bin kontan/iStock via Getty Images

The dislocations of the world seem to be coming home to rest.

And, it seems as if a lot of the impact created by these dislocations is resulting in a strong movement of monies into the U.S. dollar.

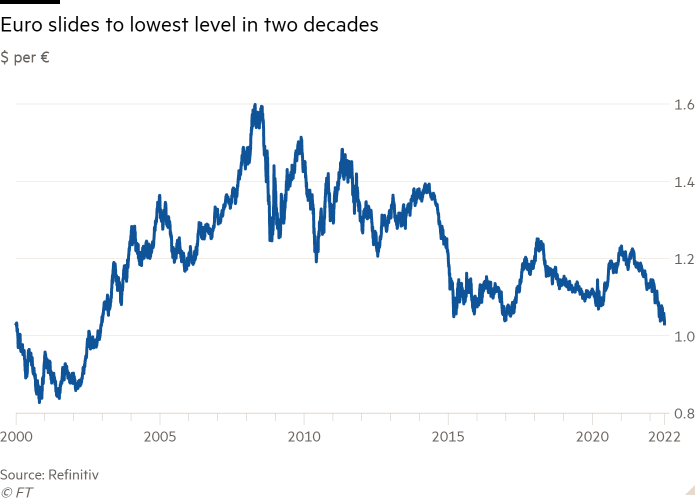

“In a sign of worsening sentiment about the growth outlook, the Euro dropped almost 1.4 percent against the dollar to $1.0243.”

Europe is in a mess.

The cost of one pound has also dropped below $1.2000.

And, as of 11:00 am in the United States the S&P 500 Stock Index had dropped by about 75 points to around 3,750 and the Dow Jones Industrial Average had dropped by about 700 points or to around 30,400.

This is the lowest point for the Euro since 2002.

Euro/Dollar exchange rate (Financial Times)

Money is pouring into the United States, but not into stocks.

Bitcoin continues to trade for around $19,000 or less.

Europe In Trouble

Gas prices have risen in Europe, connected with the Russia/Ukraine war, and a gas strike in Norway has certainly not helped.

But, there are other factors causing the move.

Inflation on the Continent has hit a new high for the Eurozone.

Furthermore, Germany has run a deficit in its trade balance for the first time in 30 years.

Italy is facing the worst agricultural problems in many years.

And, debt loads are really weighing on companies, and this is not going to get better if a recession hits the continent soon.

Furthermore, the political situation does not seem to be that stable in Europe.

Federal Reserve Continues To Outdo European Central Bank

As far as central bank policies are concerned, the Federal Reserve System in the United States seems to be far ahead of its European counterpart, ahead of the Bank of England, and the Bank of Canada, in keeping with a restrictive monetary policy fighting inflation.

Although investors seem to be thinking that the Fed will not follow up its 75 basis point increase in its policy rate of interest in June with another 75 basis point rise in July, the bets are still on that the Federal Funds rate will still be close to 3.33 percent early in 2023.

There are no indications that the other central banks will match this rate of increase over the next 12 months.

Thus, it seems as if the pressure will still continue on for the value of the U.S. dollar to rise in the coming months.

Many investors are still talking about the possibility that the U.S. dollar will reach parity with the Euro and with the British Pound by the end of the year.

This possibility certainly does not seem out of the question at this point in time.

The United States

But, the United States faces its own problems going forward.

Will the Federal Reserve create a recession with its “tight” monetary policy?

Will the Federal Reserve create stagflation with its “tight” monetary policy?

What will the Fed do if the stock market crashes?

What will the Fed do if some debt markets break?

There are already serious concerns being expressed about the future of the “blank check” space (the SPACs), and other debt sectors that expanded very rapidly during the Fed’s bath of liquidity that came with the 2020 Fed response to the Covid-19 pandemic and the subsequent recession.

And the list can go on and on.

As I have written about many times, the U.S. economy has endured many shocks over the past two years, and it has experienced supply chain problems, it has experienced employment restructuring, and it has, and will continue to face, major technological changes.

All these changes have created disequilibrium and dislocation problems throughout the economy.

The federal government, as well as state governments, have also contributed to the economy that is far “out of sync.”

Focus On The Dollar

I focus on the value of the dollar because of its central position within this whole complex of markets and industries.

The value of the U.S. dollar connects what is going on in the United States with what is going on in the rest of the world.

In this sense, it is a very, very important variable to keep watching.

When the dollar is doing things like it is doing now, one has to stop and think about why the dollar is performing the way it is.

The value of the dollar dropping from $1.1400 at the beginning of this year to under $1.0300 is significant.

Something is going on.

In today’s world, a lot is going on, and it is not very pretty.

So. catch up with the dollar. Learn from the movements in the dollar.

If the value of the dollar drops to parity with the Euro and with the British Pound, what does that imply for the U.S. stock market, for the U.S. economy, for the Eurozone, and for England?

Lots are happening.

Be the first to comment