Ethan Miller

Investing is an absolute game and positive total returns are key. But there is also a relative aspect where you can upgrade your portfolio and reduce risks in a way that helps you lose less money if things go south. We are going to talk about that today and do so in relation to two extremely popular funds. Since we have covered both funds previously, we will give only a brief overview of our previous stance and then dive into why we think a big switch will likely protect you.

Reaves Utility Income Fund (NYSE:UTG)

UTG is a popular fund with the dividend crowd and we haven’t really been too excited about it. We had a Sell Rating on this in April, but as the fund tanked, we upgraded it to a Hold rating in June. A key reason for our upgrade in June was that the utilities sector had fallen enough to merit a less hostile stance and we did feel that the short bet could be pressed any more.

DNP Select Income Fund (NYSE:DNP)

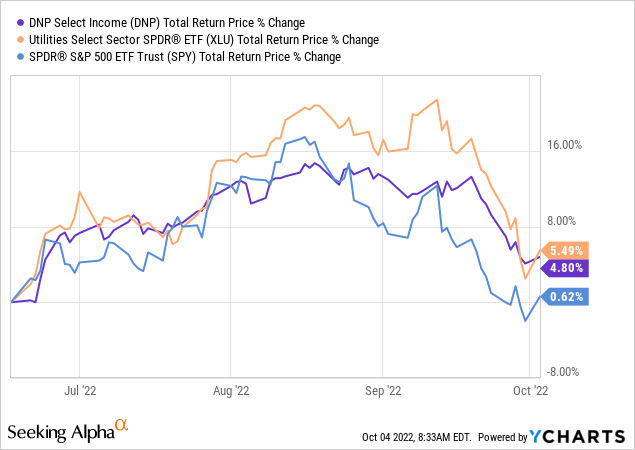

We covered this one for the first time in June and the fund has definitely not gone in the direction we expected. While we painted a much deserved Sell rating on this, it is actually higher now than when we wrote on it and has outperformed the market.

Outlook On The Sector

Utilities have two major forces acting on the sector today. On one hand, they represent the epitome of defensiveness and are least likely to see big earnings downgrades in a recession. Hence the money managers who need to be 100% invested, are flocking here like there is no tomorrow. On the other hand, this is by far the most rate sensitive sector there is and higher interest rates should hurt it. In the shorter run, obviously it appears that the first criteria is winning. Money managers were badly positioned for a rate hike cycle with many insisting in late 2021 that the Federal Reserve would not raise rates even once. They were just as badly prepared for inflation, blindsided no doubt by the Federal Reserve’s complete ignorance of the rising threat late last year. So the dash out of Class C thrash (we are talking about growth stocks trading 20X sales multiples) has made utilities relatively well bid. Utilities are also the least sensitive to a stronger US Dollar (duh) and that has also helped. We believe this has now played out in full or close to it. The second round of investing will be flying out of utilities and into bonds. The sector is also one of the most heavily indebted ones and the recent round of earnings growth has been provided primarily by moving to lower rate debt. With that in full reverse, utilities are likely to start disappointing investors. We remain bearish on the sector.

A Relative Outlook On The Two Funds

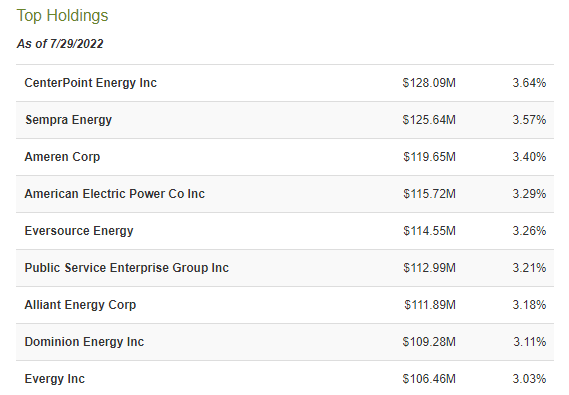

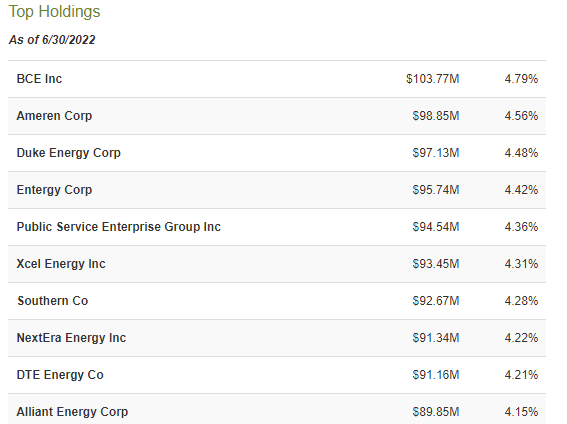

DNP and UTG stick to the utility sector and overall the holdings are quite similar between the funds. There are some notable differences in the top 10 and we can see that DNP runs a less concentrated shop than UTG.

CEF Connect-DNP

UTG has almost 5% in the Canadian telecommunications giant BCE Inc. (BCE) and shares Ameren Corp. (AEE) and Alliant Energy Corp (LNT) with DNP.

CEF Connect-UTG

Overall, DNP has 134 holdings vs just 44 for UTG. We don’t see that as a material difference as most investors won’t put all their money in one of these funds. Hence, the diversification achieved by UTG is more than sufficient.

DNP has done quite well over the long run and the 10-year total annual return on NAV has been 8.34%. UTG has done okay over the same timeframe with a total annual return of 7.74% on NAV.

Both funds use leverage and we think that is likely to bite both of them in the coming months. UTG uses about 19.71% net leverage and all debt is floating.

On April 27, 2022, the Fund entered into a Credit Agreement with State Street Bank and Trust Company. Under the terms of the Credit Agreement, the Fund is allowed to borrow up to $650,000,000. Interest is charged at a rate of the one month SOFR (“Secured Overnight Financing Rate”) plus 0.65%. Borrowings under the Credit Agreement are secured by all or a portion of assets of the Fund that are held by the Fund’s custodian in a separate account (the “pledged collateral”). Borrowing commenced under the terms of the Credit Agreement on April 27, 2022. The Credit Agreement with State Street Bank and Trust Company replaced the credit facility previously in place with Pershing LLC.

Source: UTG Semi-Annual Report

DNP on last check used 27%, and there was a mix of fixed and floating rates utilized.

The use of leverage enables the Fund to borrow at short-term rates and invest in higher yielding securities. As of April 30, 2022, the Fund had $1.105 billion of total leverage outstanding, which consisted of: i) $75 million of floating rate preferred stock, ii) $132 million of fixed rate preferred stock, iii) $300 million of fixed rate secured notes and (iv) $598 million of floating rate secured debt outstanding under a committed loan facility. On that date the total amount of leverage represented approximately 25% of the Fund’s total assets.

Source: DNP Semi-Annual Report

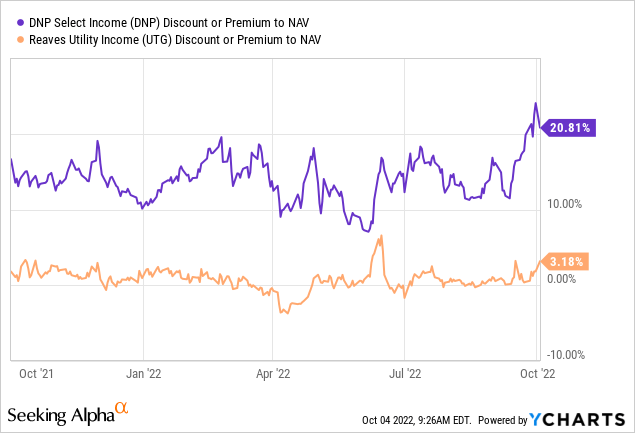

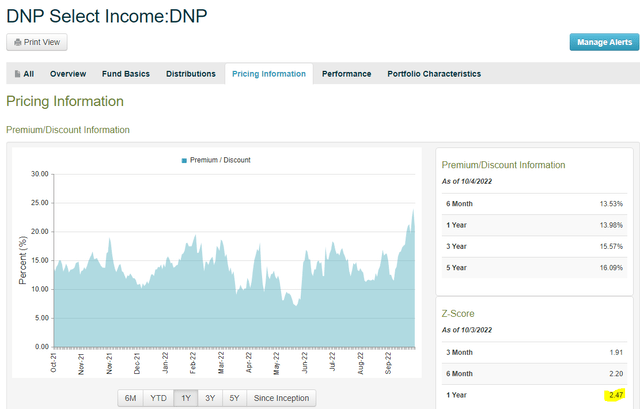

The two funds are overall similar with the major difference shown so far as being that of more leverage used by DNP. This may be a subtle difference but one likely to bite DNP. The biggest factor here and one that has confounded many is the difference in the premiums these two currently sport. DNP’s 20.81% is rather astounding and one reason our earlier bear call has not panned out. The premium actually expanded as the NAV dropped from June.

UTG’s 3.18% while not remarkably attractive, is more in line with the times of today. One other way to gauge the premium is the Z-score and on that front DNP is hitting the red zone as well with a 2.47. That is a horrible number and likely to revert sooner rather than later.

UTG sports a 1.73 on the same scale, but its absolute proximity to NAV makes this far safer.

Verdict

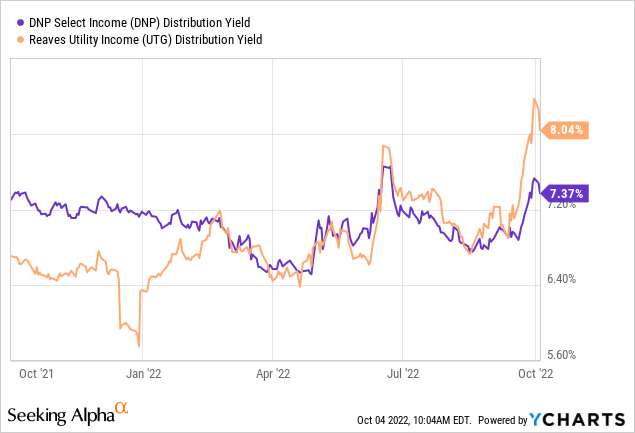

We think both funds are likely to bounce in the short run and then head lower. DNP remains extremely vulnerable as we don’t believe that there is any scenario where it “earns” its distribution over the next 1-3 years. The fund is paying 9% on NAV and utility sector dividend yield is under 3.5%. Rising leverage costs will hurt as well. That likely means that the NAV depletion accelerates over the next few years and this could awaken the prospects of a distribution cut. DNP remains badly priced for this with a massive premium to NAV. We think this warrants a switch to UTG at this point, despite DNP having delivered a better NAV performance. An income investor has no fear from this trade as the distribution yield gets a boost as well.

While we think the relative switch makes sense, we rate UTG a Hold and DNP a Strong Sell.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment