sankai

The abrdn Income Credit Strategies Fund (NYSE:ACP) is a high yielding closed-end-fund (“CEF”) that pays an attractive 17% current yield from its portfolio of international senior loans and bonds.

However, like many CEFs I have reviewed recently, my main concern with the ACP fund is that it is trying to maintain a distribution yield that is unsustainable, judging by the fund’s 10 year average annual return of 7.9% from 2012 to 2021 vs. the current yield of 16.9% of NAV. Every year that the fund pays out more in distribution than it earns will shrink the earning asset base for future years. This creates a long-term negative spiral of shrinking NAV and shrinking distribution.

Fund Overview

The abrdn Income Credit Strategies Fund is a closed-end-fund that seeks to provide high levels of current income with a secondary objective of capital appreciation. The fund has $166 million in net assets as of October 31, 2022. (note, while Seeking Alpha has the fund’s name as Aberdeen Income Credit Strategies Fund, the asset manager, Standard Life Aberdeen, rebranded itself to abrdn in April 2021).

Strategy

The ACP fund seeks to achieve its investment objectives by investing primarily in loans and debt instruments (and related derivatives) of issuers that operate in a variety of industries and geographies. The fund aims to emphasize high current income by investing in high yield senior secured floating rate and fixed rate loans and in second lien or other subordinated loans or debt instruments. The fund also uses leverage to enhance returns. As of November 30, 2022, the fund had $128 million in leverage vs. $304 million in gross assets for 42% leverage.

Portfolio Holdings

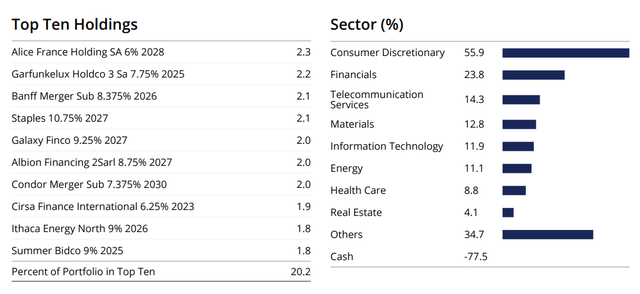

Figure 1 shows ACP’s top 10 holdings and sector allocation as of October 31, 2022. The fund’s largest sector allocations are Consumer Discretionary, Financials, Telecom, and Materials.

Figure 1 – ACP top 10 positions and sector allocations (ACP October 2022 factsheet)

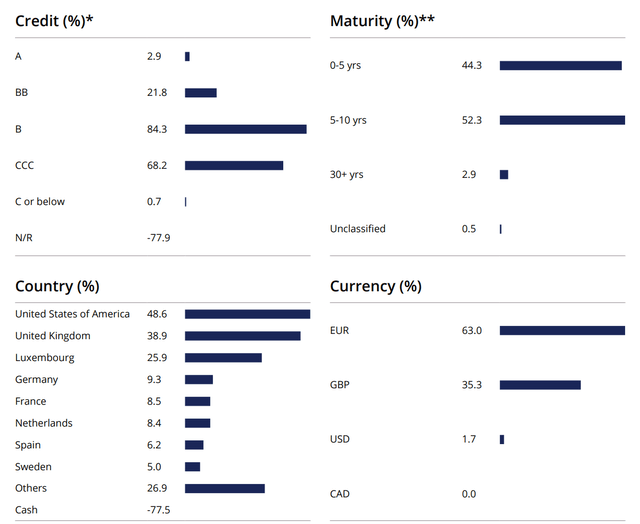

The ACP fund has a large international component, as shown in Figure 2. Only 49% of the fund’s assets are invested in the U.S., and almost all of the fund’s assets are denominated in Euros (63%) and GBP (35%). The ACP fund has a modified duration of 5.95 years, with 44% of assets maturing in less than 5 years.

Figure 2 – ACP portfolio allocation by credit, maturity, geography and currency (ACP October 2022 factsheet)

Returns

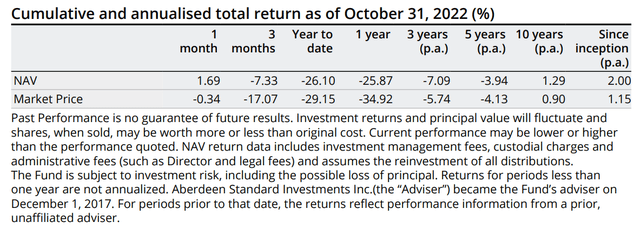

The ACP fund has had poor historical returns, with 1/3/5/10 Yr annualized returns of -25.9%/-7.1%/-3.9%/1.3% respectively to October 31, 2022 (Figure 3).

Figure 3 – ACP historical returns (ACP October 2022 factsheet)

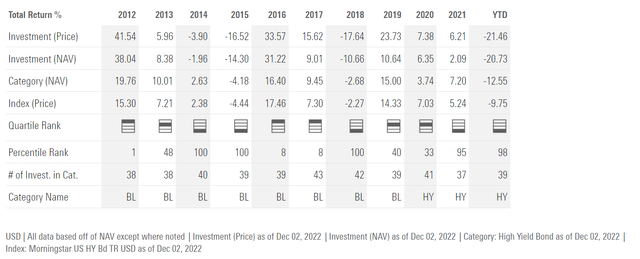

The poor long-term performance is primarily the result of a horrible 2022 that has erased several years of returns (Figure 2). Excluding 2022, ACP’s average annual total return on NAV was 7.9%.

Figure 4 – ACP annual returns (morningstar.com)

Distribution & Yield

The ACP fund pays a high distribution yield of $0.10 / month, which translates to a market yield of 17.1%. On NAV, the distribution yield is 16.9%. The monthly distribution rate has been held constant since late 2020.

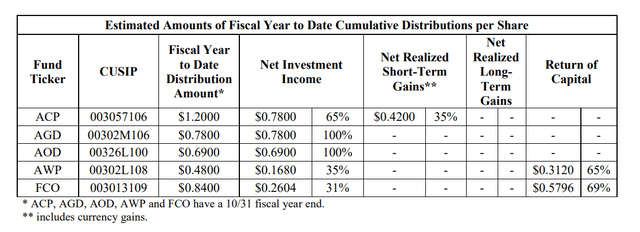

Investors should note that the fund’s fiscal 2022 distribution of $1.20 is 35% funded through return-of-capital (“ROC”) (Figure 5).

Figure 5 – ACP’s distribution is partly funded through ROC (ACP October 2022 Section 19 notice)

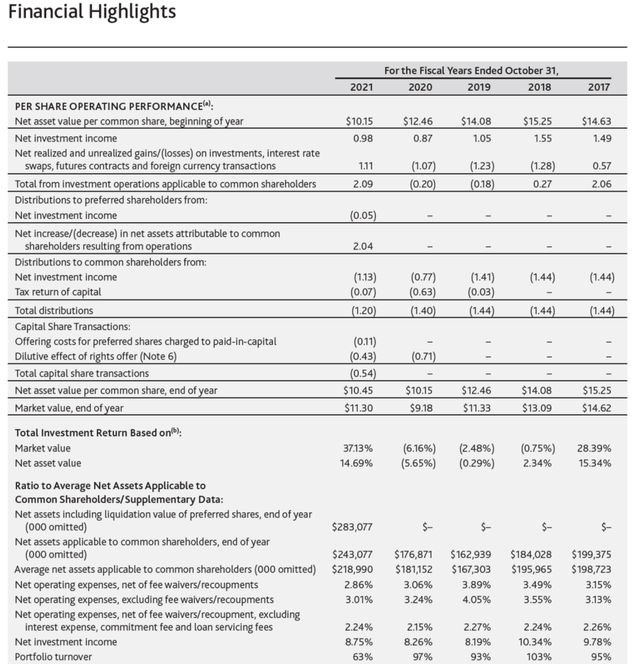

In fact, from the fund’s 2021 annual report, we can see that in the past 5 fiscal years, the fund has earned $4.04 / share in income and capital gains, but paid $6.92 / share in distributions (Figure 6).

Figure 6 – ACP financial highlights (ACP 2021 Annual Report)

The overpayment of distribution vs. income has shrunk the NAV from over $15 in 2017 to $7 currently, and the distribution has been cut from $0.12 / month in 2017 to $0.10 / month currently. Given the high forward yield, there is a high likelihood of another distribution cut in the near future.

Fees

The ACP fund charges a 3.06% net expense ratio. This is high relative to other peer funds.

Proposed Fund Merger To Double Net Assets

In November, the ACP fund’s shareholders voted in favour of acquiring the assets of the Ivy High Income Opportunities Fund (IVH), a $190 million CEF that pays an 8.0% trailing yield. The fund merger will more than double ACP’s net assets and is expected to complete in Q1/2023. I believe the manager will revisit the fund’s distribution rate after the fund merger.

Conclusion

In summary, the ACP fund pays an attractive 17% current yield from its portfolio of high yield international loans and bonds. However, my main concern with the ACP fund is that it is trying to maintain an unsustainably high distribution yield. Every year the fund pays out more in distribution than it earns will shrink the earning asset base for future years. This creates a long-term negative spiral of shrinking NAV and shrinking distribution.

Be the first to comment