William_Potter

It’s been a while since I wrote an article on AFC Gamma (NASDAQ:AFCG). Since May, shares have basically chopped sideways (while paying out two $0.56 quarterly dividends), but I figured it was high time that I wrote an update on this cannabis mortgage REIT.

Investment Thesis

AFCG is a small cap lender focused on the cannabis industry. Due to the regulatory complexity and uncertainty, they are one of a few publicly traded companies that operate in the space. Because of this, they are able to get double digit yields on their portfolio. This leads to a juicy dividend yield of 13.1% as the company pays out nearly all of their earnings to shareholders. One red flag investors should be aware of is the external management, but I think that is offset by large insider ownership. They also have intentionally targeted limited license jurisdictions, which in my opinion lowers the risk of the loan portfolio. Despite the risks and the complexity of the market, the imbalance between supply and demand for capital in the cannabis industry should lead to attractive returns for AFCG.

Overview

AFCG operates in a space that most financial institutions have avoided by lending to cannabis companies. Due to the regulatory complexity, AFCG can secure large yields on their loan portfolio. The cash interest rate on the portfolio sits at 11.8% based on the most recent investor presentation, and the yield to maturity is 18% after factoring in various fees. While I view AFCG as a more speculative bet than REITs like Innovative Industrial Properties (IIPR) or NewLake Capital Partners (OTCQX:NLCP), I still like the risk/reward proposition.

AFCG is a bet on a couple of things: a continued mismatch in the supply and demand of capital available to the cannabis industry and investors continuing to look for income opportunities. As long as the legalization effort remains stuck in neutral, the capital available to industry will remain limited. This should give the cannabis REITs looking to step in and fill that gap with attractive opportunities, whether it is on the real estate side for IIPR and NLCP or on the lending side for AFCG and Chicago Atlantic Real Estate Finance (REFI).

Insider Ownership, External Management, and Portfolio Strategy

The company has large insider ownership, so management should be incentivized to keep the dividends coming as they continue to grow the loan portfolio. However, AFCG is externally managed, which most REIT investors view as a red flag. In a previous disclosure, they included language on how they could internalize management once reaching a certain size, but I still view the external management as a drawback.

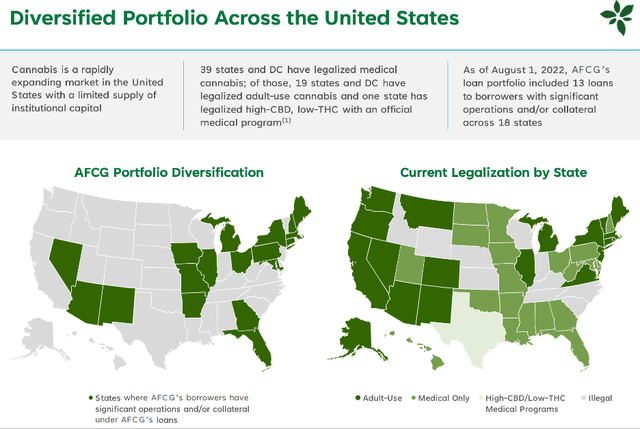

Loan Portfolio Map (afcgamma.com)

They have continued to avoid the unlimited license states, which is a prudent choice in my opinion. While some states have chosen to go different directions when it comes to legalization and regulation, and that has its pros and cons, licenses in limited license jurisdictions can be valuable collateral if a company isn’t able to meet its obligations.

Right now, this doesn’t look like an issue for AFCG, which said in the most recent earnings call that all of borrowers are current with their interest payments and no loans are on a non-accrual. We have seen some tenant issues with IIPR in the last quarter, so it is possible that it could become a problem for AFCG in the future. While that is something worth keeping an eye for investors, AFCG is currently trading right around book value from the end of Q2.

Valuation

At the end of Q2, AFCG’s book value was $17.03, down a penny from the previous quarter. I think we will probably see shares stick pretty close to book value, but I am curious to see what book value will be with the upcoming Q3 report. As a relatively young public company, AFCG doesn’t have a long operating history, but as an investor, I would like to see book value grow over the long term along with the dividend. As a mortgage REIT, most of AFCG’s return will be driven by the juicy dividend which has seen impressive dividend growth since going public.

The Dividend

In my last article, AFCG had provided investors with juicy dividend hikes for several quarters in a row. Since then, there was a token one penny hike in Q2 and then the dividend was held steady at $0.56 in Q3. I won’t be adding to my position unless the share price drops even further, but I’m expecting the company to at least maintain the dividend over the next year. They only have a couple loans maturing in 2023 and it is a relatively small portion of their book at approximately $15M. I’m not counting on further raises, but the dividend yield now sits at 13.1%, which is attractive. I plan to continue to reinvest the dividends unless we see a significant pop in the share price.

Conclusion

My speculative position in AFCG is a small one due to the risks related to the cannabis industry and the regulatory complexity. However, with shares trading near book value, I think we will see attractive returns driven by the large dividend. The company has impressive yields on its loan portfolio, and the portfolio should continue to grow over the next couple years. The external management is something to consider, but the insider ownership and the limited license strategy for the portfolio has me bullish on AFCG. Investors that understand the risks associated with the industry might consider AFCG and its juicy dividend.

Be the first to comment