filmfoto

Thesis

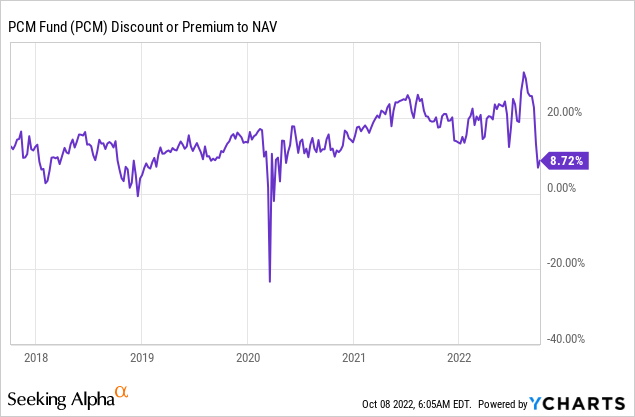

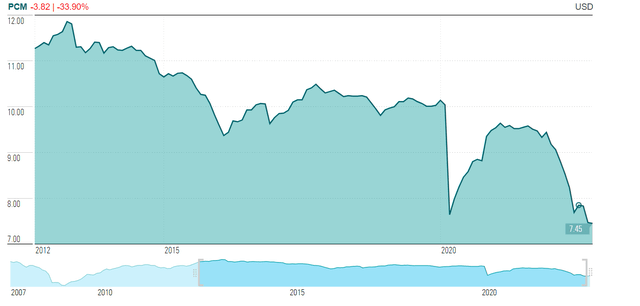

The PCM Fund (NYSE:PCM) is a small CEF from Pimco. The vehicle has only $92 million assets when leverage is excluded, and falls on the small side for this asset manager. The individual portfolio managers who choose the credits are the same tried and tested individuals you see in (PTY), (PFN) or (PDI), namely Alfred T. Murata and Daniel J. Ivascyn. What makes this fund interesting is its high leverage of nearly 50% and its very persistent premium to NAV:

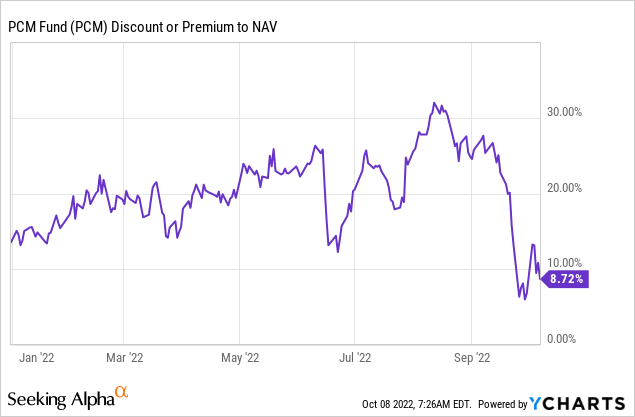

We can see that in the past five years the fund has usually traded at premiums exceeding 10% ! That is rare, even by Pimco standards, with only (PTY) coming to mind as an alternative to “high premium” funds.

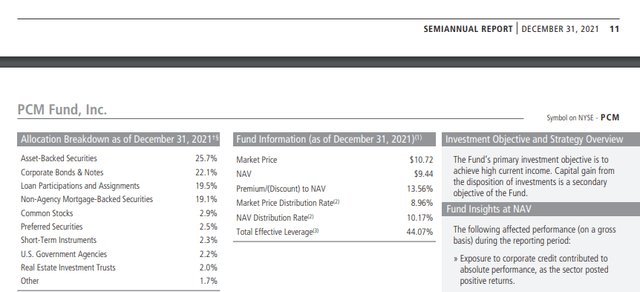

The vehicle is overweight non-agency MBSs, having pivoted to this asset class in 2022. Non-Agency MBSs accounted for only 19% of the portfolio at the end of 2021, but now represent more than 49% of the holdings.

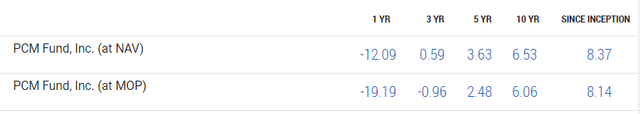

The fund has a 12% dividend yield, but expect a long term annualized return closer to 8% to 9%:

The fund is down significantly this year on the back of much higher mortgage rates, increases in MBS durations and significantly wider credit spreads. We expect the next three to six months to continue to be challenging, with a high correlation between the PCM pricing and the market risk-off sentiment.

Holdings

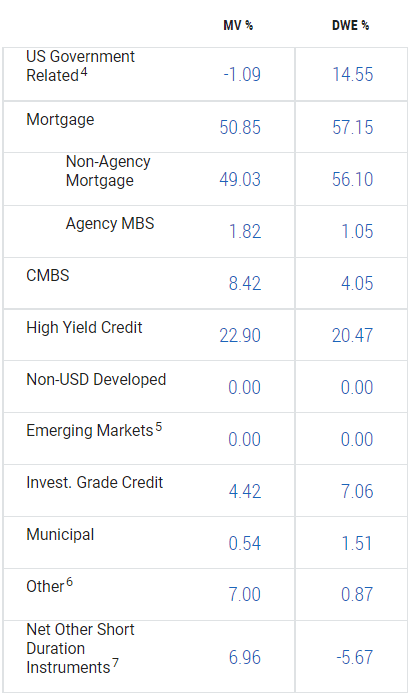

The fund falls in the usual Pimco HY suite, but is overweight Non-Agency Mortgages and High Yield:

Holdings (Fund Website)

We can see that, from a market weight perspective, Mortgages and High Yield constitute more than 70% of the PCM portfolio. And to be more specific, on the mortgage side, the fund takes positions in the non-agency space.

Non-Agency Mortgages are bonds which are not guaranteed by the U.S. government or any government-sponsored enterprise. Non-agency MBS are often based on pools of borrowers who couldn’t meet agency standards. Private entities, such as banks, can also issue mortgage-backed securities based on pooled mortgages. The lack of government backing means that non-agency MBS contains credit risk not present in agency MBS. In other words, there is a higher chance of default on these bonds.

By being overweight non-agency MBSs, the fund takes significant credit risk in addition to rates duration implications. The manager does not present the credit rating of the underlying securities or a weighted average portfolio rating, but we suspect the majority sits in the below investment grade space.

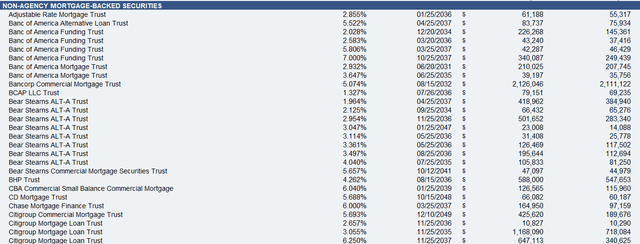

The manager does not identify the exact tranches of debt either, but by looking at the coupon we can safely assume they are mezz and sub tranches:

At the end of the day if an investor believes we are in for a deep dive in home prices coupled with foreclosures, then this fund might not fit the bill for said individual. The mortgage debt in the portfolio will attach (i.e. default) if there are substantial foreclosures and the value of the house is not sufficient to cover the mortgage debt. This is what the 2008 crisis was all about, with subprime mortgages being the culprit. We do not think we are going to see a repeat, but the housing market will be under pressure with modest to moderate price declines in our view.

The fund has pivoted to non-agency MBSs in 2022, with the collateral composition at the end of 2021 being much different:

Fixed Income Allocation (Fund Fact Sheet)

We can see from the above table snapped out of the Semiannual Report that the PCM Fund had only 19% allocated to non-agency mortgages at the end of 2021.

State of the Housing Market

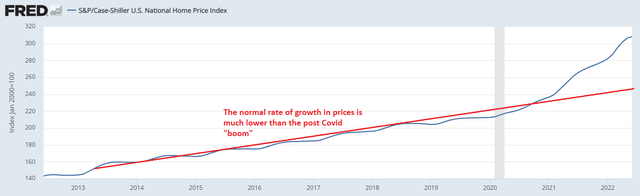

Due to the zero rates environment, the housing market has seen ever-increasing prices:

As we can see from the above graph, the post-Covid Fed policy resulted in a massive acceleration in house prices, significantly outside the normal growth rate witnessed in prior years. Prices will come down towards the normalized growth rate. Nothing goes up parabolically.

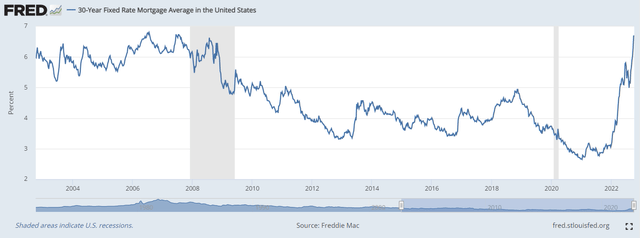

Mortgage rates have risen significantly, and we anticipate them to stay elevated:

We can see from the above chart that post the Great Financial Crisis, mortgage rates moved below the 5% threshold and stayed there. In the new higher inflation for longer macro environment, and with an overbought housing market, we expect mortgage rates to re-establish a 5% to 7% range for the next few years. This results in tighter financial conditions and fewer people re-financing.

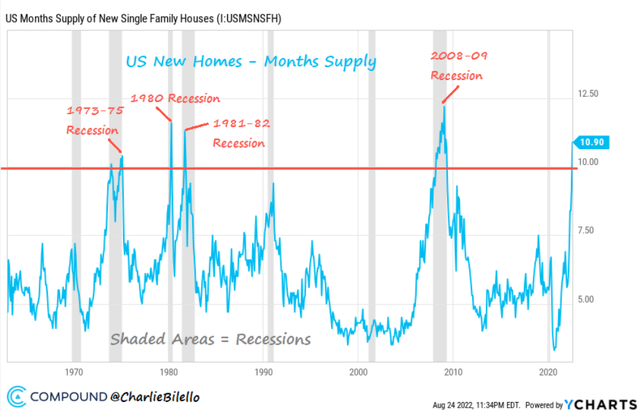

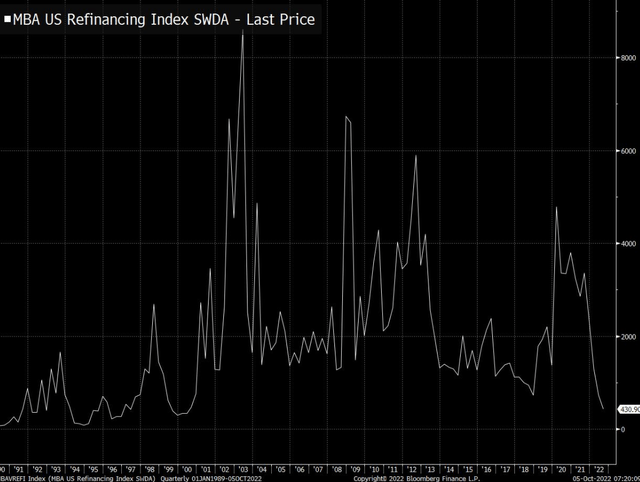

We are already starting to see the tighter financial conditions feedback in the housing market:

Supply of new homes (Compound Advisors)

Higher mortgage rates have resulted in fewer people buying houses, which in turn have started to create a glut of unsold homes. This will translate into lower prices next.

The message is similar from the Refinancing Index data, which is starting to hit decade-long lows. At the current elevated mortgage levels, people simply choose not to refinance or move for that matter, unless absolutely necessarily. We are going to see more of this as new mortgages command monthly payments that are prohibitively high.

Distribution Coverage

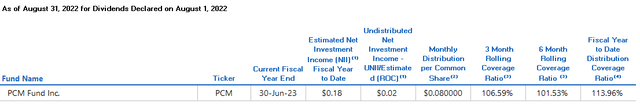

The fund currently has an above 100% coverage, albeit decreasing:

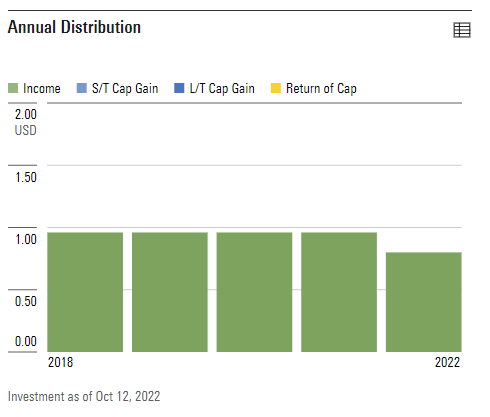

The fund does not like to use ROC, with the dividend having been cut in the past:

Annual Distribution (Morningstar)

The fund does erode NAV however, either through trading activity or performance, exhibiting a -2.5% to -3% NAV shrinkage per year:

Premium / Discount to NAV

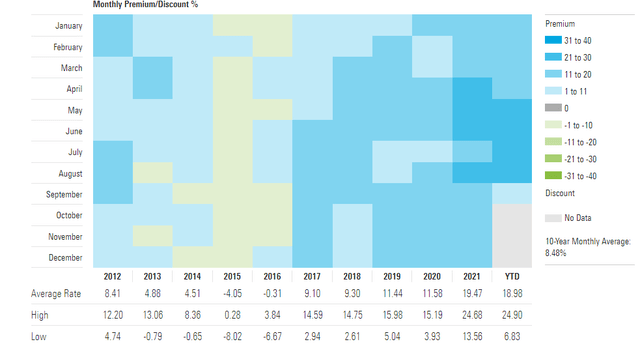

The fund has traded at premiums to net asset value for very long periods of time in the past:

Premium/Discount to NAV (Morningstar)

We can see that after 2016, the average premium to NAV has been over 10%. This is fairly unusual, and it speaks to an investor base who is very faithful to the fund, coupled with zero rates.

As the risk-off environment has taken hold in 2022 on the back of higher rates, the fund’s premium to NAV has decreased:

Conclusion

PCM is a small, niche fund from Pimco. The vehicle has pivoted towards non-agency MBS bonds in 2022, that bucket now accounting for almost 50% of the fund. The vehicle has posted a -20% total return so far in 2022, driven by higher rates and wider credit spreads, coupled with an increase in duration for the underlying MBS bonds. We feel the next few months will continue to be challenging, with better times ahead. While the mortgage market is not done with its trials and tribulations (more duration trouble ahead), purchasing an asset class when mortgage rates are close to 20-year highs is most certainly a good entry point. The CEF usually trades at significant premiums to NAV (over 10% on average) but has seen that number shrink on the back of the risk-off environment. An investor also needs to be aware that PCM does take significant credit risk through its portfolio and high leverage (non-agency MBSs do not have a government guarantee). The fund has been around since 1993 and has been able to navigate many market environments, and we feel the vehicle is finally becoming attractive as the premium shrinks.

Be the first to comment