Olivier Le Moal/iStock via Getty Images

Given the $14B buyout of STORE Capital (NYSE:STOR), investors in the company are probably looking for a new source of yield. This article will discuss what my analysis suggests are the best triple net REITs.

Even for those who don’t own STOR, the implications of this purchase are quite significant for the entire sector. Valuation of triple net lease assets have been in question since the rise in interest rates. There was still transaction volume in the private property market, but individual transactions were small enough that it was difficult to discern whether they represented market wide cap rates or aspects of the specific properties.

With the buyout on 9/15/22, clarity on cap rates was restored as STORE Capital was definitively valued at $14B. This is smart money and that is a massive triple net transaction which almost single handedly resets the going cap rate for triple net assets of similar quality.

6.25% Transaction Cap Rate

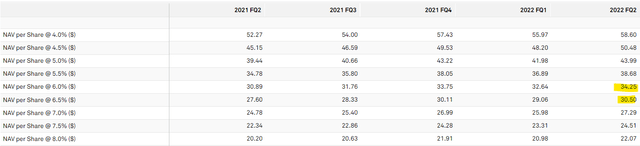

The $14B price tag equates to a price per share of $32.25 in cash. This per share valuation represents a cap rate halfway between 6.0% and 6.5% using most recent quarter’s annualized NOI.

S&P Global Market Intelligence

It also represented a roughly 20% premium to where STOR had been trading.

From the new reference point, we can now get a better sense of valuation for the sector.

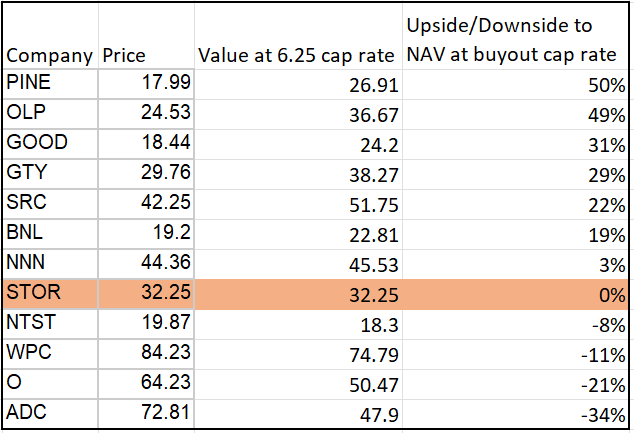

Valuation at 6.25% cap rate

The property portfolios of the various triple net REITs are a bit different so they shouldn’t all trade at the same cap rate, but I do find this to be a relevant starting point. Shown below are the discounts and premiums to 6.25% implied cap rates at which the triple net REITs are trading.

2nd Market Capital

4 of the REITs are actually trading at premiums to the buyout valuation. I think the premium makes sense for W. P. Carey (WPC) as it has a substantial amount of industrial assets that are higher growth. Netstreit (NTST), Realty Income (O) and Agree Realty (ADC), however, have portfolios that are very similar to STOR’s so I think they are probably overvalued at this time.

On the discounted side, a few of these look quite interesting. Spirit Realty (SRC) has a very similar profile to STOR making its 22% discount opportunistic. In my opinion, they would be next in line for a buyout if private equity has appetite for more triple net.

Getty Realty (GTY) continues to trade at a discount as electric vehicle hype stirs fear of obsolescence for gas stations. I think these fears are overblown for 4 reasons:

- EVs are still a tiny portion of the cars on the road

- Even if/when EVs become the dominant fleet they would need to charge on the go and gas stations make the most sense as the place to do it.

- Getty’s properties are usually located on corner lots which have substantial convenience value

- Convenience stores are increasingly being used for non-gasoline related trips with many franchises becoming mini-grocery stores. In the Midwest Kwik-Trip is booming and Buc-ees in the south.

Basically, the market is valuing Getty as if its real estate is a declining asset, but in my opinion, the value embedded in the locations creates a long runway of growth.

Gladstone Commercial (GOOD) has a massive 31% discount to a 6.25% cap rate valuation and it is this cheap price that fuels its 8.25% yield. I don’t see the discount as warranted given the extent to which GOOD outperformed the other triple nets operationally in the pandemic. STOR had substantial tenant delinquencies while GOOD collected virtually all of its rent.

One Liberty Properties (OLP) is cheap, but not quite as cheap as implied by the 49% discount to a 6.25% cap rate valuation. Their earnings for this measurement period were artificially inflated by 2 things:

- Over $5 million in litigation proceeds received so far in 2022

- Deferred rent collections

Using more normalized NOI, I think OLP would be closer to a 25% discount which is still quite sizable. This is a company that doesn’t do much with fairly low transaction volume. They are big believers in just letting their triple net assets cashflow and are diligent about not diluting those cashflows. For those looking to just cash a big dividend check, OLP might be a decent way to go.

Finally, Alpine (PINE) is trading at a whopping 50% discount to the buyout cap rate valuation. The challenge here is that PINE is externally managed and hasn’t yet been public long enough to see a clear track record.

GOOD, for example, is also externally managed, but they have decades of clear evidence showing management is aligned with shareholders. While I think PINE is fine at this price, I would rather go with one of the more fundamentally certain REITs that are still quite discounted.

Cashflow valuation

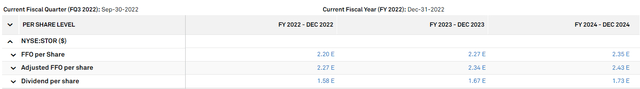

Beyond resetting the cap rates to a new level, the deal also provided clarity on what sort of cashflows buyers of triple nets are requiring. Shown below are the consensus estimates for STOR’s FFO and AFFO.

S&P Global Market Intelligence

A $32.25 price tag represents a 14.2X FFO multiple and a 13.8X AFFO multiple. For triple nets I think AFFO is the better measure so we will use that for our multiple valuation.

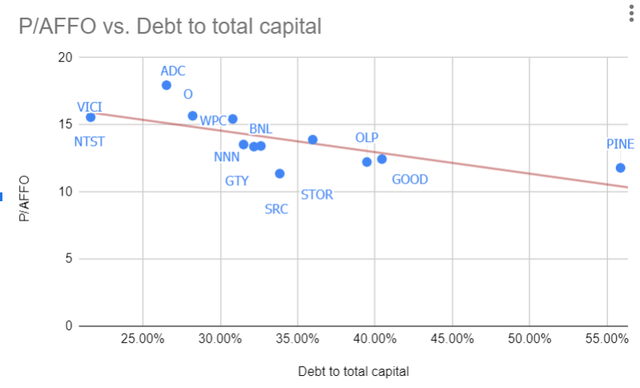

NAV is a leverage neutral metric so we were able to compare the triple nets on a straight cap rate without having to adjust for leverage. AFFO is not leverage neutral and higher leverage companies should be able to generate more AFFO/share all else equal.

As such, for the AFFO valuation I like to normalize the multiples for the varying levels of debt at the given REITs. The results are below.

Since NOI is a massive component of AFFO, one would think that those cheapest on the NOI based cap rate valuation would be the same as those cheap on the leverage adjusted AFFO valuation.

To some extent they are with GOOD, GTY and SRC showing as the most discounted to fair value. Alpine, however, which was the cheapest on the cap rate valuation is actually above the fair value line. The difference in the metrics is that AFFO takes into account efficiency at a corporate level whereas NOI only looks at property level profitability.

Those scoring better on the AFFO valuation than the NOI based valuation likely have either a lower cost of debt capital or lower G&A expense. Our individual company analysis backs this up as we know GOOD, GTY and SRC to do fairly well in those regards with locked in fixed rate debt and reasonable management compensation.

Triple nets as a whole

The sector has gotten cheap while the fundamentals remain constant. I think it is a good area in which to invest and I am consistently overweight the sector. The valuation at which institutional capital is entering the space suggests there is still substantial value to be had here.

Be the first to comment