Scott Olson

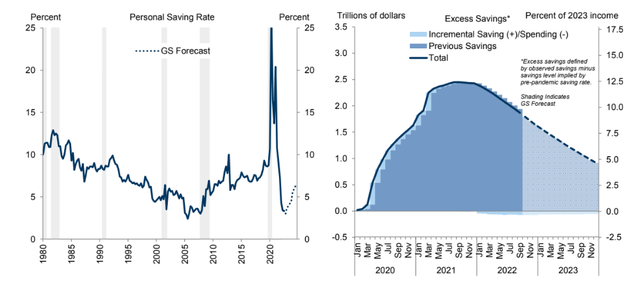

All eyes will be on the consumer in 2023. With robust retail sales numbers in recent months, but dwindling excess savings from the pandemic, the U.S. Personal Saving Rate has collapsed to decade-plus lows. The hope is that a soft landing in the labor market will help cushion the blow of potential monthly job losses next year – small net retractions in the NFP numbers would be acceptable compared to steep labor market declines seen in past recessions. As it stands, consumers keep spending, but there are signs of trading down to lower-cost retailers.

Dollar Tree (NASDAQ:DLTR) reported strong results on Tuesday, but tepid guidance and rising costs are big risks. Is the stock a buy now? Let’s browse the aisles.

Consumer In Focus: Saving Rate Down, Excess Savings Falling Hard

Goldman Sachs Investment Research

According to Bank of America Global Research, Dollar Tree is one of the largest dollar store chains in the United States, with over $25 billion in revenues in 2020. The company operates 15,685 stores in 48 US states and five provinces in Canada under the Dollar Tree, Family Dollar, and Dollar Tree Canada banners, and stores carry an assortment of consumables, general merchandise, and seasonal products.

The Virginia-based $6.9 billion market cap General Merchandise Stores industry company within the Consumer Discretionary sector trades at a high 22.0 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

The firm reported beats on the top and bottom lines on Tuesday morning, but shares traded sharply lower as cost pressures persist with the well-known dollar(ish) store. Weak earnings guidance was also a bearish culprit.

Dollar Tree has significant near-term headwinds from rising labor costs to higher shipping rates to traffic recovery headwinds. Inflation and a weakening consumer are not positive trends, despite the natural and obvious trade-down effect among middle-income families.

Further downside risks include growing competition from other dollar stores and discount retailers – particularly in the dog-eat-dog food retail area. SNAP benefit cuts is a concern, too. Upside potential, though, stems from better same-store sales growth, improved margins due to category spending shifts, and even a loosening of tariffs.

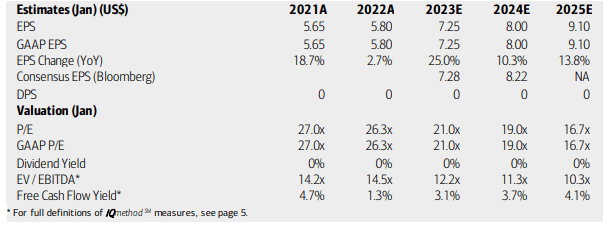

On valuation, analysts at BofA see earnings having grown below the rate of inflation in 2022, but then a sharp acceleration is seen next year along with robust per share profit growth in 2024 and 2025. The Bloomberg consensus forecast is even more sanguine on EPS in the next two years.

Still, both the operating and GAAP P/Es remain at a premium to the market, though in line with the richly valued Consumer Discretionary sector. DLTR’s EV/EBITDA is also high, but the firm is free cash flow positive. The firm’s forward PEG ratio is 1.2, significantly below its 5-year average of 2.0. Overall, the valuation is good considering its growth prospects.

Dollar Tree: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

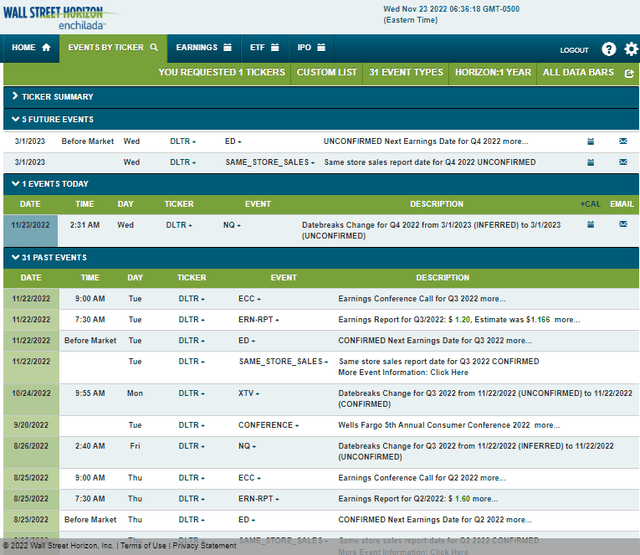

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Wednesday, March 1 BMO. The calendar is light until that event, however.

Corporate Event Calendar

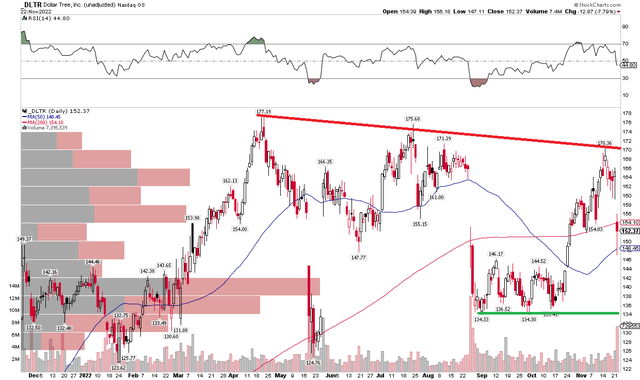

The Technical Take

DLTR has a messy, rangebound chart in the last year. But that’s not necessarily a bad thing in this weak year for the broad market and, specifically, the Consumer Discretionary sector.

I see resistance at a downtrend line off the April high – shares met sellers there in July and again just in November before its Q3 earnings results hit the tape. There is support, though, at $134 (and the longer-term chart shows an impressive zone around $120 that should hold up).

Overall, I would like to see the stock breakout above the $170 level and make new all-time highs above $177 to help solidify a new bullish move. Until then, the stock is simply meandering in a broad range with volatility. I’d look to buy the dip on a move to $140 – notice the high volume-by-price that begins there. A sell-stop order below $134 would make sense for a favorable risk/reward. Profits should be taken on an approach of the mid-$160s.

DLTR: Shares Consolidating, But Still Outperforming The Broad Market

The Bottom Line

I like DLTR valuation here given the growth outlook, but major macro risks pose a threat to earnings next year. It might be too soon to buy the stock, but buying on weakness over the next six months could prove to be a good play. The PEG ratio is attractive. The chart, though, is simply in consolidation mode. I’d wait for a breakout before getting long.

Be the first to comment