FreezeFrames

On Thursday, October 27, 2022, Permian-based independent exploration and production firm Pioneer Natural Resources Company (NYSE:PXD) announced its third quarter 2022 earnings results. At first glance, these earnings were mixed. Pioneer Natural Resources failed to meet the revenue estimates presented by its analysts, although the company did beat on earnings. With that said though, both figures were up substantially versus the prior-year quarter.

This general year-over-year growth is something that has been relatively common across the oil and gas sector recently, making it one of the few sectors to deliver growth in today’s economy. We also see a very interesting development here, as Pioneer Natural Resources has begun to diversify outside the traditional fossil fuel sector and into renewables. This may be just an attempt to improve its standing in the eyes of the management of the incredibly large number of environmental, social, and governance funds that have sprung up over the past few years, but that does not stop it from being a potential growth opportunity. Despite all these good things, though, the stock continues to have a very high effective yield and an attractive valuation. There may be some reasons to consider a purchase today.

As my regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Pioneer Natural Resources’ third-quarter 2022 earnings results:

- Pioneer Natural Resources brought in total revenue of $6.093 billion in the third quarter of 2022. This represents a significant 36.52% increase over the $4.463 billion that the company brought in during the prior-year quarter.

- The company reported an operating income of $2.524 billion during the reporting period. This compares quite favorably to the $1.384 billion that the company reported in the year-ago quarter.

- Pioneer Natural Resources produced an average of 656,582 barrels of oil equivalent per day during the most recent quarter. This was at the high end of its guidance but represents a significant decline over the 675,793 barrels of oil equivalent per day that the company produced on average last year.

- The company announced its participation in two renewable energy projects as part of a joint venture with NextEra Energy (NEE). These projects will have a total nameplate capacity of 300 megawatts when complete.

- Pioneer Natural Resources reported a net income of $1.984 billion during the third quarter of 2022. This represents a strong 90.40% increase over the $1.042 billion that the company reported in the third quarter of 2021.

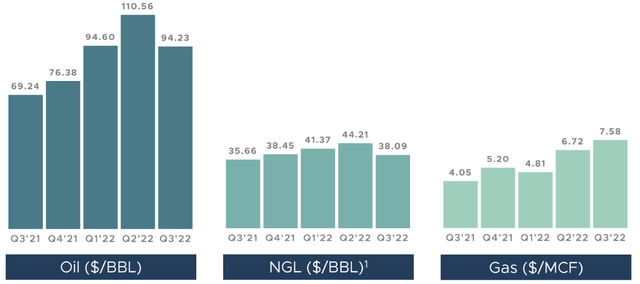

It seems certain that the first thing that anyone reviewing these highlights will notice is that essentially every measure of financial performance improved significantly compared to the year-ago quarter. This happened despite the fact that the company’s production was down somewhat. The causes of this are unlikely to be much of a mystery, however. After all, anyone that has filled up the tank of their car over the past year knows that oil prices in the third quarter were quite a bit higher than they were last year. The same is true of natural gas. These things showed up in Pioneer Natural Resources’ price realizations. As we can see here, the company received considerably more money for each unit of product that it sold during the most recent quarter than it did in the third quarter of last year:

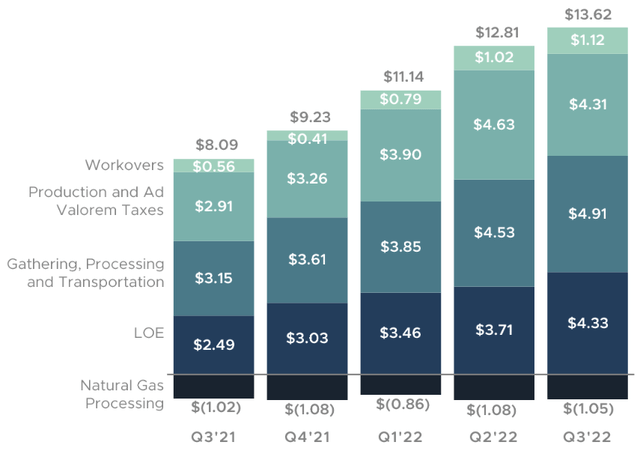

It should be fairly obvious how higher prices would result in improving financials. After all, if the company receives more money for each unit of product that it sells then it brings in more revenue. All else being equal, higher revenue means that more money is able to migrate down to cash flow and net income. Of course, all else is rarely equal in the energy industry. One of the big differences during this quarter is that Pioneer Natural Resources’ costs of production increased, which is the continuation of a trend that has been going on for the past year:

This is not something that is unique to Pioneer Natural Resources as all traditional energy companies have been dealing with rising costs over the past year. The biggest reason for the cost increases is inflation, particularly in steel and diesel prices. This is because these two commodities are critical for drilling and completing wells and the rising prices of these items make it more expensive for the company to drill wells.

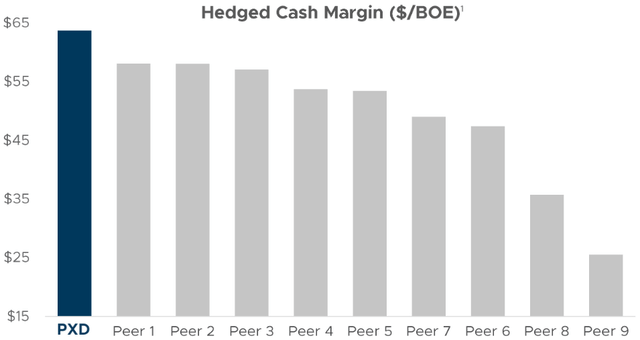

As I have pointed out in the past, one of the biggest problems with shale oil production is that the wells have a high decline rate. This requires producers to continually drill new wells in order to maintain, let alone grow, their production. Thus, Pioneer Natural Resources has no real choice but to pay these higher costs unless it wants to see its output fall off a cliff. Fortunately, we can still see that it only costs the company an average of $13.62 per barrel of oil equivalent that it produces and the price of oil is substantially above that. This allows the company to generate high profit and free cash flow margins even given the inflationary environment. In fact, Pioneer Natural Resource has much higher free cash flow margins than most of its peers:

This is nice to see because ultimately free cash flow (“FCF”) is the money that the company has available to reward its shareholders. This is because this is the money that the company generates through its ordinary operations that is left over after it pays all its bills and makes all capital expenditures. The company had a levered free cash flow of $2.3588 billion in the most recent quarter, which is substantially higher than the company had in any other quarter over the past year:

|

Q3 2022 |

Q2 2022 |

Q1 2022 |

Q4 2021 |

Q3 2021 |

|

|

Levered Free Cash Flow |

$2,358.8 |

$1,370.0 |

$413.0 |

$485.9 |

$593.4 |

|

Unlevered Free Cash Flow |

$2,377.5 |

$1,390.6 |

$436.1 |

$510.3 |

$619.0 |

Pioneer Natural Resources has indeed been using this money to reward the stockholders, which is something that we can all appreciate. This is part of the company’s commitment to return 75% of its free cash flow to the shareholders. In the third quarter results announcement, the company declared a dividend of $5.71 for the quarter, which corresponds to $22.84 per share annualized. This gives the stock an annualized 8.59% yield at the current price. This is substantially above most other things in the market, and it is easily enough to attract the attention of most income-focused investors. This dividend also might be large enough to take away some of the pain that is felt when filling up your car with gasoline, so that is certainly a nice bonus.

Pioneer Natural Resources has also been able to use its free cash flow to keep its debt at a very reasonable level. This is nice considering that prior to the pandemic, the shale oil industry was the largest issuer of junk-rated debt in the United States. We can see this by looking at Pioneer Natural Resources’ leverage ratio, which is also known as the net debt-to-adjusted EBITDAX. This ratio essentially tells us how long it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to that task. As of the third quarter, Pioneer Natural Resources had a leverage ratio of 0.3x based on its trailing twelve-month adjusted EBITDAX. This is one of the lowest ratios in the industry and it is well below the 1.0x that most of the strongest companies in the industry possess. Overall, Pioneer Natural Resources seems quite solid here and the company certainly does not appear to be using too much debt to finance its operations. This is overall nice to see, because even if something causes the company’s cash flow to decline for some reason, it should still be able to carry its debt.

One of the most interesting things that we see in this report is that Pioneer Natural Resources has begun to enter the renewable energy space. It is doing this by participating in the development of two projects that are intended to both power the company’s own operations in the Permian Basin as well as supply some power to the Texas power grid. The first of these is a 140-megawatt wind farm that is being constructed by a subsidiary of NextEra Energy on Pioneer Natural Resources’ land. Pioneer Natural Resources itself has already entered into a power purchase agreement for some of the energy that will be produced by this facility.

In addition, the company is participating in the 160-megawatt Concho Valley Solar project that started operation in October 2022. Pioneer Natural Resources has not explained exactly how it is participating beyond these details; however, we can assume that it is part owner of each of these facilities. It has stated that it will have no capital expenditures, however, which is curious. These are most likely projects that are meant to appease some of the environmental activists that have been pushing for the oil and gas industry to improve the sustainability of its operations. It is possible that the company will derive some small amount of revenue from selling electricity into the Texas power grid, though.

Another thing that some readers may note is that Pioneer Natural Resources saw its production decline somewhat year-over-year. Fortunately, the higher prices that the company obtained for the products that it produced were able to offset the impact of the lower production but the overall decline might still be concerning to some readers. Unfortunately, Pioneer Natural Resources did not provide a reason for the decline so we can only speculate to the cause. However, the company’s production was only down 2.93% compared to the year-ago quarter, so there are many things that could account for this decline, many of which are simply natural production fluctuations that are common to the production of crude oil and natural gas and are thus completely out of the company’s control.

We may see this reverse itself in the fourth quarter, though. The company has guided to produce an average of 655,000 to 680,000 barrels of oil equivalent per day during the fourth quarter of 2022. As the midpoint of this guidance is well above the company’s third-quarter production, we can assume that this means that Pioneer Natural Resources is planning to take steps to boost its production over the next few months. This is something that is nice to see, considering that crude oil prices are currently a bit lower than they were in the third quarter, so the higher production might help to offset this impact. Overall, though, I will admit that I am expecting to see the company’s fourth quarter 2022 come in a bit weaker than its third-quarter results due mostly to the lower energy prices.

In the introduction to this article, I stated that Pioneer Resources still appears to be somewhat undervalued despite the strong performance that the stock has delivered over the past twelve months. We can see this by looking at the stock’s price-to-earnings growth ratio, which is a modified version of the traditional price-to-earnings ratio that takes the company’s forward earnings per share growth into account. Generally speaking, a price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. According to Zacks Investment Research, Pioneer Natural Resources will grow its earnings per share at an 8.55% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.97 at the current stock price. As this is below 1.0, it is a sign that the stock could be undervalued relative to its earnings per share growth. When we combine this with all the other good things that we see in this earnings report, there could certainly be some reasons to buy the stock.

In conclusion, there is a great deal to like in Pioneer Natural Resources’ latest earnings report. We see the strength and strong free cash flow that we have seen in most energy companies over the past year or two, but we also see the company developing an interest in renewable sources of energy. It will be interesting to see where Pioneer Natural Resources takes this new renewable operation, as it could potentially represent a growth opportunity. Unfortunately, the fall in crude oil prices in October will probably result in the fourth-quarter 2022 results coming in a bit weaker than what we saw this quarter, but they should still be reasonable. When this is combined with an attractive valuation, we see an excellent argument for purchasing Pioneer Natural Resources stock today.

Be the first to comment