The best photo for all

A company with a promising business model that has lost virtually all of the bullish analysts provides a great contrarian play. DocuSign (NASDAQ:DOCU) falls perfectly into this category with another analyst jumping ship with the online documents company trading down toward the yearly lows. My investment thesis remains bullish on the stock, though the founding CEO exiting the company following FQ1’23 earnings was a huge setback.

All The Bulls Have Left

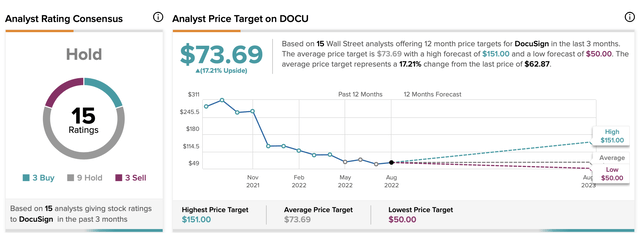

Back at the peak of the cycle in late 2021, DocuSign had an average analyst price target of $311 with all but one analyst having a Buy rating on the stock. Now, only three analysts have Buy ratings after RBC Capital downgraded DocuSign to a Hold to start the week.

Analyst Rishi Jaluria cut the price target on the stock to $65 from $80 when cutting DocuSign to a Sector Perform. The average analyst price target is now down below $74 for the stock trading at $61.

The stock now has nine analysts with Holds and three analysts with Sell ratings. The market shouldn’t work this way where analysts are the most bullish at the peak stock prices over $300 and the analysts are now the most bearish on DocuSign when the stock trades below pre-COVID levels.

The market feels like DocuSign won’t turnaround their electronic signature business despite the move to the contract agreement cloud. The company remains the leader in the space and should easily top recent weakness impacted by COVID pull forwards.

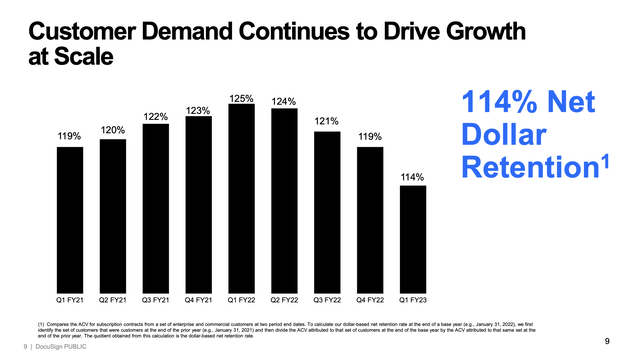

The net dollar expansion rate dipped to only 114% in the last quarter. With guidance for FQ2’23 billings nearly flat, the net expansion rate should dip further as customers that ramped up spending during COVID to peak at 125% expansion rates are no longer growing spending rates heading into a potential recession.

Source: DocuSign FQ1’23 presentation

CEO Departure

The CEO departure a week after earnings provides a disappointing set back. Dan Springer had bullishly repurchased shares at much higher prices in an encouraging move, but him leaving the company following weak FQ1’23 numbers definitely sets up the business for a volatile period.

The former CEO of the electronic signature firm was definitely clueless on the slowing business dynamic. He bought shares above $140 back in December with an elevated valuation despite having to cut guidance following those purchases.

The document company faces concerns over sales execution issues with the next CEO. The company still needs to hire a replacement and a lot of new CEOs like to alter business models impacting short-term results. DocuSign might need a year to completely position the business under an external CEO hire.

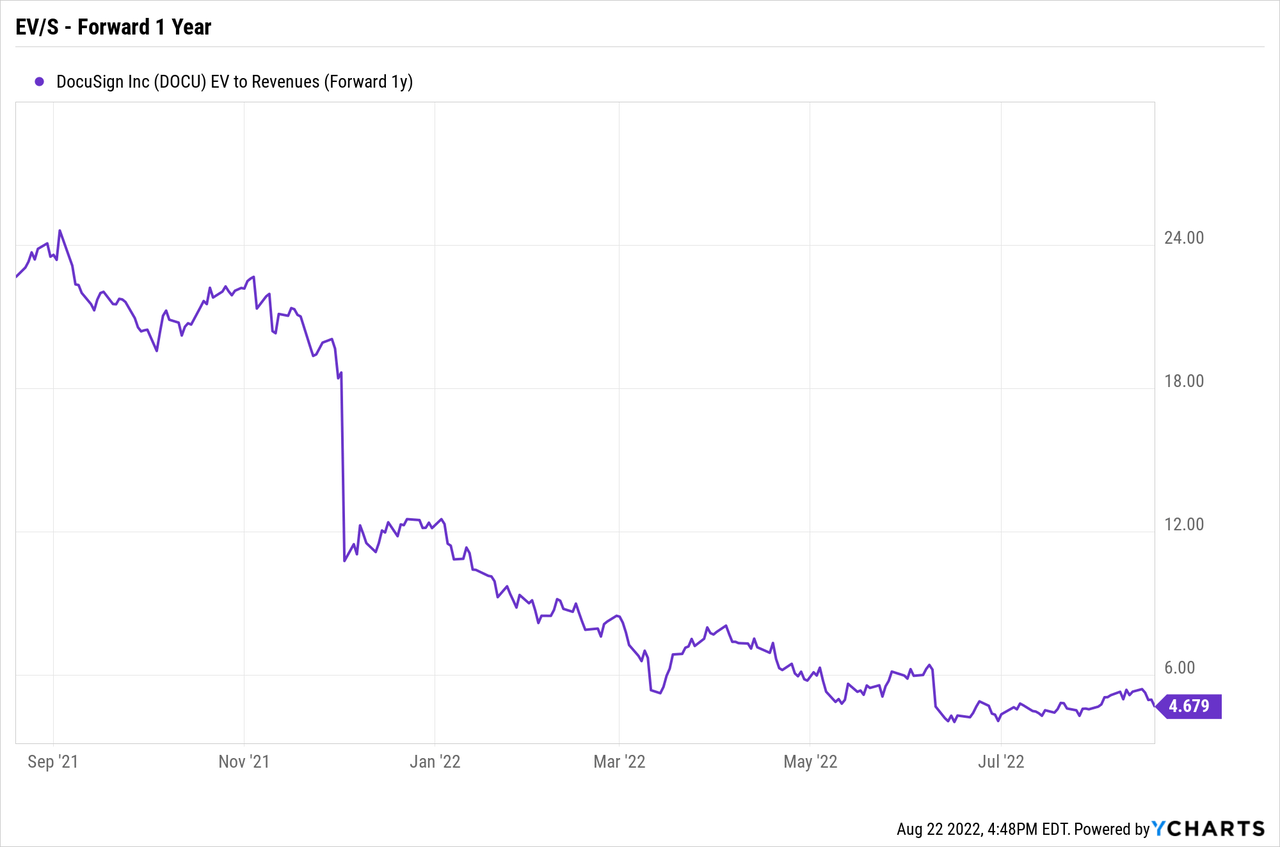

The stock is far more reasonable here trading less than 5x forward EV/S targets. DocuSign was still trading at elevated levels, but the CEO made a ridiculous purchase still willing to pay over 10x sales on his insider purchases at the end of 2021.

While analyst moves are setting up for a low on DocuSign, the stock could easily struggle to rally for a while. Fellow COVID pull forward pal Zoom Video (ZM) just reported more signs of general weakness. The video communications service that got a huge boost during COVID is now struggling to grow at all with FQ3’23 revenues guided to a likely revenue dip form the $1.1 billion reported for the July quarter.

The Zoom numbers don’t bode well for DocuSign. The electronic signature leaders didn’t see the same meteoric revenue boost as Zoom, but the company definitely saw sales growth accelerate and now DocuSign faces similar growth issues. In addition, Zoom has had to reprice stock grants and options causing a big boost in stock-based compensation. The video communications company reported a $263 million charge in the last quarter, which is an excessive amount for $1.1 billion in quarterly revenues.

Investors will definitely take a look at the SBC charges for DocuSign in light of the lowered share price. Ultimately though, what matters is the updated diluted share counts from issues SBC to key employees.

Takeaway

The key investor takeaway is that DocuSign has some of the key signs of a bottom in the stock. Most analysts are now bearish on the stock and DocuSign actually held recent lows on a downgrade. The CEO departure is actually the most troubling aspect of being ultra bullish on the stock here.

Investors can own DocuSign for the long term, but one might want to hold some capital for better entry points when the management picture is more clear.

Be the first to comment