jcamilobernal/iStock Editorial via Getty Images

Investment Thesis

This Sunday, 18 December, the final of the FIFA World Cup 2022 in Qatar will take place with defending champions France taking on Argentina. Among the companies with a large exposure during the World Cup have been the FIFA Partners and FIFA World Cup Global Sponsors as well as Regional Supporters from different regions such as Europe, Asia-Pacific, the Middle East, North Africa, North America and South America.

Here I will present 5 companies that are among the FIFA Partners and FIFA World Cup Global Sponsors that I consider to be attractive in terms of risk and reward. In addition to that, I consider these companies to be appealing for dividend income and dividend growth investors that aim to invest with a long investment-horizon:

- Coca-Cola (NYSE:KO)

- Anheuser-Busch (BUD)

- Visa (NYSE:V)

- adidas (OTCQX:ADDYY)

- McDonald’s (NYSE:MCD)

Some of these companies can already provide you with an attractive Dividend Yield, these include: Coca-Cola, McDonald’s and adidas. At the time of writing, Coca-Cola pays a Dividend Yield [FWD] of 2.75%, adidas of 2.66% while McDonald’s is 2.22%. These three companies can already contribute to generating an additional income in the form of dividends.

Although I agree that these Dividend Yields are not extraordinarily high, these companies do provide significant scope for future dividend enhancements. In particular, steady revenue growth, high brand strength and a relatively low Payout Ratio contribute to the fact that I expect these companies to succeed in significantly increasing their dividends in the coming years.

A company such as Visa, which also makes the list, will help your investment portfolio to significantly increase the dividend you earn year after year, thus helping you to gain an important additional income for retirement (since it contributes to the fact that your dividend increases with a higher growth rate).

Coca-Cola

Coca-Cola has strong competitive advantages over its rivals and disposes of a wide economic moat: among these advantages are its strong brand image and worldwide distribution network that makes it almost impossible for new competitors to enter into its business field.

In the Forbes ranking of the most valuable brands in the world, Coca-Cola is ranked 6th (with a brand value of $64.4B). In addition to that, the company is number one in terms of brand value within its industry according to the same ranking.

Coca-Cola’s strong competitive position is reflected in its high EBIT Margin [TTM] of 28.90%, which is 249.41% above the sector median (8.27%). Furthermore, Coca-Cola’s EBIT Margin [TTM] is significantly higher than the one of its competitor PepsiCo (NASDAQ:PEP) (EBIT Margin of 15.05%), once again highlighting its strong competitive position.

Coca-Cola’s high Return on Equity [TTM] of 44.13% is a powerful indicator that the company is very efficient in using shareholder’s equity to generate income. Coca-Cola’s Return on Equity is 307.23% above the sector median (which is 10.84%), indicating again that the company is an attractive choice for your portfolio.

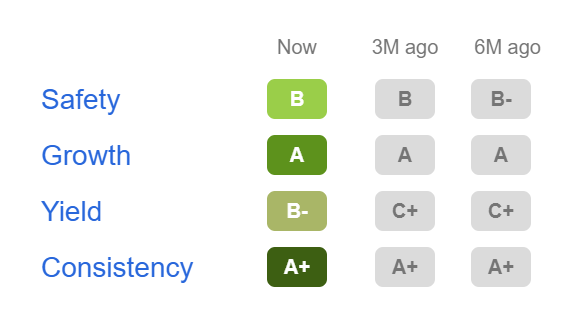

At this moment in time, Coca-Cola’s Dividend Yield [FWD] is 2.75%. The Seeking Alpha Dividend Grades are an additional indicator showing that the company is an excellent pick for dividend income investors that, at the same time, seek Dividend Growth. I consider the combination of both Dividend Income and Dividend Growth to be very important for any investment-portfolio, because it allows you to increase year over year the additional income that you generate.

Coca-Cola is rated with an A+ for Dividend Consistency and gets an A for Dividend Growth. For Dividend Safety, it receives a B rating and for Dividend Yield, a B-.

Source: Seeking Alpha

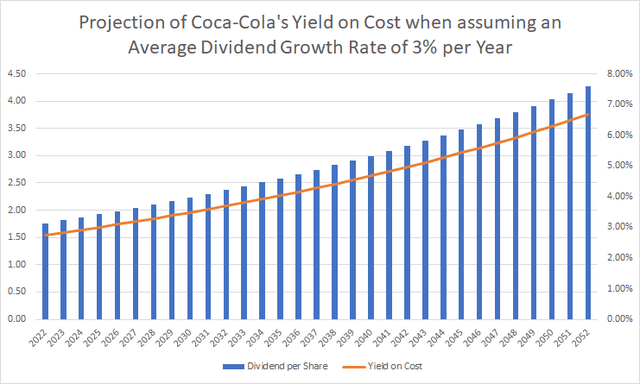

Coca-Cola’s Average Dividend Growth Rate over the past 5 years has been 3.52%. Below you can see the projection of its Yield on Cost when assuming an Average Dividend Growth Rate of 3% over the following 30 years. The fact that Coca-Cola has been able to increase its Dividend over the past 60 years and considering the company’s Payout Ratio of 70.16% in combination with a strong brand image, make me believe that Coca-Cola should be able to raise its Dividend with a Growth Rate of approximately 3% over the next decade.

When assuming that the company is able to raise its dividend with a Growth Rate of 3% per year on Average, you would be able to reach a Yield on Cost of 3.70% in 2032, 4.97% in 2042 and 6.68% in 2052.

I agree with those who claim that Coca-Cola is not very attractive in terms of Valuation at this moment in time: with a P/E GAAP [FW] Ratio of 28.55, Coca-Cola is 13.11% above its Average P/E Ratio over the past 5 years (25.24). In addition to that, I also agree with those who claim that you cannot expect large capital gains with an investment in the company. However, in my opinion, Coca-Cola is an appealing choice in order to help you to reduce the volatility of your investment portfolio, while increasing constantly your wealth, including the dividend payments you receive. The company’s 60M Beta of 0.59 strengthens my theory that you can reduce portfolio volatility with an investment in Coca-Cola.

If you were to think of Coca-Cola as a soccer player for a team at the World Cup, it would be a defender that helps the team not to concede goals. In terms of your investment portfolio, this means that Coca-Cola can contribute to your stock portfolio declining less in turbulent times and during a market crash. It can even help you to sleep more soundly because you don’t have to worry as much about your investment portfolio losing too much value the next time the stock market crashes.

However, due to Coca-Cola’s limitations in terms of Growth, I would not overweight the company in an investment portfolio, but I would use its stock to be among the defensive players of your investment portfolio.

In my in-depth analysis on Coca-Cola, I go into more detail about the company’s Valuation and I show you how to benefit from its growing Dividend Payments while investing for retirement.

Anheuser-Busch

Like Coca-Cola, Anheuser-Busch is a company with strong competitive advantages, and also a wide economic moat. In my comparative analysis on Anheuser-Busch and Heineken, which I wrote back in July, I already mentioned its broad and diversified product portfolio as one of its competitive advantages:

AB InBev has a broad and diverse product portfolio of more than 500 beer brands, including: Budweiser, Corona, Stella Artois, Beck’s, Hoegaarden, Leffe and Michelob Ultra.”

In addition to that, I discussed the company’s strong competitive advantages in more detail:

Several factors contribute to AB InBev’s strong competitive advantages over its opponents: the company’s broad product portfolio with strong brands helps to reduce the risk of its operations and also provides strong pricing power, which is very important in these times of high inflation. Through synergies of its global business units, the company reduces its operating costs, which allows it to operate with lower costs than most of its competitors.”

Anheuser-Busch’s EBIT Margin [TTM] of 25.20% is significantly higher than the one of its competitors: the company’s EBIT Margin is 204.69% higher than the one of the sector median (8.27%), underlying its strong competitive position and reflecting again its product portfolio consisting of strong brands.

Different indicators also show us that the company is on track when it comes to Growth: it has shown an EPS Diluted Growth Rate [FWD] of 8.40% over the past 5 years and a Free Cash Flow Per Share Growth Rate [FWD] of 9.84% over the same period, indicating that it has been able to grow its earnings with a relatively high rate over this time period.

When it comes to Valuation, it can be highlighted that the company currently has a P/E [FWD] Ratio of 21.95, which is 3.93% above the sector median (21.13), indicating that it is fairly valued. In my opinion, Anheuser-Busch can be rated with a premium as compared to its competitors, particularly due to its strong brands and pricing power. Therefore, I consider the company to be currently attractive in terms of Valuation.

Visa

Visa is another one of the FIFA Partners and I consider the company to be an excellent choice for all investors that are seeking Dividend Growth.

At this moment in time, the company’s Valuation is very attractive: Visa’s current P/E [FWD] Ratio of 25.44 is 21.59% below its Average P/E Ratio of the last 5 years (32.44). In my opinion, this Valuation is very attractive, particularly when taking into consideration the company’s high Growth Rates: Visa has shown an Average Revenue Growth Rate of 10.86% over the last 5 years and an Average EBIT [FWD] Growth Rate of 12.18%. At the same time, it has shown an EPS Diluted Growth Rate [FWD] of 16.28% over the same period. All of these are strong indicators confirming that Visa is absolutely on track when it comes to Growth.

Visa’s Valuation is significantly lower than that of its main competitor Mastercard (NYSE:MA), which currently has a P/E [FWD] Ratio of 35.13.

Visa’s strong competitive position is also reflected in the company’s very high EBIT [TTM] Margin of 67.33%. This EBIT Margin is 916.74% above the sector median (6.62%), which provides us with a strong indicator of Visa’s excellent competitive advantages and competitive position. Visa’s EBIT Margin is also higher than the one of its rivals Mastercard (56.97%) or PayPal (NASDAQ:PYPL) (14.12%).

Furthermore, Visa’s Return on Equity (40.88%) is significantly higher than the one of PayPal (10.86%) or of American Express (NYSE:AXP) (31.68%), demonstrating that its management uses shareholder’s equity to generate income more efficiently.

The combination of the company’s strong competitive advantages (such as its strong brand image, its broad financial network and its high customer loyalty, etc.) as well as its currently attractive Valuation in combination with strong Growth perspectives, lead me to the conclusion to currently rate the company as a strong buy. In my comparative analysis on Visa and PayPal, I tell you why I consider Visa to be the currently more appealing choice and go into more detail in regards to the company’s Valuation.

adidas

Even though I consider adidas’ competitor Nike (NYSE:NKE) to be the more attractive choice among these two sporting goods manufacturers when investing with a long horizon; particularly because of its higher brand value and its even stronger competitive position (underlined by Nike’s EBIT Margin of 13.25% while adidas’ is 6.52%), adidas is definitely worth taking a closer look at. The reason for Nike not being part of this selection is because the company is not among the FIFA Partners and FIFA World Cup Global Sponsors.

At this moment in time, adidas shows a P/E GAAP [TTM] of 29.11, which is 28.61% below its P/E Ratio of the past 5 years, demonstrating that the company is currently undervalued.

Several numbers further confirm that adidas is on track in regards to Growth: adidas shows an Average EBIT Growth Rate [FWD] of 13.86% and an Average EPS Diluted Growth Rate [FWD] of 19.28% over the past 5 years. In addition to that, the company’s Average Free Cash Flow Per Share Growth Rate [FWD] over the last 5 years is 13.17%, indicating that adidas is able to increase its earnings with relatively high rates.

Furthermore, at adidas’ current stock price of $62.12 and its Free Cash Flow per Share [TTM] of $4.19, the company shows a Free Cash Flow Yield of 6.75%, which contributes to the fact that I consider adidas to be an attractive choice when it comes to risk and reward.

Furthermore, adidas’ 60M Beta of 1.00 indicates that the risk of investing in the company is lower than the risk of investing in competitors such as Under Amour (NYSE:UA, NYSE:UAA) (60M Beta of 1.49) or Lululemon Athletica (NASDAQ:LULU) (60M Beta of 1.31).

Adidas currently shows a Dividend Yield (FWD] of 2.66%, which is significantly higher than the likes of Nike (1.24%), Under Armour (currently does not pay a dividend) and Puma (OTCPK:PMMAF) (1.36%), thus strengthening my belief that adidas is the most attractive choice for dividend income investors among these sporting goods manufacturers.

The combination of a relatively high Dividend Yield and a relatively high Dividend Growth Rate (adidas has shown Dividend Growth Rate of 10.04% [CAGR] over the past 10 years), make the company an excellent pick for investors seeking to combine Dividend Income and Dividend Growth.

McDonald’s

Another company which is among the FIFA World Cup Global Sponsors and which I consider to be an attractive choice for investors when considering risk and reward, is McDonald’s.

The company’s strong competitive position is underlined by its high EBIT Margin [TTM] of 43.70%, which is significantly higher than other competitors such as Starbucks (NASDAQ:SBUX) (EBIT Margin of 13.78%) or Restaurant Brands International (NYSE:QSR) (31.83%) both being part of the Restaurants Industry.

McDonald’s low 60M Beta of 0.64 further demonstrates that an investment in the company can contribute to the reduction of volatility in your investment portfolio. Comparing the company’s 60M Beta with other competitors such as YUM! Brands (NYSE:YUM) (60M Beta of 1.01) or Restaurant Brands International (0.99) shows that the risk of investing in McDonald’s is lower.

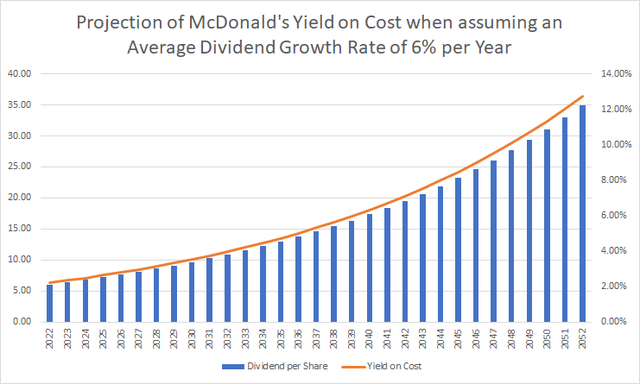

At this moment in time, McDonald’s has a Dividend Yield [FWD] of 2.22%. At the same time, the company’s low Payout Ratio of 56.67% and its Average Dividend Growth Rate of 8.12% over the past 5 years, make me believe that the company should be able to raise its dividend over the coming years by a significant amount. This makes McDonald’s not only an excellent choice for dividend income investors, but also for investors seeking Dividend Growth.

Below you can find a graphic which shows the Yield on Cost for McDonald’s when assuming that the company were able to increase its Dividend with an Average Dividend Growth Rate of 6% per year. The graphic shows that you could expect a Yield on Cost of 3.97% in 2032, 7.12% in 2042 and 12.74% in 2052 while assuming this Growth Rate of 6%.

Overview of the Dividend of the 5 Selected Companies

|

Coca-Cola |

Anheuser-Busch |

Visa |

adidas |

McDonald’s |

|

|

Symbol |

KO |

BUD |

V |

ADDYY |

MCD |

|

Sector |

Consumer Staples |

Consumer Staples |

Information Technology |

Consumer Discretionary |

Consumer Discretionary |

|

Industry |

Soft Drinks |

Brewers |

Data Processing and Outsourced Services |

Apparel, Accessories and Luxury Goods |

Restaurants |

|

Dividend Yield [FWD] |

2.75% |

0.87% |

0.84% |

2.66% |

2.22% |

|

Dividend Yield [TTM] |

2.75% |

0.87% |

0.74% |

2.66% |

2.06% |

|

Dividend Growth Rate 5 Years [CAGR] |

3.53% |

-32.96% |

17.95% |

9.42% |

8.12% |

|

Consecutive Years of Dividend Growth |

60 Years |

0 Years |

14 Years |

0 Years |

21 Years |

|

Dividend Frequency |

Quarterly |

Annual |

Quarterly |

Annual |

Quarterly |

Source: Seeking Alpha

Conclusion

This Sunday the final of the FIFA World Cup Qatar 2022 will take place with France playing Argentina. In this article I have shown 5 companies that are among the FIFA Partners and FIFA World Cup Global Sponsors and which I consider to be particularly attractive when it comes to risk and reward.

All of the selected companies have a strong brand image among their competitive advantages, thus contributing to build an economic moat over their rivals. The companies’ strong brand images gives them pricing power in times of high inflation like the current one. In addition to that, a strong brand image reduces the risk for investors, because a strong brand will not be destroyed from one day to another.

In addition to the above, all of the companies I have selected for you in this article pay a dividend. Some of them already pay an attractive Dividend Yield (such as Coca-Cola, adidas and McDonald’s) others stand out due to their high Dividend Growth Rates (such as Visa, which has shown a Dividend Growth Rate [CAGR] of 17.95% over the past 5 years).

Having a combination of dividend income companies and dividend growth companies in your portfolio ensures that you can build up an attractive additional income. At the same time it allows you to significantly increase this additional income in the form of dividends year over year. In this way, you can increase your wealth steadily. Moreover, this strategy allows you to worry less about the strong price fluctuations on the stock market.

Author’s Note: Enjoy watching the final of the World Cup 2022 and I hope that this article was of value for you in order to find attractive dividend income and dividend growth stocks for your investment portfolio. I appreciate any feedback on this article!

Be the first to comment