DjordjeDjurdjevic

Introduction

Although DoorDash (NYSE:DASH) is down 66% YTD, I think the company continues to trade above fair value. Firstly, revenue growth will slow on a strong base from previous years and declining consumer confidence. Secondly, high inflation will continue to weigh heavily on the company’s spending levels, causing the business to continue to generate negative operating income in the coming periods, which will be negatively received by investors in a tightening US monetary policy cycle.

Market overview

According to the company’s 2021 annual report, the restaurant delivery market is valued at $1 trillion and the grocery market is $2.5 trillion. In my forecasts, I assume that the market will continue to grow at a level slightly above inflation, and the growth rate of DASH will continue to outpace the market as a whole due to low penetration of online delivery.

According to my calculations, the company will increase its market share from 1.5% in 2022 to 2.2% in 2026. However, despite the company’s potential to grow its market share, the focus of investors’ attention is on achieving operating profitability. It is important to understand that, in my personal opinion, the company lacks a competitive edge over Grubhub and UBER’s main competitors.

Here I want to highlight the following factors:

1. Low customer loyalty

2. Price competition

Since, in my opinion, companies provide the same services to users, it is difficult for sector players to stand out and have to compete on price, as users use the service where the price is simply cheaper. This creates limited potential for price increases for the end consumer.

At the same time, it is difficult for the service to raise the level of commissions for restaurants, since in this case the restaurants on the platform may cease cooperation.

As a result of the above factors, I believe that the company has limited potential for profit growth, which is especially true in current times.

Financial analysis and projections

First, I would like to share the main assumptions of my model:

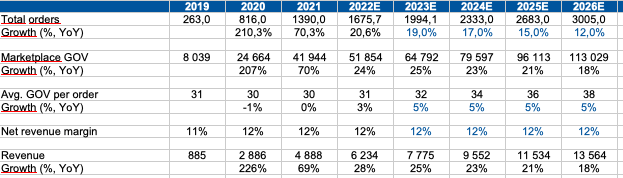

Total orders: in my calculations, I assume a gradual decrease in the growth rate of new orders because of 1) a high base of previous periods 2) an increase in the penetration of online delivery 3) competition.

Avg. GOV per order: based on historical analysis, I believe that the current level of the average check is comfortable for the consumer. Thus, I think that the average check will grow in-line with inflation. (GOV: total dollar value of orders completed on marketplace)

Net revenue margin: in my model, I use a flat level, in view of: 1) competition for restaurants on the platform 2) growth in incoming costs for restaurants

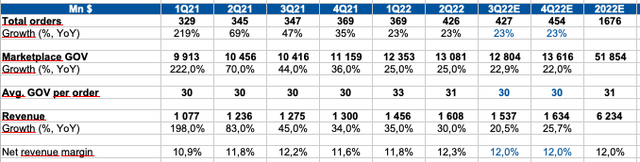

Quarterly projections for 2022FY

Personal calculations (Personal calculations)

Yearly projections for 2022-2026FY

Personal calculations (Personal calculations)

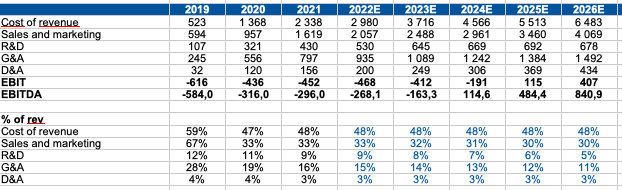

Next, let’s move on to modeling SGA costs:

Cost of revenue: we are seeing that CoS (% of revenue) has stabilized in 2020 and 2021 due to growing economies of scale. Based on past periods, I believe that the company will not be able to decrease CoS (% of revenue) in the next years. Thus, I assume the flat level.

Sales and marketing: here we also see that the level of spending on sales and marketing (% of revenue) has stabilized. I believe that the company cannot add a significant reduction in marketing costs, because this will lead to an additional slowdown in revenue growth, so I am considering a phased reduction in accordance with management’s statements.

R&D and G&A: In my analysis of R&A and G&A spending, I have come to the conclusion that it is really difficult to accurately predict the level of spending that a company will face in the coming years. However, I came to the conclusion that a further increase in revenue per 1 employee will reduce costs (% of revenue), so I also include a cost reduction at a neutral level due to economies of scale.

Thus, according to my calculations, the company will be able to demonstrate a positive operating margin only in 2025, which, in my opinion, will be negatively perceived by investors in the current macroeconomic conditions.

Personal calculations (Personal calculations)

Drivers

Interest rate cut: I think this is unlikely based on the Fed’s rhetoric. So, most likely, we will see further rate hikes during 2023.

Growth in the average ticket that could support the unit economy: quarterly dynamics of the average ticket shows that there is no growth, and I see no potential for further growth

Increasing Fees: With competition in the sector for users and merchants, I believe the company has very limited room for price increases

Risks

Decrease in the average check: I believe that the company’s users may start shopping less often and/or reduce the average check due to rising inflation and a decrease in real disposable income.

Slowdown in growth-rate: the decline in consumer income and consumer confidence could have a negative impact on the company’s top line growth.

Increase in input costs and decrease in profitability: rising operating costs could have an additional negative impact on operating margins as the company must continue to compete for labor and invest in marketing.

Valuation

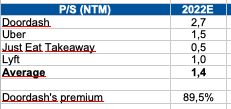

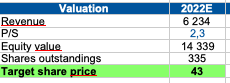

I believe it is preferable to use a multiple rather than a DCF model to value a company because the DCF model is too sensitive to input for a growth company with an uncertain future. I’m using a P/Sales multiple of 2.3, which I think is a fair value, so the fair share price is $43.

First of all, I suggest looking at the multiples of peer companies.

Yahoo.finance

We see that at the moment the company continues to trade at a premium relative to its peers. On the one hand, I agree that DASH should trade at a premium due to higher business growth. However, in my personal opinion, the risks of a slowdown in business growth and negative operating income should be reflected in the quotes. In my calculation, I set a quite optimistic 2.3 multiple, which continues to reflect the premium for the growth rate. Even in this case, I don’t see the fundamental upside.

Personal calculations (Personal calculations)

Conclusion

I believe the company is currently trading above its fair price of $43/share. In addition, in the next quarters, in my opinion, there are no catalysts for growth and reasons for revising the fair price of the share, since the high level of competition in the sector for users and restaurants on the platform will not allow the company to increase the commission level, and the growth of interest rates and an increase in incoming costs will continue to put pressure on operating expenses, as a result, the company will not be able to surprise investors with positive operating income exits in the coming quarters, which will be negatively perceived by the market.

Be the first to comment