solarseven/iStock via Getty Images

In case you missed it, I wrote an article on March 13, 2020 (Friday the 13th) called “This Too Will Pass”.

That’s right…

It was written just as the global pandemic was spreading with 4,612 deaths reported (3,173 of those in China) and the disease was beginning to spread across the globe. The stock market had officially entered a bear market, but as I pointed out in the article,

It’s temporary. The real winners in all of this – and yes, there most definitely will be winners when everything is said and done, probably sooner than later too – will be those investors, analysts, and businesses that can think long-term.

Now, let’s fast-forward to now – June 12, 2022 – exactly 27 months since I published that article and here’s what has happened:

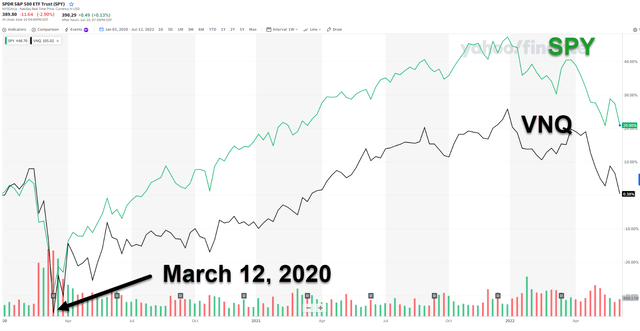

Yahoo Finance

As you can see, the stock market has seen quite an uptick since March 2020, as the (SPY) and (VNQ) hit all-time highs in late December…

And then…

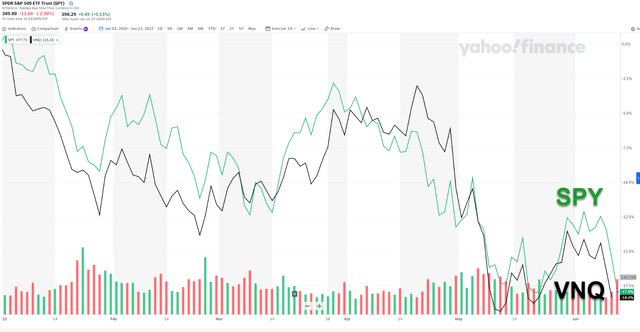

Yahoo Finance

Year-to-date, SPY has fallen by around 18% and VNQ has dropped by another 18.4%.

As I pondered the latest stock price movements, I began thinking of these very same words that I wrote about on March 13, 2020,

“This Too Will Pass”

Stay Calm Folks

During 2020 I decided to become a “voice of reason”, especially for REIT investors, who were fearful that they would lose their entire life savings on real estate stocks.

We even put together a tactical portfolio in which we handpicked REITs that would generate significant alpha for our members.

We called the portfolio the “Cash is King” portfolio, and boy was that an appropriate name, in which we have participated on some of the bargains of the century:

- Essential Properties Realty (EPRT): +144%

- Hannon Armstrong (HASI) +129%

- Ladder Capital (LADR): 107%

- Ventas Inc. (VTR): +93%

- Iron Mountain (IRM): +90%

We have since sold out of all of these names, except for HASI, and we’re now looking for similar opportunities to unlock value in this current market environment.

Of course, there are new dynamics at play, in which real estate could once again serve as the foundation to construct a portfolio that will stand the test of time.

Recently I read a Kiplinger’s article (July 2022) in which J.P. Morgan Asset Management chief global strategist said,

It’s a particularly challenging year, but I’m reasonably optimistic. The major concerns this year have been about inflation, the Federal Reserve rising rates very rapidly and the possibility of recession.

We don’t know about geopolitical events, whether in Ukraine or other situations that may flare up. But I think economic growth can moderate without going into a recession, I think inflation can moderate, and I think the Federal Reserve will cool its tone. That should make it reasonably positive second half for U.S. stocks.

I fully concur with this statement, and I also agree with the chief global strategies that,

by the fourth quarter, I expect economic growth, adjusted for inflation, of less than 2.5% year-over-year; by the fourth quarter of next year, less than 2.0%. So I think the economy will grow, but at a much slower pace.

The way I view it, “this too will pass” is the same thing as transitory inflation.

merriam-webster.com

The word transitory means “temporary” and remember that transitory inflation was caused by the pandemic and the policy response. Now that the pandemic has faded, the supply chains will continue to improve.

Also, the stimulus funds that were dumped into the economy over the last two years is now drying up. By the end of the summer, when many go on vacations (including me) there will be less demand, this inflation will naturally diminish.

As the chief global strategist adds,

There’s a huge excess demand for labor, and that momentum will keep the economy out of recession. The unemployment rate will drift down to 3.3% by the fourth quarter of this year, which will be the lowest in 70 years, and to about 3.1% by the fourth quarter of next year.

Once more, and I’m no economist, but I do agree that the labor tea leaves look good right now, but is layoffs start to mount and the jobless rate rises, recession alarm bells could ring.

Of course, as I point out frequently on Seeking Alpha, when inflation surges, it’s best to put your money into physical assets that track the jump in prices, with real estate often suggested as the best option.

Citing J.P. Morgan’s chief strategies once more,

It’s important for people to invest in companies that have a real product, a real good, a real service, and a real cash flow being generated. That’s how you build a portfolio for the long run. The last few years have been great for fads. I don’t think the next few years will be.

He left out one thing…real estate!

Buy REITs

REITs are seen as a hedge against inflation and are seen as an inflation hedge because they can pass through rent increases for various properties. Remember that operating expenses are passed through to the tenant, effectively locking in “rea;” return for the landlord.

Strong cash flow growth is a great antidote for rising rates and inflation and the very best way to combat rising rates is to outgrow their headwind.

Also keep in mind that property values – like the prices of other hard assets – have historically kept pace with general price inflation, especially during period of prolonged inflationary pressures.

Today I would like to provide you with three of my top picks that offer enhanced dividend growth prospects. I know you’ve heard me say this before, but it’s worth mentioning again, “the safest dividend is the one that’s just been raised”.

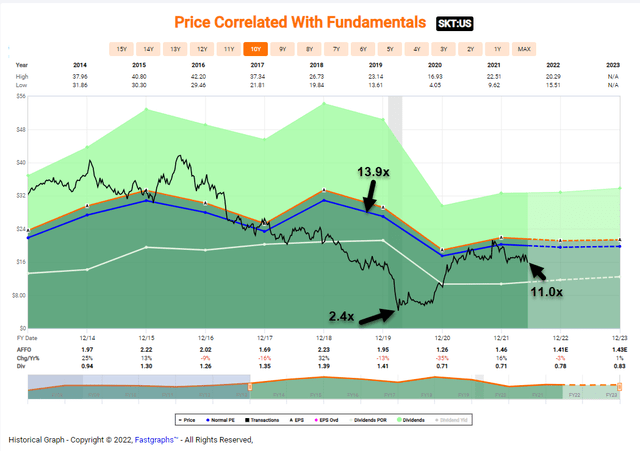

My first pick is Tanger Outlets (SKT), a “pure play” outlet REUT that owns 36 properties in 20 States and Canada comprised of 13.6 million square feet. Around 90% of the square footage is located on the Top 50 MSAs or leading tourism destinations. Around 94% of the portfolio is open-air.

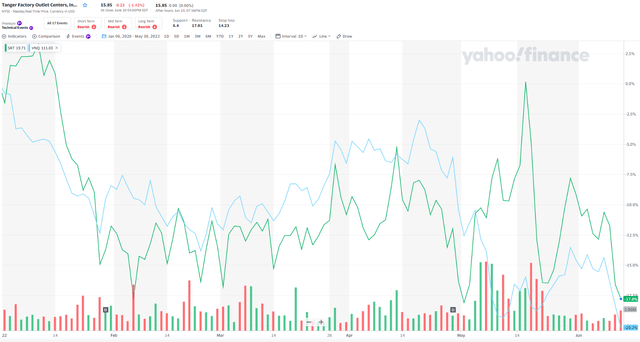

Some of SKT’s top tenants include Coach, BOSS, ELIE TAHARI, MICHAEL KORS, Adidas, lulelemon, Nike, kate spade, TORY BURCH and Columbia Factor Store. As viewed below, SKT shares have fallen by ~17% year-to-date (-18% for VNQ).

Yahoo Finance

In May SKT broke ground on a new six-building, 290,000-square-foot open-air outlet center located along I-24 at the Century Farms development, outside of Nashville, TN.

The outlet is slated to open in fall 2023 on a 32-acre parcel that will house a roster of more than 70 brands, including digitally native companies and popular local concepts. On the Q1-22 earnings call SKT’s CEO confirmed that the company had reached its 60% pre-leasing hurdle (requirement).

SKT has always maintained financial discipline and post pandemic the company is in excellent shape with no significant debt maturities until April 2024 and net debt to adjusted EBITDAre of 5.4x for the trailing 12 months (compared to 6.8x a year ago).

At the end of Q1-22 SKT’s weighted average interest rate was 3.1% and 93% of the outstanding debt was fixed. The dividend is well-covered with a FAD payout ratio of 38% (also in Q1-22).

SKT’s Board also recently approved a 9.6% increase in the dividend on an annualized basis and the company increased guidance for 2022 and expects core FFO to be in the range of $1.71 and $1.79 per share. Also SKT expects same-center NOI growth at a range of 2.5% to 4.5%, up 100 basis points.

Notably, April traffic at SKT outlets returned, even as consumers face higher gas prices during this inflationary environment.

Tenant sales remained strong at $464 per square foot for the trailing 12-month period, an almost 20% increase from the pre-pandemic comparable period in 2019. SKT ended Q1-22 with 94.3% total portfolio occupancy.

As viewed below, SKT shares have recovered considerably from the pandemic low of 2.4x (P/AFFO) and shares are now trading at 11.0x – below the average multiple pf 13.9x.

Fast Graphs

Outlets remain an important part of the retailer omni-channel, especially now with over-stocking (due to the supply chain). We also find SKT’s low payout ratio attractive which is just part of the DNA for the very disciplined management team.

With a new CEO at the helm (we’re interviewing him soon at iREIT on Alpha), we remain bullish that SKT can continue to find suitable sites for new development and also create potential acquisition opportunities (i.e. buying out some of its JV partners).

The dividend yield now stands at 5.1% and SKT has plenty of cushion to accelerate the distribution. Multiple expansion (100 bps), FFO growth, and dividend increases support our 12-month total return forecast of 20%. We maintain a Buy.

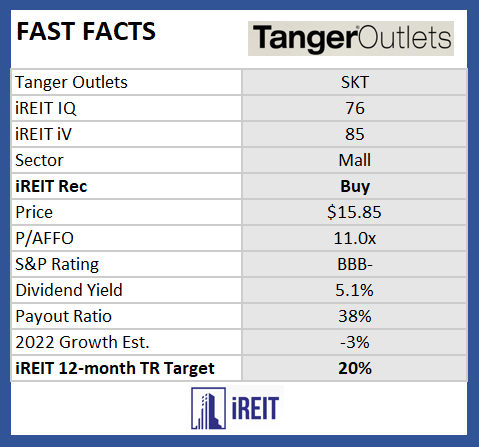

iREIT on Alpha

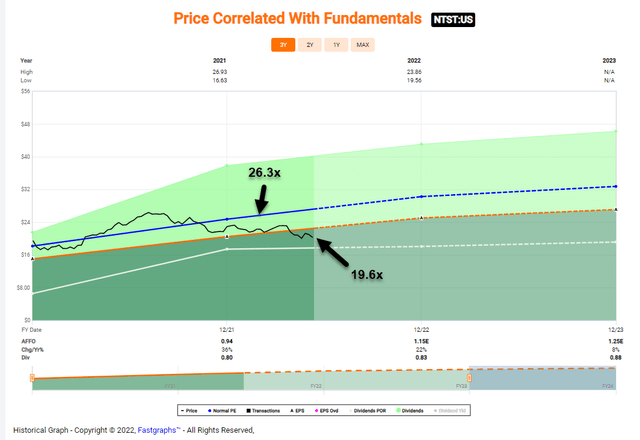

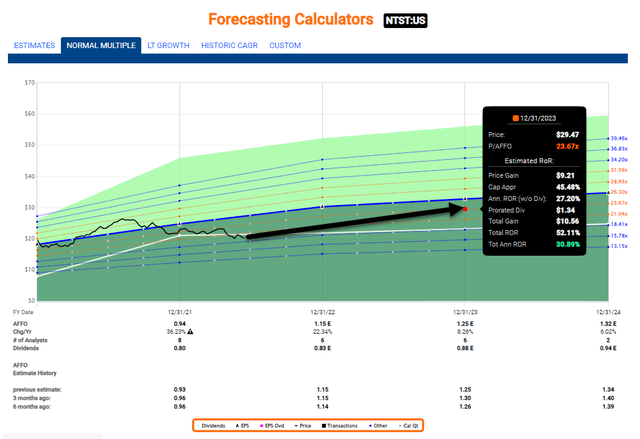

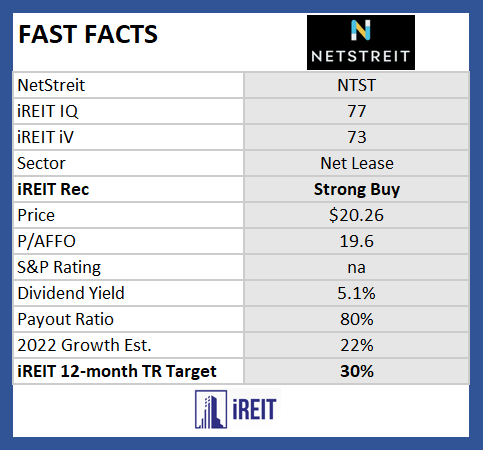

NetStreit (NTST) is a net lease REIT that IPO’d in 2020, and currently has a portfolio of around 361 properties in which over 80% of the portfolio consists of investment grade tenants, or tenants with an investment grade profile (the 2nd highest % in the net lease sector).

As seen below, NTST shares have dropped by roughly 11% year-to-date (-18% for VNQ).

Yahoo Finance

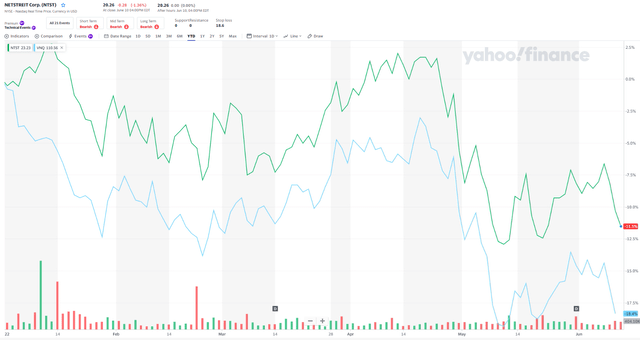

In just around two years, NTST has grown its portfolio by an average of $101 million per quarter and now has a market cap of around $1 billion. To fund that steady growth NTST has maintained strict financial discipline, at the end of Q1-22 the company had total debt of $295 million, of which $175 million is from a fully hedged term loan with a remaining balance from the revolving line of credit.

NTST has no debt maturities until the maturity of the revolver in December 2023, which is subject to a one-year extension option. The net debt to annualized adjusted EBITDA ratio was 4.6x, which was at the low end of the targeted leverage range of 4.5 to 5.5x.

In Q1-22 NTST acquired 34 properties for $90 million at an initial cash cap rate of 6.3% and a weighted average lease term of 8.2 years. In addition, rent has commenced on two development projects that had total cost of $7.6 million and had a weighted average investment yield of 7.6%.

NTST grew AFFO by around 36% in 2021 and analysts are forecasting more impressive growth of 21% in 2022 (highest in the peer group and one of the highest in the REIT sector).

Shares are now trading at $22.73 per share with a P/AFFO multiple of 19.6x, compared with the average 2-year multiple of 26.3x.

Fast Graphs

NTST’s equity yield is now around 5.1% and the payout ratio is around 80%, which means the company should boost its dividend substantially this year.

Given its small size, NTST should be able to move the needle, especially is the company continues to acquire around $100 mm every quarter. As you can see below, we updated our forecast for 2022 which reflects a total return target of 30%.

Fast Graphs

iREIT on Alpha

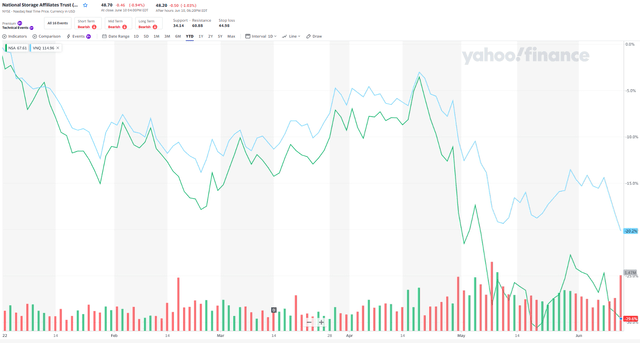

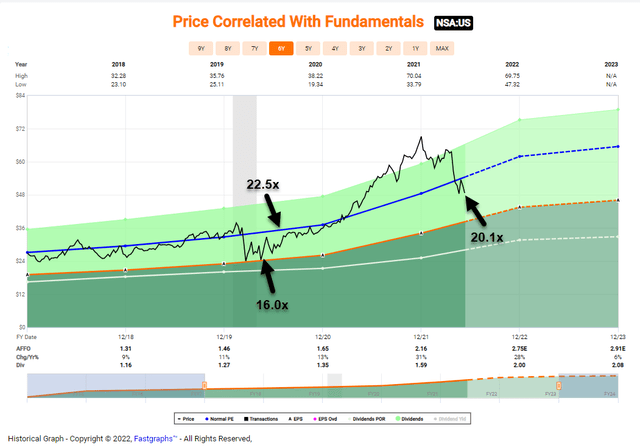

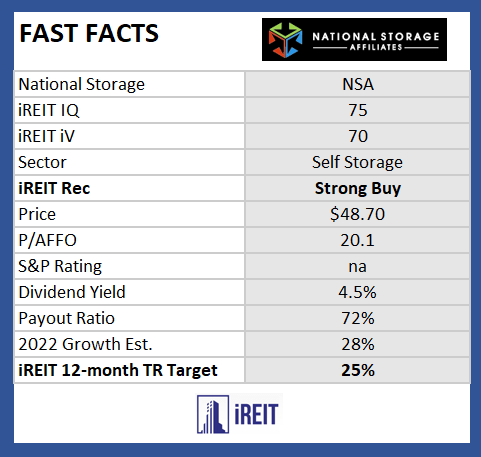

National Storage (NSA) is a self-storage REIT that owns 1,061 properties (884 wholly owned) and over 68.4 million square feet. A key component of NSA’s strategy is to capitalize on the local market expertise and knowledge of regional self-storage operators by maintaining the continuity of their roles as property managers.

As seen below, NSA shares have dropped by roughly 30% year-to-date (-18% for VNQ).

Yahoo Finance

In Q1-22 NSA acquired 12 stores valued at approximately $93 million with cap rates averaging 5.3%. Subsequent to Q1 the company closed with one of its JV partners on the acquisition of a high-quality 7 property portfolio, strategically located in the Houston MSA and valued at $208 million.

NSA’s balance sheet is strongly positioned. During Q1-22 the company issued $17 million of OP equity in conjunction with acquisitions and closed a remaining $125 million tranche of private placements.

Subsequent to quarter end, Kroll Bond Rating Agency upgraded NSA’s credit rating of its operating partnership to BBB+ from BBB flat, reflective of the conservative balance sheet, multiple options for capital and strength of the self-storage sector.

At the end of Q1-22 leverage was 5.7x net debt-to-EBITDA (towards the low end of the targeted range of 5.5x to 6.5x) with no debt maturities through 2022,, In addition, NSA has just 18% of principal debt subject to variable rate exposure and $185 million of availability on the revolver.

NSA has seen 163% growth in its quarterly dividend since the IPO. More recently the company declared its $0.55/share quarterly dividend, a 10% increase from prior dividend of $0.50.

As a result of the strong performance, we decided to increase NSA’s Buy Below target and we recently added shares to one of our iREIT on Alpha portfolios.

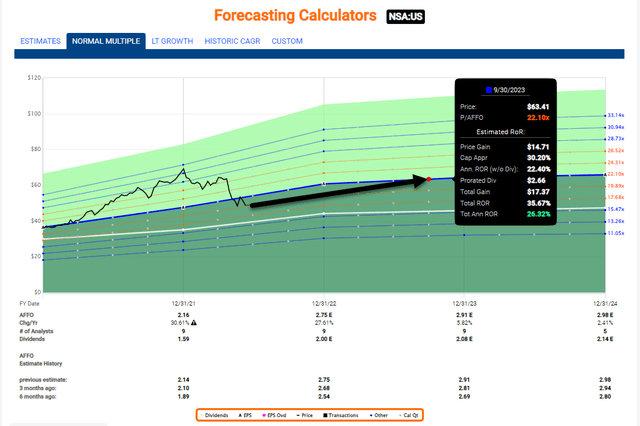

Shares are now trading at $48.70 per share with a P/AFFO multiple of 20.1x, compared with the average multiple of 22.5x (also was 16.0x in March 2020).

Fast Graphs

We have continued to increase exposure to self-storage REITs in this current cycle, recognizing the pricing power that exists within the property sector. NSA’s low payout ratio and size supports our opportunistic total return forecast of 25% over the next 12 months.

Fast Graphs

iREIT on Alpha

Keep in mind what is truly important in life…

This too will pass…

…and by investing in REITs – like the one’s I reference in this article – you should be well-positioned to navigate rising rates, inflation, and your fear of missing out. Our team is here to assist you by providing high quality picks with a wide margin of safety.

As Seth Klarman explains,

A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable and rapidly changing world.

That is the world we’re living in right now folks, and as our good friend on Seeking Alpha, Regarded Solutions, reminds us (RIP my friend),

Brad Thomas

Be the first to comment