sefa ozel

Investment Thesis

The labor market is projected to worsen in the upcoming months, negatively impacting consumer spending and sentiment, and macroeconomic conditions. While the real estate market would exacerbate this, inflation and high interest rates would be detrimental to the global economy in the coming year. Consequently, I think the S&P 500 index is expected to fall further until the first quarter of 2024.

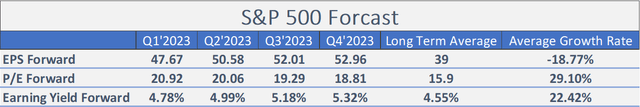

S&P 500 Valuation Forecast

The future-looking estimates of S&P 500 earnings per share for the next four consecutive quarters of 2023 are predicted to increase and reach 52.96 in Q4’2023. Its long-term average is at around 39 while the average growth rate is expected to be -18.77%. At the same time, the forward-looking values of PE ratio are expected to decrease in the year of 2023, and reach 18.81 in Q4’2023 while the long-term average is about 15.9. Even if this value reverts to the mean, it will not be all that bad.

In addition, the earning yield forward estimates are projected to be in an uptrend and reach 4.78% and 5.32% in Q1’2023 and Q4’2023, respectively. These forecasts are better than the current 2 year treasury rate of 4.31% after peaking at 4.72% on November 7, 2022. But, the long-term average of S&P500 earning yield is only 4.55% which is lower than that of 2 year treasury rate at 5.01%. In other words, S&P 500 returns are expected to perform better than 2 year treasury rate in 2023 but may have a mid-term downside risk. This risk may be tolerated by the fact that the average growth rate of SPX is at 22.42% which is greater than that of the 2 year treasury rate of 13.98%.

However, there are some issues with optimistic earning projections during some so-called Black Swan events that are often seen through previous recessions. As such, we could carefully look into recent macroeconomic conditions and analyze facts rather than make future-looking estimates based on historical growth rates.

Macroeconomic Outlook

Many leading companies including Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Meta (META), Twitter, etc. have frozen hiring new employees and some have laid off their recruiters. A lot of manufactures are cutting off their employees now. This tendency is expected to continue and may be worse in 2023. This leads to severe consequences such as increasing unemployment rate and decreasing personal income. When people have no jobs, they will cut off their savings and expenditures. The customer demand for finished goods and services will therefore decline, and so will retail sales. This will cause an imbalance between supply and demand with rising inventories in contrast to the lower demand. So, many manufacturers must stop ramping up their production lines and wholesalers will reduce their sales and inventories. This will likely lead to an unbalanced wholesale trade and unfavorable production and manufacturing statistics being released. I think these factors will exacerbate the economic slowdown, raising the likelihood of a recession as a knock-on effect on each term.

Housing Market Indicators

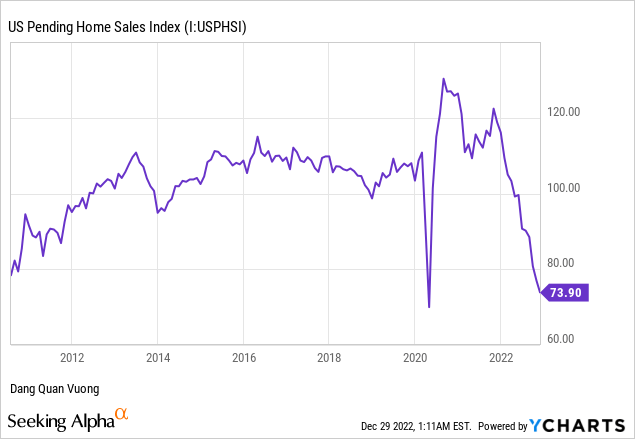

The Pending Home Sales Index (PHSI) measures the number of home sales where a contract has been signed but the transaction has not yet been completed. This is a reliable prediction of existing home sales because it is built on a large number of pending housing contracts with the inclusion of sellers listing and buyers buying in the United States. This metric is considered a future-looking indication for the real estate market strength and the health of the broader economy. This index has rapidly dropped since the 2021 peak, and recently reached 73.9 in value as seen in the Covid-19 pandemic. It implies that the sales of U.S. houses will be generated less in the upcoming time. This will be even worse when the unemployment rate rises and real personal income falls.

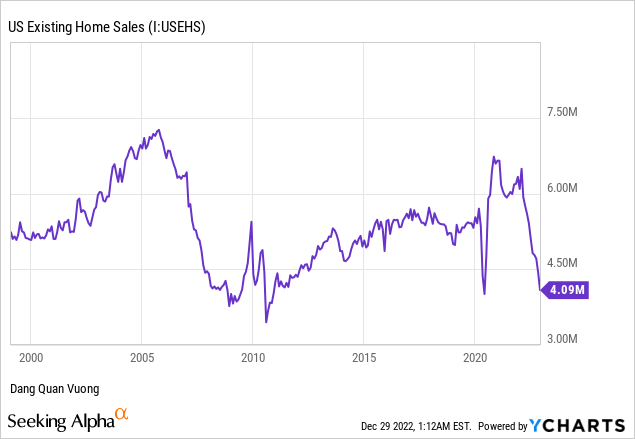

The number of existing home sales has already fallen to 4.09M, a figure that is comparable to that of the great recession and the Covid-19 pandemic. The decline in the number of bidders and the readiness to acquire homes may be the cause of this. The number of closed house sales is anticipated to decline even further in the near future in light of the pending home sales index described above.

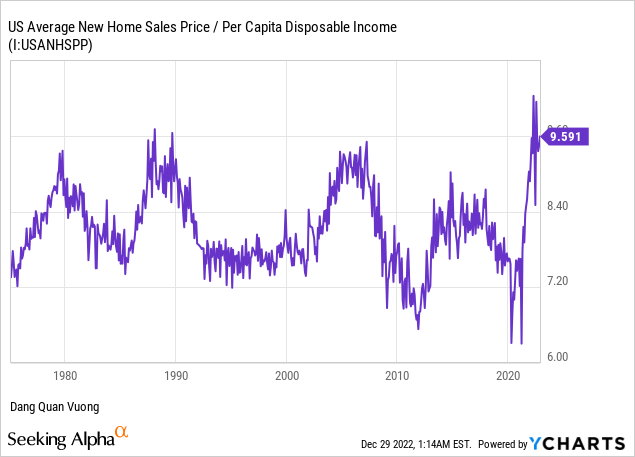

In turn, the fact that the average new home sales price looks to be expensive relative to the per capita disposable income may have the greatest impact on home sales. The average new home sales price to per capita disposable income ratio is a good illustration of this. Thus, in order to balance the housing market, we should expect this ratio to decline even further.

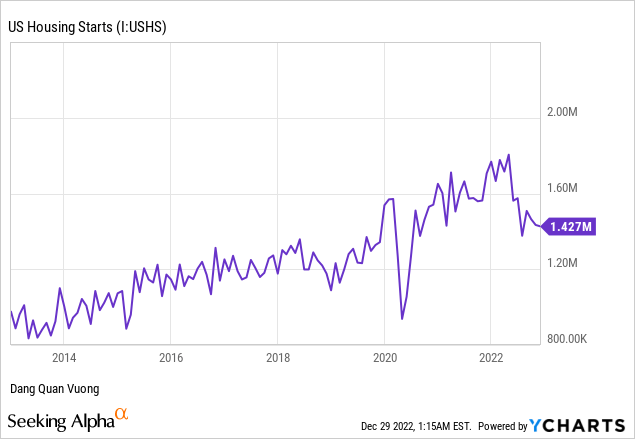

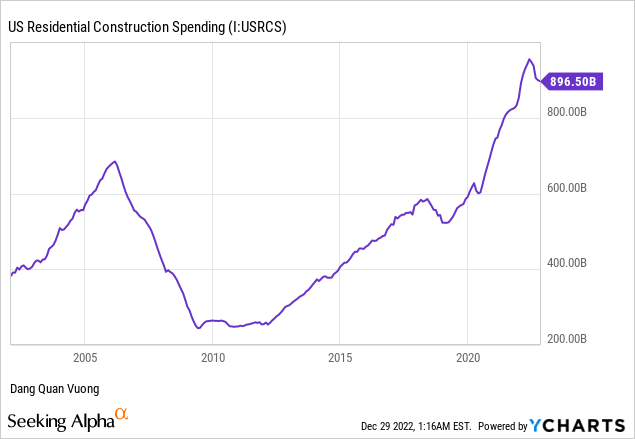

Additionally, it may cause significant declines in US residential construction spending and house starts. An economic indicator known as housing starts counts the number of new homes that are being built as soon as the first stone is laid. The U.S. residential construction spending measures how much money is spent on new buildings. Because they might lead to a rise in the demand for appliances and furniture as well as job vacancies, these indicators are crucial for monitoring consumer spending and the labor market over the long term. The overall economy will be impacted when the number of new home constructions declines since it will have a significant impact on consumer spending and the unemployment rate. Since home sales are predicted to fall, we should anticipate that they will continue to decrease.

Recession Indicator:

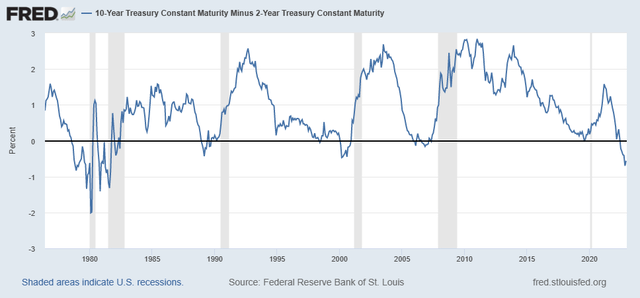

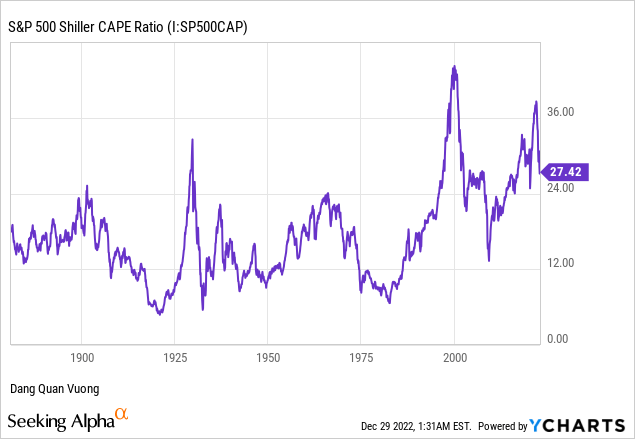

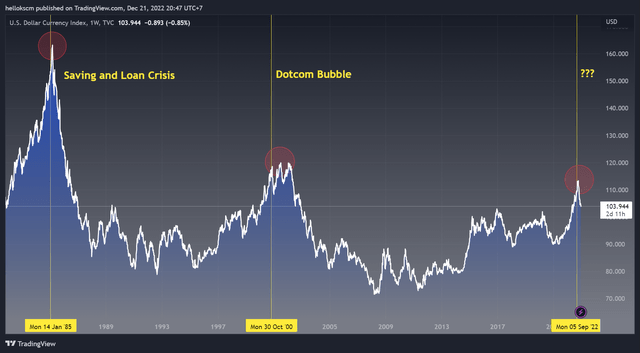

In actuality, no indicator or model can predict the top and bottom of the market with the accuracy of 100 percent. However, certain metrics can assist us in identifying when market conditions are unfavorable and risk management is required. The inverted yield curve, when it has moved beyond negatively below the zero line, would be the most obvious symptom of an impending recession. Further evidence that the equities market is overvalued comes from the S&P 500 PE Shiller ratio. The US dollar is strong in the interim, which frequently has a detrimental impact on the global economy. Therefore, we need to think critically about whether a recession is likely.

Federal Reserve Bank of St. Louis, 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity [T10Y2Y], retrieved from FRED, Federal Reserve Bank of St. Louis; DXY (TradingView)

Market Sentiment

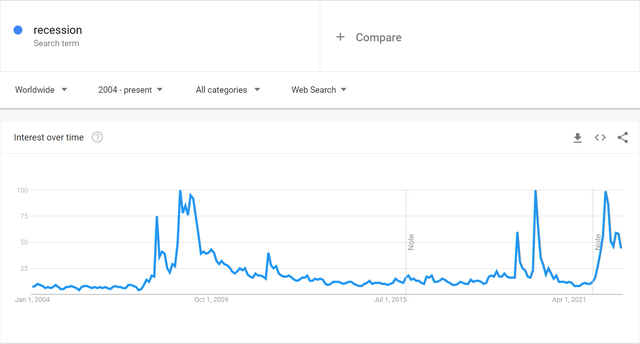

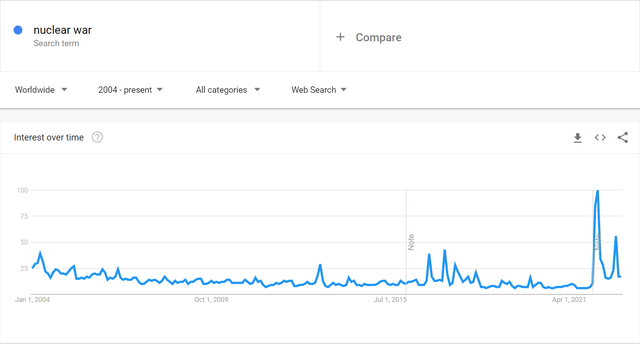

The terms “recession” and “nuclear war” are being searched for more frequently as people become more worried about the recent economic slowdown and the political turmoil in the Ukraine and Taiwan Strait. It infers that they are now viewed as a severe threat to the future of the globe. This does not imply that these occurrences are inevitable, but rather that they have a psychological impact on human behavior, including CEO and corporate confidence, saving habits, and consumer sentiment for the near future. Should this be happening, the impending recession will become a self-fulfilling prophecy, slipping into a de facto recession.

The number of searches for “recession” has surged recently. (GoogleTrend) The number of searches for “nuclear war” has surged recently. (GoogleTrend)

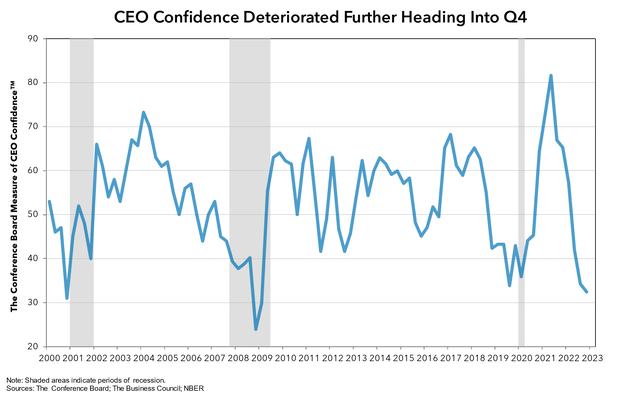

In a survey conducted by the Conference Board, the majority of CEOs who were asked to identify the economic conditions they are most likely to experience in the next 12 to 18 months said they are prepared for a recession. The CEO confidence index has dropped to levels last seen during the recessions of 2000 and 2008 as a result, which is not good for their business operations. Particularly, 68% of CEOs predicted a deep EU recession, while 85% of CEOs anticipated a brief and mild US recession with limited global spillover. Most of them appear to be gloomy when questioned about demand predictions and changes of input costs. They also predicted that political and governmental instability may present the biggest problem for the entire world. The low CEO’s confidence would have a significant impact on the economy. If they have a negative outlook, they will cut back on operating expenditures and capital investments, which could result in a vicious cycle that raises the unemployment rate and hurts business growth factors such as corporate sales growth and profit margin.

CEO Confidence Index (The Conference Board)

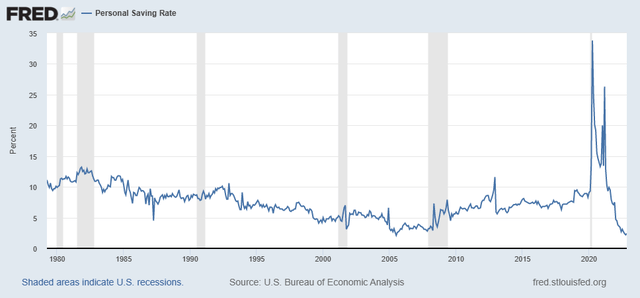

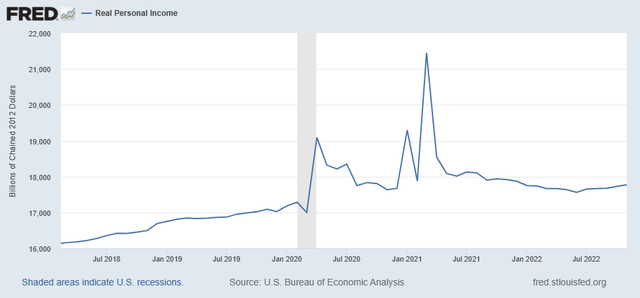

The ratio of disposable personal income to savings, where the former is the amount of money left over after taxes have been paid, and the latter is the former less all outgoing expenses, is known as the personal saving rate. It depicts how Americans save and spend money as well as their financial situation. The most recent report shows that this ratio has increased from 2.2%, which is the lowest in history, to 2.4% since it peaked in April 2020. FRED demonstrated that since May 2021, there has been an increase in disposable income. Americans therefore prefer to consume goods and services, whereas since March 2021, real personal income in the U.S. has decreased. It seems odd considering that consumers appear to be less willing to spend their income on purchases, according to consumer sentiment compiled by the University of Michigan. The most likely possibility is therefore that consumers are investing more as a result of the high inflation or that their spending will decrease in the near future.

U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; University of Michigan, University of Michigan: Consumer Sentiment [UMCSENT], retrieved from FRED, Federal Reserve Bank of St. Louis;

![University of Michigan, University of Michigan: Consumer Sentiment [UMCSENT], retrieved from FRED, Federal Reserve Bank of St. Louis;](https://static.seekingalpha.com/uploads/2022/12/29/56542342-16722959918580189.png)

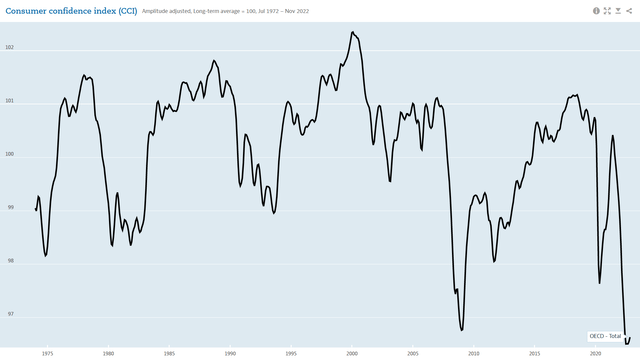

As reported by OECD, the consumer confidence index for the United States, Europe, and Asia have all plunged to an unprecedentedly low level. This index reveals how consumers feel about the state of the economy as a whole, company conditions, the labor market, and their capability to save money now and in the coming six months. As such, consumers around the world lack confidence in their expected employment and financial situation. They might become less likely to make major purchases, particularly for automobiles and homes. It also implies that individuals are possibly saving more and consuming less when, in reality, personal saving rates have declined as a result of inflation.

OECD (OECD) Organization for Economic Co-operation and Development, Consumer Opinion Surveys: Confidence Indicators: Composite Indicators: OECD Indicator for the Euro Area (19 Countries) [CSCICP03EZM665S], retrieved from FRED, Federal Reserve Bank of St. Louis; Organization for Economic Co-operation and Development, Consumer Opinion Surveys: Confidence Indicators: Composite Indicators: OECD Indicator for China (People’s Republic Of) [CSCICP03CNM665S], retrieved from FRED, Federal Reserve Bank of St. Louis; Organization for Economic Co-operation and Development, Consumer Opinion Surveys: Confidence Indicators: Composite Indicators: OECD Indicator for the United Kingdom [CSCICP03GBM665S], retrieved from FRED, Federal Reserve Bank of St. Louis;

![Organization for Economic Co-operation and Development, Consumer Opinion Surveys: Confidence Indicators: Composite Indicators: OECD Indicator for the Euro Area (19 Countries) [CSCICP03EZM665S], retrieved from FRED, Federal Reserve Bank of St. Louis;](https://static.seekingalpha.com/uploads/2022/12/29/56542342-16722961089555533.png)

![Organization for Economic Co-operation and Development, Consumer Opinion Surveys: Confidence Indicators: Composite Indicators: OECD Indicator for China (People's Republic Of) [CSCICP03CNM665S], retrieved from FRED, Federal Reserve Bank of St. Louis;](https://static.seekingalpha.com/uploads/2022/12/29/56542342-16722961656860669.png)

![Organization for Economic Co-operation and Development, Consumer Opinion Surveys: Confidence Indicators: Composite Indicators: OECD Indicator for the United Kingdom [CSCICP03GBM665S], retrieved from FRED, Federal Reserve Bank of St. Louis;](https://static.seekingalpha.com/uploads/2022/12/29/56542342-16722962211283274.png)

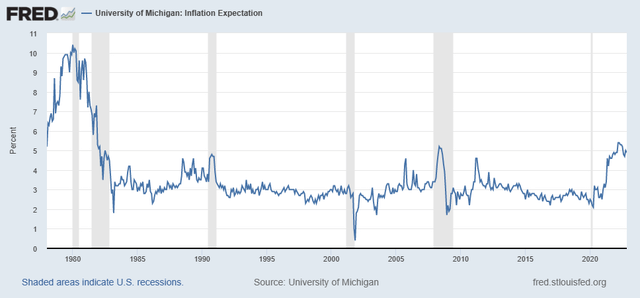

Despite a decline in inflation-adjusted personal income, inflation expectations are likely to increase. Consumer sentiment will be negatively impacted by this as people may tighten their budget on spending.

Real Personal Income (Fred) Inflation Expectation (Fred)

High Interest Rate

The FED said that they would slow down interest-rate hikes in 2023. Many firms anticipate that the rate of change in interest rates would be less volatile in 2023 than it was in 2022. The implication is that the interest rate would remain stable at a high level. This will have a significant impact on the economy which is evident through the strength of the USD. The strong USD might hurt exports, which would result in less demand for American goods abroad.

Consumer borrowing costs will rise as interest rates rise, directly affecting consumer sentiment. Additionally, it will raise the cost of financing for businesses, which will likely slow down manufacturing output and sales expansion. Hence, consumer spending should decline, which will impede the economy. Higher interest rates will also make owning a home more expensive, which will result in fewer home sales. It will consequently have the previously described detrimental impact on the real estate market.

Higher interest rates ought to encourage more saving. However, it can actually be hard for that to happen. The personal savings rate has decreased while the FED has gradually raised the rate. Higher rates can encourage savers to fund their accounts, therefore this is abnormal. It can be a hint that many people may have difficulties paying their bills.

Technical Analysis

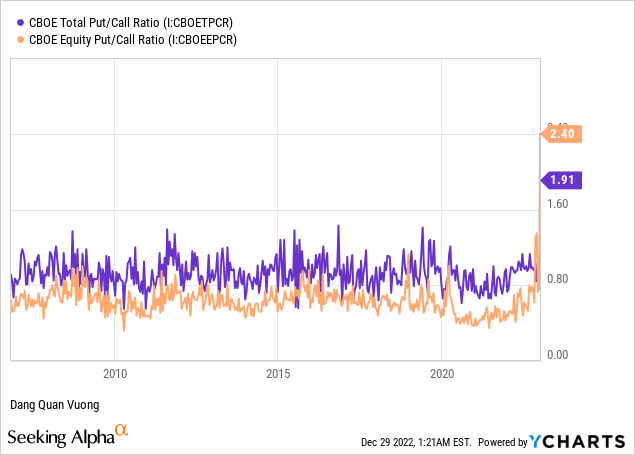

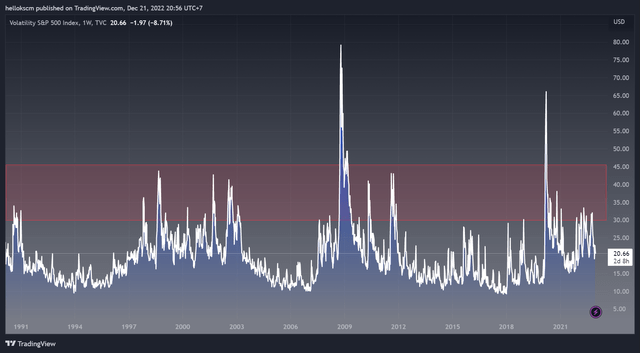

When it comes to technical analysis, the equity puts to calls ratio has increased to over 2 and has recently remained at 1.91, which is the highest level ever. A put contract gives the buyer the option to sell on the expiration date. The potential selling pressure will rise when investors and traders buy additional put contracts. Therefore, it suggests that market participants are feeling pessimistic. In addition, the CBOE volatility index is still at a high level of roughly 20 after topping above 30, which could cause further downside movement. This does not guarantee that the market will surely continue to go down, but the impending short-term volatility will be unleashed shortly.

VIX (TradingView)

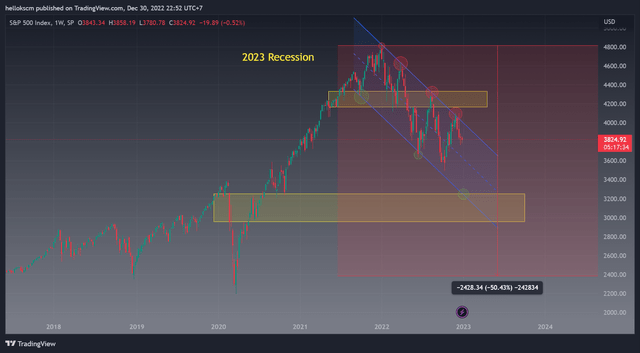

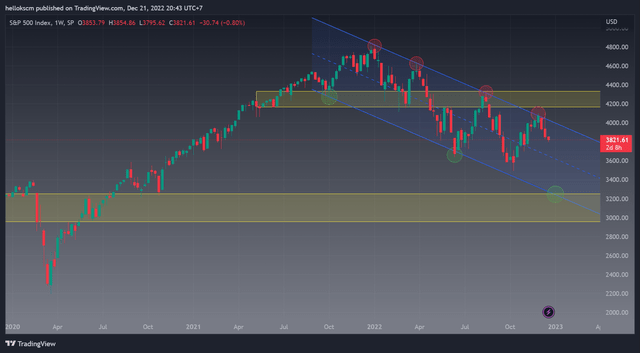

Technically speaking, the S&P 500 has dropped following reaching the upper band of the falling channel at 4200 and currently is headed towards the lower band at 3200. This provides an additional strong support for SPX and makes a confluence at this point. At this moment, there is a chance that we will witness a rebound around this zone.

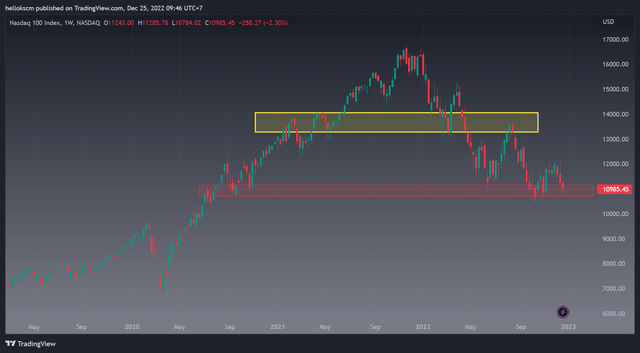

Looking at the Nasdaq 100 index, we can see that it is finding support at 10,900. This support for NDX is likely to be shattered if SPX keeps sliding. Then, NDX may continue plummeting to the new support level of 9500. After a period of time, SPX could be at 3200 and NDX be at 9500. This zone is a strong support, thus it is likely that these indices will experience a short-term rally there.

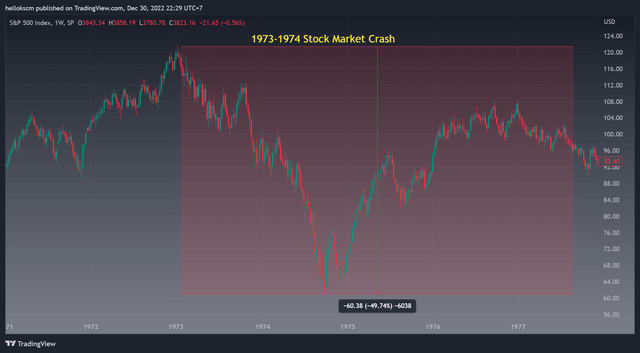

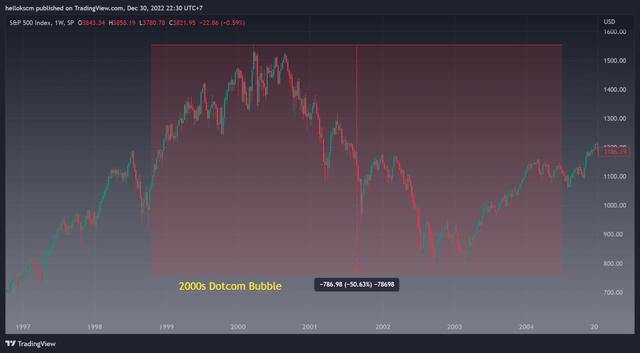

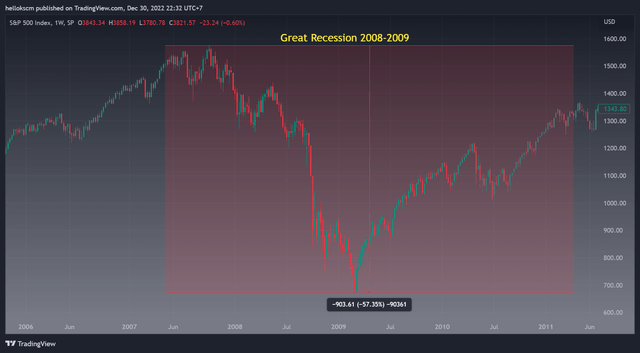

For the SPX and NDX thereafter, they will likely continue to decline to 2400 and 7000, respectively, when we are in a recession. These possible scenarios will greatly depend on the state of the world economy and corporate financial reports in 2023. However, looking at these supported points, it will create an over 50% drop in SPX as seen during the previous recessions such as 1973-1974 stock market crash, 2000s Dotcom bubble, and 2008-2009 great recession. This can be illustrated in the following figures.

1973-1974 Stock Market Crash. (TradingView) 2000s Dotcom Bubble. (TradingView) Great Recession 2008-2009. (TradingView) 2023 Recession. (TradingView)

The Bottom Line

A vicious economic cycle is what is actually taking place. Businesses and manufacturers are suffering as a result of the present economic slowdown’s quickened pace. Since many businesses may be compelled to lay off workers as a result, the unemployment rate may rise. Their personal income will decrease if many individuals lose their jobs. So, they could find it difficult to make purchases and save money. Because of this, people are less likely to buy products and services, which lowers retail sales. As manufacturers and suppliers cut off their inventories, a decline in retail sales may lead to a decline in wholesale trade. In turn, these elements will deteriorate the economic climate and raise the likelihood of a coming recession.

The recent fair value of SPX can be determined using some valuation techniques by averaging the price to earnings ratio, price to book ratio, price to sale ratio, earning yield, and earning dividend. But in my opinion, social psychology, market sentiment, and geopolitics are better indications in a recessionary situation. This may be the result of the substantial intermarket risk that exists at the moment.

This article claims that additional time is needed for the economy to release strong economic data. After dropping to 3,200 and 9,500, the SPX and NDX indexes are most likely to rebound in the vicinity of these levels. Then, they will probably keep decreasing until they reach 2400 and 7000, respectively. Until the final trading day of 2023, the market would possibly trade sideways at this low and consolidate for the next macro rally in 2024.

Be the first to comment