Bed Bath And Beyond Likely Prepping To File Chapter 11 Within 30 Days Joe Raedle

Bed Bath & Beyond (NASDAQ:BBBY) is likely on the verge of filing for bankruptcy in the coming weeks. BBBY’s management team made serious mistakes by heavily reweighting its core brand’s inventory mix to favor private label and buying back common shares at a premium in the middle of a liquidity crunch.

The Buy Buy Baby brand is not worth billions of dollars, as Ryan Cohen had suggested earlier this year. Buy Buy Baby’s revenue declined last quarter, making it likely that it won’t even sell for the ~$900 million valuation suggested by Wedbush months ago.

The only path forward for BBBY is to liquidate all of its assets at fire-sale prices, in order to maximize recovery value for its creditors. A reorganization of BBBY is not remotely viable, given the substantial, increasing BBBY’s ongoing cash burn and its core brand’s declining brand equity in face of weak consumer sentiment and an unhelpful macro climate.

A temporary short squeeze will not spare the company from filing Chapter 11 or delay it, like we saw with GameStop (GME), due to BBBY’s severely weak asset coverage.

Typically, we would provide more extensive credit research than this. However, for the sake of time – given how imminent a bankruptcy filing is – we are sharing our illustrative hypothetical bankruptcy recovery model, and won’t further expound on the factors leading to the demise of BBBY and its current situation.

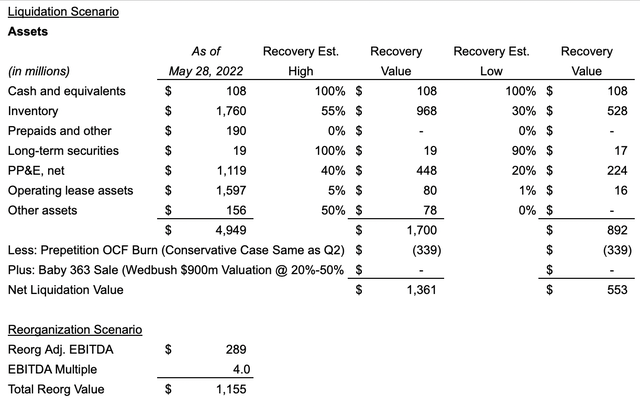

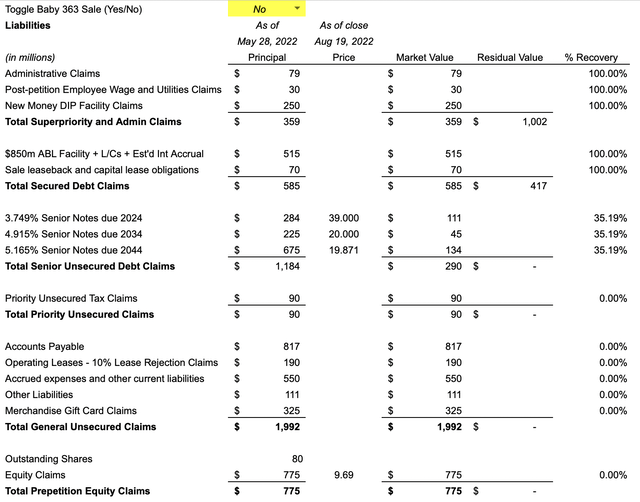

Recovery Model Without A Successful Buy Buy Baby 363 Sale

Hadrian Capital Management Analysis

Hadrian Capital Management Analysis

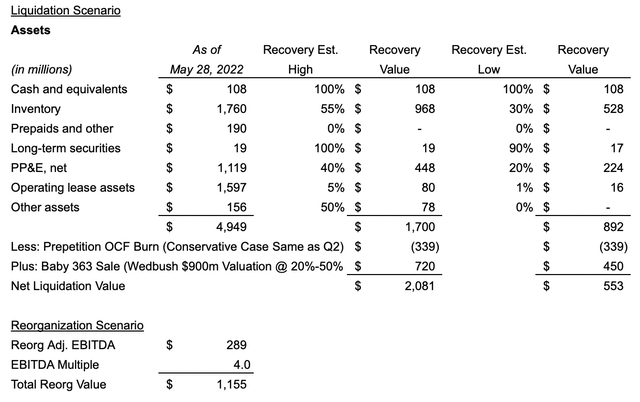

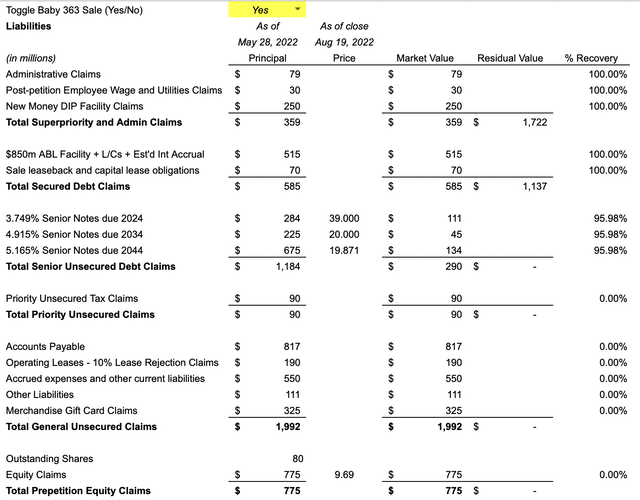

Recovery Model With A Buy Buy Baby Sale

Hadrian Capital Management Analysis Hadrian Capital Management Analysis

The above numbers are hypothetical and for illustrative purposes only. We would be surprised if BBBY manages to obtain $250 million of new money financing through a debtor-in-possession (DIP) financing facility, as the company will likely pursue a liquidating Chapter 11 rather than reemerge through a reorganization of existing indebtedness. However, we came up with this amount as a placeholder, which would give the company additional liquidity to wind down its operations in bankruptcy and enough time to sell off the Buy Buy Baby brand in a 363 sale, while maximizing the recovery value of Bed Bath & Beyond’s estate.

No matter how you slice the onion, pre-petition equity claims will be expunged and extinguished in a Chapter 11 proceeding with no recovery value, given all the claims that will rank priority to equity claim holders. There will be no come back story for investors betting on a short squeeze in BBBY’s common stock.

The one major variable at this stage is whether the senior unsecured note holders see a 30%-35% recovery if Buy Buy Baby cannot be sold, and/or if BBBY incurs more superpriority or administrative claims than expected.

However, if BBBY manages to sell the Buy Buy Baby assets through a 363 sale and fetches a value anywhere near what Wedbush’s valuation implied months ago (~$900 million asset value), then the senior unsecured note holders stand to gain substantial upside from their current trading prices, according to FINRA TRACE – particularly the 2034 and 2044 senior notes.

Be the first to comment