Marko Geber/DigitalVision via Getty Images

The first time I evaluated DouYu (NASDAQ:DOYU) with buying intent was when the stock was trading at $5/share. I revisited the thesis at $3/share and bought my first equity position at $2.84/share. Now the company trades at an unbelievable $1.34 and I am sure that many investors – like me – are truly astonished by how much the stock has dropped. Down 93% from ATH, DOYU trades at a negative $500 million enterprise value. For me, this is a clear buying opportunity. Whatever risk the market fears, the valuation cannot possibly be justified.

About DouYu

DouYu International Holdings operates one of China’s most popular game-centric live streaming platforms. And game-streaming is I quite big in China and DouYu managed to build a MAU of 62.4 million and record annual revenues well >$1 billion. To support engagement, DouYu regularly hosts eSports events and tournaments. The company monetizes the platform primary through virtual gifting/tipping, where DouYu takes a commission fee.

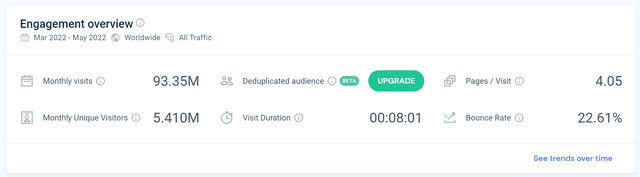

To find further insights into DouYu’s business, I have analysed the data traffic through Similarweb. According to Similarweb (total traffic data), DouYu is China’s 48th most popular website in general and has recorded monthly visits of >90 million for the period between March and May 2022. Engagement is strong – with bounce rate at only 22% and time spent per visit of 8 minutes. That said, DouYu’s traffic data is better than the same numbers for the company’s No.1 competitor Huya (HUYA), which has 70 million monthly visits, a 24% bounce rate and time spent per visit of approximately 6 minutes.

The value thesis

DouYu suffered multiple simultaneous headwinds in 2021, which pressured the stock down more than 94%. First, the government blocked Tencent’s (OTCPK:TCEHY) high-potential merger of DouYu and Huya. Then, the government shaped a stricter regulatory environment for the online/tech sector in general – and for gaming/live-streaming companies in particular. Then, the market started to price-in ADR delisting fears. And finally, the market started to worry over China’s slowing economy. All this accumulated in peak-pessimism towards DouYu and resulted in the stock trading at arguably ridiculous levels.

So, why is DouYu a bargain opportunity? Arguably DouYu isn’t the best company, but the stock is amazing at current valuation. Every investment opportunity is, in my opinion, a function of the price. And the price for DouYu appears ridiculously low. In fact, DouYu currently trades at a $400 million market capitalization. But the company has a net-cash position of $970 million, indicating a negative $500 million enterprise value. Moreover, while DouYu has recoded losses in 2021 and early 2022, the company is not necessarily unprofitable. In 2020, DouYu delivered operating income of $41 million, based on a $1.47 billion revenue. Cash from operations was even higher than net-income at $102 million.

In my opinion, a structurally profitable company trading at negative enterprise value higher than the company’s market capitalization makes absolutely no sense and indicates strong market inefficiency. However, investors might have two major concerns that would justify the extreme risk-aversion: either that the cash-position is not real (1) or that investors will not get the cash (2).

Discussion of investor concerns

First, investors might doubt that DouYu’s net cash position is real. Although this is a legitimate concern, I don’t see any merit here. In fact, DouYu’s cash position can be tracked quite accurately through the combination of equity issuance/IPO and cash flow balance from 2018 to today.

Second, even if the cash position were real, investors might doubt its attractiveness, as the company might either engage in transactions (M&A or other investments) to consume the cash, record sustained multi-year losses that consume capital, or simply not pay out any value to shareholders. This concern I share. In August 2021, DouYu announced a share repurchase program of $100 million over a 12-month period. However, 9 months into the program, the company has only acquired shares worth slightly more than $30 million. If the company is clearly undervalued, and DouYu has so much cash, why is management not buying more? Although this is a speculative argument, and investors should reflect for themselves, I give DouYu the benefit of the doubt. The environment for DouYu is currently challenging as Chinese companies suffer from ADR delisting threats, macroeconomic slowdown and freezing capital markets at home. Thus, DouYu might have every right to play it very conservatively and preserve cash, as access to capital markets remains highly restricted.

Valuation and Conclusion

As it is difficult, and speculative, valuing a company like DouYu with a discounted cash flow or discounted earnings framework, I suggest valuing DouYu simply based on the company’s balance sheet. That said, I argue that if DouYu’s net cash position of $970 million is real, and the market price to acquire the company should be – at least – equal to the cash position, or $3.12/share. As DouYu’s market price is currently $400 million, investors should have the opportunity for >140% upside. Note that I have ignored all other assets that the company has on the balance sheet! The risk/reward looks very favorable to me. I initiate coverage on DouYu with a buy recommendation and set a target price equal to $3.12/share.

Be the first to comment