FangXiaNuo

Thesis

JD.com, Inc. (NASDAQ:JD) announced earnings for the June quarter on August 23 and delivered a strong performance, clearly beating analyst consensus estimates. Most notably, despite a truly challenging macro-environment in China, JD managed to record a 5.4% year-over-year revenue growth. Remember that Alibaba (BABA, OTCPK:BABAF) recorded 1% negative growth for the same period. This highlighted the benefit of a very important consideration: because JD is arguably less exposed to regulatory scrutiny, the company can play an aggressive market expansion strategy while Alibaba needs to keep a lower profile. Consequently, although I am positive on both Alibaba and JD.com, I would choose JD if I had to pick one of the two.

For reference, JD has significantly outperformed BABA for the trailing twelve months, being down only 11% versus a loss of almost 45% for BABA.

JD’s strong June Quarter

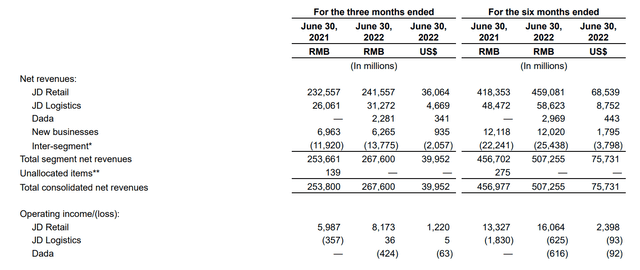

During the June quarter, JD.com generated total revenues of RMB267.6 billion, which reflects a 5.4% increase versus the same quarter one year prior. Notably, JD’s performance clearly beat analyst consensus estimates, which have expected total sales of about RMB267.6 billion. Income from operations almost expanded by a factor of ten: RMB3.8 billion for the second quarter of 2022 versus RMB0.3 billion for the same period one year prior. JD also managed to expand its customer base considerably (up 9.2% year over year) and now has more than $580.8 billion active customers.

Lei Xu, JD’s said:

JD.com’s resilient business model, industry-leading supply chain capabilities and efficient operations helped us deliver solid quarterly results amidst ongoing challenges in the external environment

However, in the earnings call with analysts, Xu also added that the Q2 2022 quarter had been the “most challenging quarter since we’re listed.” The fact that JD nevertheless managed to record attractive growth and a RMB3.8 billion net income should be a testament of the company’s business quality.

I would also like to highlight that JD’s logistics arm has increased revenues by almost 20% year over year and has managed to record operating profitability for the first time, generating operating profit of RMB36 million. Investors who are interested to place a more focused bet on JD Logistics can do so by buying the company’s equity, which is listed in Hong Kong under the ticker 2618.

Pick JD for a Rebound

In the context of relatively strong and improving fundamentals, investors should consider that JD is still trading very cheaply. Notably, JD’s one-year forward P/E of estimated x26 is about 30% cheaper than the company’s 2-year average of x36.2 (Source: Bloomberg EQRV). The same argument can be made for JD’s unlevered EV/EBIT multiple, which is x32 versus x43 as the average for the past 2-years.

There is an old saying in investing: companies that show above-market performance in an economic downturn will benefit from the following upturn first and strongest. Accordingly, if investors think China’s economy has bottomed in Q2 2022, they should buy JD. And there are good reasons to believe that China’s economy is on track to improve: First, China’s central bank has recently cut key lending rates. Second, government officials have pressured banks and credit institutions to expand bank lending in order to support the economy. Third, China has already initiated multiple fiscal stimuli and infrastructure investment programs to “restart” the economy. And fourth, with regards to tech/internet companies specifically, China has vowed to actively support the healthy expansion of platform economies.

Conclusion

I am impressed by JD’s strong June quarter, and I am confident to reiterate my Buy recommendation on the company’s stock. Moreover, I slightly upgrade my target price from $82.22/share to $85/share, as I believe JD’s performance will likely provoke consensus earnings upgrades in order to reflect continued market share gain against Alibaba and other e-commerce players in China.

My initiation article on JD: JD.com: A Buy At Prices Below $70/Share; Upside Potential (NASDAQ:JD)

Be the first to comment