Nikada

Tencent (OTCPK:TCEHY, OTCPK:TCTZF), the most valuable Chinese company and one of the biggest enterprises globally until recently, has continued seeing its market cap drop since February 2021. The primary reason for the ongoing sell-off is the overall negative sentiment towards China which was covered in detail in the article The Market Has No Mercy On Alibaba. Yet, Tencent’s business remains intact and the company keeps achieving further milestones as one of the global tech leaders. Although the last two years have been tough for Tencent’s investors in terms of returns, they also created an opportunity to acquire more shares of this wonderful business for a lower price.

People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game.

– Peter Lynch.

Tencent fell out of favor among investors not only due to the deepening negative view on China or domestic regulatory actions but also due to slowing growth and a decline in revenues for some segments of its business. This pushed impatient investors to dump the stock. Yet, the company grows its customer base which may be even more important than increasing revenues quarter-over-quarter. With the higher numbers of active users, revenue growth will come. Fundamentally, Tencent is an extraordinary business worth at least what it’s trading for. Even though macro and domestic risks keep weighing on the share price, patient investors may expect ample returns.

Outlook

Tencent operates in the Interactive Media and Services industry which has been particularly challenged in recent years due to the pandemic. It’s also undergoing changes accelerated by the health crisis and experiencing increased volatility. However, there are many opportunities for growth in this dynamic space. PwC – a global consulting firm, in its in-depth Entertainment & Media Outlook Perspectives Report,concluded:

One thing is clear from the data and the forecasts: the vast E&M complex is growing more rapidly than the global economy as a whole. With each passing year, more people around the world are spending more of their time, attention and money on the complex and increasingly immersive E&M experiences that are available to them.

Before analyzing financials and calculating the fair value of the business, it’s worth taking a look at the company’s segments’ performance and outlook.

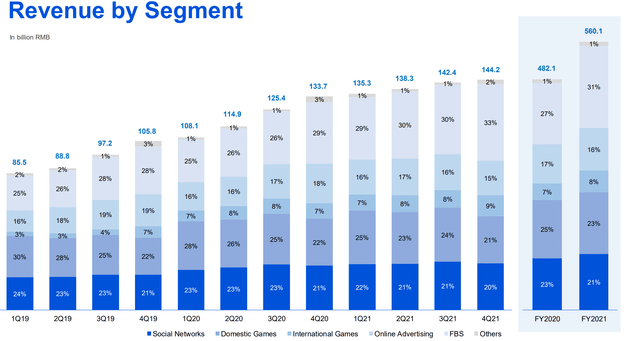

Tencent’s Revenue by Segment Since Q1 2019 (Tencent)

Domestic and International Games

Almost one-third of Tencent’s revenues in 2021 came from gaming. It’s a core segment for the company divided into Domestic Games and International Games. According to PwC’s report, gaming is among the entertainment and media sectors experiencing the most significant growth. Tencent is well-positioned to continue delivering strong performance in this segment, although videogame sales have been on a decline in 2022. However, it’s crucial not to focus on month-to-month fluctuations but on long-term prospects and these are bright for Tencent.

- 15% of the world’s total gaming revenue in 2021 came from Tencent. As a comparison, the second largest player in the sector – Sony (SONY) was responsible for 8.5% of global sales.

- Among the top ten most popular PC games, three are made by studios owned by Tencent or in which the company has a significant stake. These are Fortnite, League of Legends, and Valorant.

- Tencent developed and operated 5 out of the top 10 international mobile games in regard to daily active users (DAU) in 2021.

- In September 2022, the company’s combined PC and mobile games DAU among adult users increased by a double-digit percentage YoY.

PwC projects gaming to grow by 8.4% CAGR until 2026, which is a steady solid increase. Tencent is likely to participate in this trend by growing revenues from this segment in alignment with the sector at least. However, with its strong portfolio of products, acquisition of new studios, and constant development of existing franchises, the company can expect to gain its market share. It’s worth noting that the industry is becoming much more than just gaming known till recently. It paves its way to the metaverse with dedicated in-game advertising, virtual items, and a whole new spectrum of entertainment that can be monetized. It’s difficult to make estimates on how it could translate into revenues but the opportunity is immense. As stated in the annual report for the fiscal 2021 year, the company sees a further upside.

Going forward, we aim to grow further our existing titles via deepening market penetration, product enhancements and operational optimisation. In addition, we will continue to release new titles, which we expect to drive additional growth, particularly for 2023 and beyond.

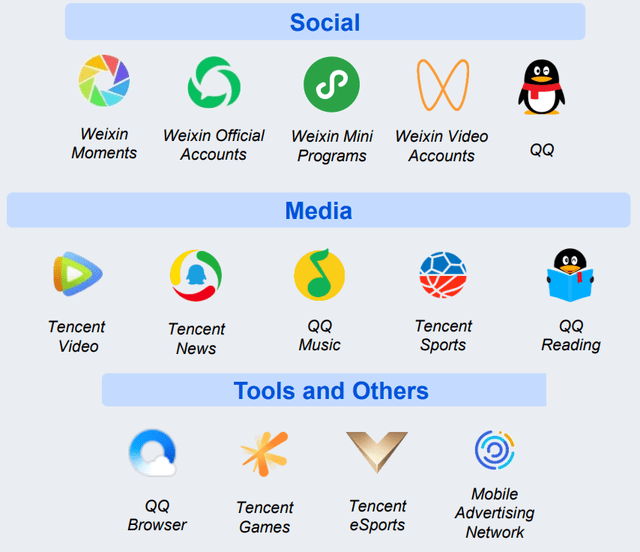

Social Networks

Social Networks is the segment that generates around one-fifth of the company’s total sales and it relies on the multi-purpose platform – WeChat (known also as Weixin in China). The super app offers a range of services, from communication and socializing to live stream events or health assistance.

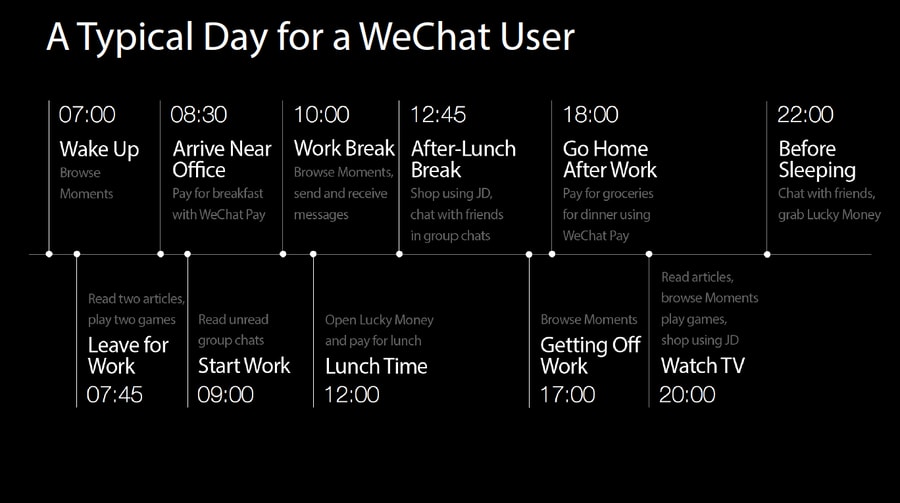

A Typical Day for a WeChat User (fleximize)

WeChat has approximately 1.3 billion monthly active users (MAU) who utilize the application for diverse social purposes both in their private and professional life. The super app still grows the number of active users, even at the current remarkable market penetration. And although user growth has slowed down, the possibilities for user engagement and monetization are prominent. Just in January 2020, Tencent launched WeChat Video Channel which was a response to Douyin, Kuaishou, and other short-form video applications that gained popularity in recent times. WeChat Video is a platform where everyone can record and upload content. As of June 2022 total video views grew by over 200% YoY with daily active creators and video uploads increasing by over 100% YoY. Tencent keeps innovating in other domains of its Social Networks sector as well. Some of the achievements were mentioned in the Q3 earnings call.

- The number of DAU of Mini Programs, which are “sub-applications” within the WeChat super app, exceeded 600 million.

- Health Code Mini Programs assisted users in verifying their health and travel status surpassing over 320 billion visits year-to-date.

- Video Accounts drive user engagement with live stream events and highly successful live concerts.

For a long time, the market position of giants like Tencent with its highly popular platforms such as WeChat seemed to be unassailable. But competitors emerge in this space as well challenging different components of Tencent’s super app. Luckily for the company, WeChat has a major competitive advantage due to its size, diversification, and stickiness driven by the nature of the platform where the user can perform almost all online activities without leaving the app. However, consumer behavior evolves, competitors innovate and fight for customers, and disruptions are common, especially in the tech space.

Online Advertising

Online advertising has always been an essential revenue stream accounting for a high double teen percentage of total sales. Currently, it constitutes 16% of Tencent’s revenues. However, this segment has been hurt the most by the regulatory changes. In order to comply with new rules, limitations on launch screen ads had to be introduced. Besides that, there were applied restrictions on ads for the elderly and minors, as well as the Personal Information Protection Law which is analogous to other international privacy laws like GDPR.

Yet, Tencent posted an 8% growth YoY for its fiscal 2021 year and the company has seen stabilization in ad spending recently. Again, a positive catalyst comes from Video Accounts with in-feed ads gaining traction. Monetization of this piece of the Weixin universe has been just initialized and it’s already attracting incremental ad spend. Video Accounts represent a major opportunity to expand Tencent’s market share and drive profitability. By starting more new initiatives such as Video Accounts, Tencent will be able to introduce more ad spend options from existing and new advertisers.

Tencent’s Advertising Business (Tencent)

Another huge opportunity to grow advertisement sales is again – metaverse with its own dedicated ad system.

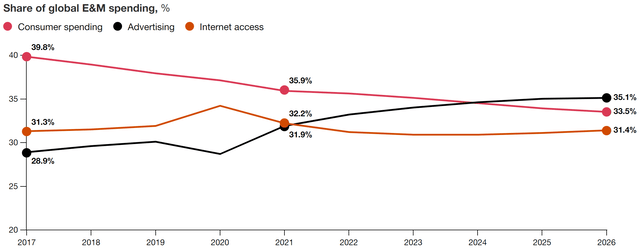

In the report from PwC, it’s projected that advertising will become the biggest among the three main Entertainment and Media (E&M) sectors by 2026.

Share of Global E&M Spending (PwC)

Over the five-year forecast period from 2021 to 2026, global internet advertising revenue is supposed to grow by 9.1% CAGR and reach $723.6 billion in 2026. Rising in popularity mobile video ads alone are poised to surpass $138.9 billion by 2026. A global recession may likely disrupt the growth of the ad market which is already being seen in revenue numbers from Meta (META), Google (GOOGL), and Snap (SNAP). Additionally, the Chinese economy is experiencing a broad slowdown which forces businesses to cut their advertising budgets. In the case of Tencent, after consecutive YoY declines by -18% in both Q1 and Q2 of the fiscal 2022 year, Q3 showed signs of normalization. In the long run, the company should keep up with the global growth in advertising. Moreover, in the relatively strongly developing Chinese economy, more people will be spending more time in various digital environments where they will be exposed to digital ads.

FinTech and Business Services

Approximately a third of Tencent’s sales are made from FinTech and Business Services which in FY 2021 experienced staggering 34% revenue growth YoY. The management reassured in their outlook that the robust growth of the segment will likely continue.

We generate approximately half of our revenues from FinTech and Business Services as well as Online Advertising that directly contribute to, and benefit from, overall economic activity, which should position us for revenue growth as China’s economy expands

Two main pillars of the FinTech part of the segment are Weixin Pay and LiCaiTong. The first relies on commercial transactions which are averaging over 1 billion daily payments since 2020, and social transactions. These include transfers such as bill sharing, utility payments, or cash gifts in a form of digital red packets. Commercial payment volume deteriorated in 2022 due to the zero-COVID policies and lockdowns. Yet, the recent quarter showed resumed expansion by growing double-digit YoY, specifically in categories such as groceries, dining services, and transportation.

LiCaiTong is a new money-market fund launched in 2020 through which the company expands its offer in the FinTech space. The wealth management service offers financial products from partners which go beyond traditional digital payments services. This type of synergy is pursued by other meaningful players in the FinTech industry such as PayPal (PYPL) whose goal is to develop PayPal into a super app with an offering similar to that Tencent has.

The finTech segment is poised to experience further growth due to the continued digitalization of traditional industries as well as the videolization of the internet space. Ongoing lockdowns are probably a matter of time. Once they are lifted, the economic activity should return, and with it – payment volumes.

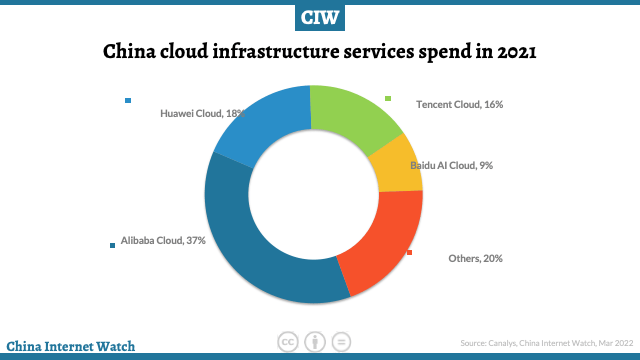

Business Services are mainly cloud-related offerings for enterprises. However, the segment generates revenue from other products such as chips, AI solutions, Tencent Docs, and Tencent Meetings. Tencent’s cloud offering is the third biggest cloud infrastructure in terms of spending as of 2021.

China Cloud Infrastructure Services Spend in 2021 (chinainternetwatch)

The company has seen growing demand for cloud solutions and has been responding accordingly with a palette of innovative products. In the Q2 fiscal 2021 year, sales from the TDSQL database alone grew over 30% YoY and became 5% of the company’s cloud revenue for that quarter. It was also named the leader for the distributed database in China by Frost & Sullivan – an American research and consulting firm assisting clients to accelerate growth. Tencent is monetizing historically offline industries by offering cloud solutions in form of PaaS (Platform-as-a-Service), SaaS (Software-as-a-Service), and IaaS (Infrastructure-as-a-Service) to enterprises and organizations in the public sector. In the third quarter, the company managed to significantly increase gross margin and trim loss-making activities. On the hardware front, the company developed three own chips (AI inference, smart NIC, and video transcoding) which favorably positions the company in regard to the Sino-American semiconductor dispute.

Revenue growth from the Business Services segment has slowed down in 2021 due to overall economic weakness but in the long run cloud solutions are expected to have robust growth. China’s cloud infrastructure services market saw a 45% gain to $27.4 billion in 2021 according to Canalys. Tencent remains a significant player in the cloud space and keeps acquiring new customers as digitalization reaches new branches of the Chinese economy.

Valuation

The company reports its financials in compliance with International Financial Reporting Standards (IFRS). In addition to the numbers required by these specific accounting standards, Tencent’s management declares non-IFRS financial measures. The company believes that it provides investors with necessary supplementary information to evaluate the performance of the firm’s operations. This way of reporting allows the management to exclude certain non-cash items and partially, the impact of M&A transactions. But most of all, it removes the impact of net gains or losses from investee companies on profit numbers. Thanks to that, the influence of the price fluctuation of Tencent’s publicly listed holdings is neglected. Thus, non-IFRS earnings estimates will be used in the valuation model.

The overview of Tencent’s segments shows that the company can expect roughly ~10% revenue growth CAGR in the next five years. The highest sales increase can be anticipated from FinTech and Business Services which will be driven by cloud solutions. Growth numbers don’t include metaverse monetization which can significantly push sales to the upside. The estimates also don’t take any long-term recession into account. That’s why a ~10% compounded revenue growth seems to be reasonable.

According to Market Insider Tencent will generate the following adjusted profit numbers in the next four years which were inserted into the discounted earnings model.

| 2022 | 2023 | 2024 | 2025 |

| 12.05 CNY | 14.39 CNY | 16.98 CNY | 20.86 CNY |

EPS Estimates (Source: Market Insider)

Earnings growth projected by analysts is higher compared to the company’s estimated revenue growth from respective segments. One of the reasons may be that the sales from some divisions will be loftier due to the new opportunities that were not considered. Also, margins may improve through a reduction in selling and marketing expenses, the generation of high-quality revenue, or workforce optimization. Besides that, Tencent can continue repurchasing its shares which will drive EPS even higher. These factors may significantly alter earnings, especially in the next 3-5 years.

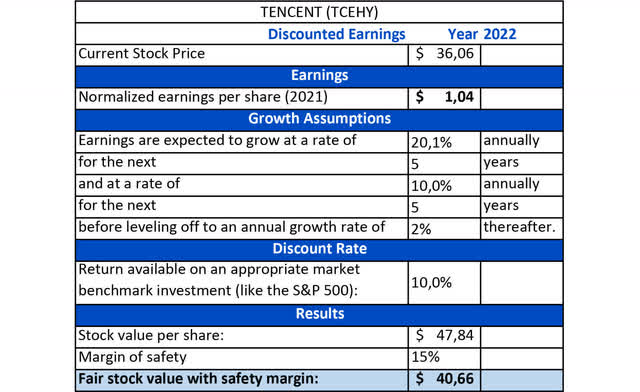

The valuation model assumes that the EPS growth will amount to 20.1% CAGR in the first five years and it’ll slow to 10.0% growth CAGR in the subsequent five-year-long period. Further, it’ll reduce to 2.0% a year CAGR into perpetuity. Besides that, a discount rate of 10% and a 15% margin of safety were applied.

Tencent Discounted Earnings Model (Author: Data from Seeking Alpha)

Based on these assumptions, the fair price for Tencent today is $40.66 a share. The stock price fell 41.65% YoY and has experienced increased volatility in the last weeks reaching $24.75 at some point. The valuation suggests that Tencent is currently undervalued by 12.8%. Obviously, by applying lower values of EPS, the fair price could oscillate around the current price the stock is trading now. However, one may argue that buying a business like Tencent even at a fair price is still a great deal. With all the opportunities ahead, strong financials, high margins, sound management, broad diversification, and the position in the market, robust growth can be expected and stock price appreciation should go along with it.

Key Risks

- Regulations. Policy changes have already adversely affected Tencent and it may continue. This can be seen in the slower growth, as well as in the company’s financials. Many market observers are concerned about a shift towards a state-oriented economy in pursuit of common prosperity. Moreover, certain regulations introduced over the last two years suggest that Chinese policymakers aren’t fond of the power that large tech companies gained over the last two decades. It creates a picture of China changing its direction to government-directed hardline policies. Chinese policymakers are trying to balance communism and capitalism which may hurt free markets and entrepreneurship. However, it doesn’t have to mean a complete abandonment of capital markets. Nevertheless, worries intensified after the reelection of Xi Jinping for another term as he frequently referred to Marxist-Leninist ideology in his speeches. This narrative induces fear among Westerners who immediately relate it to a return to the economy that existed under Mao Zedong. Nobody knows how far the shift in terms of Chinese market policies will go. Yet, more regulations and a more state-oriented approach can substantially curb Tencent’s prospects and growth.

- Demographics are a serious issue for China. Unlike the USA, China can’t rely on immigration, especially with a foreigner-unfriendly environment. An increase in the population can happen only through steady birth growth. According to China’s National Bureau of Statistics country’s population experienced a minuscule increase of 480,000 people in 2021. In comparison, annual population growth just a decade ago was around eight million. This massive deterioration suggests that China can experience an absolute decline in population in 2022. This would be the first time in sixty years. What is more, China’s fertility rate (births per woman) fell in 2021 to just 1.16, far below the 2.1 standard required for a stable population.

- COVID. Another key risk, especially in a short term, is COVID and COVID policies. The management has been mentioning the adverse influence of the health crisis on its business on multiple occasions. It may be concerning since the restrictions are not being loosened and they keep weakening the economy. Lockdowns are dampening economic activity, hindering mobility, and leading to an overall downshift in some of Tencent’s businesses. However, thanks to the company’s diversification, a decline in some segments may be partially offset by increased activity in others. It’s likely that COVID will have a diminishing effect on the Chinese economy over time. Nevertheless, it’s a serious health and financial problem for the country right now.

Conclusion

Tencent has been experiencing challenges in recent times on multiple levels. Policy changes, regulations, government scrutiny, economic slowdown, zero-COVID strategy, and changing consumer behavior are just a few. Still, the company has remained very opportunistic and strategic about its operations. Even in such a tough environment, Tencent managed to generate growth in some branches of its business. The firm suffered declines in sales in some segments which were partially offset by initiatives stabilizing earnings. Revenue prospects are encouraging and Tencent is well-positioned for a recovery. The company keeps on generating resilient free cash flow and returns capital to its shareholders through buybacks and dividends. This overall stability should be encouraging for investors. Although the business may be fairly valued or slightly undervalued, it may be of interest to investors looking for high-quality enterprises in an uncertain, inflationary environment.

Be the first to comment