wildpixel

Seagen (NASDAQ:SGEN) is a relatively young, commercial stage, biotech pharmaceutical company with a current market capitalization of about $32 billion. Largely driven by unconfirmed reports, but from the Wall Street Journal, usually a reliable source, many investors believe Seagen will be acquired by Merck (MRK), with only the details to be worked out. This article will discuss the likelihood of that event happening and its effect on the stock price of Seagen. I will then focus on recent Seagen developments that indicate how the company could do if it continues to be an independent company.

Potential Deal Breaker: Price

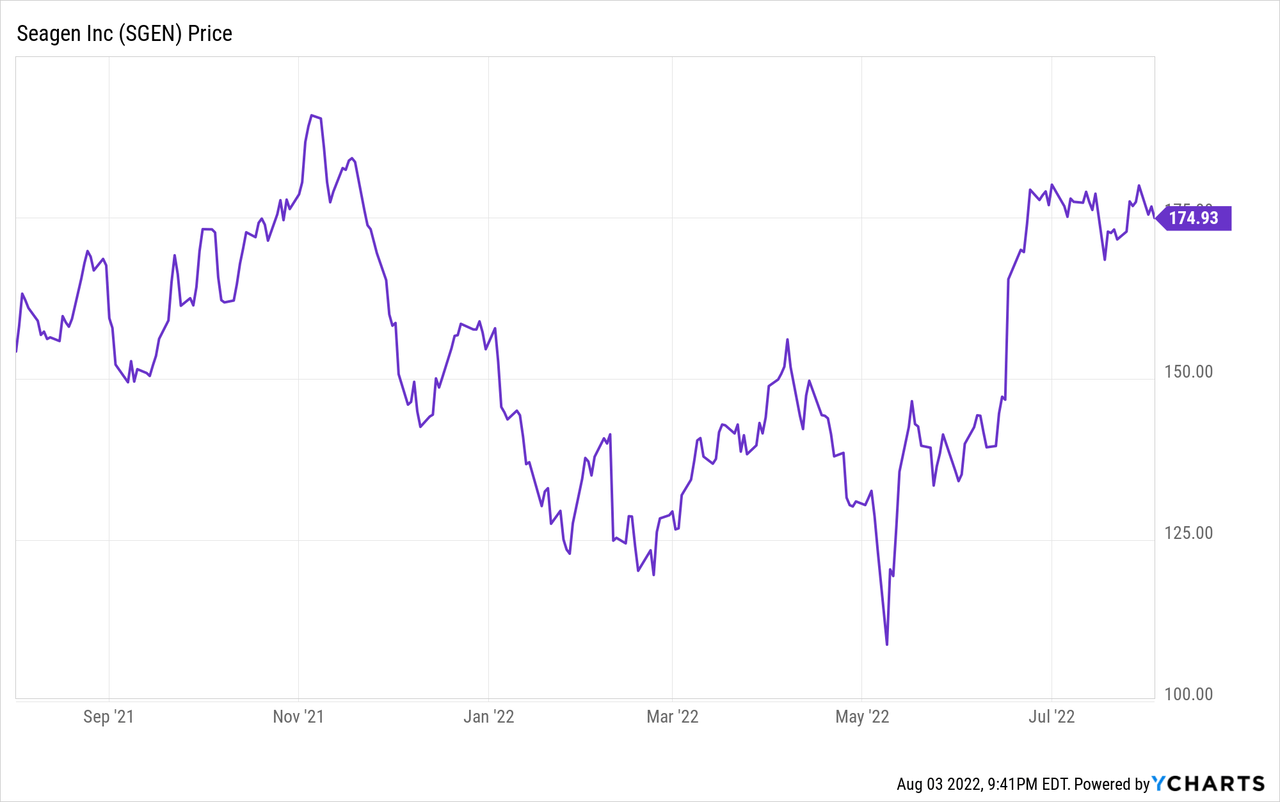

Although in general biotech stock prices saw declines in 2021 and 2022, going back to June 16, before a 15% jump on rumors of talks between the two companies, Seagen closed at $146.78. That itself was well above a 52-week low of $105.43 on May 9, 2022. The stock closed on Wednesday, August 3, 2022, at $174.99, which will be taken as the current price, for the purposes of this analysis.

Consider the market capitalizations of Seagen at each of these prices. There are about 184 million shares outstanding. At the low end of the range, $105.43, the market cap was about $19 billion. Before the merger rumor came out, at $146.78, the market cap was about $27 billion. At $174.99, the market cap is about $32 billion. How much return is needed to justify that level of capital? If you only want 5% per year (I want more!), about $1.6 billion in net income is needed. As you will see below, Seagen is currently generating net losses. Merck, or anyone buying Seagen stock, needs to think about how much revenue can be ramped in the future, and how quickly. Merck may also be able to get some cost synergies by eliminating administrative overhead if it does make the acquisition.

Now consider what Seagen and Merck have said to investors lately about the potential merger. As far as I can tell, the truth is: Nothing. Nada. Zero. That may be because they want to keep talks secret, but we can’t assume they are even really talking at this point.

Finally, consider the management issues at Seagen. The former CEO, Clay Siegall, resigned in May. He was arrested for domestic violence. That does not mean he was a bad manager, but it does add a variable that is difficult to evaluate. How central was Clay Siegall to the company’s success? How much is the company worth without him?

Merck has a variety of options besides a full acquisition of Seagen and doing nothing. It can buy Seagen stock, or it can buy into more Seagen drug programs. Either of those might be more attractive than buying the whole company. Any attraction to each option will vary with price.

Seagen Q2 2022 Results

Seagen reported Q2 results on July 28. Revenue was up 28% y/y to $498 million. But losses were high, with a net loss of $135 million, compared to a loss of $85 million year earlier. That resulted in a GAAP EPS loss of $0.73. Revenue was up as both Seagen’s older, leading drug Adcetris and more recently approved drugs. Padcev, Tukysa, and Tivdak ramped sales rapidly. Collaboration revenue, at $27 million, was also well up from $5 million in Q2 2021.

Seagen’s net loss was due to a rather heavy R&D spend of $304 million, an SG&A spend of $220 million, and cost of goods sold of $106 million. Seagen is well-funded. Despite losing about $100 million in the quarter, the ending cash and investment balance was $1.9 billion.

Seagen Approved Drug Potential

Much of the potential for Seagen reaching profitability and then becoming a major pharmaceutical company has already been derisked through FDA approvals of 4 drugs. Adcetris (brentuximab vedotin) is an ADC (antibody-drug conjugate) that seeks out cells expressing CD30 and kills them. It was originally approved by the FDA in 2011 (and by the EU in 2012) to treat second-line Hodgkin lymphoma and anaplastic large cell lymphoma. Note the long timeline: any investor thinking profitability would come soon after the FDA approval was mistaken. Later the label was expanded to include cutaneous T-cell lymphoma and peripheral T-cell lymphoma. It is currently in clinical trials for several indications including first-line Hodgkin lymphoma. It is also still going through the process of international expansion. There is reason to believe that the drug will continue to ramp revenue, perhaps around the current rate of 11% per year, until it becomes subject to biosimilar competition.

Padcev (enfortumab vedotin) is an ADC targeting nectin-4. It was approved in December 2019 by the FDA for metastatic urothelial (bladder) cancer that failed to respond to a PD-1 inhibitor and to platinum chemotherapy. In July 2021, the FDA expanded the label to include some advanced urothelial cancers following failures of other therapeutic agents. It was also approved in Europe in April 2022. Given its recent introduction, and that it will take some time to get national reimbursement approvals in Europe, it should continue to ramp revenue for years. In Q2, it generated $124 million, up 50% y/y. It continues to be tested in clinical trials for a variety of solid tumors, particularly bladder tumors, so the label could see further expansion. The Padcev regulatory process was paused in the EU in Q1 2022 due to severe skin reactions. Seagen is working with regulators to resolve the issue.

Tukysa (tucatinib) is not an ADC. It is a small molecule that inhibits HER2. It is used as part of a chemo cocktail to treat HER2+ breast cancer, in patients that failed prior HER2-based treatments. It was approved by the FDA in April 2020 and then in Europe in 2021. Its label could be expanded pending the results of 8 clinical trials for various HER2+ cancers, including colorectal and gastroesophageal cancers. It is not ramping as fast as the other Seagen agents, but generated $89 million in Q2, up 7% y/y. In July 2022, Tukysa plus Trastuzumab reported positive Phase 2 results in HER2-positive metastatic colon cancer at ESMO. The FDA granted breakthrough therapy designation in July. Also, the Tukysa plus Kadcyla Phase 2 HER2+ breast cancer trial completed enrollment in Q2. Label expansion could accelerate the ramp.

Tivdak (tisotumab vedotin) is the newest approved Seagen drug, generating $17 million in Q2. Another ADC, its antibody attaches to tissue factor (CD142). It was approved to treat cervical cancer (following disease progression after chemotherapy) in the US in September 2021. It was developed and is marketed in a 50/50 partnership with Genmab (GMAB). It is being tested for treating earlier lines of cervical cancer, platinum-resistant ovarian cancer, and a basket of other solid tumors.

Seagen Pipeline Potential

The Seagen ADC platform has generated a variety of potential therapies. The antibody determines what cells are targeted, the payload how the target cell is killed, while the linker is important for insuring that the payload is not accidentally delivered to healthy tissues. This article can only provide an overview of the three potential therapies in the pipeline that have advanced to at least Phase 2 trials. See the Seagen Pipeline page for the drugs in Phase 1 or preclinical trials.

In April 2022, a pivotal phase 2 trial of disitamab vedotin in patients with second line HER2-expressing metastatic urothelial cancer began enrolling. The trial is designed to support registration under the FDA-accelerated approval pathway. This ADC was licensed from RemeGen in 2021. The companies have a global development and commercialization agreement. Seagen made a $200 million upfront payment. RemeGen retains commercialization rights for Asia.

Ladiratuzumab vedotin is an ADC that targets LIV-1 expressing cells. It is currently in a Phase 2 trial, combined with pembrolizumab, for first line triple-negative breast cancer. It is also being tested as a monotherapy in metastatic solid tumors, including breast cancer.

SEA-CD40 attacks cells expressing CD40. It is in a Phase 2 trial, as a monotherapy and combined with other agents, for melanoma and NSCLC (non-small cell lung cancer). A Phase 1 trial is testing it in solid tumors and lymphomas.

While not all trials will lead to positive results, Seagen has a good track record with its platform. I think it is safe that at least some of its clinical and preclinical therapies will eventually produce results that allow for FDA approval and commercialization.

Conclusion

Assuming Seagen keeps a lid on expenses, it needs about $135 million more per quarter in revenue to reach break-even. If Merck decides to buy it, the question is at what price. Seagen is unlikely to want to sell for less than the current stock price. But that price may make Merck reluctant to take on an otherwise attractive acquisition target. I think the safe plan for new investors is to evaluate Seagen independently. If the current price makes sense, it does not matter if it dips some if Merck or Seagen fails to combine.

As to the price, it already assumes a lot about the future. Suppose revenue ramps gradually, so that in two years net income is running about $100 million per quarter, or $400 million per year. Then the market capitalization and stock price would depend on what multiplier investors are willing to bet on. I would not likely go over 30, which would give Seagen a market capitalization of $12 billion. But at today’s price, the market cap is already $33 billion. Merck might be able to take out some costs and increase net income or might be willing to take a longer-range view. For individual investors who discount the acquisition scenario, the question becomes: how long is the investment horizon? We cannot know how quickly revenue will ramp, but we can know our investment horizons. I would say at $175 per share, my investment horizon better be at least 5 years. I like Seagen for the long run, but I think I will wait and reevaluate if the acquisition talks turn to vapor, and the stock price heads back down. Short term, I see considerable risk that the stock could drop under $150 again if the deal is not announced in a reasonable period of time.

Be the first to comment