Joe Raedle/Getty Images News

After finally going public through a SPAC merger in October 2021 with a $9 billion valuation, WeWork Inc. (NYSE:WE) has lost~ 33% year-to-date (YTD). The company is yet to relive the glory days that saw it reach a valuation of $47 billion. At the time (2019), this valuation was $10 billion more than the market capitalization of Ford Motor (F) and now at par with Simon Property Group (SPG). However, investors have shied away due to its cash crunch that saw the company burn billions before ousting its then CEO, Adam Neumann. Fast forward to 2022, WeWork is aiming to pick up the pieces and regain its lost momentum.

Thesis

Since 2020, WeWork has worked to right-size its business portfolio while positioning itself as a leading space solution. It has expanded its product offerings and restructured leases to increase savings and tenancy expenses. From a company that was fueled by $12 billion venture capital and debt, WeWork is struggling to lower its cash burn rate by streamlining its administrative expenses. In this article, I will explain why I am raising my rating for WeWork to hold from sell.

How We Got Here

Over the past decade, WeWork has operated as a co-working brand offering a flexible space environment. The sense of community provided by the company with intentionally designed spaces has continued to raise demand. Freelancers, small business operators, startups up, and Fortune 500 companies have found safe working spaces in the company. Despite the strong demand pipeline that translated to solid revenue growth, the company has been plagued by rising expenses.

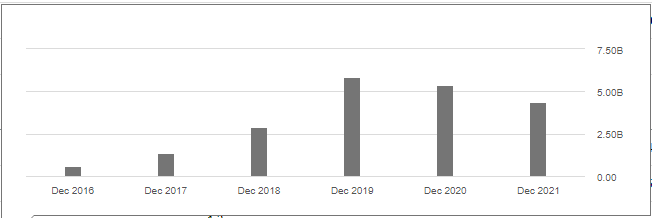

Since 2016, WeWork’s operating expenses have increased by $3.8 billion or 620.82%.

Seeking Alpha

Selling General & Admin expenses hit a high of $3.643 billion in December 2021 after witnessing its peak at $5.252 billion in 2019. Higher expenses have continued to increase the operating losses reached a peak of $3.243 billion in 2019. At the time, investors raised concerns over WeWork’s business model that halted its IPO plans. Since then, operating losses have declined 26.19% almost similar to revenues at 24.76%.

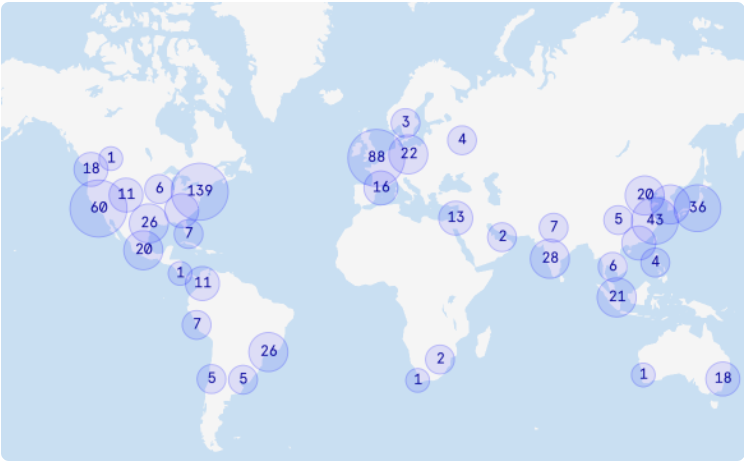

The high expenditures were boosted by a rapid growth strategy that saw WeWork attain a global footprint of over 800 locations with 154 locations in the US alone.

WeWork

Statistics indicate that the co-working office services company is now located in up to 77 cities across 23 countries. Leading global space provider IWG PLC (OTCPK:IWGFF) formerly Regus has 224 locations in the US alone with a total leasing space of 16.9 sq. ft. On its part, WeWork’s total leasing space stands at 27.6 million sq. ft.

Cost Restructuring

Since Q4 2019, WeWork has rationalized its rent and tenancy expenses through lease exits and amendments by 500 million on an annualized basis. Also streamlining of its SG&A has seen the company garner $600 million in operating expenditure savings and saved up to $1.5 billion.

To achieve long-term viability, especially in the international space, WeWork has embraced an asset-light strategy. This strategy that encapsulates franchises and joint ventures has made the company increase its real estate portfolio. In countries such as China, India, Japan, and Latin America, WeWork has invested in up to 335,000 desks or 37% against 912,000 to facilitate this international expansion. For a company that hosts the likes of Coinbase (COIN), WeWork is outdoing itself, even going to an extent of accepting crypto payments.

Hybrid Work Environment

That notwithstanding, WeWork’s rival IWG is gaining on the hybrid work-space model and even intends to add 1,000 new locations globally in 2022. This announcement comes at a time, office landlords are just recovering from the pangs of Covid19. Businesses are being forced to shift to a permanent hybrid space model. Here employees operate between their homes and the office.

In confirmation of this addition, IWG CEO Mark Dixon stated, “The shift from fixed workspace to flex is now irreversible and the business will continue to accelerate its growth adding a thousand locations in the next year alone.”

Apart from the locational access advantage, IWG customers will also benefit from the firm’s digital assets. The firm stated that it was merging with The Instant Group, a flexible workspace company to enhance its hybrid work strategy. IWG is said to invest£270 million ($353.65 million) to purchase the selling shareholders’ stake in The Instant Group’s management. In turn, the latter is investing£50 million in the combined portfolio with IWG which is slated for a public listing in 2023. I believe this new entity will give customers the chance to expand digital booking platforms across a flexible workspace market.

While WeWork is a tech-friendly, tech-enabled commercial real estate company it is yet to cash in on the hybrid work setting, similar to IWG. Hybrid work setups in suburban areas will prove pivotal as more people move close to home environments. In its Q4 2021 earnings call, WeWork stated that 63% of its desk capacity was occupied in in New York, London, Paris and San Francisco, which are arguably its largest markets. WeWork is yet to diversify to suburban areas which will provide room for expansion at cheaper rates.

Prospects

WeWork expects revenues to increase by 30% to 36% (YoY) in 2022 as companies continue to switch to a hybrid work model. Full-year revenue is expected to range from $3.35 billion to $3.5 billion. Owing to the pandemic, companies prefer their employees to work away from their offices. With WeWork offering workstations, private offices, and customized floors, it has become the best alternative.

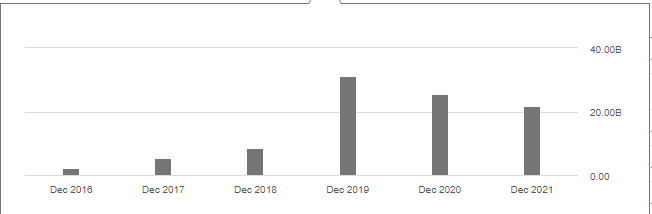

WeWork has grown its total asset base from a value of $2.239 billion in 2016 to $21.76 billion in 2021.

Seeking Alpha

Total assets have declined 30.15% from $31.15 billion in 2019 to $21.76 billion in 2021. WeWork is yet to recover from the investor shock witnessed in 2019.

Further, the company’s current assets have continued to decrease over the years. After reaching a high of $2.464 billion in 2018, current assets now stand at $1.471 billion, a decline of 40.3%. Therefore, the annual growth prospects may not be as high in 2022 as compared in 2019.

Risks

Total liabilities have decreased by 17.3% (after its failed IPO in 2019) with its total debt at $21.7 billion. Despite the decline in liabilities, WeWork’s debt balance is still high.

WeWork’s cash levels are also low at $923.7 million as of Q4 2021 against a high of $2.021 billion in 2017. The company’s statement that it may reach profitability in 2022 is also an exaggeration. Total accumulated losses have continued to increase from $816.5 million in 2016 to $14.143 billion in 2021, an increase of more than 1,630%.

Bottom Line

WeWork is still a work in progress. The numbers are not impressive. Nevertheless, the company’s global footprint growth is a step in the right direction. WeWork needs to cash in on the hybrid work model by forging a move similar to IWG. I believe that the decrease in expenditures and increase in savings since 2019 has been slow and should be expedited. The company has continued to witness an increase in accumulated losses that now stand at $14 billion and a total debt of $21 billion. However, there is still an opportunity for revenue growth as companies recover in the post-pandemic environment. For these reasons, we propose a hold rating for the stock.

Be the first to comment