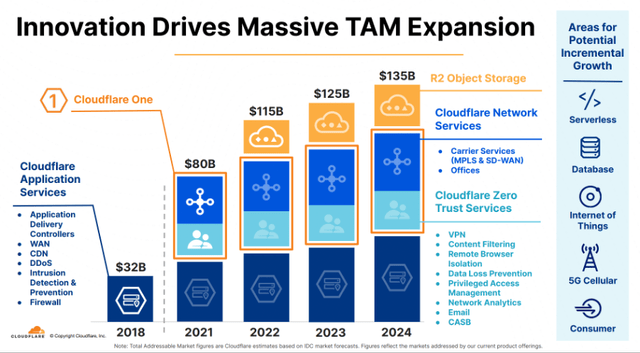

Similar to many something-as-a-service companies, Cloudflare is able to lean on its existing customer base when releasing new products in order to generate additional sales, since it is a lot easier to integrate new ‘add-ons’ if a business is already using Cloudflare. Through this, the company has managed to continually increase its total addressable market.

Cloudflare Q2’22 Investor Presentation

My personal thesis for investing in Cloudflare is the following: it is a leader in multiple growing industries that are transitioning to the cloud, from CDN to cybersecurity, and operates in business-critical areas, making Cloudflare more recession resistant than other companies. It has continually, successfully rolled out new products to existing customers (as evidenced by its high dollar-based net retention rates) & has seen substantial growth thanks to this. The company has an attractive long-term operating model, with operating margins expected to exceed 20%, and it has been growing rapidly over the last few years & should continue to do so in the future.

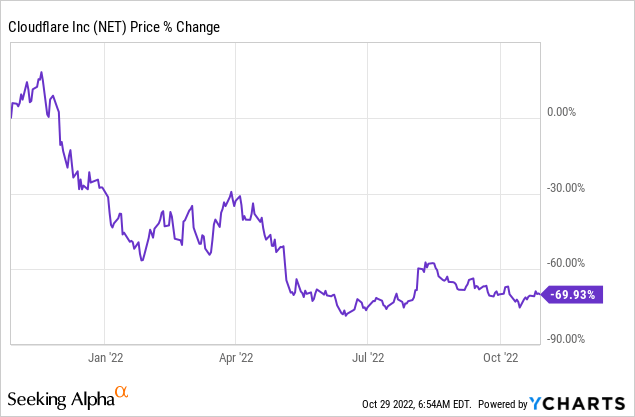

Despite the bright future that Cloudflare has, 2022 has not been a fun year for shareholders. The company has seen its shares fall by 70% so far in the past 12 months, in a market that has decimated many high growth, richly valued technology companies. Despite this tumbling share price, it’s still difficult to argue that Cloudflare’s stock appears ‘cheap’.

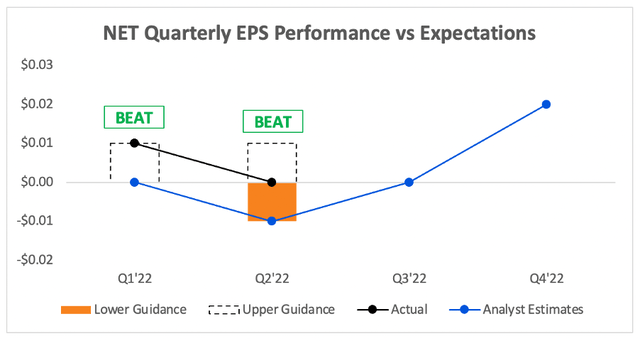

It trades at a premium valuation because it is a premium business, as shown when it smashed its Q2 earnings a few months ago. But investing is a forward-looking game, and investors are now hoping that Cloudflare will bring the same brilliance to its Q3 results – so, what should investors be watching out for? Let’s take a look.

Latest Expectations

Cloudflare is set to report its Q3 earnings on Thursday, November 3, after the market closes, and there are several key items that investors should keep their eyes on.

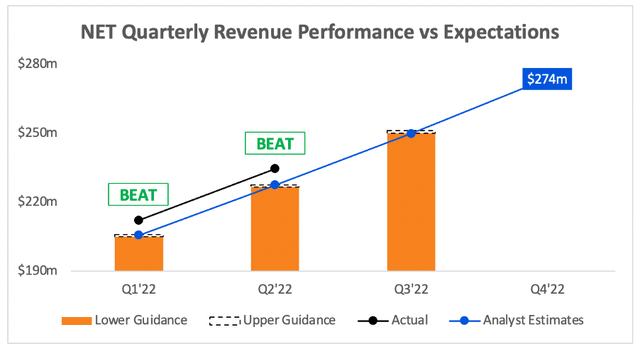

Starting with the headline numbers, analysts are expecting Q3 revenue of $249.8m, representing YoY growth of 45%. This expectation is very slightly below management’s guidance of $250-$251m for the quarter, perhaps implying that Wall Street is expecting Cloudflare to see the same sort of headwinds faced by the big names that have reported over the past couple of weeks.

My belief is that Cloudflare is one of the most recession resistant businesses out there, but that would not stop the company from being hit by headwinds such as a strong US dollar; we have already seen this impacting all the big tech companies.

In the first half of 2022, international customers made up 47% of Cloudflare’s overall revenue, so it would be fair to assume that the company will be impacted by foreign exchange headwinds.

On the plus side, Cloudflare prices its product portfolio in dollars – meaning that these headwinds should be less impactful, but it would result in rising prices for non-US businesses, and therefore could lower demand. CFO Thomas Seifert had this to say on the Q2 earnings call:

Headwinds from foreign exchange have also accelerated. And with our product portfolio priced in U.S. dollars, our products are becoming more expensive internationally. And while we haven’t seen a material change in our customers’ behavior to date, we are seeing elongated sales cycles at the high end of our business. We are cognizant of the increasingly cautious environment that factor this into our outlook.

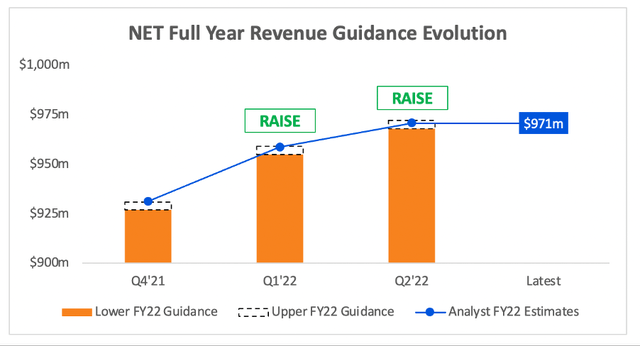

These headwinds didn’t stop Cloudflare from raising its full year revenue guidance last quarter to $968-$972m, which would represent full year revenue growth of 47 to 48% YoY.

The big question now is whether or not Cloudflare will raise that full year revenue outlook once again; the company normally does this fairly reliably, so it’ll all depend on just how badly the macroeconomic environment is deteriorating. Analysts are expecting full year revenues of $971m, so any raise would be well received.

Moving onto the bottom line, and not too much to talk about here. Analysts are expecting Cloudflare to report EPS of $0.00 (how exciting), but the numbers here are always fairly negligible.

Aside from the top line, what else should investors be watching out for? Well, there are a couple of key metrics that I always look at when Cloudflare reports.

2 Key Metrics To Watch In Cloudflare’s Q3 Earnings

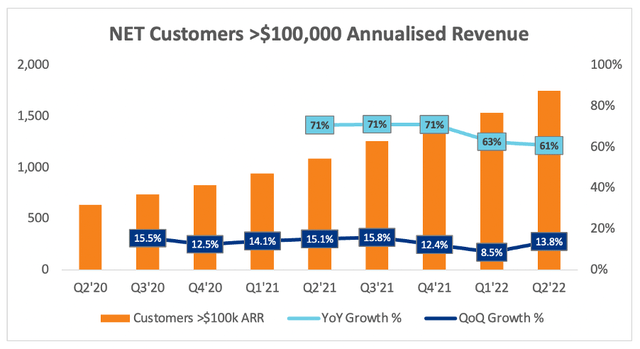

One of the most significant key metrics to take a look at is the number of large Cloudflare customers in the quarter, and more specifically the growth rates of these customers. These are a great indication of the demand for Cloudflare’s products, particularly now that we are in a difficult macro environment; I am expecting to see a slowdown for this reason, so if Cloudflare does deliver strong numbers on this front, then I will be very, very impressed.

In fact, back in Q1’22, I had started to get worried. The quarterly growth for large customers had slowed down to single digit percentages, but thankfully (and somewhat surprisingly) growth recovered in Q2’22.

Looking ahead to Q3, I think that any kind of sequential growth over 10% would be impressive, but if Cloudflare can exceed 12% or 13%, then I think shareholders should be incredibly pleased.

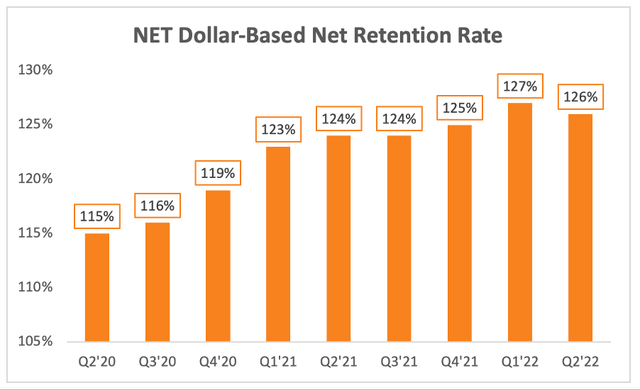

The next metric that’s always worth watching for Cloudflare is the dollar-based net retention rate, as this is a key indicator of the company’s ability to upsell its customers with new products – a core aspect of my investment thesis.

Cloudflare has a goal of getting this DBNRR above 130%; it may struggle to achieve that in the current environment, but clearly, it has been on an upward trajectory over the past couple of years, and this has resulted in revenues actually accelerating, which is quite incredible to see.

Quick Take: Core Financial Metrics

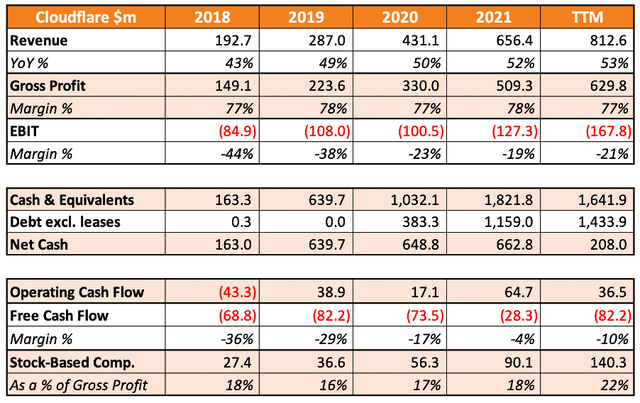

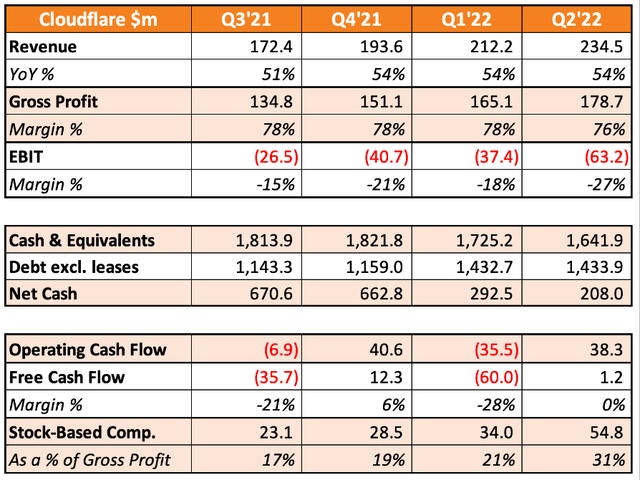

The evidence of Cloudflare’s revenue acceleration can be seen in the below table, where revenue growth has gone from 43% YoY in 2018 to 53% YoY over the past twelve months. I believe this is a testament to the company’s ability to successfully roll out and upsell new products and services to its existing customer base, whilst also winning over new, large customers.

There are a few trends in these financials that I’m not as big a fan of. Free cash flow margins are negative, and the net cash position has been falling – if the company doesn’t start producing positive free cash flow, then the net cash position will flip into a net debt position.

This wouldn’t be the end of the world, as Cloudflare still has more than enough flexibility with its balance sheet, and the debt referenced is convertible notes which are less daunting than, say, bank loans. But, I am keen to see that free cash flow start to turn positive more frequently.

Looking at the quarterly financials below, investors can see that revenue is still growing at an extremely healthy rate, with over 50% YoY growth in each of the last four quarters. It will be interesting to see whether or not that can continue in this quarter, when plenty of businesses have struggled, even the likes of AWS which provides a similar style of business-critical infrastructure.

Free cash flow was positive in the latest quarter, and thankfully CEO Matthew Prince spoke on the Q2 earnings call about his eagerness to ensure it stays that way:

What I’m watching closely is our free cash flow margin. It showed significant improvement quarter-over-quarter, and we continue to forecast it will be positive in the second half of the year.

…I’m ensuring right now in this uncertain time that Cloudflare is prioritizing being free cash flow positive.

Positive free cash flow will help to preserve the balance sheet, and will also give investors like myself a little more peace of mind.

NET Stock Valuation

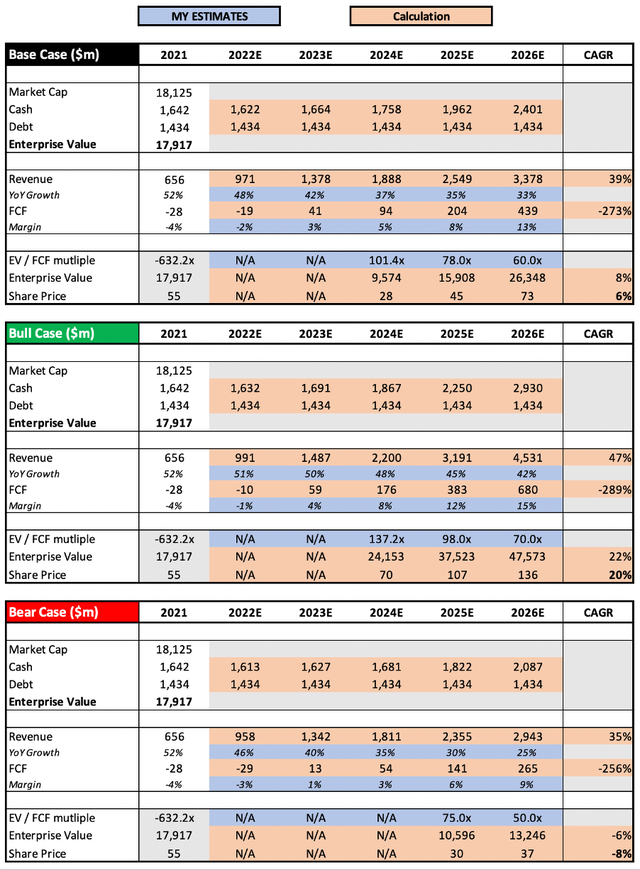

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Cloudflare is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have changed the valuation model slightly from my previous article, as I believe this method allows me to better demonstrate the potential upside and downside in my bear and bull case scenarios. The base case scenario has remained fairly similar to my previous base case scenario.

Some may argue that my bull case scenario is not bullish enough, as I am assuming that the revenue acceleration seen over the past few years does not continue. Yet I do still assume that revenue grows at a 47% CAGR through to 2026, which is a bullish case for pretty much any other business. Alongside this growth in revenues comes greater operating leverage and higher free cash flow margins, and a higher EV / FCF multiple is merited due to the more favourable prospects for Cloudflare from 2026 onwards.

My bear case scenario essentially assumes the opposite, although it still allows for a 35% revenue CAGR – in case you were wondering how much success is baked into Cloudflare’s current share price, it’s a lot.

Put all that together, and I can see Cloudflare shares achieving a CAGR through to 2026 of (8%), 6%, and 20% in my respective bear, base, and bull case scenarios.

Bottom Line

Ah the joys of investing in ‘growth’ companies; a high-quality business with a valuation that’s almost impossible to put your finger on! That is why I look at so much more rather than just the current valuation, or even the current product portfolio, when it comes to these types of companies – in a previous article, I outlined Cloudflare’s economic moats, management team, future prospects and more.

But the tumbling share price shows that clearly valuation does matter (who knew?), so I use my model to ensure that the price I’m paying for these disruptive, high-quality businesses is not completely insane – and, right now, I think the price is reasonable for Cloudflare.

Q3 earnings will certainly be a big test for this business. CEO Matthew Price sounded fairly confident on last quarter’s earnings call, but big tech’s Q3 results have shown profound headwinds that businesses will struggle to escape. Yet Cloudflare’s decision to bill in US Dollars could be a helpful shield against the FX pressure, and the company has been executing so brilliantly that it is difficult to bet against it.

Given all this, I will reiterate my ‘Buy’ rating on Cloudflare. Clearly, this a stock that is prone to volatility, and investors may see shares fly in one direction or another following its results; but, in 5+ years, I think this is a company that investors will have wanted in their portfolio.

Be the first to comment