towfiqu ahamed/iStock via Getty Images

Senseonics Holdings, Inc. (NYSE:SENS) shares have dropped 53% in the past year, with the stock trading 55.84% below the 52-week high. In its Q2 2022 earnings release, SENS exceeded analysts’ expectations to hit a revenue of $3.71 million despite missing its earnings per share (EPS) by $0.01. This stock caught my attention after the FDA’s premarket approval of its long-term implantable continuous glucose monitoring (CGM) – Eversense system in 2018, the first of its kind in the world. The company has continued to improve on its constituent medical structures after this approval.

Thesis

Senseonics plans to increase the launch locations of its long-term Eversense E3 CGM system after securing the FDA’s approval back in Q1 2022. Investors should also not downplay, the company’s collaboration with Anthem/ Elevance (ELV) which has helped increase the value of Eversense. Due to its positive expectation of growth and performance, the company also raised its revenue guidance for the full-year 2022 vowing to augment shareholder value.

Business Overview into H2 2022

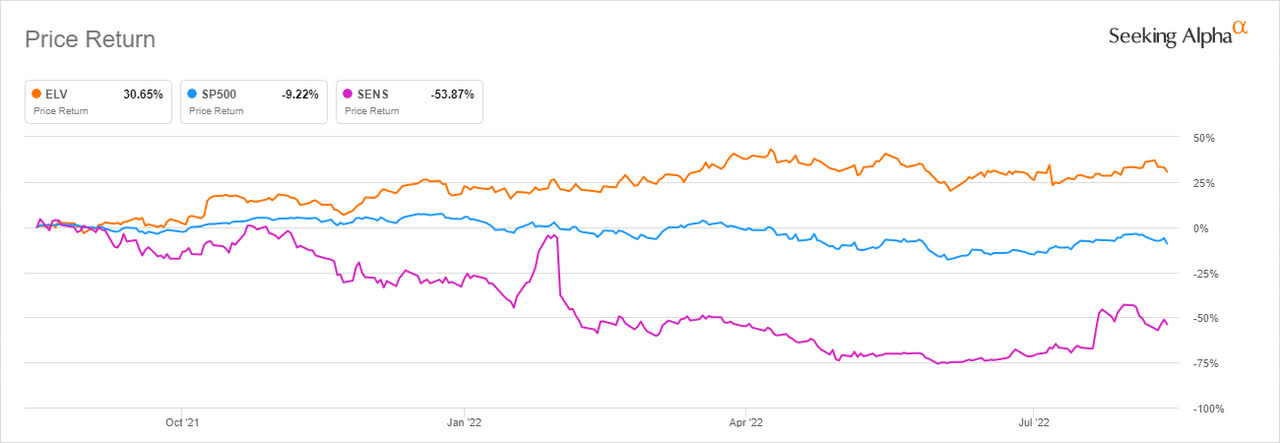

Senseonics, a medical technology firm with headquarters in Germantown, Maryland is focused on developing long-term implantable continuous glucose monitoring (CGM) systems for diabetes patients. The company scored big after announcing that Elevance Health (formerly Anthem) accepted to provide coverage to its implantable CGM systems including Eversense. This decision adds more than 45 million covered lives with more payers writing Eversense into their CGM coverage policies. ELV outpaced both the S&P 500 (at -9.22%) and SENS (at -53.87%) in the one-year analysis rising by more than 30%.

Seeking Alpha

Through its affiliated companies, Elevance serves patients across 14 states in the U.S. with more than 45 million people included in its family health plans. The decision to partner with SENS comes after agreeing to provide coverage to Cigna Corp (CI), and Humana Inc. (HUM) among other insurance providers. This commitment shows Senseonics stands to benefit from an increased broad-based coverage across the U.S that will enable payers to access the benefits of the long-term Eversense CGM system.

Currently, CGM covers more than 250 million people as well as pays for the in-office sensor insertion session for healthcare providers. What this addition means is that Senseonics’ global commercial partner, Ascensia will be able to introduce more diabetes patients to the Eversense CGM system. Big healthcare players in the diabetes space have embraced strategic partnerships in the second half of 2022 to increase awareness of disease control mechanisms.

Anthem, the second largest health insurer in the US with a market cap of $116 billion, is preceded by UnitedHealth Group, Inc (UNH). UNH has a market cap of almost $500 billion and its quarterly revenue hit the record mark of $80.332 billion in Q2 2022. UNH’s subsidiary Optum announced that it was working with Sanofi (SNY) – an R&D therapeutics company – to supply affordable insulin. The company is giving a 30-day offer of Sanofi insulin to diabetes patients at $35 through its online system, Optum Store.

At the beginning of August 2022, UNH announced that it was launching the Diabetes Prevention and Control Alliance (DPCA) in partnership with U.S. YMCA and Walgreens (WBA). The DPCA program aims to help diabetes patients control their condition through education and support. While UNH is providing free cover to program participants, it plans to harness WBA’s presence in local communities to market its overall services.

According to the CDC, more than 34 million people in the U.S. of all ages (approximately 1 in 10 people) have diabetes. Additionally, about 88 million adults (1 in 3) have pre-diabetes. The U.S agency estimates that 1 in 3 Americans are likely to develop diabetes at a point in their lives, making curative and management measures necessary. On its part, CGM has been proven as a necessary medical tool to manage individuals with diabetes in certain circumstances. The first is short-term use which normally takes 3 to 14 days. It is used by a healthcare providers to offer diagnostics to patients. The second, long-term CGM use, helps in managing pregnant diabetic individuals while the third, Long-term use applies to patients with type 1 and type 2 diabetes. As an example of CGM, Eversense acts as an implantable glucose sensor.

Advanced Sensor and Digital Offerings

February 2022 saw Senseonics obtain approval from the FDA to market and commercialize its 180-day version of Eversense. This is after acquiring the 90-day CGM system back in 2018. The new Eversense E3 device is a long-term (surgical) implant that works for 6-months without the need for replacement.

Senseonics

Eversense E3 CGM system

While releasing the Q2 2022 earnings results, Senseonics CEO Tim Goodnow stated:

We believe the ability to share 6 months of CGM data on a single sensor provides significant value to patients and their providers, and we will continue to advance our digital capabilities with additional partners in the coming quarters.”

Senseonics is unrivaled in this delivery, as it not only plans to introduce novel diabetes management systems but also more doctors and patients to the E3 product offering. The implanted nature of this technology will bring on board new clinical workflow as the company continues to advance the 90-day Eversense system.

In June 2022 (just before the closure of Q2 2022), Senseonics announced that it had received the CE mark for the next generation Eversense E3 CGM system. This approval opens the way for the usage of the E3 CGM system in the member states of the European Union (EU). The work of Ascensia, Senseonics’ commercial partner will be to make it available in the European markets from Q3 2022. Investors should at this point consider an increase in revenue into the fourth quarter of 2022 and beyond.

It is vital to mention, that the approval of the E3 system (unlike the Eversense XL system) entails its non-adjunctive (or its ability to inform insulin treatment decisions without confirming the patient’s glucose levels from a simple finger-stick test). Coupled with the coverage agreement with Anthem or Elevance, Senseonics will increase its competitiveness in the diabetes management market since it has the longest-lasting CGM product worldwide.

The CGM market size is estimated to be worth $32.5 billion as of 2030. From the base year of 2021 and in the forecast period of 2022 to 2030 the market is expected to grow at a compounded annual growth rate (CAGR) of 10.7%.

Senseonics is fighting for CGM market share with other dominant players such as Abbott Laboratories (ABT), DexCom Inc. (DXCM), and Medtronic plc (MDT) among others. With up to $178.45 billion in market capitalization, Abbott Laboratories announced that the FDA had approved its Lifestyle Libre Pro continuous glucose monitoring (CGM) system for use by clinicians among diabetes patients. The company currently markets the consumer version of the FreeStyle Libre in Europe while the Pro version has been approved by the FDA for clinical applications. Europe proves as an important market for CGM-related systems thereby vindicating Senseonics’ move to seek CE approval.

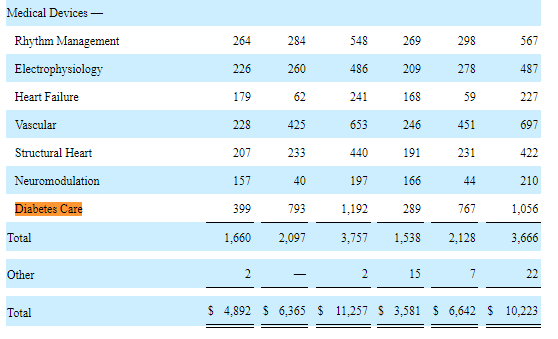

In fact, in the three months ended on June 30, 2022, Abbott Laboratories recorded a 12.88% increase in Diabetes care-related sales in the U.S. and the international market.

Abbott Laboratories

In the U.S., diabetes care garnered $399 million an increase of +38.06% from Q2 2021 while the international market’s sales stood at $793 million a rise of 3.39% from the same period in 2021.

Risks

Senseonics has not yet shared the exact cost of the Eversense E3 system. We believe that if this new model exceeds the daily cost of the 90-day sensor, then it will harm sales thereby affecting revenue. This risk can be averted if the company moderates the price so that it matches the 90-day sensor.

It is also vital to note that most insurance companies will cover the cost of the insertion and procedures for removal after the expiry of the insertion period. The high cost may therefore be felt through an out-of-pocket acquisition. If the patient has Medicare and also requires insulin then, the insurance will cover the costs associated with the procedure.

It will be important for Ascencia (as the commercial partner for Senseonics) to provide a patient assistance program to help clients understand how the CGM costs will be covered in case there lacks adequate insurance coverage.

Since 2010, Senseonics has narrowed its focus on R&D to establish a commercially viable CGM. It has never generated significant revenue as a result of product sales. It has increased its net losses from $115.5 million in the year ending on December 31, 2019, to $302.5 million in the year ending on December 31, 2021 (an increase of 161.9%). By June 30, 2022, the accumulated deficit had hit a high of $760 million. However, the company managed to lower its accumulated deficit by $191 million showing an improvement in earnings by 20.08% (QoQ).

Additionally, the company’s cash position as of Q2 2022 stood at $150.5 million (down 17.22%) from $181.8 million recorded in the quarter ending on December 31, 2021. This cash position is still high considering the cash used in operating activities in the six months ending on June 30, 2022, was $34 million thereby inferring that it can support its operations into 2023.

Takeaway

Senseonics’ goal of having diabetes patients use time-in-range CGM systems to access insulin will be realized with the successful commercialization of the Eversense technology. Both type 1 and type 2 diabetes patients now have an increased option of either using the 90-day or the 180-day CGM system to not only measure glucose levels but also manage their health condition. However, the company is yet to hit significant product sales due to commercialization challenges. Market expansion into Europe is expected to add much-needed revenue sources especially since the company has the ground-breaking E3 product. While fundamental challenges exist, we expect the company to explore all market options to ensure they add revenue into 2023. For these reasons, we propose a hold rating of the stock.

Be the first to comment