Justin Sullivan

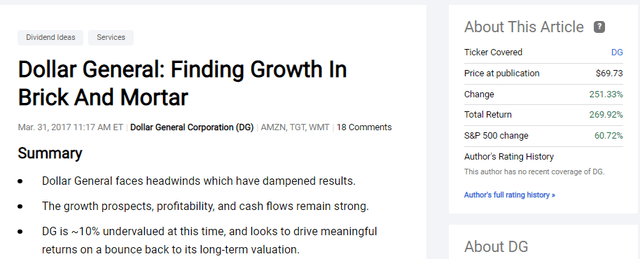

Dollar General (NYSE:DG) is the largest retailer in America by store count. The company is an absolute behemoth, but slides under the radar for many due to the customer and areas it typically serves. The company has quietly crushed the market, and an entry point from any of my four previous articles on the company would have easily lapped the S&P 500 return.

I’ve had hits and misses in my coverage, but DG has been a strong winner.

I’ve talked at length in previous coverage about what makes DG special, so I’ll just summarize as I go through where the company stands today on its metrics, valuation, and where it’s headed from here.

I don’t think the next 10 years will be as easy for DG as the last 10 were, but I wouldn’t bet against the company. Management is solid, it continues to deliver on its growth initiatives, and it remains well-insulated from competitors. I’m going to call it a hold today, but I would definitely put it on the watchlist, and you likely wouldn’t go wrong parking your money here as the company will do just fine in a recession.

Business and Recent Performance

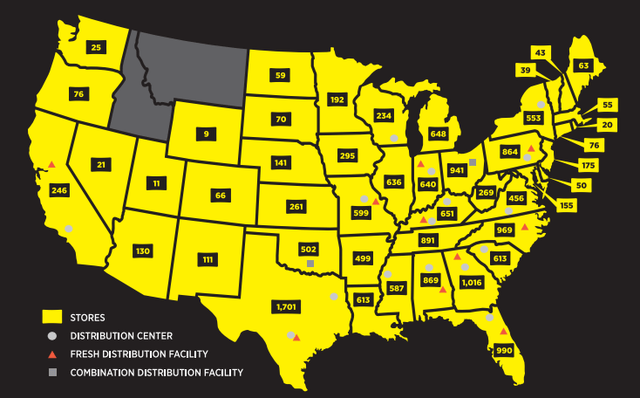

DG operates 18,566 stores across the country with a store within 5 miles of 75% of America’s population. The company has grown massively over time serving areas that are underserved by grocery stores or larger retailers like Target (NYSE:TGT) and Walmart (NYSE:WMT). Its target audience earning less than or equal to $40K per year on average in rural areas is typically not as engaged with e-commerce, and the company’s focus on low margin consumables has kept it that way.

Recent performance has not changed anything about my outlook for the company. Same-store sales growth came in at 4.6%, net sales growth was 9% to $9.4B, earnings grew 10.8%, and margins were steady. Not much to see here, the company continues to execute. It’s worth noting that DG has continually invested capital in store renovations, significant upgrades to its distribution network including its DG fresh initiative and has prioritized those investments in profitable growth over returning cash to shareholders in the form of dividends.

Growth Strategy

However, looking forward, the future is a little murkier. DG has consistently found a way to drive same store sales growth, and its initiatives are easily lab-tested in small samples and rolled out slowly across the massive store footprint. The company has executed fantastically in its real estate purchases and store location selection, maintaining high returns on capital and sales growth by not over-expanding or sacrificing quality for store count. At some point, the company will come to a point of saturation in America for its core store concept, but management has several initiatives working to maintain growth.

The first is the one I see as the riskiest. The company is rolling out stores in Mexico starting this year. I am always leery ever since Target’s Canada expansion debacle, and I don’t have high levels of confidence in DG seeing the same levels of success in Mexico as it has here in America. Management sees a similar customer profile where the first stores are opening in Northern Mexico, and the company isn’t betting the farm on this. They are starting small with a limited rollout, and we will see in the coming quarters whether they are able to get traction and build out an international footprint. If this succeeds above my current skepticism, it could significantly improve an investment thesis in the company.

Several initiatives aimed at driving same-store sales growth and improving the value proposition to customers are being rolled out across the country. DG has introduced an expansion of non-consumable items with a low price point and a treasure-hunt style approach reminiscent of Ross (NYSE:ROST) and TJX (NYSE:TJX) with a rapidly changing product profile to prevent competition with online retailers. Additionally, the company continues to rapidly expand its frozen food offerings, some produce, and health products. As management rolls it out, they appear to have a good handle on performance of the SKU’s and I would anticipate maintenance of strong ROIC and same-store sales growth.

Additionally, DG is working on its new store concept, pOpshelf. They have 80 open currently, and looking to have 150 by year-end. These locations are focused more on items you would find at a Dollar Tree (NYSE:DLTR), in low priced non-consumable home goods which could allow the company to infiltrate additional areas and even attract a slightly different consumer. Again, the company is rolling this out relatively slowly, and we will have to watch over the coming quarters how well it performs and if it could be a significant growth vector for sales.

The company is also partnered now with DoorDash across 2700 stores, and anticipates that number to be 4000 by year-end. This one is surprising to me. Considering the products they sell and the customers they serve, I would not have expected delivery to be a needle mover. However, management has said sales have exceeded their initial targets, so I suppose customers have been happy to pay the delivery fees and this could be another avenue for sales growth.

Metrics and Valuation

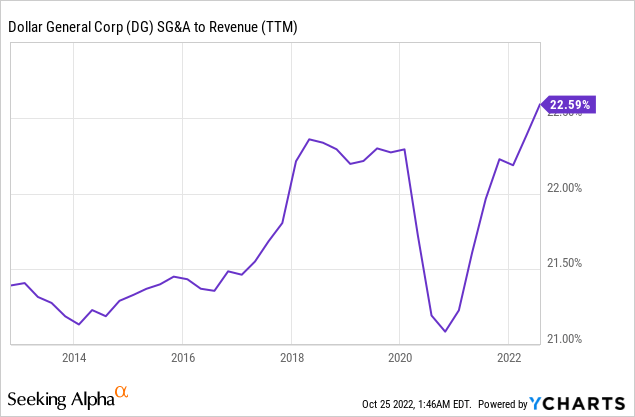

SG&A to revenue has ticked up this year, which is not what we want to see when looking to invest in a retail business. Management had this to say on the recent earnings call:

The most notable one was adding some labor hours to help further improve our in-stock levels as well as that customer service. We really like what we’re seeing there. Also, to a lesser extent, we did make targeted investments in wages in the physical box itself. But I would say more normal course proactive actions to drive the business.

We also did see some inflation on utilities and did have some higher-than-normal R&M expenses associated with the weather. But I think when you look at just overall operating margin, we feel really good about what we’re doing. We feel great about the gross margin expansion. A lot of the investments we make in SG&A really drives that gross margin expansion, which was up 69 basis for the quarter, and importantly, 1.5 points above where we were three years ago.

One way management is combatting the labor cost increases is the rollout of self-checkout. Having been in plenty of DG stores, this is a long time coming. I’ve generally only seen 2 employees maximum at a time, and even waited at a cash register more than once for someone to come to the front. This could be a huge initiative with a labor footprint the size of DG to lower costs.

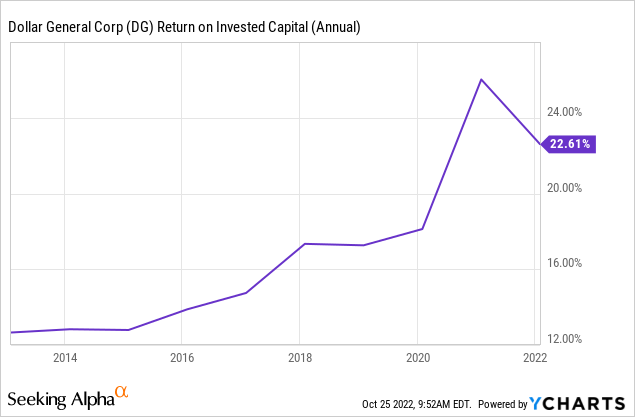

As I stated above, management has continually maintained strong returns on capital, with huge investments in the store footprint and store count growth making this even more impressive. Morningstar calculates the weighted average cost of capital at ~9%, so ROIC well exceeds that here and shows shareholder value creation over time. With a company juggling as many initiatives as DG and continuing to expand, watching ROIC and SG&A/Revenue are two of the best metrics to see how those initiatives are performing.

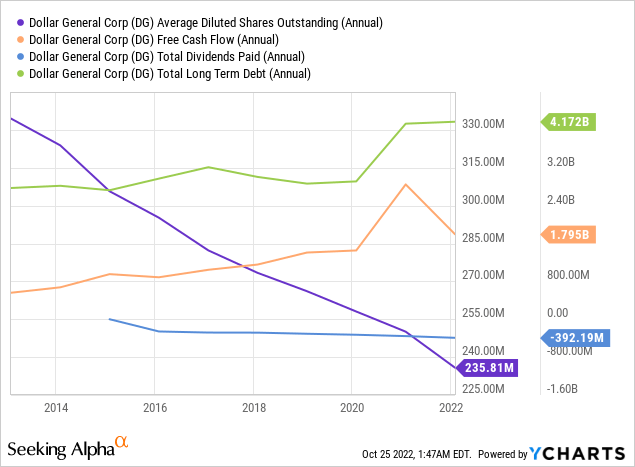

Looking at the balance sheet, DG continues to aggressively buyback shares, reducing the share count consistently over time. They are currently on a $1B buyback authorization with an additional $2B recently added to it. The company has not always repurchased shares at attractive valuations, and in many cases, I would rather just see additional dividends. Speaking of the dividend, it is well covered by free cash flow, the payout ratio stands at 13.8%, and growth listed below has been very high since the company initiated it. The yield is a paltry 0.9% as it stands, so this is not a current income play. However, based on the operating metrics, dividend growth rate, and room to grow, I could easily see DG joining the aristocrat ranks one day. The streak of dividend increases is currently at 8 years.

Dividend Champions List

Valuation and Closing Remarks

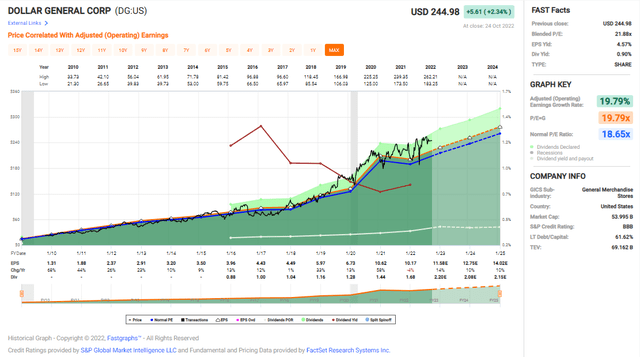

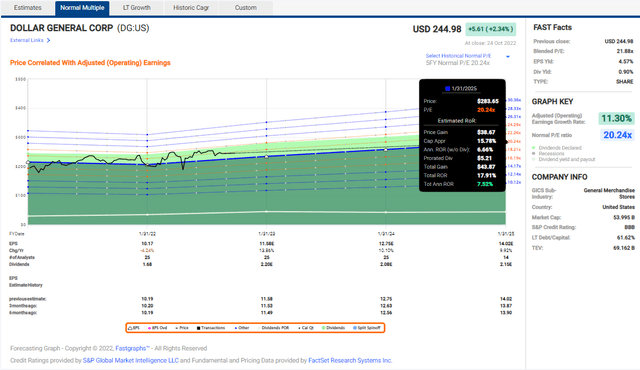

In terms of valuation, the company is currently above its long-term averages. At around 22X earnings, it’s definitely a far cry from the first time I wrote on the company when it was trading in the ballpark of 15X.

Based on analyst estimates for earnings growth, an investment today could yield around 8% annualized with a return to the company’s long-term average valuation of around 20X earnings. I think it could even more conservatively be set at closer to 18X earnings, making DG not very attractive today from a valuation standpoint.

I think DG is a fantastic business, with a strong management team, and the company continues to execute well on its operational and growth initiatives. I don’t see the next decade for the company being as easy as the last, but if some of the growth strategies pay off, the company could easily prove me wrong. Heading into (or already living in) a recession, DG is a strong company to park your money in. The stores fill a need, and sales are likely shielded from most recessionary pressures. However, I’m not a buyer today at these prices considering the landscape of businesses on sale across the market. It’s a hold.

Be the first to comment