YelenaYemchuk/iStock via Getty Images

Just over nine months ago, I wrote on Noodles & Company (NASDAQ:NDLS), noting that pullbacks below $7.20 would present a buying opportunity. This turned out to be a terrible call with the shift to negative traffic for the industry, exacerbated by margin pressure due to elevated inflation, and Noodles reeling in its unit growth plans for FY2022. The result was I took a loss on my position, with my stop hit at $6.20. Still, with the stock now trading near $4.70 and having its difficult year-over-year comps out of the way, it’s starting to become interesting from a valuation standpoint, even with the difficult macro environment, albeit as a Speculative idea.

Noodles & Company Restaurant (Company Presentation)

Q2 Results

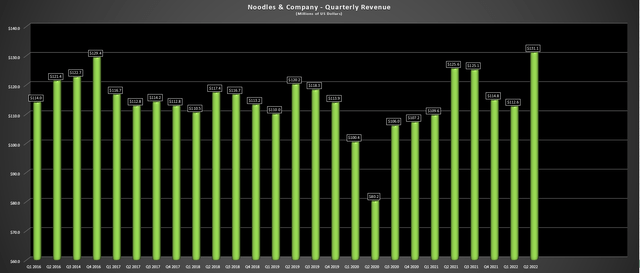

Noodles & Company (“Noodles”) released its Q2 results in late July, reporting revenue of $131.1 million, a 4% increase from the year-ago period. From a headline standpoint, this sales growth might look light in a period when pricing was up sharply, but it’s worth noting that the company saw a $4.1 million impact from the franchising of 15 stores. Digging into comparable sales, Noodles reported same-restaurant sales growth of 5.1% at company-owned restaurants and 5.3% at franchised restaurants, or a 5.1% increase system-wide. Finally, average unit volumes came in at $1.42 million, a more than 18% increase vs. pre-COVID-19 levels (Q2 2019).

Noodles Menu Offerings (Company Presentation)

While it is positive that average unit volumes are growing; the negative is that this has been primarily driven by menu pricing, with Noodles running at just over 10% pricing in Q2. Based on this figure, it’s clear that traffic was down in the period, but this was largely in line with what we saw industry-wide due to rising gas prices putting an additional toll on already shrinking discretionary budgets for consumers. The good news is that revenue growth should be buoyed by unit growth as it accelerates, and the company continues to see strong NPS scores, suggesting that its business model remains strong even if it is wading through a very difficult environment with its peers.

Noodles – Quarterly Revenue (Company Filings, Author’s Chart)

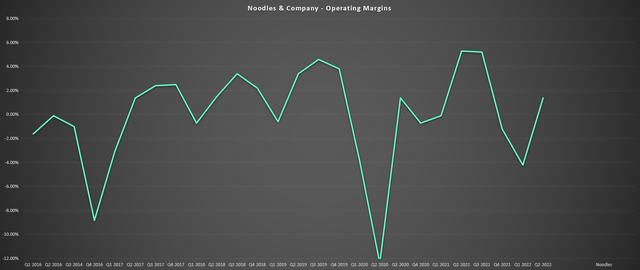

Unfortunately, while sales were satisfactory in the period, given the difficult environment, the margin performance was not, and we saw a significant decline in the company’s margins. Not only were restaurant-level margins down from 18.9% to 15.5%, but operating margins slipped to just 1.4%, even if this was a sequential improvement from Q1 levels. This was attributed to commodity and wage inflation which the industry has continued to experience, with its cost of goods sold increasing to 27.8% vs. 24.8% last year and labor up 50 basis points to 30.3%. Fortunately, labor costs as a percentage of sales increased less than some peers due to its kitchen of the future initiative.

Noodles & Company – Operating Margins (Company Filings, Author’s Chart)

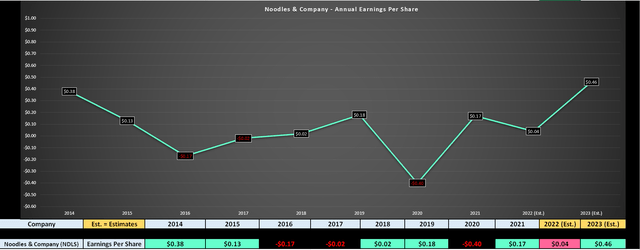

The sharp decline in margins and weaker-than-expected unit growth significantly impacted quarterly earnings per share, which plunged to just $0.05, down from $0.13 in the year-ago period. This has resulted in Noodles reporting a net loss of $0.07 for H1 2022 and being on track to report a more than 70% decline in annual EPS year-over-year (FY2021: $0.17 vs. FY2022 estimates: $0.04). Not surprisingly, this has weighed on the stock, which is one of the worst performers industry-wide, sitting at a 47% year-to-date decline, trailing the AdvisorShares Restaurant ETF (EATZ) by over 2000 basis points. Let’s look at industry-wide trends:

Industry-Wide Trends & Outlook

While this performance was quite disappointing, there are reasons to be cautiously optimistic. For starters, one theme in the Q2 Earnings Season was that commodity inflation looks like it has peaked in some areas, and Noodles called out a significant improvement in costs for chicken and durum wheat, though there was some offset from rising dairy/produce costs. If inflation has peaked, this would set the company up for much easier year-over-year comps, given that chicken was one major area that impacted margins this year, with its labor costs holding at a little more favorable levels than I expected.

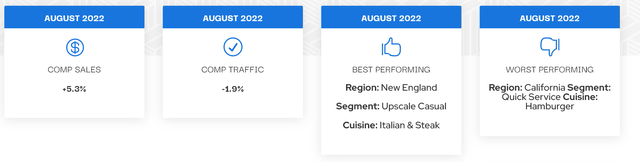

Black Box Intelligence – August Figures (Black Box Intelligence)

In addition, traffic does appear to be improving a little industry-wide from June/July levels, evidenced by a 200+ basis point improvement in traffic sequentially in August). Besides, Q2 was a kitchen-sink quarter for much of the industry due to the decline in traffic and what could end up being peak commodity inflation combined with labor tightness (overtime hours, higher hiring/training costs). So, it appears that even if Q3 and Q4 may not see a strong recovery in traffic with only moderate relief for consumers with falling gas prices, we could see some help on the margin side as companies take additional pricing, the labor environment improves slightly (fewer bonus payments), and commodity prices cool off a little.

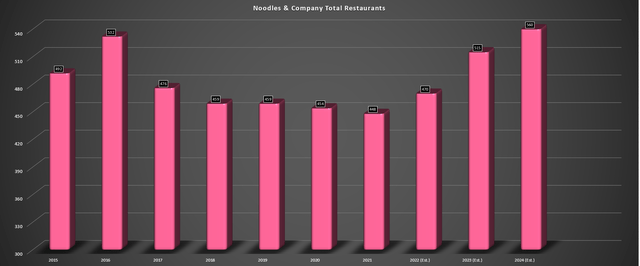

At the same time, Noodles noted that it’s the most excited about its development pipeline in years, with a deal in the works in a Southern state, and it is confident that the weaker unit growth this year is in the rear-view mirror (21 restaurant openings vs. 30+ planned). Based on its outlook, the company not only hopes to see an acceleration in unit growth to at least 10% annually in 2023, but it expects a restaurant margin contribution of 20.0% in FY2024, a significant improvement from H1 2022 levels. Finally, it expects average unit volumes of $1.50 million by 2024, up from $1.42 million currently.

Noodles & Company – Total Restaurants & Forward Estimates (Company Filings, Author’s Chart’)

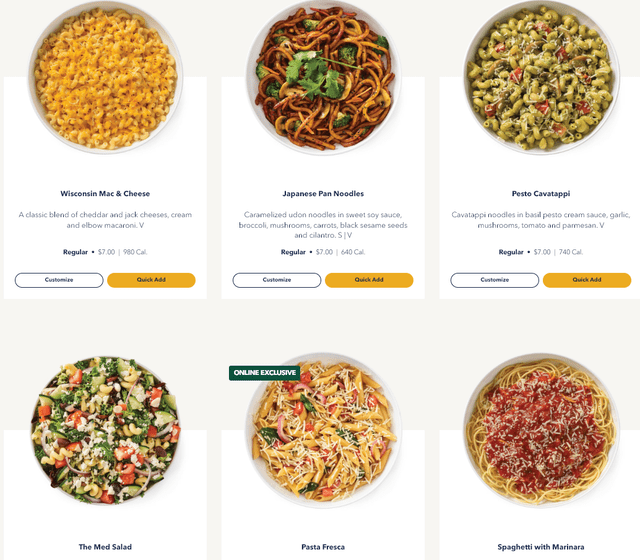

These might seem like ambitious targets, but it’s worth noting that this was a tough year for development industry-wide due to delays, and the company is already enjoying 21% restaurant-level margins at 41% of its restaurants that have achieved a $1.50+ million AUV run rate. In addition, the company noted that it enjoyed positive comps in the past extremely recessionary period (2008/2009), being a trade-down beneficiary. This time around, the company is benefiting from a large digital/loyalty program to target guests, and it unveiled a menu with seven items priced at $7.00 to ensure it maintains its entry-level value proposition for its less affluent customers.

7 Items Priced At $7 Menu (Noodles & Company)

These include favorites like Wisconsin Mac & Cheese, Pasta Fresca, Spaghetti with Marinara, and Japanese Pan Noodles. This is a very attractive price point from a convenience standpoint, with it difficult to duplicate some of these dishes at this price when factoring in one’s time. The company also noted that its LEANguini noodle is seeing positive traction, with this new offering having 56% fewer carbs and 44% more protein than wheat pasta. The continued menu innovation by Noodles, coupled with attractive price points and a healthy tilt, gives me confidence in the business model when consumers are trending more health-conscious. Hence, Noodles is an example of relatively healthy food at a very low price relative to Chipotle (CMG) and others.

Earnings Trend & Valuation

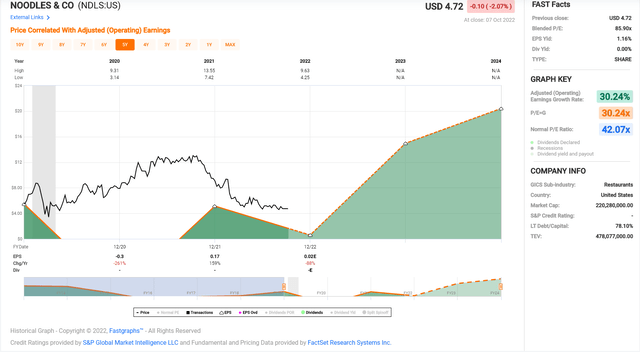

As shown below, FY2022 is expected to be a tough year for Noodles due to margin pressure, with annual EPS expected to slide from $0.17 to $0.04, a more than 70% decline year-over-year. However, with double-digit unit growth expected in FY2023 and margin improvement due to expectations of lower commodity prices and preparation/protein preparation efficiencies from a labor standpoint, annual EPS is expected to soar to $0.46 next year. Even if we assume the company misses these estimates and comes in at $0.40, this would still represent an all-time high for annual earnings per share (vs. the previous high of $0.38 in FY2014).

Noodles & Company – Earnings Trend (YCharts.com, Author’s Chart, FactSet)

Looking at the stock’s valuation below, Noodles is now valued at a market cap of just ~$220 million and has historically traded at 42x earnings, a very rich multiple for a company that’s struggled to grow annual EPS since its IPO debut. However, based on what I believe to be a more conservative earnings multiple of 15 to account for its growth offset by its smaller-scale and mostly company-owned model (vs. franchised), I see a fair value of $6.90 if Noodles can meet FY2023 annual EPS estimates. Assuming a miss at $0.40, this still points to a 28% upside from current levels ($6.00).

Noodles & Company – Historical Earnings Multiple (FASTGraphs.com)

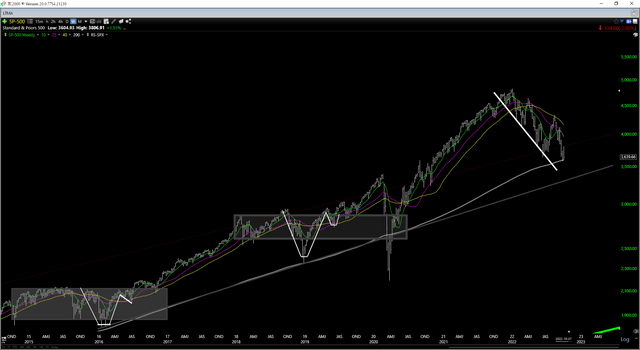

That said, in a cyclical bear market for the S&P 500 (SPY), I prefer a minimum 40% discount to fair value to justify buying micro-cap stocks, and if we compare this to a fair value of $6.90, the low-risk buy zones comes in at $4.15 or lower. This doesn’t mean that the stock must fall to these levels, but this is where the risk would make it worth a swing trade for this more speculative idea. So, while I see the valuation as very reasonable, I’m not interested in re-entering the stock just yet, especially after being very early on my previous purchase and having to exit for a loss. The S&P-500’s bear market condition is shown below, trading below most of its key moving averages.

S&P-500 Weekly Chart (TC2000.com)

Technical Picture

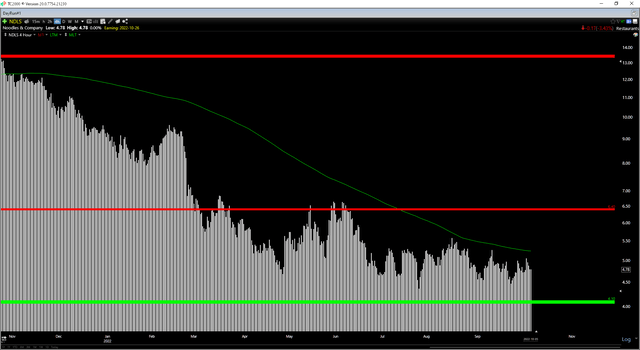

Finally, looking at NDLS’ technical picture, we can see that the stock has strong support at $4.10 and no strong resistance until $6.40. From a current share price of $4.70, this translates to $1.70 in potential upside to resistance and $0.60 in potential downside to support. This is not enough to justify a low-risk buy point (8.0 to 1.0 reward/risk for micro-caps required), but if the stock were to decline below $4.30, it would head into a lower-risk buy zone. So, with the technicals and fundamentals lining up for a relatively low-risk swing trade entry at $4.15, this is the area I would be watching closely if we see further weakness.

NDLS Daily Chart (TC2000.com)

Summary

Noodles & Company has had a rough year, and normally I would have re-entered the stock already. Still, with the S&P-500 in a cyclical bear market, it’s harder to justify owning micro-cap names without a significant margin of safety. The good news is that FY2023 should be a much better year for the company, with higher unit growth and improved margin performance, potentially resulting in record annual earnings per share, even if it’s coming a year late. So, I see this as a very Speculative idea that I wouldn’t commit more than 2.0% of my portfolio towards; I would become interested in NDLS stock from a swing-trading standpoint at $4.15 or lower.

Be the first to comment