The Netflix Corporate Office at Sunset Bronson Studios in Hollywood, owned by Hudson Pacific Properties. Noah Sauve/iStock Editorial via Getty Images

Long before the pandemic, I was bearish on office REITs. With the exception of a small position I picked up in Empire State Realty Trust (ESRT) during the Covid crash, I have almost always avoided the non-medical office REITs. In fact, it was before the Great Financial Crisis (around ’04-’05) as to the last time I purchased one. That was Boston Properties (BXP) and it was a mistake.

Since I am retired and live off dividends, I own dozens of REITs – almost every sector – and some for more than a decade. The reason I have avoided office is because I haven’t understood the need for them, when it comes to many – if not most – so-called office jobs.

To be clear, in no way am I suggesting my crystal ball with REITs has been anything above average. Lord knows I have been terribly wrong on a number in healthcare, as just one example. That supposed boom from the silver tsunami never happened. However the one long term trend I called right were offices.

The reason for that is because I have been largely self-employed my whole life. Having the contrast of the occasional formal office experiences vs. working at home, my productivity during the former always fell short, by a mile. Obviously, I had no clue a pandemic would accelerate that for others, but I was confident more and more people would embrace the home office over time.

So, why be bullish on offices now?

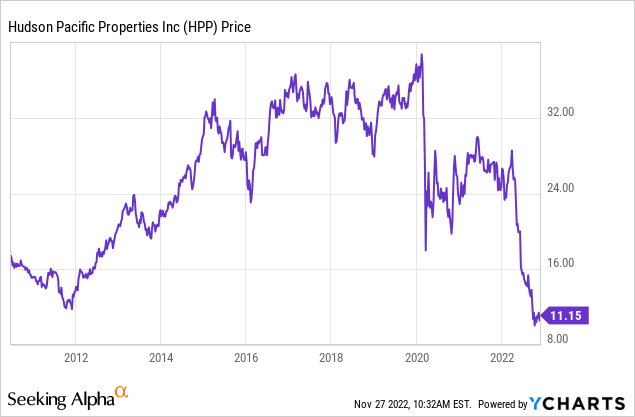

For one, falling knives often spark my interest…

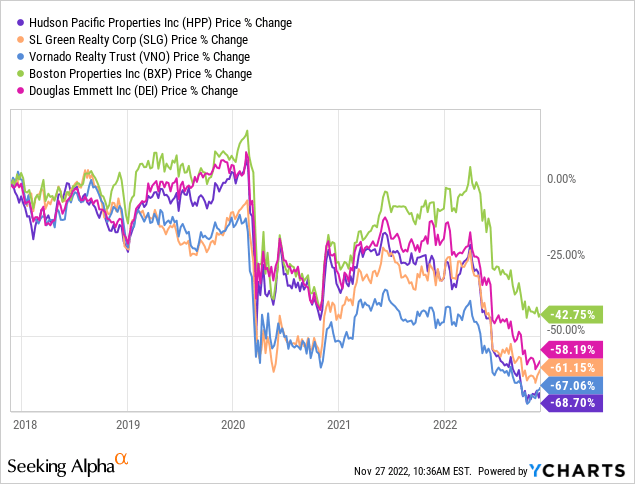

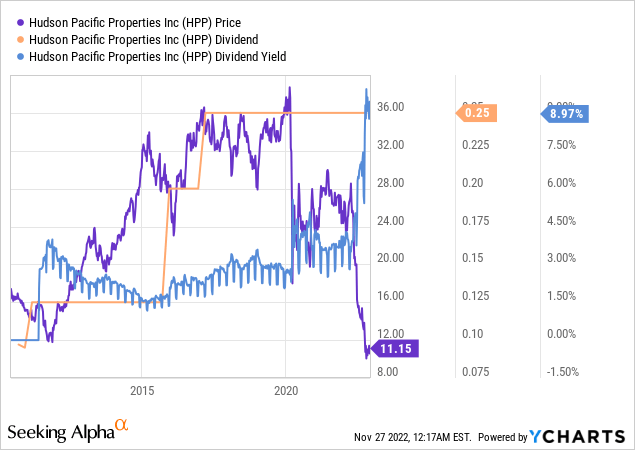

As scary as that chart may look, Hudson Pacific Properties (NYSE:HPP) comparable to most office REITs right now…

Then again, a plummeting price is not a good reason in and of itself to take the other side.

The fact is, a large segment of the population does not correlate output with work. Rather, they measure (and prefer) time in a physical office as being the metric for working. This is regardless of how little they may actually get done in the office.

You know the type… the middle-management folks who spend so much time chit-chatting about nothing relevant and milling around, while you work away like a madman trying to finish that report. You are actually more productive doing that task at home, without their yakking interrupting you, yet they can’t really do their same “work” at home. They long for the social aspect of the office and in turn, are at the forefront of the back-to-office push.

In 2020 and 2021, many believed that work from home (WFH) would become the new normal for most office jobs. It hasn’t played out as expected.

True, some are still at-home 5 days a week but for many – particularly those with higher pay – we are seeing employers require their employees to come to the office at least 3 days a week. Maybe 2.

In theory, that could require 40-60% less office space, if two employees alternated days and shared the same office/cubicle. However, that’s not how it’s playing out. Perhaps it’s just anecdotal but what I’m hearing from most – both in Los Angeles and elsewhere – are employers keeping most or all of their office space, despite less users at a given time. They’re certainly not reducing it by 40-60%, at least none I am aware of.

Of course, even a more modest 20-30% reduction in office demand could be detrimental for landlords. As leases rollover, yes smaller footprints will often be sought. But will they be sought in the same buildings? Or will they upgrade to a better Class A property, since they can now get more bang for their buck? I’m betting on the latter.

If so, that means you want to focus on the highest quality offices, in the most desirable locations. It doesn’t necessarily mean they will fetch the same inflation-adjusted rents as pre-pandemic, but they should have better odds of filling vacancies. At least at some price. Some low-quality offices can’t be filled at any price, even pre-pandemic. You don’t want to own those.

Why West coast?

For starters, invest in what you know. I’ve lived in Southern California for over half my life. While I know NYC real estate peripherally, I’m no expert. There are more office REITs focused on the greater NYC area. The West Coast players seem to get less attention on Seeking Alpha and elsewhere. For those reasons alone, I want to dig deeper.

For example, NYC-based SL Green (SLG) seems to garner 1 to 3 write-ups a month on here. Being among the larger players, with roughly a $2.6B market cap and nearly a 9% yield, I can understand why.

However, Hudson Pacific Properties is no small player, either. With a $1.6B market cap and yes, also about 9%, it’s comparable. Despite this, I was surprised to search and discover the prolific Brad Thomas has never covered it on here other than in passing on news pieces. I even did a trial on his iREIT and could not find a deep-dive.

Likewise for Douglas Emmett (DEI), which is the largest office landlord in Los Angeles. That, along with a $3.5B market cap (bigger than SL Green) and one would think write-ups would be frequent. Since 2006, I only count 12 on Seeking Alpha.

Lastly, SoCal has something NYC does not, which is the best weather. 284 days of sunshine per year. No frigid winters like NYC or muggy summers like Florida. This is why, despite the politics and high taxation, myself and many others stick around.

It’s also why I’ve heard from many people who fled during the pandemic now coming back. Boise was boring. Texas freedom found a rude awakening when in 2021, they experienced temperatures in Austin, San Antonio, Houston, and Dallas below that of Anchorage, Alaska.

Rather than fleeing out of state, what I’m seeing more of is people fleeing certain cities – e.g. Los Angeles and San Francisco – for greener pastures in adjacent communities. Separate municipalities which manage homelessness and other issues better. They still work in the city.

There are 3 large publicly-traded office REITs focused on the West Coast. In addition to Hudson Pacific and Douglas Emmett, there’s Kilroy (KRC). The latter does get a lot of coverage on here and their properties are overrated in my opinion, given their higher multiple (9.2x FFO) and relatively low yield (5%). It’s not at the top of my list, that would be Hudson Pacific. Douglas Emmett is in the middle and perhaps I’ll cover them next.

The lowdown on Hudson Pacific Properties

They are focused on media and tech along the West Coast, primarily the Bay Area, Los Angeles, Seattle, and Vancouver. With roughly 20 million sq. ft. leased and in development, the mix is 85% office and 15% studios.

They were founded in 2006 by Victor Coleman after selling his prior company, Arden Realty. They IPO’d in 2010 and he’s still at the helm.

While I love founder-led companies, I don’t particularly love his annual compensation; in 2021 he realized $6.5M out of the reported compensation of $10.5M (because equity values decreased). I believe a founder’s equity stake should be motive enough (instead of up to 8-figures annually) but that’s a conversation for another time.

You already likely knew office REITs are trading at cheap multiples, but what you may not know is how well their occupancy has recovered.

The 50% stat has been mentioned in articles and comments, such as this recent piece on SL Green. Indeed data from Kastle backs that up for major US markets. But what does that mean? Does it mean offices are half their normal occupancy?

Not exactly.

Here’s a quote from Coleman at the BofA 2022 Global Real Estate Conference (9/14/2022):

So we’re about 50% occupied right now coming from a low early pandemic to the, the worst part of the pandemic at 5 to 10%, so 50%. Just in perspective, and I don’t know what other office landlords talk about their portfolio, but from our standpoint, that’s about 20% off peaks. So when people think it’s 100%, it’s never 100%. It’s always closer to like 70, especially the tenants that we have. They were occupying space 3, 4, 5 days a week in some instances, depending if they’re fire or tech or media. And so we’re getting close to those numbers.

He goes out to talk about their Vancouver portfolio, which is above-average:

Vancouver has been the best performing market in our portfolio by far throughout all of COVID. It’s in the mid-90% occupancy range. Our activity in that market, even on the sublease space is extremely high. Rental rates, we’re seeing at all time high levels, and it’s just a very solid market. There’s very little product on the marketplace. A couple of large leases were just signed. One, the distinct one, from Microsoft. And that marketplace has really flourished throughout all of COVID, and we see no downturn. And our vacancy activity there is very, very strong; mostly middle size tenants.

Keep in mind that the conference was in September. I think we can all agree the return to office has only gained steam since.

Is the above unique to the West Coast? I don’t think so. Coleman’s quotes echo what I have seen and heard myself elsewhere, including NYC when I was there recently. While completely anecdotal, this comment a few days ago on great SL Green piece by Hoya Capital sums up perfectly what I’m also hearing:

I own a residential contracting/construction company that services Manhattan and Brooklyn. I work with a lot of real estate brokers, the market is still transacting better than most of the country and NYC is fine. I was at a restaurant at 33rd and Madison last week and there was a line out the door. I live in NJ and all the trains are full again in the morning and evening. My friends are all being required to go to the office 2-3+ days a week. They have families, a mortgage, children, wives that like to take nice vacations and they need their jobs so they are all going back to the office.

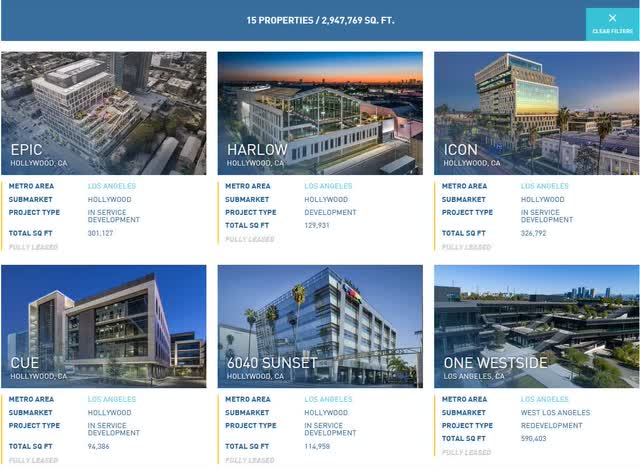

Back to the best coast, HPP has around 3M sq ft of office space, excluding studios, in Los Angeles. If you know the city, many of these are in central and east Hollywood, which is a popular neighborhood for production.

What you see in the bottom right corner, One Westside, was formerly a large mall (Westside Pavilion) which was redesigned to be an office. Google leases 100% of that.

Among several other properties on the west side, they have a 500k sq ft skyscraper at 11601 Wilshire. Okay, I know New Yorkers will laugh at me calling 24-stories a skyscraper, but remember this is LA! HPP’s HQ is also here.

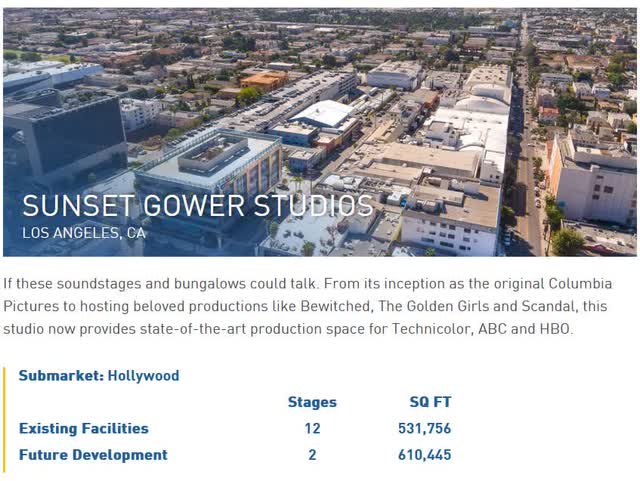

Going back to the east side, you will find their studios:

In addition you will find their Sunset Bronson (10 stages), Sunset Las Palmas (13 stages), and their newly acquired Quixote (23 stages). At one time this was my neighborhood so I know it well. In fact, I lived part-time in an apartment directly next door to Quixote.

| Market | MSF | Percent Occupied | ABR (millions) | ABR/sq ft |

| Vancouver | 1.51 | 93.4 | $39.53 | $27.95 |

| Seattle | 2.15 | 85.4 | $70.60 | $38.47 |

| San Francisco | 7.41 | 84.1 | $384.48 | $61.65 |

| Los Angeles | 2.85 | 98.2 | $165.85 | $51.23 |

| Total Stabilized | 13.92 | 88.2 | $660.46 | $53.76 |

From Q3 2022 10-Q

As you see their largest market for offices is the Bay Area. I will not go into detail on their properties there and elsewhere, but encourage you to browse them on their website. They own some noteworthy properties in SF, including the famed Ferry Building, which is mixed-use.

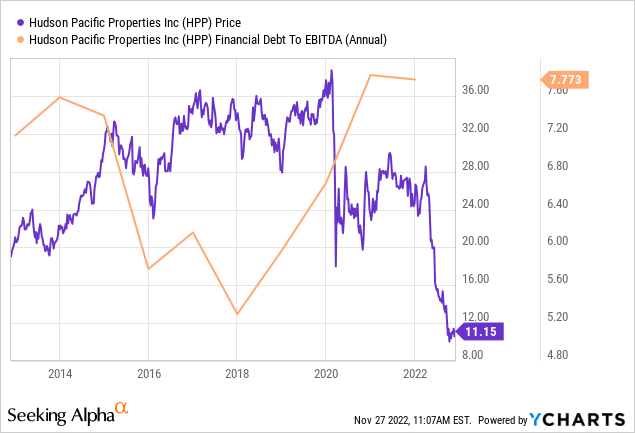

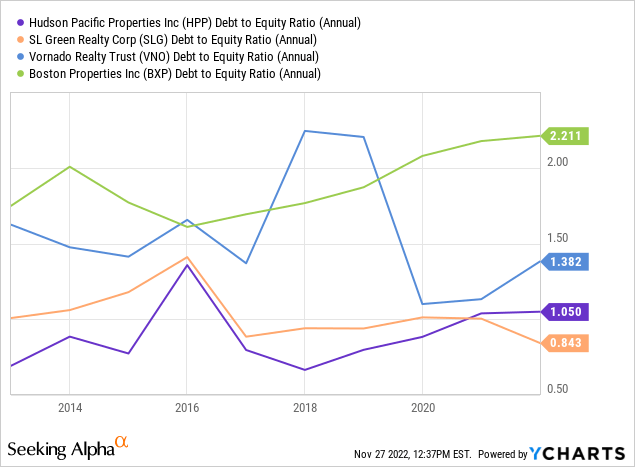

The balance sheet

With around $4.25B in net debt, yes this is a heavily indebted company. That said, it is not egregious for an office REIT. Even pre-pandemic, offices have carried higher debt than other sectors.

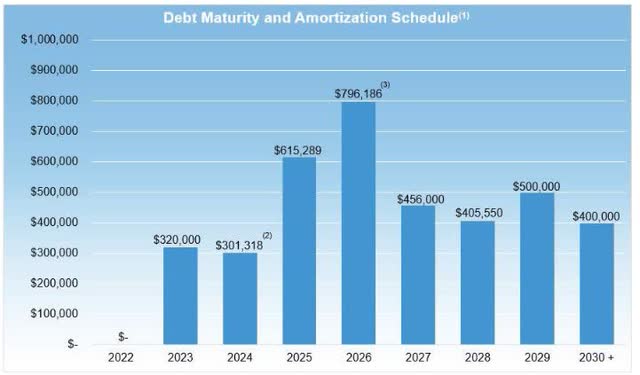

While it is tax loss selling season now, this has been a slow grind down since late spring. The primary reason is most likely related to expiring leases and debt maturities. Not that they are facing a cliff next year, rather the fear is the bearish thesis plays out and renewals are weak and rates stay high.

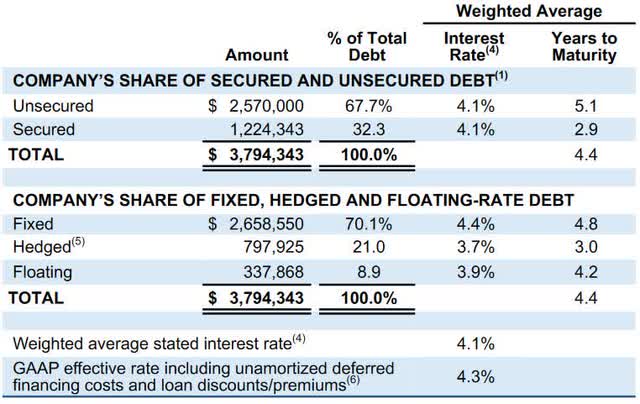

Here’s a more detailed view of the debt composition:

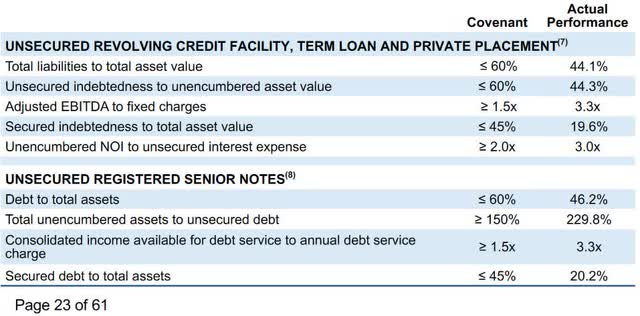

And here are the covenants and where they currently stand:

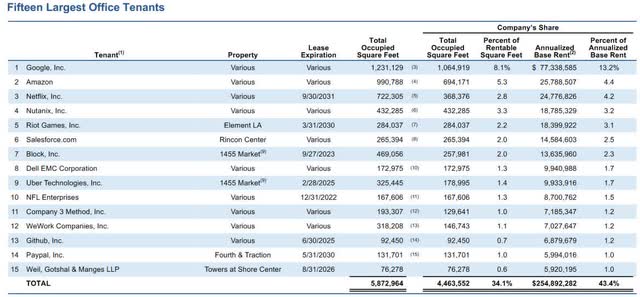

As you see, they are well within compliance. With roughly half of their office ABR expiring on or before 2025, it’s understandable why investors are skittish. Especially with recent non-renewals. QUALCOMM (QCOM) is letting Skyport Plaza expire in July (previously a top 15 tenant) and Block (SQ) will not renew at 1455 Market in Q3 of next year.

The good news is their top tenants are at minimal risk of bankruptcy themselves. The risk is how much – or how little – office space they want moving forward. What you can deduce from these names is that these are desirable offices and locations. If occupancy holds up and/or they are able to at least modestly fill the vacancies, their balance sheet should remain intact.

Plus, leasing spreads may lessen the blow of non-renewals. During the aforementioned conference, Coleman stated that in the first half of this year they realized 15% GAAP leasing spreads.

The dividend

At the end of the day, this is all you or I care about when we invest in REITs, right?

When you see a 9% yield, of course a cut is the first thing on your mind. Although certainly possible, there appears to be no immediate danger based on the current payout ratio in the low 50s percent.

Their dividend is exactly $1.00 per year and they did not cut it during the pandemic. In fact, they’ve never cut it since going public 12 years ago.

That’s the good news. The bad news is that it has remained flat since Q1 2017. If they haven’t felt comfortable raising during the 2-3 years pre-pandemic, then one has to wonder how comfortable they are with it post-pandemic. In this case, however, I think it has more to do with their desire for funds to re-invest.

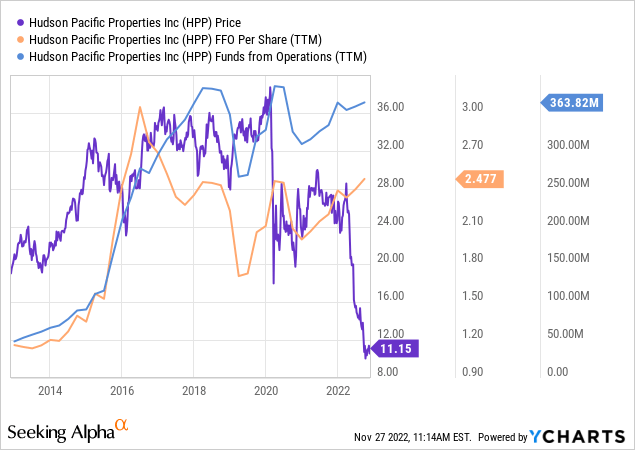

FFO remains about 12% below pre-pandemic levels; estimated $279M for 2022 vs. $316M in 2019. Despite this, they’ve grown cash flow at a 9.75% CAGR during this time; from $288M to $380M annually.

The takeaway

Sometimes, consensus pessimism is correct but more often, it’s not.

When it comes to the death of the office, maybe the worst-case scenario really will play out. This REIT, and many peers, seemed to be priced as if that is guaranteed. This is why I’m taking the other side of the bet and within the past couple weeks, have bought small positions in a few office REITs for the first time in nearly two decades.

To emphasize, my weighting is low. My position in HPP is about 10% that of blue chips Essex Property Trust (ESS) and Realty Income (O). My weighting in SLG and DEI are similar to HPP. I know they say never reach for yield but scoring up to 9% will juice my overall REIT income, while only taking on a small loss of capital risk (relative to portfolio size).

Also, several insiders have bought in recent months. I take at least some comfort in that, especially since I bought lower than most of them.

So it’s back to the office for me too, but only as a shareholder.

Be the first to comment