LeventKonuk/iStock Editorial via Getty Images

Consistency is the key to delivering a good message. Anyone who has read our work over the last two years knows that we gave a clear and consistent message on the PIMCO closed end funds. While there are several clone funds in here, PIMCO Corporate & Income Opportunity Fund (NYSE:PTY) and PIMCO Income Strategy Fund (NYSE:PFL). The bulk of ratings were in the sell zone, starting with our June 2021 article (see Abysmal Setups) and ending with the our June 2022 article. Our last article ended with a familiar dour note.

The bulk of the investors minted in this era have expected a “Fed Put”, while we are getting a completely different message today. The Fed Put has become the Fed Collar. We believe we are entering the final few months of the selloff and it will likely end with PTY and PFL at a discount to NAV. We would exercise caution and look for buying opportunities down the line.

Source: We Are Entering The Final Meltdown Phase

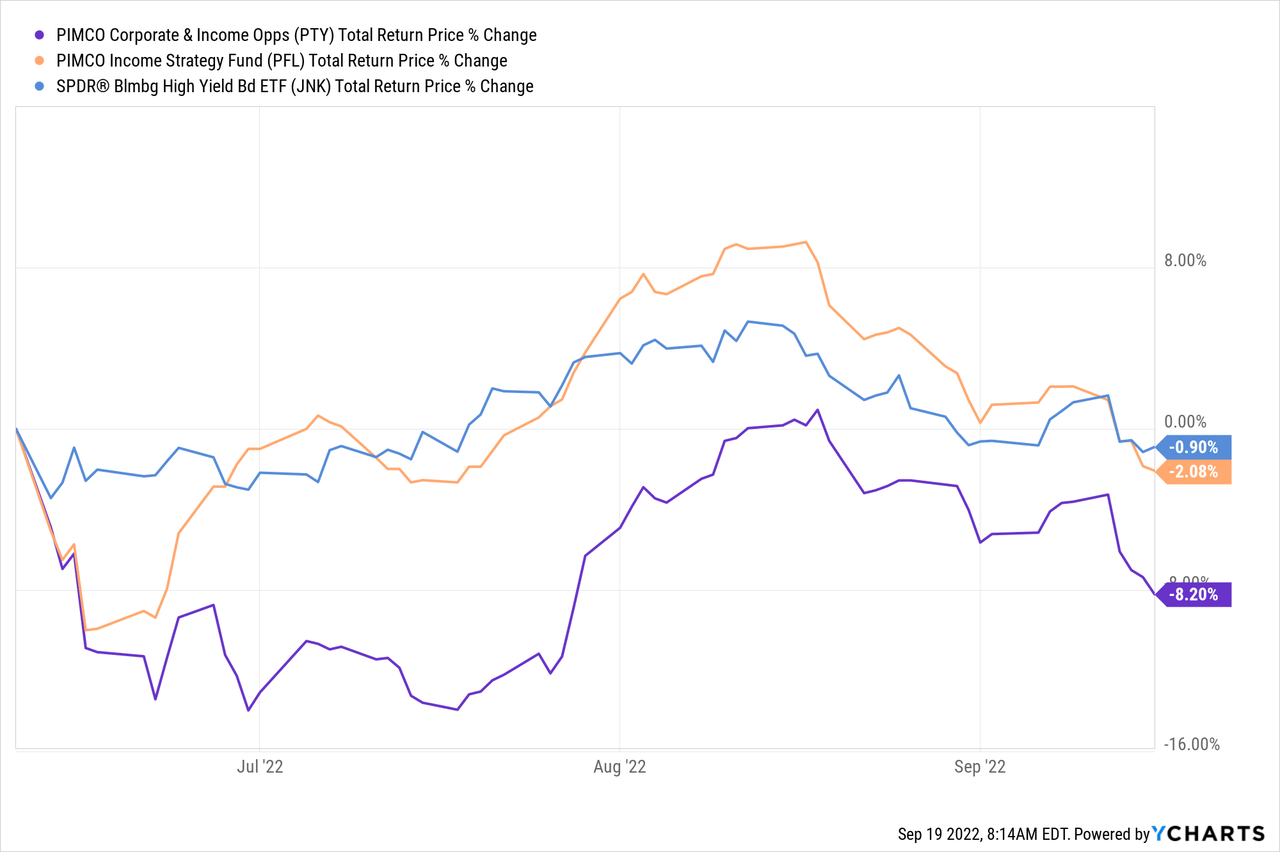

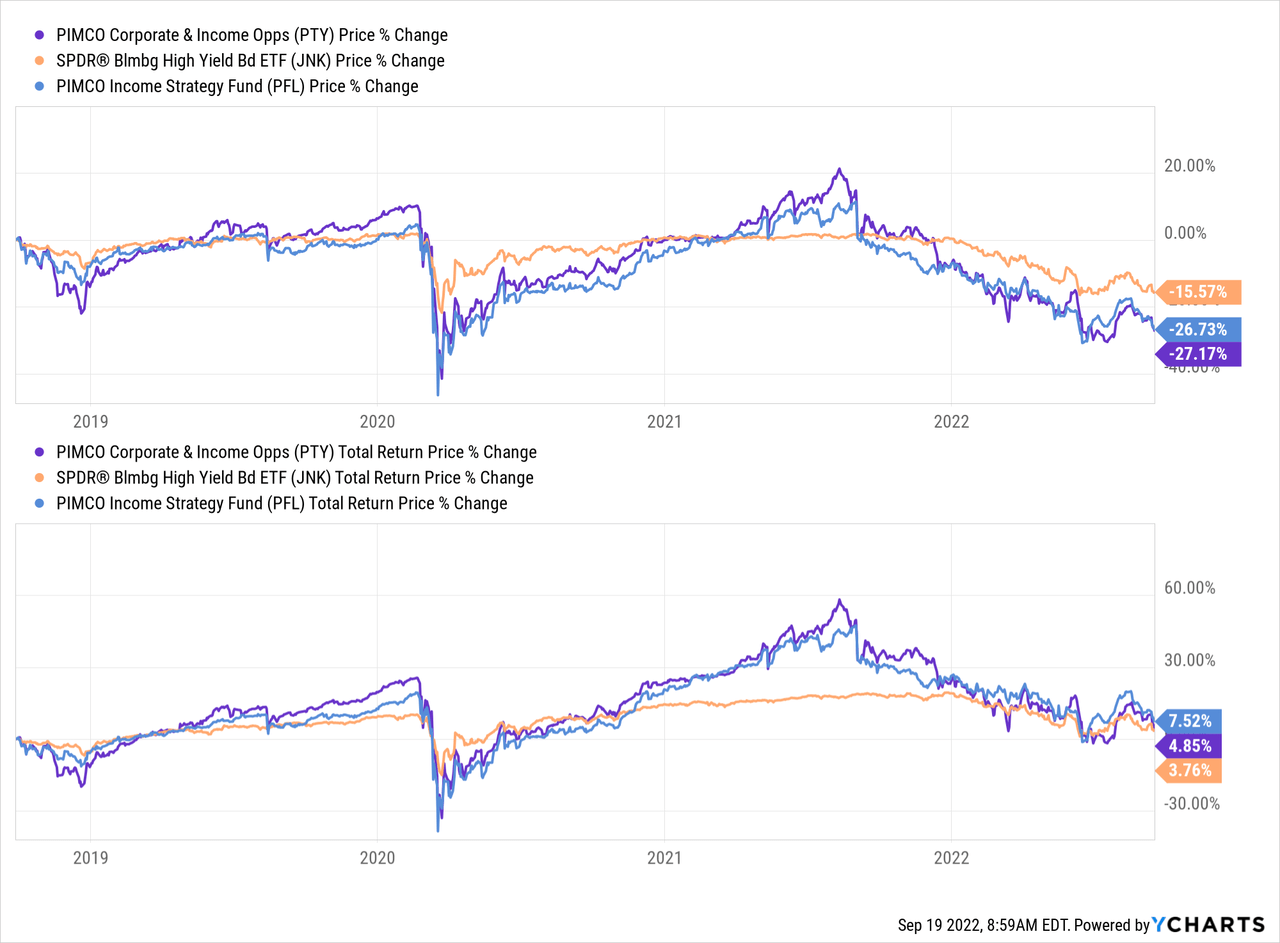

The call was correct and both funds have delivered negative total returns including distributions and underperformed SPDR Bloomberg Barclays High Yield Bond ETF (JNK).

One thing we will note here is that PTY had an accelerated decline right after our article and appeared to have melted down. Can we make a pivot, even if the Federal Reserve does not?

The Good News

There are several pieces of good news on these two funds and they are worth noting. The most important of these is that yields are now finally reflective of reality. You are getting paid to take risks. We noted this in our recent JNK article where yields to maturity were at 8.4%. This is a superb contrast to late 2021 when those same junk bonds yielded under 3.8%. The paradox was that “cash” was not trash at that exact moment where everyone seemed to believe it. With 8.4% junk bond yields, let’s face it, we are now getting good bids to take risk. By extension, PTY and PFL are no longer return-free-risk instruments that we saw them as.

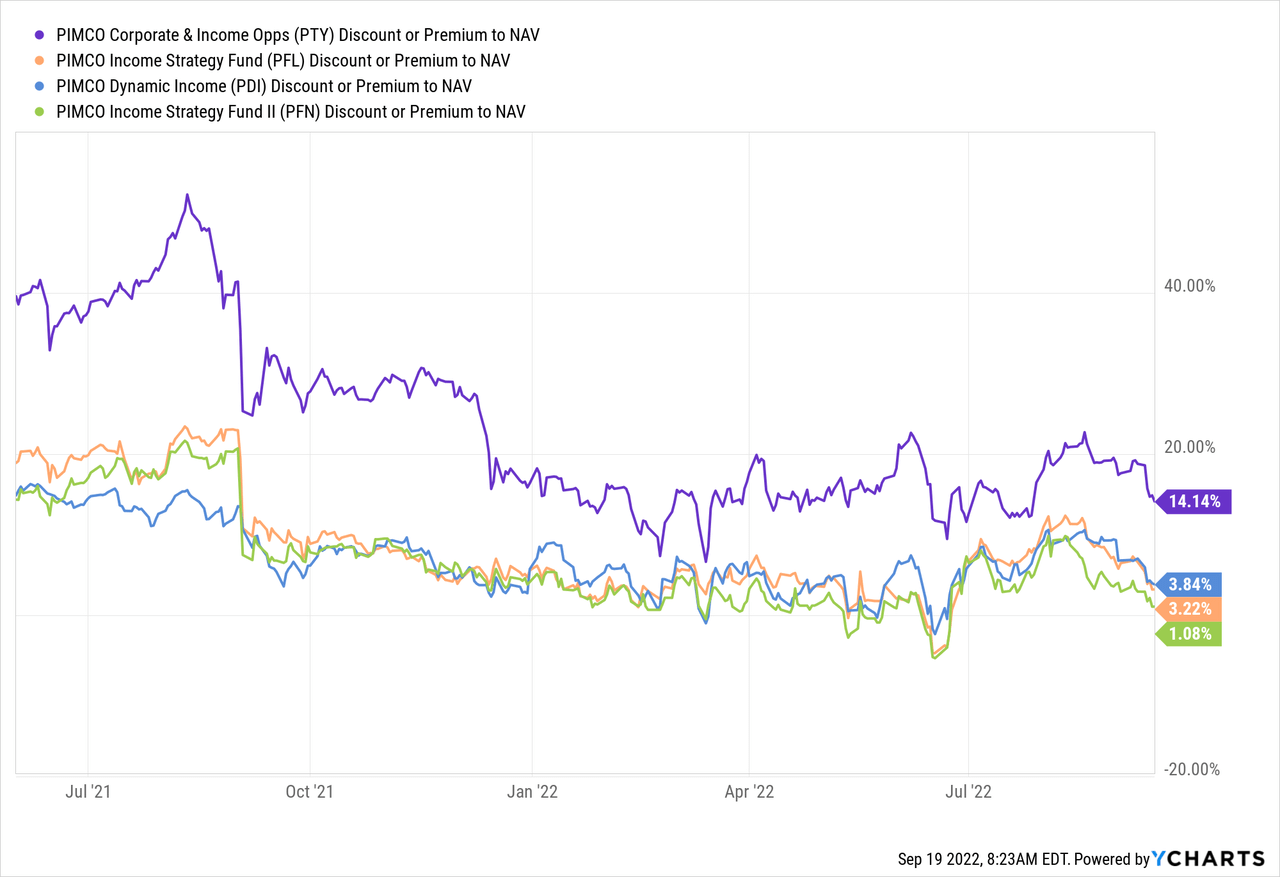

The second good aspect is that the premiums to NAV have compressed. We threw in PIMCO Dynamic Income (PDI) and PIMCO Income Strategy Fund II (PFN) to make a wider comparison. From the screen left, you can see the nice drop in premiums. We say nice, because those same initial premiums had made it impossible for anyone buying to have a positive return.

Now things have improved, although PTY is still an extreme outlier here at a double digit premium.

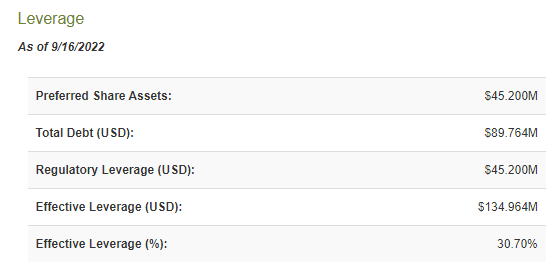

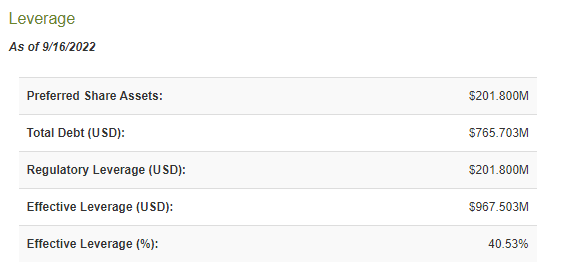

The final good aspect is that those doses of reality have sunk in and PFL and PTY are running with relatively lower leverage than previously. PFL is down to 30.7%.

CEF Connect-PFL

PTY which generally was hovering in the mid-40s is down to 40.53%.

CEF Connect-PTY

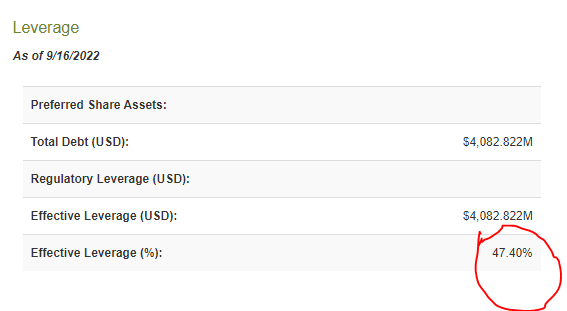

PTY’s 40.53% is still high but it does appear more balanced, especially relative to what is going on at PDI.

CEF Connect-PDI

The Bad News

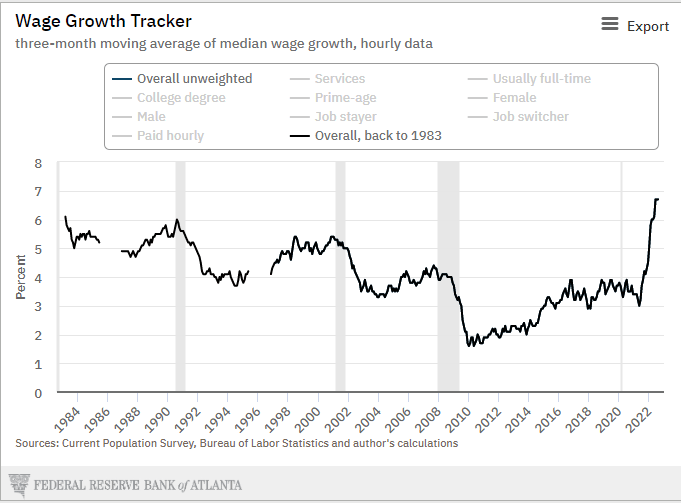

The biggest bad news for investors today is that the Federal Reserve watches wage growth first and foremost and those wages are not slowing down. Their preferred measure of wage growth accelerated upwards to 6.7%.

Atlanta Fed Tracker

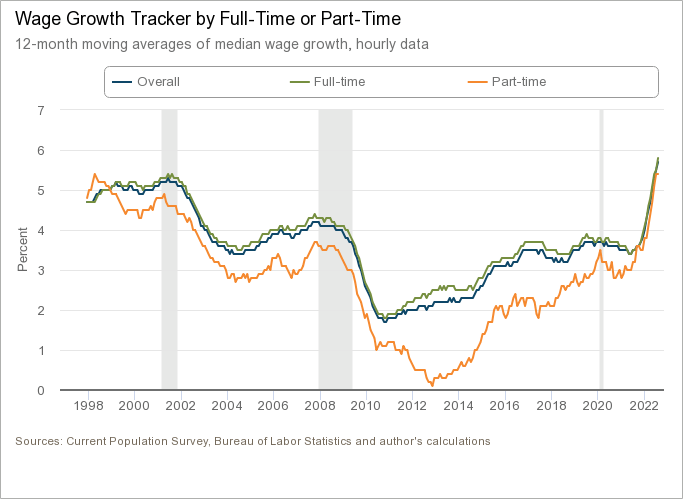

That is the highest since at least 1983 and includes the August 2022 data. Wage growth has stayed stubbornly strong in full-time and part-time jobs.

Atlanta Wage Tracker

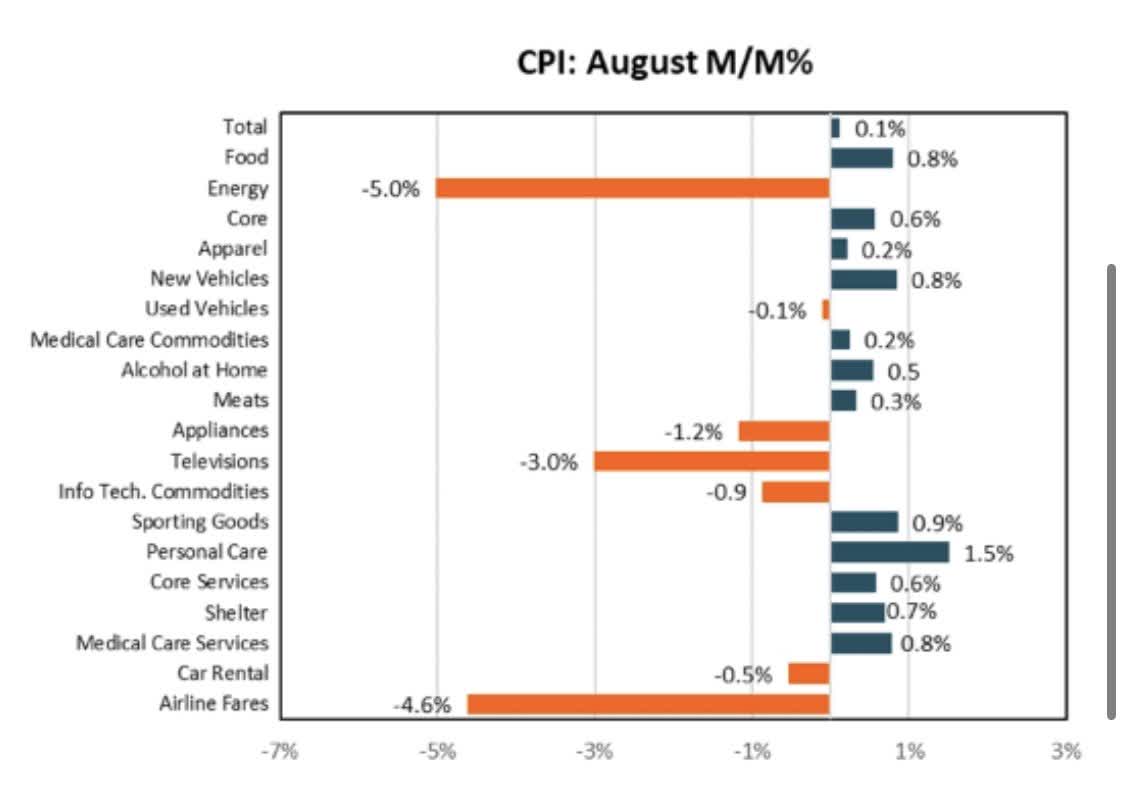

Inflation pick up in August was also broad based as Energy prices pulled back.

Michael Kantro-Twitter

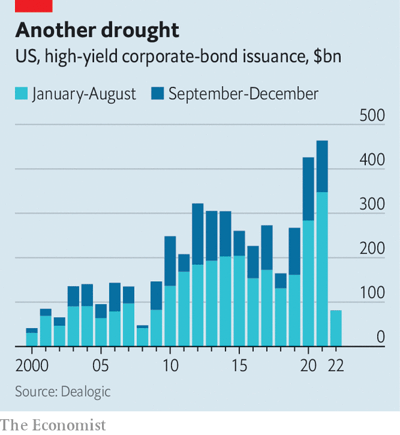

We expect at least 175 basis points of rate hikes by year end from the Federal Reserve and more tightness in credit markets. These hikes should have a double impact for PTY and PFL as their interest costs rise and we likely see more turmoil in the junk bond markets. Already, the junk bond issuance has dried up.

The Economist-Twitter

So more defaults are likely and we should see additional NAV pressures from there.

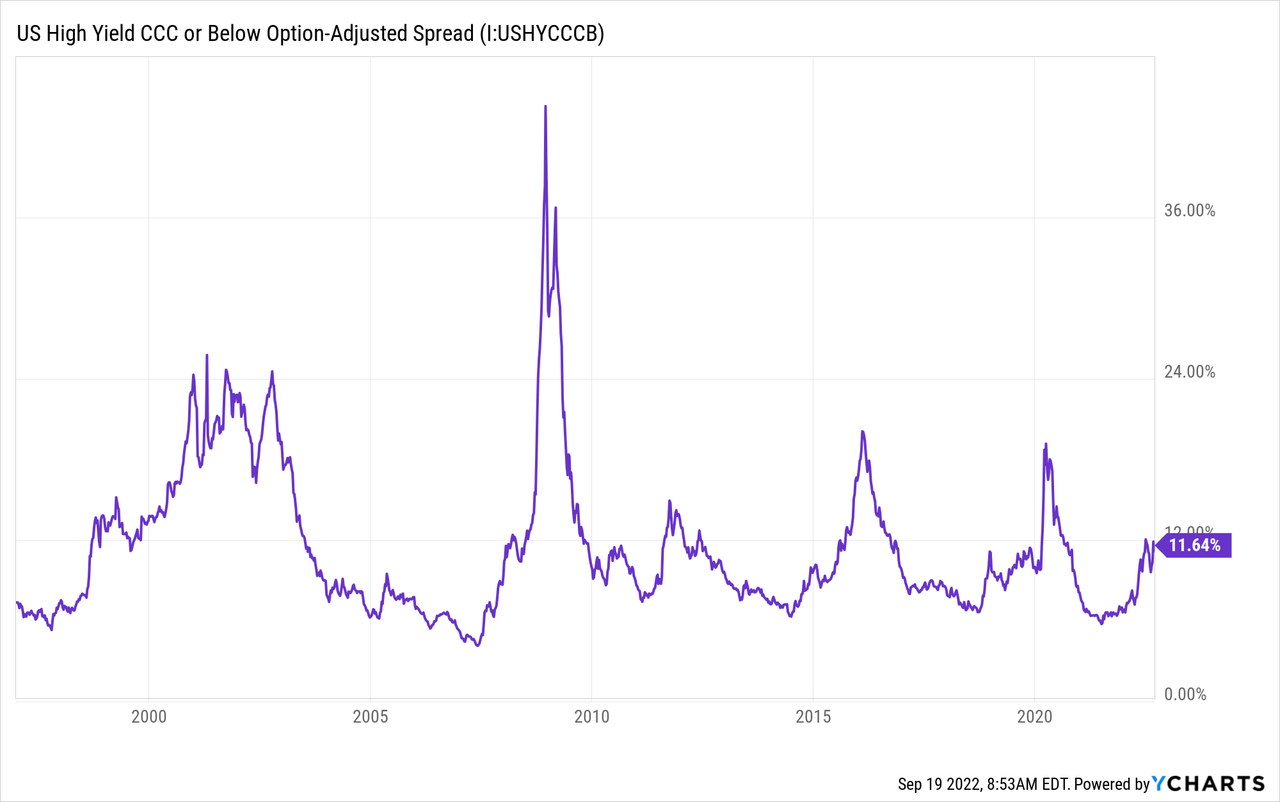

The final piece of bad news here is that the CCC spread indicator, which is off its extreme complacency levels, is not near where recessionary bottoms occur for junk bonds.

Perhaps we dodge a recession here, but we would frankly give that a less than 10% chance.

Verdict

Over the last four years, PTY and PFL have delivered extremely poor returns.

You generally did not get paid to take such high risk on a leveraged fund and pay such high premiums. No one can deny that the risk-reward ratio has improved today versus 18 months back. The bond bulls have been carted out on a stretcher. Everyone who wanted to go long Vanguard Extended Duration Treasury ETF (EDV) to earn 1.5% a year, while risking a 40% drawdown has met a worse fate. But we are not “there” yet.

Risk across a broad spectrum of assets, still has a big bid. Whether it is “apes” debating that worthless companies should be bought simply because someone is shorting them, or GameStop (GME) still defending a $8.75 billion market capitalization, it does not look finished. PTY, one of our protagonists, still sports a 14.5% premium. It does befuddle the mind to understand how a fund with a total return of 4.85% over the last four years sports a premium about three times that. We are still standing by our call that when we are done with this, PTY and PFL will be at a discount to NAV and we will see total chaos in the junk bond markets. We rate PFL as a Hold/Neutral and reiterate our Strong Sell on PTY.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints

Be the first to comment