simpson33/iStock via Getty Images

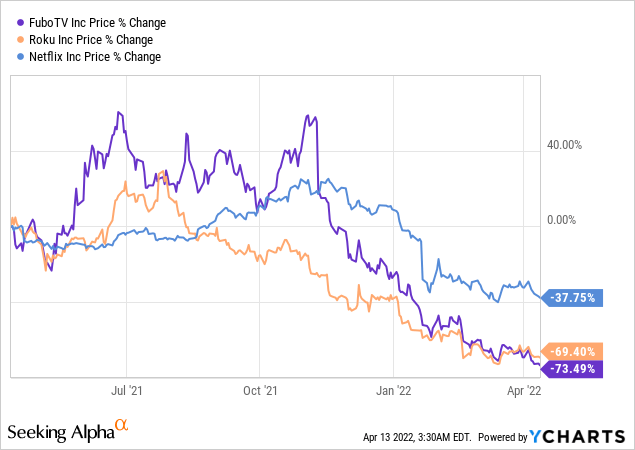

Shares of streaming platforms were brutalized in the last twelve months, in part because of the looming end of the COVID-19 pandemic which initially drove a massive upwards revaluation of stay-at-home stocks. While fuboTV Inc. (NYSE:FUBO) was a COVID-19 winner during the pandemic and saw a surge in customer sign-ups, the stock is significantly undervalued today. At $5-6 a share, I believe fuboTV offers deep value in the streaming sector and the risk profile is set to improve as fuboTV moves towards profitability!

Sector-wide sell-off in streaming names creates an opportunity to engage

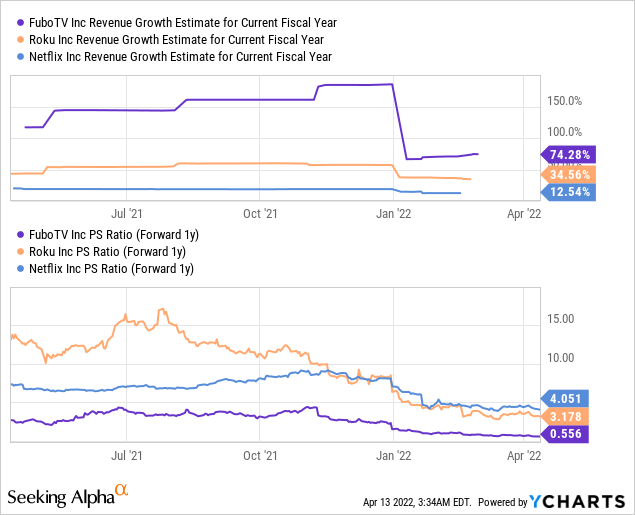

fuboTV is not the only streaming company whose shares revalued lower in 2021. Netflix (NFLX), Roku (ROKU), which is selling streaming devices, and fuboTV all had to deal with changing investor perceptions about post-pandemic growth rates. All of these companies have seen significant valuation losses in the last year.

Subscriber growth prospects remain positive

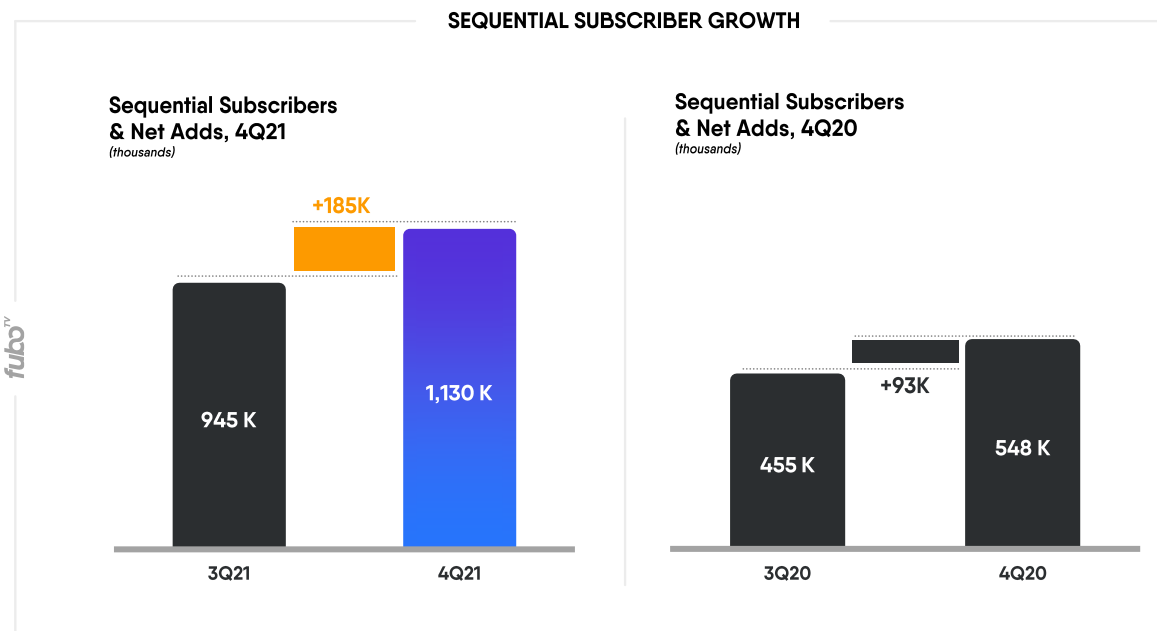

In 4Q’21, fuboTV surpassed the one million paid subscriber mark. The streaming company added 185,000 new subscribers to its platform in the fourth-quarter, ending the year with a total of 1.13M subscribers. Although the pandemic waned in the second half of 2021, fuboTV added almost twice as many subscribers in the fourth-quarter of Q4’21 as it did in the fourth-quarter of Q4’20.

fuboTV

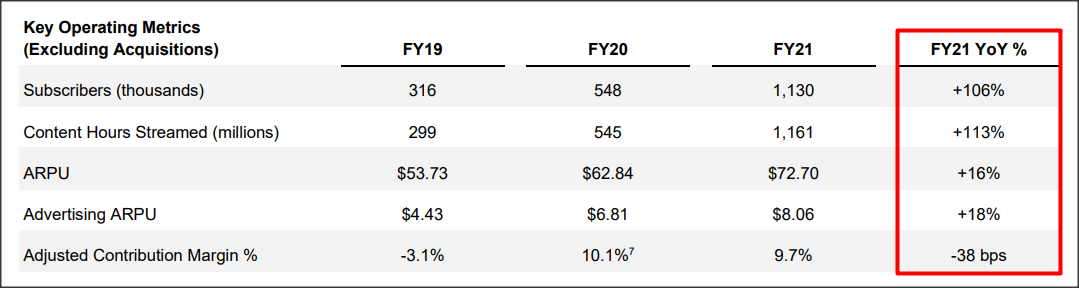

Key metrics for fuboTV, with the exception of contribution margins, remained in an uptrend in FY 2021. Subscribers and content hours streamed (an indicator of platform engagement) surged more than 100% year-over-year. fuboTV’s average revenue per user/ARPU advanced 16% YOY to a record of $72.70, indicating not only improving customer monetization but also subscriber willingness to pay more money for fuboTV’s products and services. Note also in the chart below that the firm’s advertising ARPU growth rate of 18% was higher than total ARPU growth, indicating a strong monetization opportunity in the ad business going forward.

fuboTV

Prospects for subscriber growth remain positive, too, since fuboTV expects sports fans to continue to flock to its streaming site which includes an evolving product suite. The firm expects 1.50M to 1.51M total subscribers in the North American market by the end of the year, implying 33% year-over-year growth. This is a step down from the FY 2021 subscriber growth rate of 106%, but it is still a significant number that will help the firm move closer to profitability.

fuboTV’s path to monetization success: the advertising business

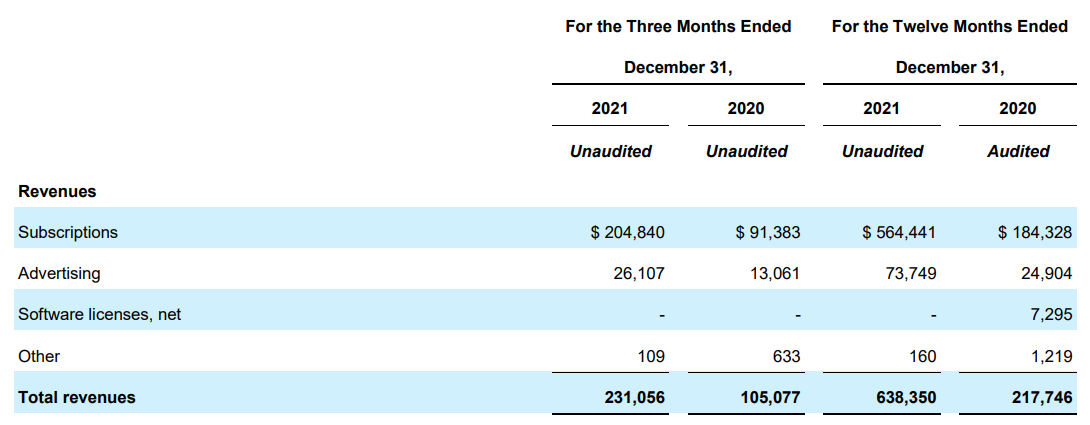

I believe the key to fuboTV’s success in the future will not only be the subscriber growth, but also its advertising business. Advertising revenues surged 196% YOY to $74M as big advertisers increased their ad spend on the fuboTV platform throughout the year. Ad revenues have about a 10-11% revenue share for fuboTV, but it is a business that has huge potential for the company long term as it explores alternatives to a subscriber-centric business model.

fuboTV

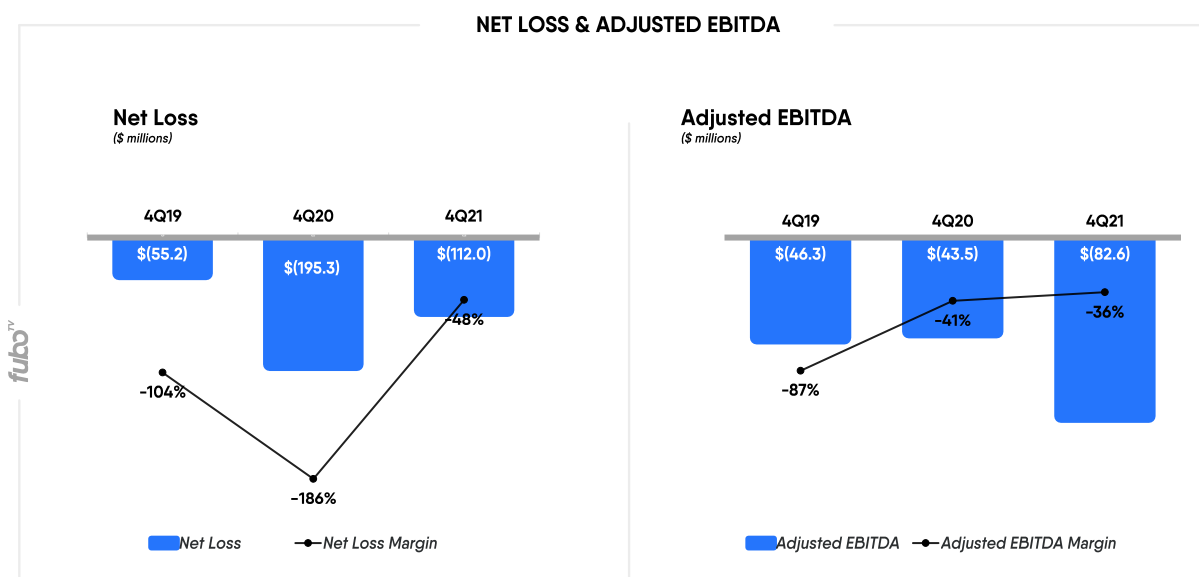

Losses continue to pile up

The most effective bear argument against fuboTV is that the platform is losing money hand over fist… which is true. The streaming company is also likely to lose money for a few more years before being able to turn the corner. fuboTV kept losing money in the fourth-quarter and ended FY 2021 with total losses of $383M. Like other streaming companies, fuboTV values top line and platform growth over profitability.

fuboTV

Move into sports betting

To increase user engagement and diversify its revenue streams, fuboTV is developing its platform and offering new services. In 2021, fuboTV made a promising move into sports wagering, which could pay off big time for the firm in the future. This is because the online sports betting market is gaining in popularity and more states are open to the idea of legalizing this business. In the fourth-quarter, fuboTV rolled out Fubo Sportsbook, a product that allows viewers to bet on live events. fuboTV said in its last shareholder letter that the integration of its sportsbook with live TV streaming has had a positive effect on user acquisition and has the potential to lower acquisition costs as well. Going forward, the sports wagering business is definitely a business that could create some buzz for fuboTV.

fuboTV’s growth is really cheap

It doesn’t happen often that one can buy a leading streaming platform for a market-capitalization-to-sales ratio of 0.56 X, but when it happens, I am loading up the truck. Other streaming platforms, namely Netflix and Roku, still trade at materially higher sales valuation factors even though fuboTV has by far the strong expected topline growth. I believe fuboTV operates in an especially attractive (and underserved) niche, sports streaming and betting, and that its shares have become seriously undervalued relative to the shares of rivals.

Risks with fuboTV

fuboTV’s biggest challenge, as I see it, is profitability. Revenues, average revenue per user, and subscribers are all growing, but the platform is not yet profitable. Delayed platform profitability, slowing customer acquisition, and weakening ARPU growth all represent risks for fuboTV and the stock going forward. However, if fuboTV manages to move closer to profitability while maintaining its growth momentum, I believe there is a chance for a major upward revaluation for fuboTV’s shares.

Final thoughts

fuboTV’s subscriber outlook for FY 2022 is still very encouraging. Unfortunately, the market currently doesn’t see it this way, in large part because growth stocks with high valuation factors have fallen out of favor with investors. I believe the market errs here, as fuboTV continues to have attractive prospects for growth in the live streaming market, the advertising business and the sports wagering segment.

While it may take a while for investors to catch up to fuboTV’s deep and growing platform value, I believe fuboTV will ultimately be rewarded for the progress management is making relating to the roll-out of new products and diversification of revenue streams!

Be the first to comment