niphon

Investment Thesis

Donaldson Company, Inc.’s (NYSE:DCI) stock has gained ~17% since our last article, significantly outperforming the S&P 500’s (SPY) flattish performance. The company is experiencing good demand across its end markets, which is benefiting its volume growth and backlog. DCI also has a strong backlog across all end markets and geographic regions, except for the disk drive business. This, coupled with the pricing actions taken to offset the inflationary pressures, should continue to drive sales growth. The margins are also improving on a Y/Y and sequential basis due to the pricing actions and the operating expense leverage and this improvement should continue in the coming quarters. Further, the company is redesigning its business to better serve its end markets and improve its profitability. The valuation is still at a discount versus its historical levels, and hence I believe that the stock can continue its outperformance.

DCI’s Q1 FY23 Earnings

DCI recently reported better-than-expected first-quarter FY23 financial results. The revenue in the quarter was up 11.4% Y/Y to $847.3 mn (vs. the consensus estimate of $827.04 mn). The adjusted EPS increased 23% Y/Y to $0.75 (vs. the consensus estimate of $0.71). The revenue growth was driven by the combination of 11% pricing and 8% volume growth, partially offset by an 8% negative FX headwind. The adjusted operating margin in the quarter was up 90 bps Y/Y to 15%, primarily due to operating expense leverage and pricing actions. This benefited year-over-year adjusted EPS growth.

Revenue Outlook

The overall end market conditions for Donaldson remained favorable in Q1 FY23. Additionally, the stabilization of global supply chain pressures helped the company bring down its backlog levels and improve fill rates. The pricing action implemented to offset inflationary pressures also supported sales in the quarter. The Engine Product segment’s sales were up 15% Y/Y to $605 mn, driven by price increases (+13% Y/Y) and volume growth, partially offset by a 7% negative FX headwind. Within this segment, off-road and on-road business sales were up 15% Y/Y and 14% Y/Y driven by high levels of equipment production and an increase in medium and heavy-duty truck builds, respectively. The Engine Aftermarket business’s sales were up 14% Y/Y to $427 mn with both OEM and independent channels up double-digit Y/Y. In the Aerospace and Defense business, the sales were up 22% Y/Y to $34 mn driven by the strength of new equipment and replacement parts as the commercial aerospace industry continues to recover from pandemic-related softness.

The sales in the Industrial segment increased 4% Y/Y driven by 7% pricing, partially offset by an 8% negative FX headwind. The Industrial Filtration Solutions (IFS) business is the largest contributor to the segment’s revenue and grew 9% Y/Y to $181 mn primarily due to new dust collection equipment and replacement part sales. The Gas Turbine Systems (GTS) business grew 53% Y/Y to $26 mn due to easier comps. The sales of the Special Applications business were down 29% Y/Y due to the reduction in disk drive market demand and destocking issues.

Looking forward, the pricing momentum from 2022 is expected to continue in 2023 and management is expecting the pricing to contribute 6% to the sales growth in FY23. Pricing should benefit more in the first half of FY23 compared to the second half as comps are easier in the first half. Additionally, the backlog across all the geographies and end markets remains strong (except for the disk drive business) which should benefit sales in FY23.

The company has raised its guidance for off-road and on-road businesses from negative low single-digit to flat Y/Y growth in FY23 due to the improvement in chip shortage issues and healthy demand. The Aftermarket business should benefit from the high levels of vehicle utilization in major regions and market share gains in underpenetrated regions such as Mexico and Brazil. The Aerospace and Defense business should continue to benefit from the strong commercial aerospace industry. Both businesses are expected to grow in the mid-single digit Y/Y in FY23. Given the strength across all the businesses, the Engine segment is expected to grow between 1% and 5% in FY23.

The management has lowered the sales growth guidance range for the Industrial segment by 200 bps to 1% to 5% due to the weakness in the disk drive business. The weakness in this business is due to the weaker demand in the PC market and among cloud providers. As a result, DCI’s channel partners have begun inventory destocking. The Special Applications (which includes disk drive business) sales are expected to be down mid-teens Y/Y in FY23 versus the previous guidance of flat growth. The IFS business is expected to grow by high single-digits Y/Y driven by the strong performance of the dust collection equipment as well as the process filtration business. The GTS business should grow low single-digit Y/Y in FY23.

Management maintained the full-year guidance of revenue growth between 1% and 5% Y/Y, despite headwinds in the disk drive business as better than expected performance in On-road and Off-road business is expected to offset this weakness. DCI should be able to manage through the current uncertain macroeconomic environment given its resilient businesses in the Advance and Accelerate portfolio, such as replacement parts, process filtration, and vending solutions. DCI’s major customers, such as Caterpillar (CAT) and Deere & Co (DE) are anticipating sales increases across their business in 2023 as the order levels and backlog remain strong. Below is a quote from DE’s CFO John May from their recent Q4 2022 earnings conference call,

As I look ahead to fiscal year 2023 and beyond, I truly believe our best years are still ahead of us. In the near term, order books across our businesses are full into the third quarter. And it’s important to note that not only do the order books continue to fill when we open them, but the velocity of orders has remained strong.”

From a medium to long-term perspective, the company announced an organizational redesign in October to better serve its end markets. This redesign, once completed, should allow DCI to efficiently strengthen its commercial execution across its entire customer base. The company has moved from its previous regional-focused model to a more comprehensive end-market-focused model. This new model focuses on three areas; end-market customers, employee development, and profitable growth. The company is aligning its resources and cost structures to meet the specific needs of each end market. This should enable DCI to serve its customers in a more efficient and effective manner. The simplified structure should reduce organizational complexity and enable clear advancement paths for its employees. Under this new model, each business unit will have full P&L responsibility, which should create greater internal ownership and accountability for long-term and short-term performance.

Apart from its organic growth, the company is also working on its inorganic growth by leveraging its recent acquisitions to further diversify the company. In fiscal 2022, DCI acquired three companies Solaris Biotech, PA Industrial Services, and Purilogics. All these companies fall under the Industrial segment. Solaris Biotech and Purilogics are Life Sciences companies, and DCI plans to further expand its presence in this market through M&As. So, I am optimistic about the company’s long-term growth prospects.

Margin Outlook

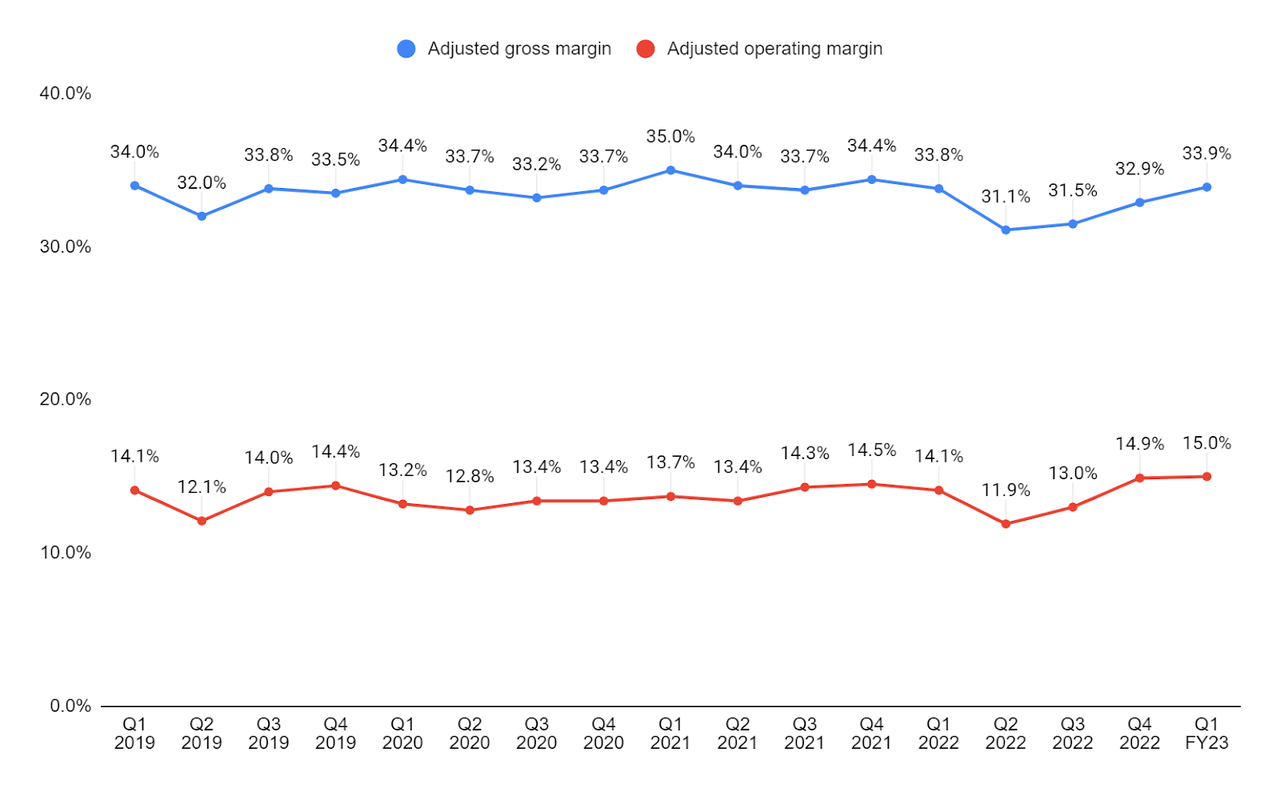

The adjusted gross margin in the quarter improved slightly by 10 bps Y/Y to 33.9%, primarily due to the pricing actions taken by the company. The adjusted operating expense as a percentage of sales was down 80 bps Y/Y to 18.9% due to the leverage on higher sales. The growth in adjusted gross margin and lower adjusted operating expense as a percentage of sales led to a 90 bps Y/Y increase in adjusted operating margin.

DCI’s adjusted gross margin and adjusted operating margin (Company data, GS Analytics Research)

Looking forward, the second quarter FY23 gross margin should be impacted due to seasonality (holiday season). However, the pricing actions taken in 2022 should continue to benefit the adjusted gross margin in FY23. Additionally, the input costs have started to stabilize and are expected to continue going forward, which should benefit margins. The company is expecting an adjusted operating margin of between 14.5% and 15% for FY23, which implies a 75 bps improvement at the midpoint versus FY22’s 13.5% operating margin. I believe the company can easily achieve this target given the 90 bps operating margin improvement in Q1 FY23 and easing raw material cost inflation.

Valuation & Conclusion

The stock is currently trading at 19.87x FY23 consensus EPS estimate of $3 and 19.02x FY24 consensus EPS estimate of $3.16, which is lower than its five-year average forward P/E of 22.91x. The company is experiencing healthy demand across its end markets, which should benefit sales along with the higher price realization. The company’s margin should benefit from the pricing actions and operating expense leverage. Given the good growth prospects and lower than historical valuation, I have a buy rating on the stock.

Be the first to comment