vetkit/iStock via Getty Images

The S&P 500 Stock Index is up 205 points already this week. The Dow Jones Industrial Average is up 1,591, and the NASDAQ is up 361.

What’s going on?

Well, the most prominent guess is that the two “bits” of less-than-good economic news coming out this week are a sign that maybe the Federal Reserve will get nervous about the economy slowing down and “back off” of its monetary tightening.

On Monday, the Institute of Supply Management announced that its manufacturing index was a little weaker in August than forecast. Stock prices took off.

Tuesday, well, we learned that job openings continued to fall. Must be that the job market is getting weaker.

Investors seem to be very much on edge.

It seems like the investment community has listened to the Federal Reserve and is aware that Jay Powell, Fed Chairman, and others are standing by the Fed’s move to tighten up on monetary policy and stick with this tightened stance.

Yet, investors seem to be very, very wary.

Investors have seen how, over his tenure as Chair, Mr. Powell has always erred on the side of monetary ease when it comes to policymaking.

Mr. Powell does not seem to want to make a mistake, particularly one that would cause markets to drop.

As a consequence, investors are very anxious to identify the time when Mr. Powell is going to back off from the current monetary stance and again flood the market with liquidity.

The news on Friday, we reported, was that the Federal Reserve was right on track, doing what it said it was going to do.

And, the expectations are that the FOMC will raise the Fed’s policy rate of interest again at its next meeting.

Yet, investors seem to be very, very sensitive to the possibility that the Fed will not stand around if there is any “smell” of a sharp drop in the market.

Plus the investment community has lots and lots of liquidity to play around with.

These investors would not want to miss the chance to buy stocks when the Fed is just about in a position to begin to loosen up on monetary policy.

Over the past two years, the Fed has pumped an enormous amount of money into the financial system, most of it still lying around today.

For example, the commercial banking system has over $3.0 trillion of “excess reserves” hanging around in their computer bases.

And, much of the rest of the financial system seems to have similar resources on their balance sheets.

What are these economic organizations going to do with all this cash?

So, investors are anxious.

Although they bought onto the Fed’s programs when the Fed was buying lots and lots of securities and flooding the financial system with cash.

As we seem to be on the other side of the hill now, investors just cannot seem to fully “buy onto” the idea that the Fed will actually carry out its program to reduce its securities portfolio by $2.4 trillion over the next year and one-half.

Under Chairman Ben Bernanke’s leadership, following the Great Recession, the Fed entered into three rounds of quantitative easing, and during this time, the S&P 500 Stock Index went up and up and up.

Under Chairman Jay Powell’s leadership, fighting the Covid-19 spread, the Fed engaged in a program where $120.0 billion of securities would be added to the Fed’s portfolio every month. This lasted almost two years.

This seems to be the way the Fed does things these days, thanks to Mr. Bernanke.

But, now the Fed has a plan to see its securities portfolio go down by $95.0 billion every month for about one and one-half years.

But, whereas Federal Reserve officials were able to convince investors that it would “stay the course” on its stated program when it was buying securities to increase its portfolio, the Fed appears to be having trouble convincing investors that it will be as diligent in reducing the size of its portfolio.

And, so the stock prices are being very volatile.

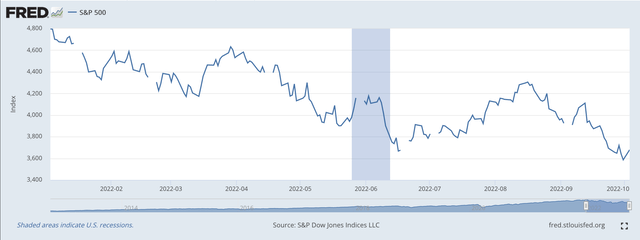

Here is the picture of stocks this year, courtesy of the S&P 500.

Standard & Poor’s 500 Stock Index (Federal Reserve)

Stock prices seem to be headed up this week.

But, the Federal Reserve insists that it will still carry on.

The question to me is whether or not the Fed’s stated plans will reduce its securities portfolio enough.

Would you believe that around the first of December 2007, the Fed held right at $780.0 billion in its securities portfolio, all U.S. Treasury securities?

Yes, you see the number correct…that’s BILLIONS of dollars.

At the end of the latest banking week, the Fed holds $8.4 trillion in its securities portfolio.

Yes…TRILLIONS of dollars.

If, in its current program, the Fed only removes a projected $2.2 trillion in securities from its portfolio, will this really be enough?

Or, will there still be too much cash in the commercial banking system to really effectively combat inflation?

This is the real dilemma to me.

The Fed has put so much money into the financial system over the past 15 years that just taking out $2.2 trillion will not really do what is necessary to fight the inflationary pressures that exist right now.

This, it seems to me, is the ultimate battle. And, it will take a long time, and, achieving it will be painful.

Always, putting too much liquidity into the financial system comes back to haunt a central bank.

At some time in the future, the central bank must pay for its past largesse.

The one thing the Federal Reserve seems to have going for it is that even though it was very, very loose in the past, other central banks have exceeded it is their looseness.

And, these central banks are paying for it right now. This is a major reason why the U.S. dollar has been so strong in foreign exchange markets recently.

So, the United States is only on the cusp of its difficulties. There is much more work to be done.

Investors are correct in testing whether or not Mr. Powell and this central bank really have what it takes to keep money tight for a sufficiently long time to put a dent in the financial conditions they have previously created.

Be the first to comment