hapabapa

What a difference a year makes – last year Docusign (NASDAQ:DOCU) shares traded well over $300 as speculators excitedly bid up all things software-as-a-service (‘SAAS’) to almost unimaginable heights (at one point shares traded north of 25x subscription revenue). This year has been a different story. The stock is now below $50 per share as analysts have been tripping over themselves to downgrade the stock as revenue growth has slowed, management has turned over, and SAAS is no longer en vogue.

While the stock was massively over-valued last year amidst the tech bubble, today I think the shares trade at a modest discount to fair value. Because shares have been highly volatile, investors who trade options may want to utilize a covered call strategy. While this necessarily limits upside, it also significantly reduces an investor’s basis in the stock and can create the opportunity to earn attractive annualized returns with less risk than owning the stock outright.

Overview

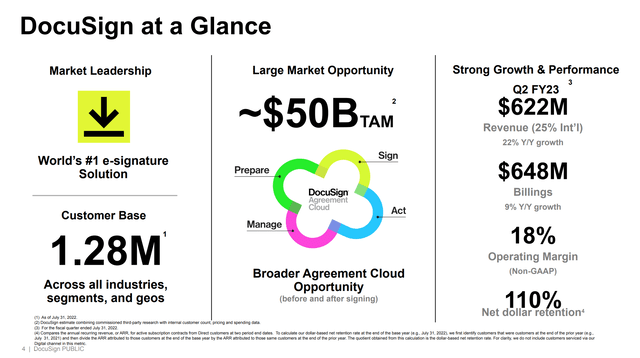

Docusign is best known for its ubiquitous e-signature product which facilitates the verified signing of documents. The company has been incredibly successful since coming public – it has grown revenue from just $500 million in 2018 to an estimated $2.5 billion today. It is the market leader in e-signature and has over 1.2 million customers.

Overview (Docusign Investor Presentation)

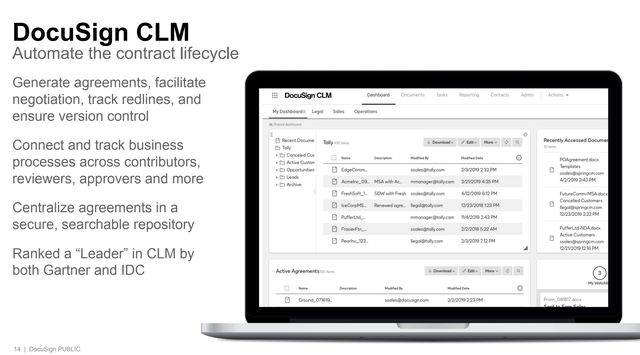

The company is looking to leverage its existing customer base and cross-sell new products such as contract lifecycle. This is a workflow tool which helps salespeople, lawyers and other professionals digitally manage negotiations.

Contract Lifecycle Management (Docusign Investor Presentation)

New CEO & Cost Cutting Initiative

In June, Docusign’s CEO Dan Springer announced his resignation. While Springer had done an admirable job of growing the company over the past five years, with a slower growth outlook for the next five years, it seems a new skill set is needed to run the business.

Springer has been replaced with former Google (GOOG) (GOOGL) executive Allen Thygeson. In late September it was announced that Docusign would be cutting 9% of its workforce. While this announcement occurred almost two weeks prior to Thygeson’s official start date, it seems highly likely that he was involved in the cost cutting program.

All-in, I view the management change as a positive. Springer managed the company through a hyper-growth phase – revenue was growing 30-50% per year and equity markets were highly accommodative (a high stock price is an invitation from investors to issue stock and use the proceeds for new growth initiatives).

However, as the company’s products have become increasingly penetrated and billings growth has slowed to sub-10%, I think a new pair of eyes on the situation will allow for positive change. It tends to be easier for a new CEO to make cost cuts and modify strategy – unlike the outgoing CEO, a new CEO isn’t beholden to defending past strategic blunders (such as building a staff for a company expected to continue to grow at 30%, funding pet research projects, etc).

Valuation

At $49, Docusign trades at just 4x 2023 estimated subscription revenue. This is at the low end of the SAAS universe which ranges from 3.5-8x currently. While revenue growth has slowed substantially, the company should still be able to produce 10%+ revenue growth through:

1/ Adding new customers of its core e-signature product

2/ Cross-selling additional products to the over 1.2 million customers who buy Docusign e-signature. The company has experienced some success in doing this as evidenced by Docusign’s net dollar retention of 110%.

3/ Increasing price to existing customers – while Docusign faces competition, most notably from Adobe (ADBE), software customers tend to be relatively sticky which allows for 3-5% annual price increases without much pushback/loss of customers.

As we sit today, Docusign earns a non-GAAP EBITDA margin of 18%. As the company grows revenue (and pares expenses – as noted above it recently embarked on a cost cutting program), I expect margins will ultimately end up in the 25-30% range which implies that Docusign trades at less than 12x my estimate of 2025 EBITDA.

At today’s price, Docusign could be an acquisition target as private equity firms such as Thoma Bravo, Silverlake and Vista Partners have been very active in acquiring software businesses. Growing SAAS companies typically fetch no less than 5-6x subscription revenue when sold. Such a price implies 25-50% upside from today’s price.

Taking advantage of volatility using a Covered Call strategy

While I see upside in Docusign shares, I do not believe the company is worth much more than $85 per share. At $85 per share the stock would trade at about 6x my 2025 estimated subscription revenue and 20x EBITDA. As such, I have sold covered long-term (January 2025 expiry) out of the money covered calls against my Docusign position with a strike price of $85 and received $9.7 per contract.

The purchase of the stock at $49 per share and sale of the $85 call for 9.7 per contract mean that my true basis in the stock (and total cash outlay) is $39.30. Should the stock not be called away, at $39.30, I’d own Docusign at less than 3x revenue (and 10x EBITDA) which is in deep value territory for a SAAS stock.

If my Docusign shares do get called away, I end up more than doubling my money in a little over two years. In summary, the covered call strategy I’ve outlined lowers my basis significantly (20%) but still allows me to more than double my money in just over two years if everything works out. I believe this is a favorable risk / return versus just owning the stock outright.

Risks

1/ SAAS stocks have been heavily out of favor in 2022 and could decline further. I believe that the covered call strategy outlined above allows investors to take advantage of volatility (and the premium received helps mitigate potential losses).

Risk to Covered Call Strategy

1/ Trading options carries additional risks & uncertainties and is best left to those with experience investing/trading options.

2/ If investors become very excited about SAAS stocks again or Docusign in particular, I have limited my gains by selling the covered call.

Be the first to comment