Justin Sullivan

We continue to be sell-rated on Western Digital Corp. (NASDAQ:WDC) as we expect demand for storage to remain weak towards 1H23. WDC’s most recent quarter, 1Q23, showed a demand slowdown on both flash and HDD fronts, consistent with our expectations back in May. We believe consumer weakness will continue to reduce demand in the storage space, negatively impacting WDC’s business. WDC stock has already dropped nearly 36% since we were first sell-rated on the stock. We expect WDC to continue to drop and recommend investors exit the stock at current levels.

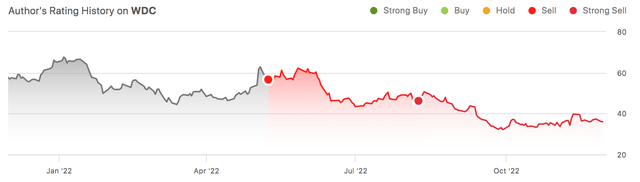

The following graph outlines our calls on WDC over the past few quarters.

Our bearish sentiment is driven by our belief that storage demand will stay low until 1H23 due to inflationary pressures and macroeconomic headwinds that have caused weak consumer spending. We don’t believe the downside risks have been priced into the stock yet, and recommend investors sell WDC stock.

Weak consumer spending infects the storage space

WDC’s flash and HDD revenue have dropped significantly on a sequential basis. We expect revenue to continue to disappoint investors as storage demand slows down in the near term. We believe weak flash and HDD demand result from weakness in the consumer market spreading to the commercial market.

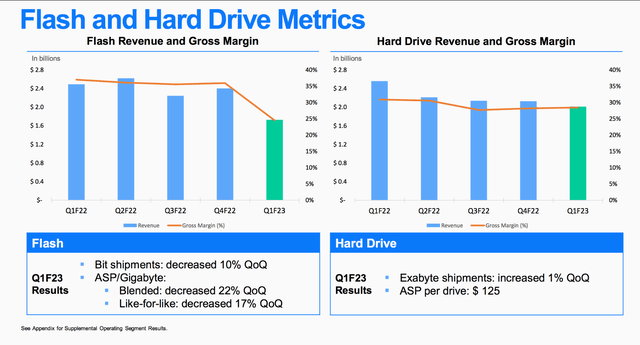

The following graphs outline the Flash and HDD metrics for WDC between 1Q22 and 1Q23.

WDC 1Q23 earnings presentation

Both PC and smartphone shipments crashed in the post-pandemic environment, negatively impacting global demand for storage. Smartphone shipments are forecasted to drop 9.5% Y/Y in 3Q22, up from a predicted 9% drop in August. PC shipments are also estimated to fall by a whipping 19.5% Y/Y for the same quarter. Our bearish sentiment is based on our belief that the fewer consumer electronics are purchased, the less data storage will be demanded. We believe WDC is especially feeling the churn of weaker storage demand on flash fronts. In WDC’s 1Q23 report, Flash revenue was $1,722M compared to $2,400M a quarter earlier, accounting for a 10% sequential decline in Flash exabytes sold. A similar decline can be seen in HDD revenue, dropping from $2,128M in 4Q22 to $2,014M in 1Q23. Flash revenue suffered a greater dip than HDD because flash storage is utilized in consumer electronics, namely smartphones and PCs. We expect WDC to suffer from weak demand until consumer spending recovers.

Cloud is not WDC’s salvation

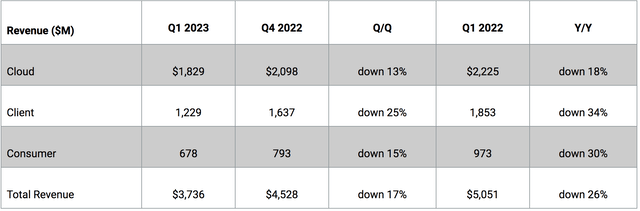

WDC juggles both flash and HDD storage segments but is more exposed to its HDD product line and, in turn, cloud end-markets. In 1Q23, WDC’s Cloud end-market represented 49% of total revenue. While the global shift of enterprises and businesses to the cloud is underway, we don’t expect WDC to take a slice of the pie in the near term. WDC’s cloud revenue is down 18% Y/Y. We believe the weaker-than-expected cloud revenue results from customer hesitation about investing in cloud storage under the current macroeconomic environment. We don’t expect cloud end-market demand to pick up before enterprises get the chance to revise their budgets for 2023.

The following graph shows the end-market demand for WDC’s 1Q23.

The entire storage industry is going through a drop in demand, and we believe WDC will feel the grunt of the weak demand alongside its peer group. WDC competitor Seagate’s (STX) 1Q23 saw a 38% Y/Y drop in HDD revenue and a low 5% Y/Y growth in its Systems, SSD, and Other segment. U.S. memory chipmaker, Micron (MU) is also a critical semiconductor to monitor in order to understand the storage situation at the moment. MU is expecting weak memory demand for next year and is leading new CAPEX cuts for 2023. The memory giant announced it would be undertaking spending cuts as it expects negative DRAM demand and single-digit percentage NAND growth. We believe WDC’s profitability will be limited due to the weak storage demand environment and recommend investors quickly exit the stock.

Valuation

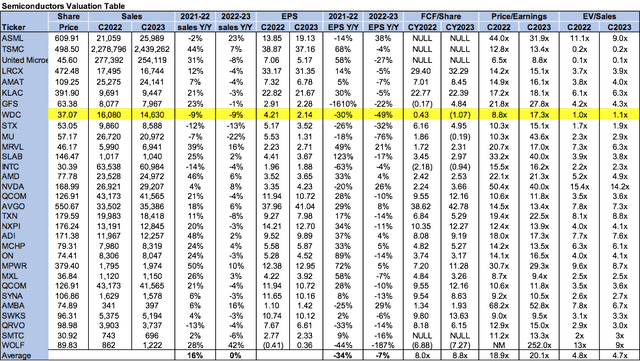

WDC is relatively cheap, but we recommend investors don’t buy the stock based on weakness as we expect the stock to get even cheaper. On a P/E basis, the stock is trading at 17.3x C2023 EPS $2.14 compared to the peer group average of 20.1x. The stock is trading at 1.1x on EV/C2023 Sales versus the peer group average of 4.7x. We expect there is more downside ahead and recommend investors sell the stock before it dips further.

The following graph outlines WDC’s valuation in comparison to the peer group.

Word Wall Street

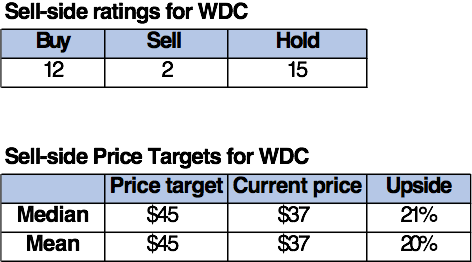

Wall Street is bearish on the stock. Of the 29 analysts covering the stock, 12 are buy-rated, 15 are hold-rated, and the remaining are sell-rated. The stock is currently trading at $37. The median and mean sell-side price target is $45, with a potential upside of 20-21%.

The following graph outlines sell-side ratings and price targets for WDC.

Tech Stock Pros

What to do with the stock

We are sell-rated on WDC. We believe WDC stock will continue to drop as demand for storage drops due to the harsh macroeconomic environment. While we like WDC’s long-term position in the storage market, we don’t expect the company to grow meaningfully in the near term. We recommend investors take the chance to exit the stock at current levels before it dips further.

Be the first to comment