Justin Sullivan

AT&T (NYSE:T) has long been regarded as a top dividend stock for investors seeking passive income. However, AT&T’s misguided policy of acquiring businesses with debt has backfired in recent years, in my opinion, with the ill-timed and destructive $49 billion acquisition of DirecTV standing out.

Even though AT&T is seeing post-paid and fiber customer growth, slow overall sales growth and recent reductions to the company’s 2022 free cash flow guidance point to growing dividend risks.

At this point, I believe AT&T will have to reduce, but not eliminate, its dividend in order to focus on debt repayment and other corporate issues.

Reduced Free Cash Flow Guidance Is A Sign Of Things To Come

Investors may have thought that by spinning off WarnerMedia and then combining the stand-alone media business with Discovery, the company was able to leave bad news (the devastating $49 billion acquisition of subscriber-losing DirecTV comes to mind) behind and focus on restructuring its core business.

These hopes were dashed this month when the company revealed new issues that could be even more damaging to dividend investors. Customers of AT&T are apparently taking longer to pay their bills, which, as everyone knows, could be a huge red flag for any business and might indicate a growing credit problem. As Americans take longer to pay their bills due to inflationary pressures on their wallets, many of these bills may never be paid at all.

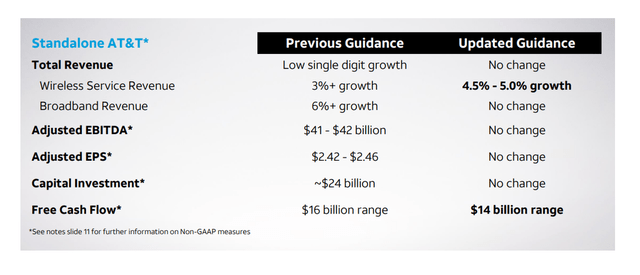

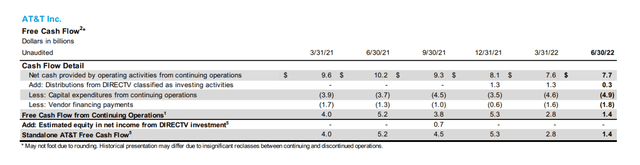

Largely because of the collection issues, AT&T reduced its free cash flow guidance by $2 billion. AT&T’s previous guidance implied a free cash flow potential of $16 billion in 2022, implying a significant decrease in cash flow. AT&T’s CEO has attributed weaker cash flow to customers taking longer paying their bills.

Free Cash Flow Guidance (AT&T)

Because bill collection issues do not go away on their own, AT&T may be forced to cut its free cash flow guidance once more, especially if the inflation problem is exacerbated by job losses.

The United States’ economy continues to add jobs (more than 500,000 in July), indicating that the labor market is not in recession. If this changes, AT&T’s bill collection issues could quickly spiral out of control, forcing the company to revise its free cash flow guidance for 2022.

AT&T’s free cash flow fell for two consecutive quarters in 2022, falling by 50% QoQ in 2Q-22. The second quarter’s free cash flow was insufficient to cover the dividend, which costs $2.0 billion quarterly. This is a red flag, especially since the company has admitted to having issues with lower cash flow.

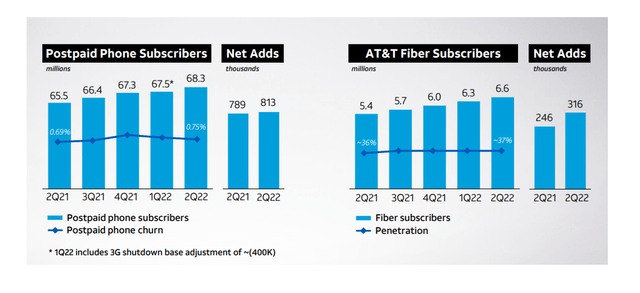

Postpaid Phone And Fiber Subscribers Are Growing

AT&T reported more than 800,000 postpaid phone net adds in the second quarter, the company’s best performance in more than a decade. At the same time, AT&T is seeing continued growth in fiber broadband, with subscribers increasing by 300,000 QoQ to 6.6 million. Customer growth in postpaid and fiber broadband is a positive business indicator that indicates future cash flow growth.

Postpaid Phone And Fiber Subscribers (AT&T)

Despite AT&T’s guidance for overall soft sales growth in 2022, I believe AT&T could see some cash flow upside in the broadband business moving forward.

Management expects low single-digit sales growth this year, but the broadband segment is expected to grow sales by 6% YoY. AT&T’s broadband segment has the capacity to serve 18 million fiber subscribers, resulting in a current penetration rate of 37%.

AT&T may develop a catalyst for stronger cash flow growth as it attracts more subscribers to its fiber business, increasing penetration and potentially producing higher ARPUs. AT&T’s fiber ARPU in 2Q-22 was $61.65, up from $60.41 in 1Q-22.

Soaring Dividend Yield Is A Red Flag

The stock dropped and the yield increased after AT&T revealed that it did not cover its dividend pay-out with free cash flow in 2Q-22.

AT&T’s stock currently yields 6.03% on an annualized dividend of $1.11 per share. AT&T’s stock price has yet to recover from the post-earnings consolidation, which I see as a strong indication that the market has turned decisively negative on AT&T’s ability to keep its dividend anchored at its current level.

Why AT&T Could See A Higher Valuation

Better inflation data and stronger economic growth would almost certainly alleviate AT&T’s bill collection issues, but this is probably wishful thinking at this point.

Inflation and interest rates continue to be significant risks for AT&T, and I believe that more customers will become delinquent and fail to make timely bill payments. However, if this is avoided, I believe AT&T will be able to close its large price gap.

Valuation Comparison

AT&T, Verizon Communications Inc. (VZ), and Lumen Technologies Inc. (LUMN) all have low P-E and P-FCF ratios, which is common for utilities.

Lumen Technologies is particularly appealing to income investors due to the company’s high free cash flow and cash infusion catalyst from the sale of non-core assets.

My Conclusion

AT&T is currently a dividend value trap, and the company will most likely aim to provide a less appealing dividend yield in order to control its cash flow risks.

AT&T has already warned that it is taking longer to collect payments from customers, which is cited as the primary reason for the company’s reduced free cash flow guidance for 2022.

A recession or persistently high inflation would put people’s budgets under even more strain, and AT&T may have to reduce its free cash flow guidance as well.

Be the first to comment