TomasSereda/iStock via Getty Images

Overview

In this series of articles, I am focusing on single Dividend Challenger stocks and determining whether they are solid long-term buy options for investors based on a number of criteria related to performance, financial strength, valuation, dividend strength, etc. In the first article of this series, I reviewed the Dividend Challenger stock ACCO Brands (ACCO) and determined it to be a hold for current shareholders and should be avoided for other long-term investors. That article can be found here.

Dividend Challengers are stocks that have increased their dividends every year for at least five consecutive years. This list is maintained with the Dividend Champions (25+ years) and Dividend Contenders (10+ years). More information on these lists can be found here.

For this article, I will be reviewing the stock performance, financials, recent news, valuation, and dividend strength of Willis Towers Watson Public Limited Company (NASDAQ:WTW).

Willis Towers Watson Public Limited Company is an advisory, broking, and solutions company that operates in two segments: Health, Wealth and Career & Risk and Broking. The company was founded in 1828 and is based in London.

Dividend

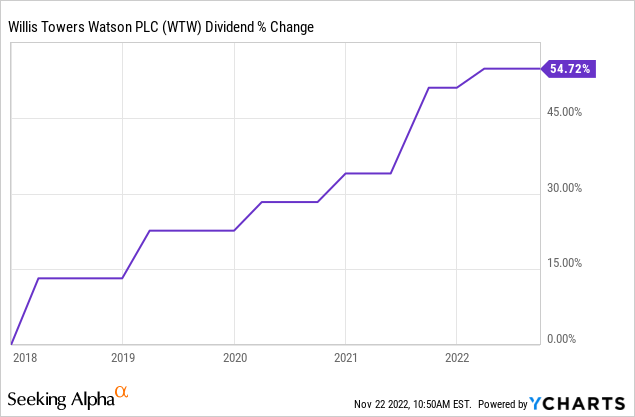

Willis Towers Watson Public Limited Company is on the Dividend Challengers list with 6 years of consecutive dividend growth. Looking at the chart below, you can see that this stock has increased its dividend by over 50% over the past five years.

WTW’s quarterly dividend in 2022 is $0.82 per share, up from $0.80 and $0.71 in 2021.

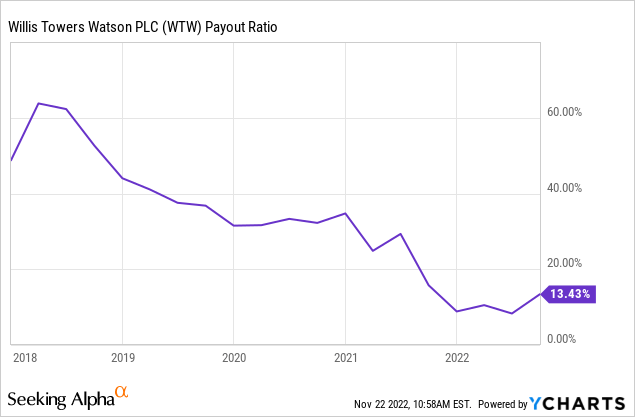

Looking at the chart below, you can see that WTW’s payout ratio has dropped significantly in recent years and is low, meaning that it should be able to continue its dividend growth moving forward.

WTW currently has a dividend yield of 1.38%.

Financials

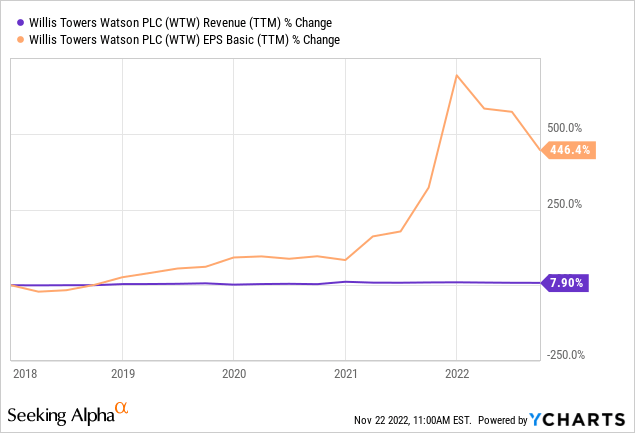

WTW has seen a fairly steady rate of low revenue growth over the past five years. Compared to its earnings growth, revenue looks flat having gained just 7.90% over the past five years. Earnings growth has been far more impressive even though it has seen a slight decline from its peak at the beginning of this year.

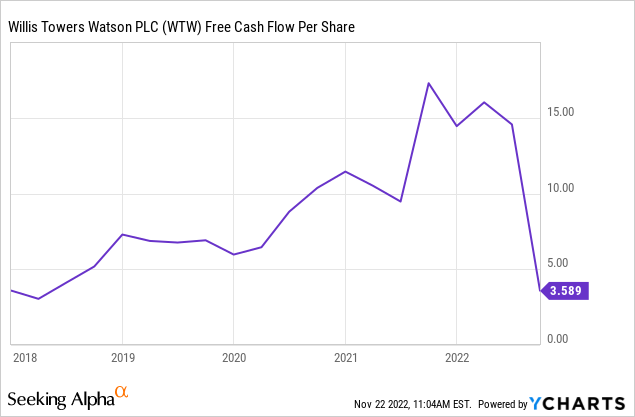

When looking at cash, you can see that WTW’s free cash flow per share had seen a fairly steady increase in recent years; however, that trend ended this year as its current free cash flow per share is at its lowest level in the past several years.

If this continues it could apply pressure to WTW’s current low payout ratio and future dividend growth.

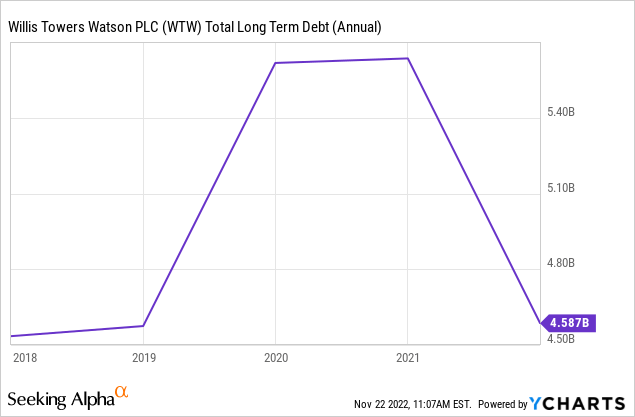

WTW has been able to lower its long term debt from its higher 2021 levels as seen in the chart below.

In its last quarterly report, Willis Towers Watson beat its earnings estimate but missed its revenue estimate with a 1% decline in revenue compared to the same quarter last year.

Valuation and Performance

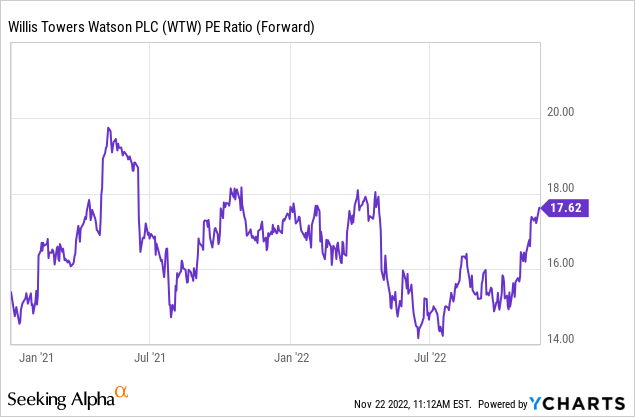

WTW currently has a forward PE ratio of 17.62. Looking at the chart below, you can see that this is on the upper end of its recent historical average.

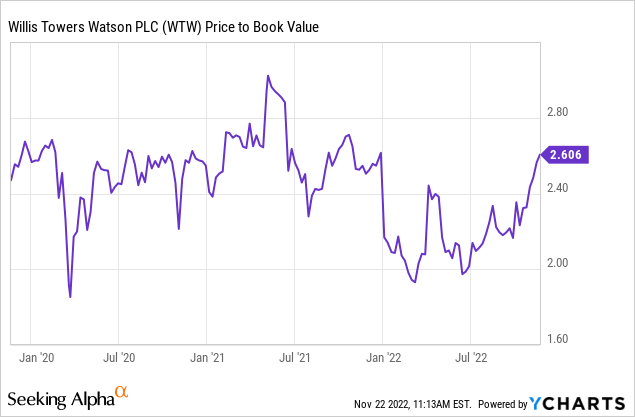

A similar trend can be seen when looking at WTW’s price to book value.

At first glance, this seems like a negative and appears to make WTW an overvalued stock; however, this does not take into consideration WTW’s price performance during this time period.

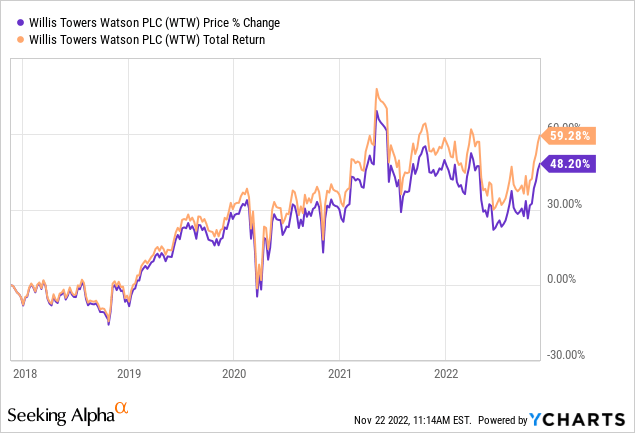

Looking at the chart below, you can see that WTW’s stock price is also near its five year high which makes its current valuation a little more reasonable.

Peer Comparison

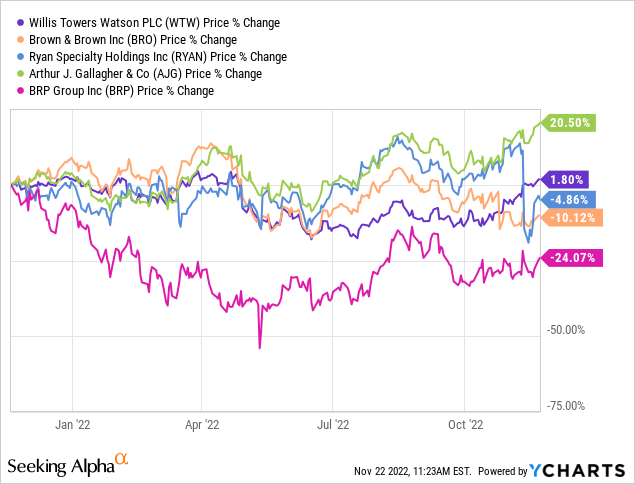

A few stocks within the same industry as ACCO include Brown & Brown (BRO), Ryan Specialty Holdings (RYAN), Arthur J. Gallagher (AJG), and BRP Group (BRP).

In terms of stock price, you can see in the chart below that only Arthur J. Gallagher has performed better over the past year, with Brown & Brown, Ryan Specialty Holdings, and BRP Group all having seen a decline in price during this time.

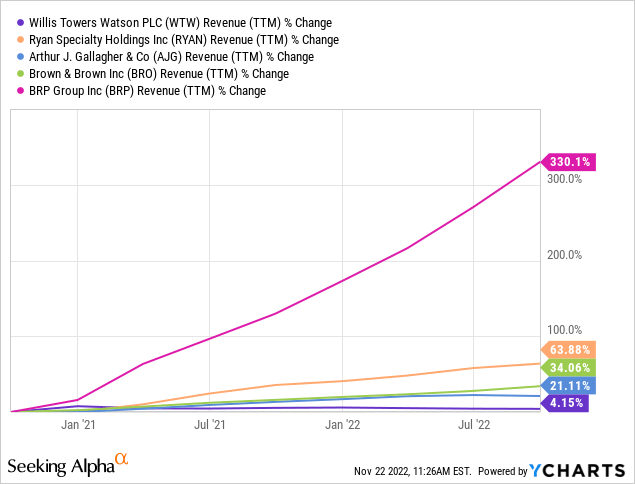

When looking at revenue, Willis Towers Watson has seen the lowest growth rate over the past three years.

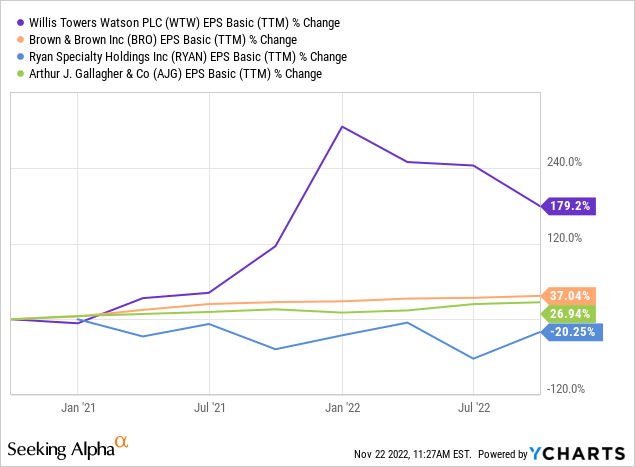

However, when looking at earnings, Willis Towers Watson has seen the highest growth over the past three years.

Recent News

WTW’s quarterly results were announced last month and as noted above the results were mixed with the company beating earnings estimates but missing revenue estimates. Looking through the earnings call transcript there are some things to be excited about:

- organic revenue growth accelerated, reaching 6% this quarter

- continue to execute against our capital allocation strategy, completing $369 million in share repurchases in the third quarter

- realized $29 million of incremental annualized savings

- raising our guidance on cumulative run rate transformation savings action by the end of 2022 from over $80 million to approximately $110 million

- New/enhanced products such as WTW’s Global Peril Diagnostic Tool and the launch of Risk Intelligence Quantified.

And there are other items that continue to be of concern:

- Impact of WTW’s Russian divestiture

- Fluctuations in foreign currency rates

- Rising commercial interest rates

- Labor shortages

Conclusion

I do believe that WTW is a solid long term buy option for investors with the right expectations. WTW’s revenue growth is what it is. Solid, dependable mid single digit yearly increases. I don’t expect growth beyond that, but I also don’t believe there is too much of a risk that this low growth won’t continue or that its dividend growth won’t continue on the same path it has seen recently.

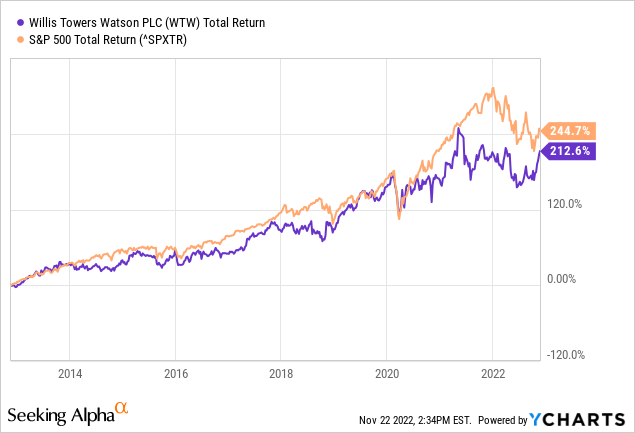

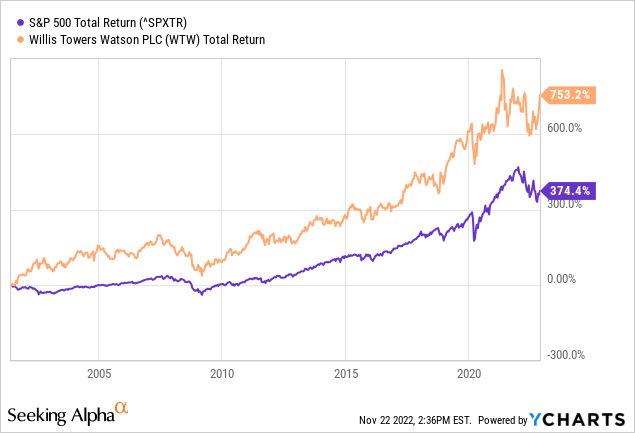

Looking at the charts below, you can see that WTC has tracked very closely to the S&P 500 over the past 10 years and has actually outperformed it when looking at lengthier time frame.

I’m not alone in liking WTW as it was recently announced that Baupost Group recently increased its stake in the stock from 927K shares to 1.29M.

WTW’s revenue portfolio is pretty balanced with revenue coming in from Health, Wealth, BD&O, and Career segments reducing the risks associated with any individual segment. I think WTW compares favorably overall with its peers considering a stock like BRP does not pay a dividend and continues to have negative earnings or a stock like RYAN that has a forward PE value of 33.77 compared to WTW’s 17.62 value.

I do also like Brown & Brown as a long term investment option as it was recently included in my article ranking Dividend Champions within the insurance industry and came in 4th in overall ranking with the 2nd best 5-year dividend growth rate and the best stock price appreciation over the past 10 years compared to the other Dividend Champion insurance industry stocks.

As always, I suggest individual investors perform their own research before making any investment decisions.

Be the first to comment